Emerita Resources Corp. (EMO:TSX.V; EMOTF:OTCQB; LLJA:FSE) announced it is continuing to intersect copper-gold mineralization with associated zinc-lead-silver in its drilling campaign at El Cura deposit, part of Emerita's wholly owned Iberian Belt West (IBS) project in Spain.

IBW contains three identified Volcanogenic Massive Sulfide (VMS) deposits: La Romanera, El Cura, and La Infanta.

"These results demonstrate that El Cura remains open for further resource expansion with additional drilling," Emerita President Joaquin Merino said. "We currently have four drilling rigs operating at El Cura, and we look forward to additional positive drill results as the drill campaign continues throughout 2025."

According to Emerita, new drilling results from the campaign at El Cura include:

- Hole EC050: 10.8 meters grading 4.8% copper (Cu), 1.4 grams per tonne gold (g/t Au), and 72.6 g/t silver (Ag).

- Hole EC046: 8.9 meters grading 1.1% Cu, 1.2 g/t Au, and 15.5 g/t Ag.

- Hole EC039: 1.5 meters grading 1% Cu, 0.6% lead (Pb), 1.9% zinc (Zn), 2.0 g/t Au, and 38.7 g/t Ag.

- Hole EC043: 3.7 meters grading 1.3% Cu, 1.6% Pb, 2.6% Zn, 0.9 g/t Au, and 52.1 g/t Ag.

- Hole EC044: 4.9 meters grading 1.2% Cu, 0.9% Pb, 1.3% Zn, 1 g/t Au and 26.7 g/t Ag.

In March, Emerita announced an updated independent mineral resource estimate (MRE) for IBW reflects a 35% increase in total indicated mineral resource tonnage and a 44% increase in total inferred mineral resource tonnage compared to the previous estimate released in May 2023.

The updated MRE is based on 105,554 meters of drilling across 299 drill holes. The IBW project's total indicated resource now stands at 18.96 million tonnes (Mt) with grades of 2.88% Zn, 1.42% Pb, 0.50% Cu, 66 g/t Ag, and 1.28 g/t Au (8.44% Zn Eq or 3.01% Cu Eq). The total inferred resource is reported at 6.8 Mt, grading 3.25% Zn, 1.5% Pb, 0.73% Cu, 56.3 g/t Ag, and 0.77 g/t Au (8.72% Zn Eq or 3.00% Cu Eq).

Analyst Cites Upcoming Catalysts

A March 17 report from Clarus Securities highlighted the substantial increase in the mineral resource with the total global resource growing by 37% to 25.77 million tonnes at 8.51% Zn Eq, adjusted for recoveries. Analyst Varun Arora noted that this increase exceeded expectations, particularly at the La Romanera deposit, which added more than 5 million tonnes while improving its Zn Eq grade to 7.85%, up from 7.49%.

"We were only expecting approximately 2 million tonnes in resource growth and are pleasantly surprised by the significant increase of 33%," Arora stated. He attributed the expansion to step-out drilling that extended mineralization by 150–200 meters below the prior resource boundary, as well as improved metallurgical recovery assumptions, especially for gold.

The report also introduced a maiden mineral resource estimate for El Cura, which came in at 1.3 Mt, slightly below Clarus' initial projection of 2 Mt. Arora explained that the lower estimate resulted from drill density constraints, noting that further infill drilling should add more tonnage. He described El Cura as a high-grade, copper-rich deposit with a copper equivalent (Cu Eq) grade of 3.16%, including a strong gold credit of 1.44 g/t. Looking ahead, Clarus projected continued resource growth at El Cura and La Romanera, estimating that El Cura's resource could more than triple to approximately 4 Mt with further drilling.

Clarus maintained a Speculative Buy rating on the company and assigned a CA$3.15 target price, citing multiple upcoming catalysts. The firm identified key milestones, including an environmental certificate for IBW expected in the first half of 2025, continued drilling at El Cura and La Romanera, and a preliminary feasibility study (PFS) slated for late Q3 or early Q4. Arora emphasized that IBW's permitting progress and metallurgical advancements positioned the project for long-term growth, reinforcing its potential as a significant asset in the Iberian Pyrite Belt.

Deposit Has 'Excellent Potential to Grow'

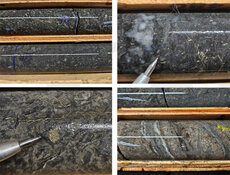

The drill results released Tuesday focused on determining continuity of mineralization within the El Cura deposit to support conversion to mineral reserves in the upcoming National Instrument 43-101-compliant prefeasibility study and testing the continuation of the deposit both at shallower levels and where it remains open at depth, the company said.

"These results confirm good continuity of grade and width within the deposit," the company said in the release. "By testing the shallower extents, Emerita has confirmed that El Cura remains open in all directions, particularly down plunge and to the west of drill holes EC046 and EC050. The deposit continues to have excellent potential to grow through additional drilling."

Four drill rigs are on-site currently, testing El Cura in these open directions, Emerita said.

Copper to See Gradual Decline, Gold Continues to Smash Records

According to Reuters on April 15, Citi is forecasting a slower drop in copper prices over the next three months, noting that U.S. President Donald Trump relaxed tariffs, China bought on dips, and scrap supply remains tight due to U.S. stockpiling.

"All point to a more gradual copper price decline through 2Q'25 versus the deeper and faster investor sell-off we previously anticipated, with funds still positioned net bullish," Citi added in a note, according to Reuters.

The investment bank raised its three-month copper forecast to US$8,800 per tonne after it had reduced the forecast to US$8,000 following the original tariff announcements. The bank estimated average copper prices of US$9,000 per tonne in the second quarter.

Gold's attractiveness as a safe haven has continued to help it hit new record highs, however, as concerns about Trump’s intention to oust Federal Reserve Chair Jerome Powell weighed on investors.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Emerita Resources Corp. (EMO:TSX.V; EMOTF:OTCQB; LLJA:FSE)

Gold rose to a new record of US$3,500.05 per troy ounce earlier Tuesday, according to Refinitiv data, and last traded at US$3,479.5 per troy ounce, CNN reported.

Gold has risen over 31% so far this year. It’s been one of the biggest winners as Trump advances his global tariff agenda.

It's "driven by rising demand for safe-haven assets amid declining confidence in the U.S. dollar and escalating geopolitical and economic risk," Rania Gule, senior market analyst at XS.com. wrote in a Tuesday research note, according to CNN. "In my view, this rally reflects ongoing recession fears in the U.S. economy and heightened political tensions."

Ownership and Share Structure

According to Refinitiv, management and insiders own 5.32% of Emerita. Of those, Michael Lawrence Guy owns 1.45% of the company, David Patrick Gower owns 1.3%, and Joaquin Merino-Marquez owns 1.04%.

Institutions own 1.12% of the company, including Merk Investments LLC, with 0.99%.

According to Refinitiv, there are 263.52 million shares outstanding with 249.5 million free float traded shares, while the company has a market cap of CA$300.26 million and trades in a 52-week range of CA$0.38 and CA$2.00.

| Want to be the first to know about interesting Gold, Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Emerita Resources Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.