This is working out very well. When we looked at Blue Lagoon Resources Inc. (BLLG:CSE; BLAGF:OTCQB) early this month when it was priced at CA$0.30 we decided that it was on the point of breaking out of a fine bull Pennant, and as it turns out, it was, for it has since broken out and trended strongly higher, so that we are now up almost 50% in three weeks.

With it now quite heavily overbought as a result of this strong advance it is a good time for us to take a fresh look at it with the aim of figuring out what is likely to happen next.

The first point to make is that gold is in "meltup mode" so that, although it is at a 45-year overbought record it is likely to continue higher, albeit that, as a result of this overbought state, we will not be surprised by any periods of consolidation or reaction that occur along the way. A big reason that it is likely to continue higher is that the dollar is verging on collapse as it heads towards losing its reserve currency status. This is a good backdrop against which quality gold stocks like Blue Lagoon should continue to advance.

The second point is that, having broken out of the fine low Pan base pattern in February that followed a severe bear market from the early 2020 highs, the new bull market in Blue Lagoon is still in its early stages, as we can see on its 8-year chart below. . .

The advance is being driven by strong upside volume, which is why the On-balance Volume line shown at the top of this chart has been soaring, and so it is considered likely that it will run at the resistance shown on the CA$0.65 – CA$0.75 area before stopping to consolidate. At this point, it would probably make sense for traders to take profits and redeploy the funds elsewhere for a while until it looks like the stock is ready to break above this zone to continue higher still. Before leaving this chart, we should note that it makes clear that the price could easily advance to the early 2020 highs in the CA$2.10 area in due course.

The 3-year chart is worth looking at as it shows the slightly tilted Pan base in much more detail. Tilted Pan bases often lead to a sharper advance than the normal flat ones, the reason being that fewer investors suspect that the stock is on the verge of a big move because of the continuing new lows so an abrupt change of sentiment follows the breakout.

Lastly, the 6-month chart shows the bull market from its inception in detail, with the powerful breakout in February being followed by a Pennant consolidation that we correctly read to predict the big upleg that followed, which at this point is still ongoing, although it is getting quite heavily overbought.

Nevertheless, it could carry on up to the CA$0.65 – CA$0.75 area as mentioned above before we see a longer period of consolidation or reaction.

If you want some fundamental reasons to like this stock, here they are. . .

- Fully Permitted: One of only nine companies in BC to receive a mining permit since 2015.

- Low Capex: $38M already spent; Fully funded with only $3M required to complete the water treatment plant and fund the first six weeks of operations.

- Near-Term Cash Flow: Production begins in July / Aug at 15,000 oz/year, with cash flow starting in September.

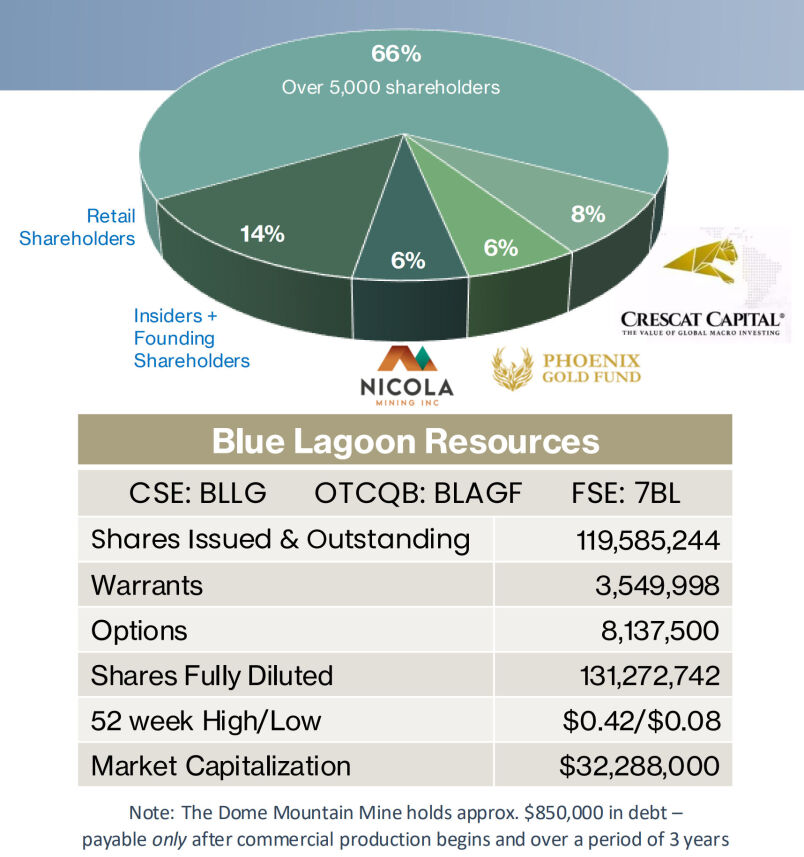

- Toll Milling Agreement Secured: Nicola Mining (who, after a site visit last year, invested $1M and owns 6% of BLLG) will process the company's ore.

- High Recoveries & Grade: 5,000 tonnes processed with 95% gold recovery at 9 g/t.

- Significant Resource Growth Potential: Current 218,000 oz gold resource at 9 g/t (3.5 g/t cutoff) from just one vein —15 additional high-grade veins remain untapped.

- Blue Sky Potential: 50,000m drilled since 2020 indicates a clear path to 1M+ high-grade ounces on the main vein, plus additional targets across the 22,000-hectare property.

- Strategic Investors & Final Raise: Now closing a $3M financing — $2.6M already secured, led by existing shareholders including Crescat (8%), Phoenix Gold Fund (6%), and Nicola Mining (6%).

About two-thirds or 80 million of the almost 120 million shares outstanding are in the float. . .

More interesting information may be perused in the company's Investor Deck.

We therefore stay long and Blue Lagoon is a Buy on any approach to the lower rail of the uptrend channel shown.

Blue Lagoon Resources' website

Blue Lagoon Resources Inc. (BLLG:CSE; BLAGF:OTCQB) closed for trading at CA$0.44 US$0.3165 on April 22, 2025.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.