In this author's opinion, China, and to a lesser extent India and other developing nations, are responsible for the largest and longest base metals bull market the world has ever experienced. Many fear the bull market for natural resources is over when in fact nothing could be further from the truth. This seems especially true, because of the supply/demand picture, regarding copper.

Copper's chemical and physical properties:

- High ductility

- Corrosion resistant

- Malleable

- Excellent conductor of heat and electricity

- Alloyed with other metals—zinc to form brass, aluminum or tin to form bronzes or alloyed with nickel—it acquires new characteristics for use in highly specialized applications.

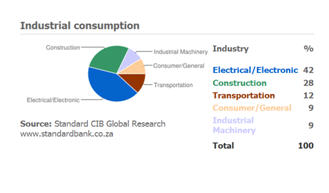

- Conducting electricity and heat

- Telecommunications

- Transporting water and gas

- Industrial machinery and equipment

- Coins for currency

- Roofing, gutters and downspouts

- Protecting plants and crops

- A feed supplement

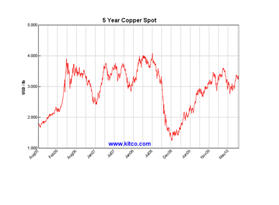

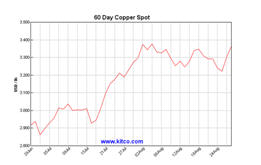

Copper's price hit US$3.75/lb. in May 2006 after rising from a 60-year low of US$0.60/lb. in June 1999. By February of 2007, it had dropped to US$2.40/lb. but had rebounded to US$3.50/lb. by April 2007.

By February 2009 copper prices were—because of weakening global demand and a steep fall in commodity prices—at US$1.51/lb.

Copper prices started a comeback and during the summer of 2009 and again during the summer of 2010 the price of copper defied conventional market wisdom – sell in May and go away – by rallying strongly and in 2010 managed to hold close to its recent highs coming into the end of August.

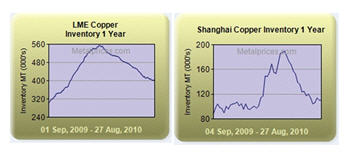

Copper inventories at the London Metal Exchange (LME) and Shanghai Futures Exchange have both seen dramatic reductions.

Copper exploration/development companies looking for or trying to develop deposits already found and copper miners looking to expand their production capacity are all facing some serious challenges:

- Falling ore grades

- Country risk

- Water supply

- Labor problems, strikes

- Shortage of skilled labor

- Cost of capital for project finance

- Capital cost overruns

- Tax and sharing initiatives

- Energy costs

- Inadequate exploration funding—The Metals Economics Group estimates that exploration spending plummeted 42% to $7.7 billion in 2009.

- A lack of new discoveries

- Currency fluctuations

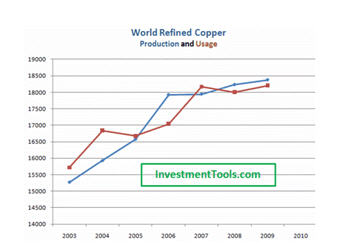

On August 24th 2010, the International Copper Study Group (ICSG) released preliminary data that showed world copper production fell short of refined usage by 190,000 tons in the first five months of 2010.

This author believes the full ICSG report showcases an underperforming industry and tells us there is the potential for a large copper demand/supply imbalance coming in the near future.

Also consider:

- The declining rate of production at the world's largest copper mine, Escondida. BHP Billiton forecasts a 5%–10% production cut at the mine this year due to lower ore grades—Bart Melek, global commodity strategist with BMO Nesbitt Burns in Toronto, said this could take as much as 80,000 to 100,000 tons of copper out of the market;

- U.S. copper mine production had been expected to increase by more than 200,000 tons last year; instead production declined by 120,000 tons;

- Rio Tinto and Freeport McMoRan both saw their output drop in the first six months of this year;

- A lack of investment in new mining capability because of recent low prices;

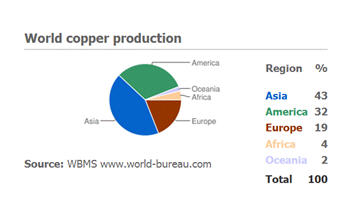

- The growth in demand from China, India and other emerging markets;

- Consistent declines in warehouse inventories are underpinning the price of copper;

- A low interest rate environment bodes well for the whole resource sector;

- The overall weakness in the USD translates into support for dollar-denominated metal prices;

- The potential for a drop in production from Australia—the world's fifth largest copper producer—as a result of a resource tax the government might implement;

- India's power production needs to rise by 15%–20% annually, which, according to the International Energy Agency (IEA), means India needs to invest $1.25 trillion by 2030 into its energy infrastructure. Because of this investment into new infrastructure India's annual copper demand is expected to more than double to nearly 1.5 million tons by 2012—up from a current 600,000 tons. India usually exports between 100 and 150,000 tons a year, Indian copper exports are likely to cease and indeed Indians might become large copper buyers.

"Prices are underscoring the relatively robust nature of physical conditions and from a business cycle perspective inventories remain fairly low. If economic conditions deteriorate there isn't going to be that much destocking as manufacturers have been quite disciplined ... The market is factoring in the fact that supply tightness is not going away." -Dan Brebner, analyst at Deutsche Bank

According to Barclays Commodities Research analysts copper is forecast to average $6989/t this year and $7763/t in 2011.

For 2011, BMO anticipates a global supply deficit of some 280,000 metric tons, with a price forecast of $3.70 a pound.

Investors have concerns:

- The extent of the recovery currently underway in the U.S. and Europe

- A slowdown in Chinese growth

"Copper consumption estimates for China are being revised up. Huge spending on copper-intensive power infrastructure on the state grid in ‘rural areas' will continue through 2012 (12B RMB). Beijing has also renewed the ‘home appliance subsidy scheme' and is promoting electric cars, which are twice as copper-intensive as conventional vehicles." -Patricia Mohr, Scotiabank economist

Mohr also said that China's demand for copper will grow 13% this year and by another 8-10% in 2011.

"I think the global growth story is back on. China, India and Brazil, especially, are just growing by leaps and bounds. . .and they need the copper for housing and infrastructure." -Michael K. Smith, president of T&K Futures and Options Inc.

The Chinese are:

- Increasing the level of housing construction;

- Seeing strong increases in car sales, up over 50% YOY;

- Targeting urban population growth of 60% by 2020, this is up from 49% in 2010*;

- Currently consuming 40% of total global base metal production;

- Raising domestic metal prices, by stockpiling, to stave off unemployment;

- Creating and transmitting more electricity;

- Providing massive direct subsidization of export production in many key industries; Maintaining strict non-tariff barriers to imports;

- Keeping their currency, the yuan, at an artificially low exchange rate—the undervalued currency keeps China's exports cheap.

- At the end of 2009, mainland China's total population was 1.334 billion—712 million people or 53.4% of the population were residing in rural areas, while 622 million or 46.6% were residing in urban areas—Chinese urban dwellers are the largest such population in the world;

- City's Blue Book: China's Urban Development Report No. 3 said China's urban population is twice that of the population of the U.S., one quarter more than the total population of 27 countries of the EU and that the urban economy would continue to drive domestic demand;

- The UN has forecast that China's population will have about an equal number of people, the 50%-point phenomenon, living in the rural and urban areas by 2015;

- China has set a goal of 65% of urbanization rate in 2050. Over the coming 40 years that means 20 percentage points of urban growth per year, that translates into 300 million rural residents becoming urban residents over this time period;

- By 2025 China's urban population is expected to rise to 926 million. By 2030 that number will increase to a billion;

- China's current urbanization rate of 46% is much lower than the average level of 85% in developed countries and is lower than the world average of 55%;

- In 2010 the disposable income of the urban population stood at 17,175 yuan per capita—the net income of the rural population was 5,153 yuan per person;

- Over the next two decades China will build 20,000 to 50,000 new skyscrapers;

- By 2025, 40 billion square meters of floor space will have been built;

- 221 Chinese cities will, by 2025, have one million people;

- More than 170 cities will need mass transit systems by 2025.

India

"Every major industrialized country in the world has experienced a shift over time from a largely rural agrarian-dwelling population to one that lives in urban, nonagricultural centers. India will be no different. However India's urbanization will be on a scale, that outside of China, is unprecedented." -McKinsey Global Institute's report India's Urban Awakening

India has 1.2 billion people and the second largest urban system in the world— currently 340 million people.

Less than 60% of the households in India's cities have sanitation facilities, and less than half have tap water on their premises.

The share of the urban population in India is expected to reach 40% by 2021, and by 2011, urban areas could contribute around 65% of GDP.

A report done by the McKinsey Global Institute called India Urban Awakening predicts that 590 million people or 40% of the population will live in cities by 2030 up from 340 million today. By that time, Asia's third largest economy would have 68 cities with populations over 1 million, up from 42 today.

With less than 1/3 of the population India's urban areas generate over 2/3 of the country's GDP and account for 90% of government revenues.

Scrap Copper

People have been using copper for over 10,000 years and recycling (it can be recycled without any loss of chemical or physical properties) almost as long—it has been estimated that at least 80% of all copper ever mined is still in existence.

Unfortunately:

"Indications are that demand in Europe, the U.S. and Japan is holding up well and scrap has become very tight." Barclays Commodities Research analysts

"Scrap (supply) is tight." Edward Meir, analyst with MF Global

"There is little information regarding this market (talking about the scrap market); however, it has not been a decisive factor either for the demand or supply side of the copper market." -Juan Villarzu, former head of world's largest copper company, Codelco

Conclusion

This author believes that the U.S. and Europe are, or are in the process of becoming, mostly irrelevant when it comes to the demand side of the copper supply equation. Increased demand for the red metal in developing nations will more than make up for decreased demand in the Western world. And when western economies recover, as they eventually must, then the supply squeeze will become even tighter.

The citizens of the worlds developing nations aspire to have what we have, the ease of travel, home phones, electricity, central plumbing, heating and air conditioning, cars, toys, consumer electronics and home appliances.

When you consider the recent lack of exploration spending, increasing demand from developing countries, country risk (the Democratic Republic of the Congo, the DRC, comes to mind) declining resources/grades at the world's largest copper mines and that a sufficient number of new deposits that have been found are not being brought on stream in a timely enough fashion—and those that are, carry, for the most part, much lower grades than those presently being mined then you might be forgiven for coming to the same conclusion that I have—growth in global copper demand, at the same time supply is declining, seems likely.

China alone has one fifth of the world's population, India another 1.2 billion people, most of them want the same quality of living and level of consumerism and materialism we enjoy in the west.

Could copper come into a major demand squeeze? Is the red metal on your radar screen?

If not, maybe it should be.

Richard (Rick) Mills

rick@aheadoftheherd.com

www.aheadoftheherd.com

If you're interested in learning more about specific potash juniors and the junior resource market in general please come and visit us at www.aheadoftheherd.com.

Membership is free, no credit card or personal information is asked for.

Richard is host of aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 200 websites, including: The Wall Street Journal, SafeHaven, Market Oracle, USA Today, National Post, Stockhouse, Casey Research, 24hgold, Vancouver Sun, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor and Financial Sense.

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard Mills does not own shares in any company mentioned in this report and none are sponsors on his website aheadoftheherd.com

Ahead of the Herd.com Media Group Inc., a division of Ahead of the Herd Holdings Inc. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. While we believe the sources of information to be reliable, we in no way represent or guarantee the accuracy of the statements made herein. Ahead of the Herd.com does not provide individual investment counseling, act as an investment advisor or individually advocate the purchase or sale of any security or investment. The publisher, editors and consultants of Ahead of the Herd.com may actively trade in the investments discussed in this website and newsletter. They may have substantial positions in the securities recommended and may increase or decrease such positions without notice. Neither the publisher nor the editors are registered investment advisors. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this website and publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.