Victoria Gold Corp. (VIT:TSX.V) announced multiple results from its 100%-owned Dublin Gulch gold property in the Yukon with back to back news releases on Sept. 18 and Sept. 19.

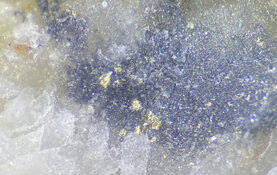

In the Sept. 19 press release, Victoria Gold announced the first assays received from the "2017 Bluto target surface trench exploration program. TR17-16 was the first major trench constructed at the Bluto target this season and was concentrated on a trail built with heavy equipment to access a water source that would be utilized in the planned 2017 Bluto diamond drilling exploration program."

"The fact that a high-grade gold vein was discovered early in this campaign demonstrates that our Potato Hills Trend mineralization model is working and we look forward to the first ever drill results from this highly prospective area," noted John McConnell, president and CEO of Victoria Gold.

Following the press release, Chris Thompson, an analyst with Raymond James, reported on Sept. 19 that "VIT's continued exploration success demonstrates potential upside for Eagle, providing possible satellite deposits which could extend the planned mine life beyond the current 10 years." He pointed out that "recent drilling and trenching along the Potato Hills trend have identified several new targets including Spinach (~500 m north of Olive-Shamrock), Popeye (~1 km west of Olive-Shamrock), and Bluto (6 km east of Eagle)."

He explained that he is maintaining a Buy rating and that the $1.00 target price "is derived by applying a 1.0x multiple to our fully funded NAV. We feel our target is justified given Eagle's safe jurisdiction and fully permitted status."

Raymond James has an Outperform rating on Victoria Gold and a target price of $1.00 per share. The company's shares are currently trading at $0.48.

Echelon Wealth Partners analyst Ryan Walker stated in a Sept. 19 report that "Victoria Gold reported a trench assay from the new Bluto Target, along the Potato Hills Trend model that the Company is using successfully to guide exploration at its 100% owned Dublin Gulch project in the Yukon." He pointed out that Victoria Gold is currently testing another 22 trenches with assay results pending on 10 of the holes.

Walker highlighted that "results nearer to Eagle in the Olive-Shamrock area are demonstrating the potential for relatively quick mine-life additions, while strong results from Spinach and Bluto confirm the substantial exploration potential remaining along the 18km-long Potato Hills Trend at Dublin Gulch, something we highlighted in our original investment thesis."

"Our positive bias towards VIT shares reflects the project's strategically large resource, fully permitted and shovel ready status, district-scale land package with substantial exploration potential near excellent infrastructure, and situation in Canada," Walker concluded.

Echelon maintains a Speculative Buy rating om Victoria Gold with a target price of $0.90 per share.

Victoria Gold's Sept. 18 press release detailed the results of the "the first eleven (11) exploration drill holes at the Spinach target, a previously untested area north of the Olive-Shamrock Deposit." The announcement highlights the details of the drill results and notes that "2017 exploration at the Spinach target included soils geochemistry surveys, geologic mapping, trenches and diamond drilling focused on assessing the gold mineralization potential of the northern contact margin of the Dublin Gulch intrusive stock."

In a Sept. 18 report, Echelon Wealth Partners analyst Ryan Walker stated that "drilling at Spinach tested an area of approximately 400m by 400m. For comparison, the Eagle Gold deposit, which is now under construction, contains Proven and Probable reserves of 2.7 Moz Au grading 0.67g/t Au, part of a wider resource containing 4.0 Moz Au grading 0.65g/t Au in Measured and Indicated resources, and a further 0.5 Moz Au grading 0.61 g/t Au in Inferred resources."

Gary Sidhu, an analyst with PI Financial, stated in a Sept. 18 report that "drilling at the Spinach zone this year totaled 6,265 metres (22 holes) targeting a coincident gold/arsenic soil geochemical anomaly." He highlighted that "mineralization intersected here is distinct from both the Olive-Shamrock deposit and Eagle deposit however, [and] continues along the same Potato Hills Mineralization trend."

Sidhu noted that the distinct mineralization discovered is a good sign for future exploration and "results indicate exploration methods (mapping, soil geochemistry, and trenching) have been successful in identifying mineralized zones."

"Victoria controls what we consider to be a strategic asset: a sizeable gold development project (~200koz/y), which can be developed for a reasonable initial capital expenditure . . .we expect Victoria will garner interest from a variety of gold producers as an M&A target."

PI Financial maintains a Buy rating and a target price of $1.10 per share on Victoria Gold.

Read what other experts are saying about:

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Melissa Farley compiled this article for Streetwise Reports LLC and provides services to Streetwise reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Victoria Gold Corp. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Additional disclosures about the sources cited in this article