Streetwise Oil & Gas - Exploration & Production Articles

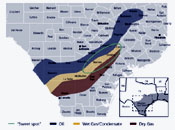

Unlock the Eagle Ford with These Three Words

Source: Matt Insley, The Daily Reckoning (10/22/12)

"The Eagle Ford is in between the optimization phase and the harvest phase, ready to pay out for investors."

More >

Exxon's Biggest Canada Deal Signals Shale Rush

Source: Bloomberg, Joe Carroll and Rebecca Penty (10/18/12)

"The Duvernay shale, which is soaked in natural gas as well as petroleum liquids such as propane and ethane, which fetch higher prices, may rival the mammoth Eagle Ford formation in south Texas."

More >

Play Housing and Agriculture with Energy

Source: Frank Holmes, Frank Talk (10/18/12)

"Companies involved in oil refining, exploration and production, drilling and infrastructure stand to gain, as well as companies involved in food, forest and paper products. These are essential ingredients for the billions of people on the planet."

More >

Is Energy Independence Really on the Oil and Gas Agenda?

Source: The Christian Science Monitor, Kurt Cobb (10/16/12)

"Inadequate infrastructure has U.S. oil and gas priced below global rates, but when transportation costs are reduced, companies will ship their oil to the highest bidder."

More >

Energy Investment Is an International Adventure: Darrell Bishop

Source: Alec Gimurtu of The Energy Report (10/11/12)

Looking for outsized returns? Then broaden your horizons, suggests National Bank Financial Analyst Darrell Bishop, who focuses on regions where property acquisition is cheaper and oil sells at the Brent premium. In this exclusive interview with The Energy Report, Bishop whisks us around from Western Europe's North Sea, to behind the former Iron Curtain in Albania, to developing energy plays in New Zealand. Learn how to navigate the risks of the space and what makes a far-from-home smallcap worth it all.

More >

US Power Demand Will Cause 'Daily Volatility' in Natural Gas Flows: TransCanada

Source: Platts (10/10/12)

"The upcoming challenge has pushed pipeline companies to join forces with regional transportation organizations, power generators and ISOs to develop a cohesive framework for operators and services."

More >

Who's Winning Big in Lopsided Energy Markets?: Kim Pacanovsky

Source: Zig Lambo of The Energy Report (10/9/12)

Industry experts are all over the map on short- and long-term projections, but producers are still pumping and there's money to be made in oil and gas. In this exclusive interview with The Energy Report, Kim Pacanovsky, managing director of research at MLV & Co., discusses some sweet spots in energy markets, including some companies that are enjoying success at the well.

More >

Iran's Currency Collapse Has All the Markings of a Full-Blown Crisis

Source: Kent Moors, Money Morning (10/9/12)

"Oil sanctions and ever-tighter restrictions to international banking have had a devastating impact on the rial, Iran's currency. Riots have begun and its economy is unraveling."

More >

EU Backs Away from Stricter Offshore Oil, Gas Rules: MEPs

Source: Jane Morecroft and Kimberly Peterson, Platts (10/9/12)

"The energy committee voted to switch from a detailed, technical regulation to a more flexible directive that will allow countries to adapt the rules to existing systems."

More >

Energy Basics Trump Obama/Romney Trade: Q&A with Blackstone's David Foley

Source: TheStreet, Antoine Gara (10/4/12)

"Notable in Foley and Blackstone's energy investing approach is a lack of short-term bets, such as reading tea leaves for election year policy change, and instead, a focus on long-term exploration and development trends that work regardless of who takes the White House."

More >

Why My Portfolio Gained 30% This Year: John Stephenson

Source: Zig Lambo of The Energy Report (10/2/12)

Markets aren't great—but they're not all that bad, says John Stephenson, vice president of First Asset Management Inc. They were strong enough to allow the fund manager and newsletter writer to increase his portfolio's worth by 30% year-over-year. His advice? Be nimble and buy and sell on your feet. In this exclusive interview with The Energy Report, Stephenson highlights some small-cap companies that may help you book gains—repeatedly.

More >

Why an Islamic Revolution in Saudi Arabia Will Send Oil to $300/bbl

Source: Marin Katusa, Casey Research (10/2/12)

"Is a 1973-style oil crisis about to engulf the entire world?"

More >

Pipeline Infrastructure Needed for the Bakken

Source: Brianna Panzica, Energy & Capital (10/2/12)

"Roughly a third of natural gas produced in the Bakken in July was flared due to a lack of infrastructure for transporting the resource."

More >

Investing in Oil: Five Questions to Ask the Management

Source: Keith Schaefer, Oil & Gas Investments Bulletin (10/1/12)

"Most of these answers can be found in the middle of the Management Discussion and Analysis (MD&A) in quarterly financial statements."

More >

Commodity Stocks: Improving Returns with No Extra Volatility

Source: Frank Holmes, Frank Talk (10/1/12)

"When looking at measures such as correlation, performance and risk, two indexes can have very different effects on a portfolio's results."

More >

The Case of the Missing 200 Million Barrels of Oil: Marshall Adkins

Source: George S. Mack of The Energy Report (9/27/12)

Supply threats in the Middle East have governments around the world hoarding oil, largely in secret. But it didn't get past Raymond James Director for Energy Research Marshall Adkins, who noticed the 200 million-barrel discrepancy between what was pumped and reported global oil reserves. Where did the missing oil go, and why don't prices reflect this substantial surplus? More importantly, what happens once the reality of an oversupply sets in?—A tough six months, Adkins expects. Read on to find out where you can hide when prices plummet.

More >

Cutting-Edge Technologies Will 'Green' Fracking: Keith Schaefer

Source: Peter Byrne of The Energy Report (9/25/12)

Fracking in the U.S. is here to stay, affirms Keith Schaefer, editor of the Oil & Gas Investments Bulletin. North American business is dependent on cheap energy, and even energy utilities are switching from coal to natural gas. Although environmental concerns remain, the industry has incentive to do the right thing, says Schaefer. In this exclusive interview with The Energy Report, Schaefer profiles service companies that are using cutting-edge technology to make fracking safer, greener and cheaper.

More >

Oil & Gas Stock Outlook

Source: Zacks Equity Research (9/24/12)

"While the Western economies exhibit sluggish growth prospects, global oil consumption is expected to get a boost from sustained strength in the non-OECD countries that continue to expand at a healthy rate."

More >

London Sees Oil Prices on the Rise

Source: Kent Moors, Oil & Energy Investor (9/23/12)

"The overwhelming consensus in Europe is that oil will rise, absent exogenous economic or financial problems."

More >

Taylor MacDonald Unearths Profit-Makers in the Oil and Gas Service Sector

Source: Zig Lambo of The Energy Report (9/20/12)

Everyone agrees that high energy prices are here to stay, so most companies should perform well in the long run. But what about near-term opportunities? Taylor MacDonald, associate portfolio manager at Pathfinder Asset Management, is looking to service companies for industry outperformance. In this exclusive interview with The Energy Report, he describes why proprietary niche service companies virtually own the markets they are establishing.

More >

Bob Moriarty: Finding Massively Undervalued Energy Stocks in Today's Irrational Market

Source: Karen Roche of The Energy Report (9/18/12)

Bob Moriarty knows his own mind, and his frank, no-nonsense commentary has won him a large following of devoted fans—not to mention a track record of outstanding returns on investment. In this exclusive interview with The Energy Report, the irreverent, irrepressible 321energy.com founder shares his take on energy markets. Although he describes today's markets as the most irrational he's ever witnessed, he asserts that energy stocks—many of them massively undervalued—are bound to reward long-haul investors like himself. "You don't have to pick stocks in this environment," he advises. "Just take a dart and throw it."

More >

The Mystery Behind High North American Gas Prices: Solved

Source: Keith Schaefer, Oil and Gas Investments Bulletin (9/18/12)

"North American drivers are now competing with global drivers—and global industry—for cheap American crude."

More >

The Next Recession Will Be Triggered by Oil

Source: Toby Connor, GoldScents (9/17/12)

"Any move of 100% or more in energy prices within a year has historically been the straw that breaks the camel's back.

More >

Casey Panel: The Energy Crisis Is Here—Here's How to Play It

Source: The Energy Report Editors (9/13/12)

Oil and gas reserves around the world are growing scarcer by the minute, and people are looking to their governments for answers. However, leaders' responses are often motivated more by the desire to boost approval ratings than by the need to find real, long-term supply solutions. The individual investor may not have the power to shift the tone of the emotional debates surrounding the oil and gas industry, but he or she can devise a strategy to profit. Sprott's Rick Rule, and Casey's Marin Katusa and Louis James sat down with The Energy Report to discuss what it means to participate in a politicized market and how politics affect their buy and sell decisions.

More >

Arctic Sea Ice Vanishes—and the Oil Rigs Move In

Source: Time, Bryan Walsh (9/11/12)

"According to the U.S. Geological Survey, there may be more than 90 billion barrels of recoverable oil buried in the Arctic—about 13% of the world's estimated undiscovered reserves."

More >