The Gold Report: Would you tell us about Seabridge Gold Inc.'s (SEA:TSX; SA:NYSE.MKT) strategy?

Rudi Fronk: Our strategy is essentially to turn cash into gold. When we founded the company 17 years ago, it was to give our shareholders maximum exposure to the gold price. That meant taking a different approach to the business. If you look at what the gold mining industry is doing, they are turning what we believe to be a superior form of money—gold into an inferior one—the dollar.

At Seabridge, we like to think of ourselves as modern alchemists turning cash into gold. Over the last 17 years, we have used cash from our shareholders to fund acquisitions and exploration of gold projects in Canada with the aim of increasing gold ownership per share as measured by our ounces of gold resources and reserves in the ground relative to our shares outstanding. We think there is a place for this strategy among those shareholders who value gold ownership over cash flow.

TGR: What level of resources does Seabridge have?

RF: We have more than 59 million ounces (59 Moz) of gold resources in the Measured and Indicated categories and nearly 35 Moz of gold resources classified as Inferred. Some 45 million of those ounces are reserves, with much more to come. Meanwhile, we only have 53 million shares outstanding. Gold ownership per share has grown every year since our inception. I think you will find that every other public gold company has reduced its gold ownership on a per share basis over the same period.

TGR: How did you arrive at your strategy of growing gold ownership per share?

RF: Our strategy came from two fundamental insights. The first insight was that the valuation of financial assets such as stocks and bonds relative to gold was unreasonably high due to inflationary monetary policies. These things go in cycles. In the 1970s, hard assets were overvalued against financial assets. Then, over the next 23 years we got the reverse.

"We formed Seabridge at the height of enthusiasm for financial assets."

We formed Seabridge at the height of enthusiasm for financial assets. The day we launched, in late 1999, it took 44 ounces of gold to buy the Dow—the highest ever. Since then the ratio has gone as low as 6. It's now about 15 but we would not be surprised if it gets to a ratio of 1 to 1 yet again, as it has done twice in the last hundred years, the last time in 1980 when the Dow and gold crossed with gold at $850/ounce. We believe we now are in a time when gold is increasingly needed to protect wealth.

Second, it is extremely difficult to find gold that is economic to develop. Gold is a store of wealth—the best there is—because of that scarcity. Cash you can get anywhere, you can even print it, but not gold. We decided to make this scarcity value our competitive advantage by focusing on gold ownership.

As gold potentially becomes more important as an investment, our industry is struggling. Reserves are on the decline. Discovery rates are falling. New projects are smaller and lower grade than the ones that are being depleted. Some producers have been high-grading their deposits to stay in business and meet their debt obligations, a strategy that destroys reserves. These factors support the future value of our strategy.

If gold ownership per share is your chosen metric, then you probably can't build and operate mines, which was a decision we made at the very beginning. Producers have to sell their gold to pay for its extraction. Then, they have to go out and spend enormous dollars to acquire, engineer and permit new projects to stay in business. The result is that the equity and debt dilution of their shareholders has been extraordinary. Studies show that over the past ten years, common shares outstanding of the 10 largest gold mining companies have more than doubled, while their net debt has increased by about 40-fold. Our largest shareholder likes to say that the biggest risk in owning gold stocks is dilution. That's the difficulty of being a miner. So we decided to maximize gold ownership per share rather than be a miner.

TGR: You are preparing your projects to become producing mines. Won't you then face the same dilution issues as the rest of the industry?

RF: We will face the same challenges but we have had 17 years to develop strategies to avoid excessive dilution of our gold ownership.

It's clear that gold in the ground, which is what we have now, is worth much less than gold in the hand. To realize the full value of our reserves, they will have to be mined and the costs of building and operating a mine will reduce our gold ownership. We expect to enter into joint ventures with large, experienced producers that will take on most of the costs of financing to production in return for a share of the project. This approach is designed to limit equity and debt dilution but it will cost us a significant portion of our reserves.

We think the loss of leverage to the gold price from taking on a partner will be more than offset by the substantially higher value given to ounces that have become reserves of a producing mine and this higher per ounce value should be reflected in our share price. Production should also generate a return in gold, which can be distributed to shareholders as a dividend in physical form.

The two keys to maintaining our exceptional gold ownership per share over time are exploration and acquisitions. Most miners give very little priority to exploration and they generally aren't very good at it. Producers are typically not entrepreneurial enterprises where creative exploration is encouraged. We have a really good engineering and permitting team that has added enormous value to our asset base but our core competency remains exploration. When we acquired our current projects, exploration upside was always the key criterion.

"We remain in the hunt for special assets like Iskut that only come around when the industry has been very stressed financially for a long period of time."

We are very confident we can replace the ounces mined at our projects from low-cost exploration. We have proven that over the last 17 years. And we have carefully focused our efforts on acquiring and exploring district scale projects where there is an outstanding opportunity to grow. At KSM, we believe that there is enormous remaining exploration potential to be shared with our partner. You can also see this upside at our Courageous Lake project, which consists of an entire 53-kilometer-long greenstone belt.

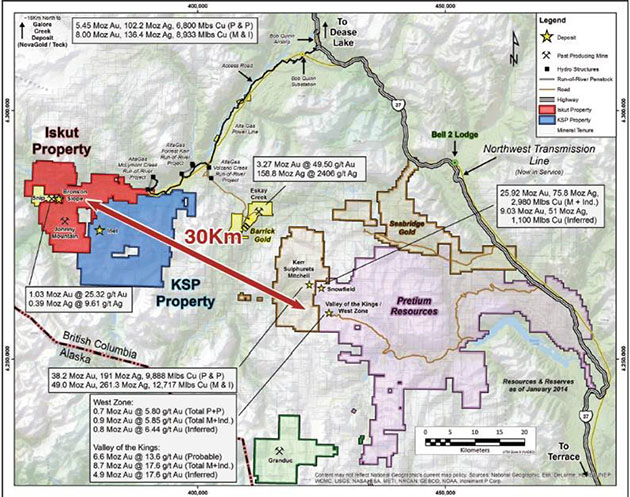

But our best exploration potential is probably at our newly acquired Iskut project just 30km from KSM. This is a huge land package containing past-producing high-grade gold mines within a very large and very powerful mineral system. Exploration to date has been piecemeal, mostly by small, underfunded companies. We think our top-flight team of geologists is beginning to unravel the secrets of this system, which we think has potential equivalent to KSM but with the strong added possibility of high grades like Pretium Resources Inc. (PVG:TSX; PVG:NYSE) has found at Valley of the Kings.

We acquired Iskut earlier this year with the purchase of SnipGold, right near the bottom of the gold market. The big producers are still selling projects they bought at the top of the market but that isn't us. We bought our existing projects near the bottom of the last gold cycle and we are doing the same in the current market.

We remain in the hunt for special assets like Iskut that only come around when the industry has been very stressed financially for a long period of time.

TGR: While Seabridge's stock price has risen substantially since the first of the year, it is still below the highs of 2011.

RF: The gold price is a teeter-totter with the stock market on the other end from gold. As long as perceived risks are low, stocks will go up at the expense of gold. When it goes the other way, I believe gold in the ground will rapidly increase in value. As a gold investor, you have to be patient and wait for the shift in sentiment. When it comes, I think you will be rewarded. We are very patient here at Seabridge.

Seabridge is a leveraged play on gold so we tend to exceed the industry averages both to the upside and to the downside, just as you would expect. As you know, gold went up nearly 650% from the low in 1999 to the high in 2011. Gold outperformed every other asset class. Gold stocks went up 1,575% from bottom to top, which is pretty nice leverage to the gold price. Seabridge beat the gold stock averages by rising 3,500%.

Industry valuations right now are based on the cash flow from producing reserves. The option value imputed to gold in the ground is next to nothing. That's what happens at the bottom of the cycle. I believe gold is now on the way up. In our opinion, the next bull market in gold has begun, and if that's the case, I believe you will be well rewarded by owning shares of Seabridge.

Rudi P. Fronk, chairman and chief executive officer of Seabridge Gold, has over 30 years of experience in the gold business, primarily as a senior officer and director of publicly traded companies. In 1999 Fronk cofounded Seabridge and has served as the company's CEO since that time. Prior to Seabridge, Fronk held senior management positions with Greenstone Resources, Columbia Resources, Behre Dolbear & Company, Riverside Associates, Phibro-Salomon, Amax and DRX. Fronk is a graduate of Columbia University from which he holds a Bachelor of Science in mining engineering and a Master of Science in mineral economics.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo compiled this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: None.

2) Seabridge Gold Inc. is a sponsor of Streetwise Reports. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclaimers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Seabridge Gold Inc. had final approval of the content and is wholly responsible for the validity of the statements. Opinions expressed are the opinions of Rudi Fronk and not of Streetwise Reports or its officers.

4) Rudi Fronk: I was not paid by Streetwise Reports to participate in this interview. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview. I or my family own shares of the following companies mentioned in this interview: Seabridge Gold Inc.

5) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

6) This interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

7) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.