Emerging junior developer Goldshore Resources Inc. (GSHR:TSX; GSHRF:OTC; 8X00:FSE) is convinced its Moss Lake project in northwest Ontario has what it takes to reach Tier 1 status in both resource size and potential.

The results of its 100,000-meter drilling program, set to continue throughout 2022, are well on the way to bearing that out, according to newsletter writer Rick Mills.

"Starting out with 4 Moz of historical resource on the largest land package assembled in northwestern Ontario for a mining company, Goldshore is in an enviable position to succeed," Mills wrote in Ahead of the Herd. "In fact, the Moss Lake project could easily help the company attain a higher value than most projects that have been targeted by the majors in the area, given the project's economics (were) last updated in 2013."

That was when the last Preliminary Economic Assessment (PEA) for the site was done. The company believes that drilling this year could expand that resource to as much as 10 Moz.

That was when the last Preliminary Economic Assessment (PEA) for the site was done. The company believes that drilling this year could expand that resource to as much as 10 Moz.

Following the drilling, Goldshore plans to have a new PEA done, possibly by early next year.

"Investors, you need to invest now," said Shawn Khunkhun, chief executive officer of Dolly Varden Silver and a director of Goldshore. "It's the only company I'm involved in with a potential clear path to become a Tier 1 asset."

Exploration Dates to 19th Century

Exploration at Moss Lake dates to the 19th century, and 2.7 million tonnes was mined up to 1950, the company said. Exploration continued, including extensive drilling in the late 1980s and modest drill campaigns and geochemical/geophysical programs in the 1990s. After 2013's PEA, more drill programs in 2016–17 confirmed extensions of mineralization along strike.

In 2021, after a reverse takeover of the company formerly known as Sierra Madre Developments Inc., Goldshore went public and acquired Moss Lake from Wesdome for CA$57 million. When the dust settled, Wesdome had a 30% equity stake in the company.

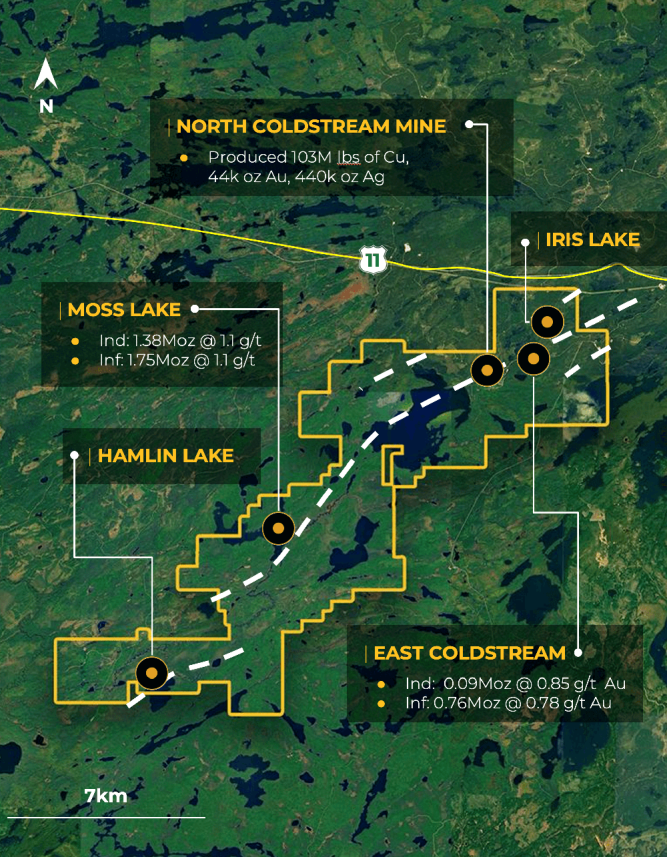

After expansions, the Moss Lake property now consists of 282 mining claims over a total area of 14,292 hectares, including gold and base metal-rich deposits that occur over a mineralized trend exceeding 20 kilometers in length.

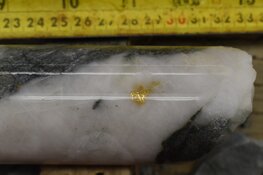

The company announced March 10 that an aerial and ground geophysical survey had increased the potential combined strike length of gold targets from 2.5 km to 11 km. The current strike length hosts historic indicated mineral resources of 39.8 Mt containing 1.4 Moz of gold at an average grade of 1.1 g/t Au and inferred mineral resources of 50.4 Mt containing 1.8 Moz of gold, the company said.

'I Want to Make Money'

Goldshore Chief Executive Officer and Director Brett Richards said he would love to build the mine to production, but the goal is to attract a major.

Goldshore Chief Executive Officer and Director Brett Richards said he would love to build the mine to production, but the goal is to attract a major.

"Are we going to bring a partner in at one stage to help take this across the finish line?" Richards told Streetwise Reports. "We have to. It's not a matter of if. And I'm not a lifestyle CEO who's just going to milk this out for five years. I want to make money. And I want to make it as soon as possible for my shareholders."

Richards said the sooner they can get through their drilling program this year, the sooner they can understand the total value.

But he said he believes in the project and had 3.4 million shares in the company as of last November.

"You don't get many of these in your career," he said of the scale of the project.

Never Been a Better Time for Gold

The rising price of gold, which hit $1,939 on March 30, also will contribute to the value. In January, the world's largest gold ETF, SPDR Gold Shares ETF (GLD:NYSE), had its largest daily net inflow since 2004 in dollar terms — $1.63 billion — as instability hit the markets.

Richards said he "saw this train coming," even though things were much different last fall. He said he attended the Gold Forum Americas gathering in September 2021 in Denver and thought he had the date wrong because the crowds were so sparse.

The precious metal wasn't needed at that time to hedge against rising costs or store value. But with rising political unrest and inflation levels leading the Fed to begin to raise interest rates, more money has flowed into the yellow metal as investors look for a safe haven for their money.

"There has never been a better time for gold."

—Goldshore Chief Executive Officer and Director Brett Richards

"I'm sad to be the benefactor of very chaotic geopolitical situations around the world," Richards said, but "there has never been a better time for gold."

Goldshore believes Moss Lake is underexplored. To accelerate this year's drilling, Goldshore is planning to have five to seven rigs active on the site after the spring breakup.

The company also just announced a brokered private placement of CA$10 million on March 16 for "Canadian exploration expenses."

Mills said the results of that exploration validate what the company is saying about Moss Lake.

"Drilling so far has demonstrated that the property indeed contains a significant volume of +1 g/t Au mineralization that underpins a meaningful, economic gold deposit," Mills wrote. "Richards, a mining industry veteran with 34 years' experience, has previously held executive roles with established miners like Roxgold, Katanga Mining, and Kinross. Given his track record in project development, there’s every reason to believe that Goldshore can unlock what could be a million-ounce opportunity at Moss Lake."

Disclosures

1) Steve Sobek compiled this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Goldshore Resources. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.