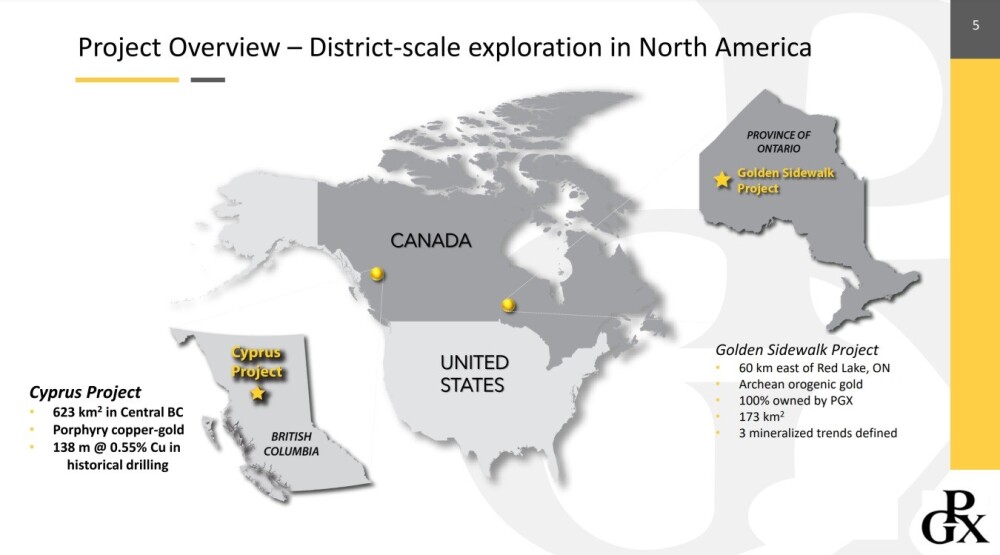

Prosper Gold Corp. (TSVX: PGX; OTCQB: PGXFF) is a copper-gold exploration company whose stock is considered to have extraordinary upside potential from its current low level with potential for massive percentage gains, the reasons being that it is advancing two district scale projects, the copper-gold Cyprus Project in British Columbia and the Golden Sidewalk Project in Ontario, which is a gold project not far from Red Lake, at a time when a metals bull market is fast gathering pace. Before looking at the company's latest stock charts, we will review its fundamentals.

The following page from the company's investor deck shows the location of its two District Scale properties in British Columbia and Ontario.

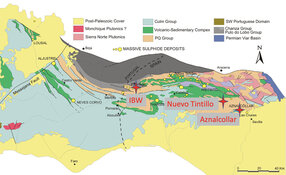

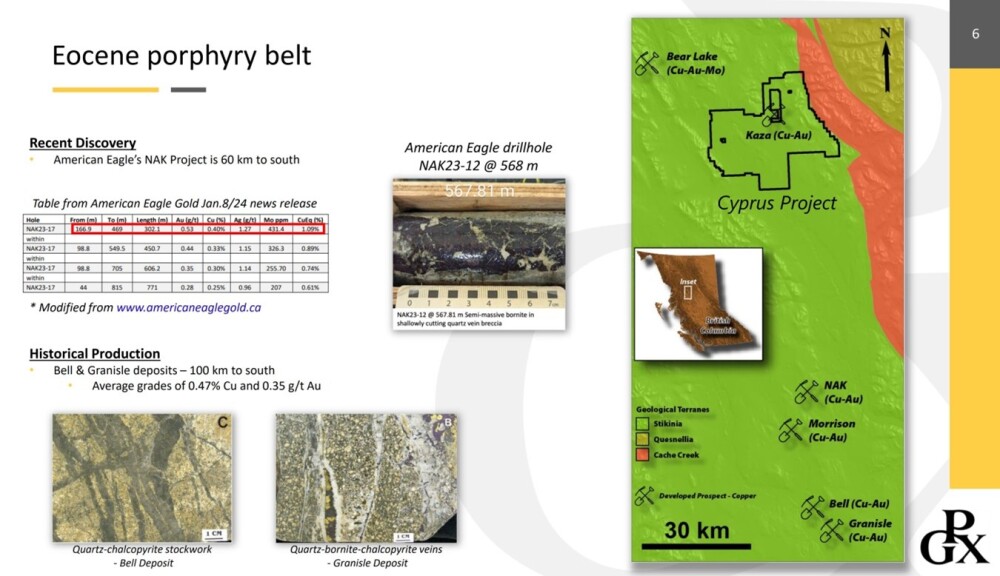

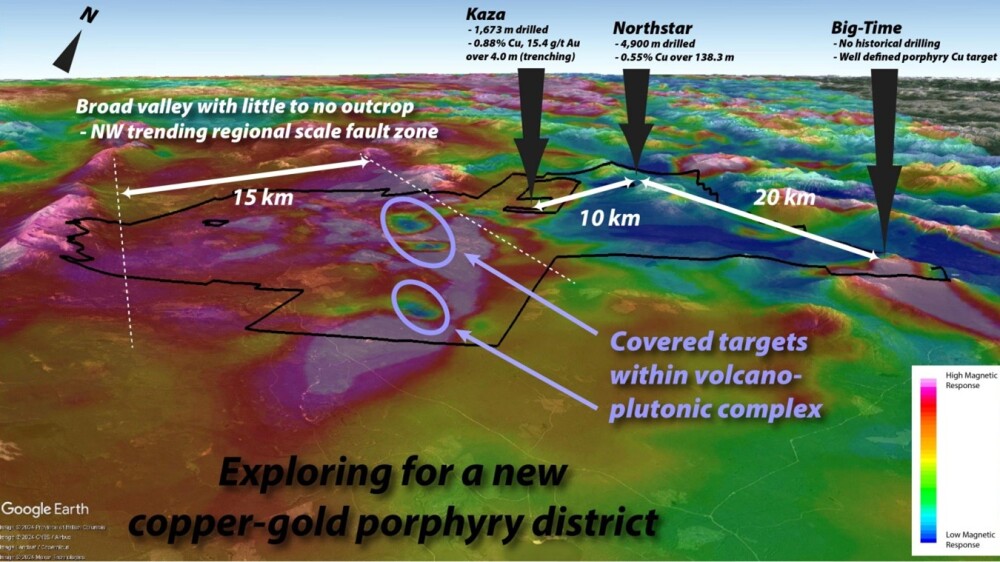

The Cyprus Project is located on the same Eocene Porphyry Belt as American Eagle Gold Corp.'s (AE:TSXV; AMEGF:OTCQB) NAK Project, which is 60 km to the south and a range of other important projects, which naturally increases the chances of major discoveries at Cyprus.

There are several main targets within the Cyprus Project. They are Big Time, Kaza, and Northstar — and significant discoveries have already been made at these targets.

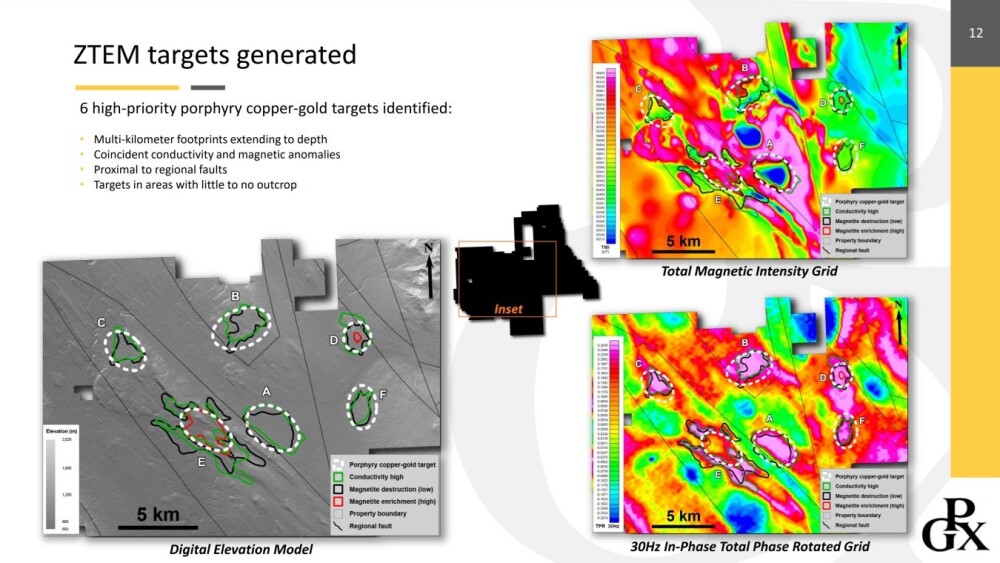

In addition to these three important targets, the ZTEM survey, whose results were posted early last Fall, identified a further six high-priority porphyry copper-gold targets.

So there is now plenty to work on and work towards at both the Cyprus Project and the Golden Sidewalk Project and we should remain aware that the President, CEO and Chairman of the company, Mr. Peter Bernier, earlier made a big discovery that resulted in his company Richfield Ventures being bought out by New Gold in 2011 for $550 million, and it is therefore highly unlikely that he would be involved with Prosper Gold if it did not have significant potential.

As of April 2, there were 62 million shares in issue, and factoring in options and warrants, there are 78.4 million shares in issue, fully diluted.

Now, we will review the latest stock charts for Prosper Gold.

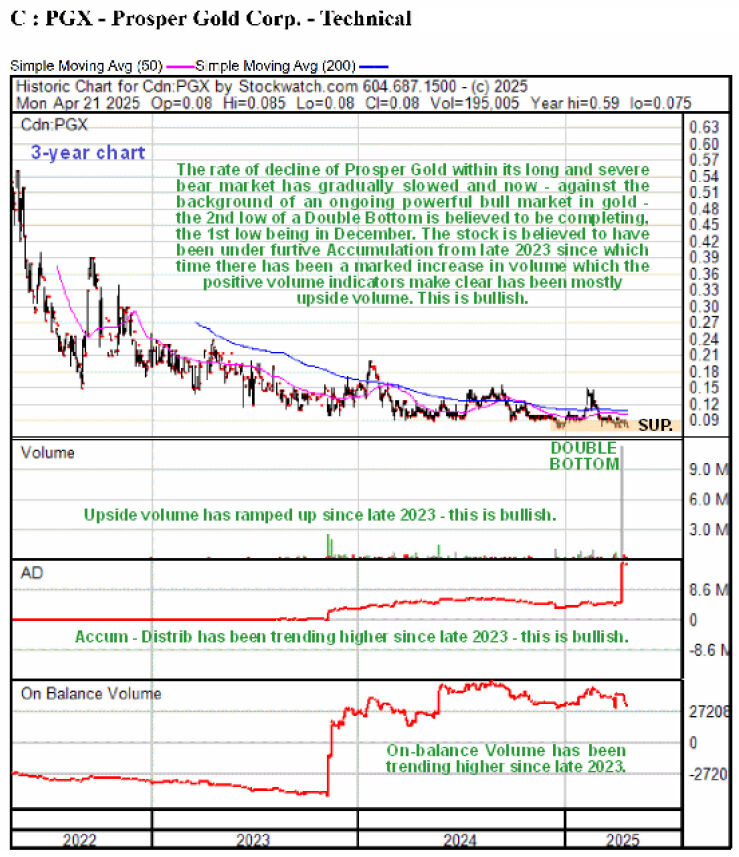

Starting with the long-term 14-year chart, we see that overall, Prosper Gold has been in a prolonged bear market from as far back as its highs in 2013, so for 12 years now, apart from lesser bull markets along the way, which we now know were really bear market rallies. At its peak, it got to over CA$6.40, and with it closing last week at just 8.5 cents, it has clearly lost almost all of its value.

This, of course, means that at its current price, there is almost no downside but potentially a lot of upside. So, is there any evidence on the charts that better times are ahead with a new bull market starting?

Fortunately, there is, and it is strong evidence. Even on this chart we can see that the rate of decline has been slowing but more importantly we can see also that there has been a substantial buildup in trading volume since late 2023 and most of this volume has been upside volume, as is made clear by the uptrending volume indicators shown at the bottom of the chart. This is bullish because it means that a lot of stock has changed hands with discouraged longtime holders of stock selling to new buyers who are buying for a reason and will not be inclined to sell until they have turned a profit.

Another important point to note is that, against the background of the now powerful bull market in gold, with gold having risen by more than 50% since early last year, larger companies are looking to increase their asset base and of course one of the easiest ways to do that is to buy undervalued smaller companies who have either defined significant resources or are sitting on most promising projects, as is certainly the case with Prosper Gold. So, that big trade last week may be an instance of such a company "putting its best foot forward."

On the 3-year chart we can see how the bear market continued over the past several years but decelerated to the point that it looks like it hit a final low last December and with upside volume improving this year and volume indicators tentatively climbing it looks like the price has just made a Double Bottom with the December low, following the latest dip, a view that is certainly reinforced by the big trade last week that caused the Accumulation line to spike.

It therefore looks like pressure is rapidly building in Prosper Gold stock for an upside breakout into a major new bull market so that the time window for buying it at this price is rapidly closing — and we may see the same sort of move soon that we just witnessed in Dryden Gold Corp. (DRY:TSXV; DRYGF:OTCQB) and partly for the same reasons.

A possible catalyst is the results from the drilling program at Cyprus that was announced on February 10. Also of note is that a funding was recently closed successfully with company President and CEO Peter Bernier increasing his stake to 15.7%, which is viewed as a clear vote of confidence.

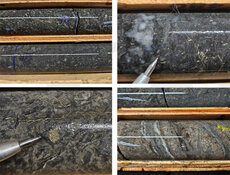

There was also news out of the company this morning (April 22, 2025) that Prosper Gold had refined its target at Cyprus, with its Winter drilling campaign striking the margin of a hydrothermal system, and the follow up Summer drill program will capitalize on these findings.

In light of the news, CEO Peter Bernier commented, "The maiden drill program at Cyprus was designed to target coincident magnetic and conductivity anomalies outlined from our 2024 property-wide ZTEM survey. The drill core and the recent IP results indicate that we drilled the margin of a hydrothermal system. We are very excited that the next phase of drilling will utilize all the data we have acquired to more effectively target this covered porphyry system."

Prosper Gold is therefore rated an Immediate Strong Buy for all time horizons. The immediate target for an advance is resistance in the CA$0.18 – CA$0.20 zone and beyond that there is much higher target in the CA$2.20 – CA$2.40 zone which is very achievable given the still relatively modest number of shares in issue and there are higher targets beyond this.

Prosper Gold Corp.'s website.

Prosper Gold Corp. (TSVX: PGX; OTCQB: PGXFF) closed for trading CA$0.08, US$0.053 on April 21, 2025.

| Want to be the first to know about interesting Gold, Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Prosper Gold Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,575.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Prosper Gold Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.