West Red Lake Gold Mines Ltd.'s (WRLG:TSX.V; WRLGF:OTCQB; FRA:UJO) regional surface mapping, geochemical sampling, and core relogging program carried out last year at its Rowan property, which is in northwestern Ontario's Red Lake Gold District and sits about 30 km away from the company's returning-to-production Madsen Mine property, yielded positive results, it was announced in a news release. Spanning 31 square kilometers, Rowan encompasses three past-producing gold mines: Rowan, Mount Jamie, and Red Summit.

"We now have a succinct and systematic logging convention for Rowan to pair with a high-confidence and detailed deposit-scale three-dimensional geologic model, which will prove invaluable for targeting and data processing in future drilling programs," Vice President of Exploration Will Robinson said in the release. "Many of the common themes we see at Madsen associated with gold are also present at Rowan, which further substantiates our regional targeting model."

Madsen is West Red Lake Gold's flagship project, to the east of Rowan. It is a past-producing gold mine that the company purchased in 2023 and is about to put back into production.

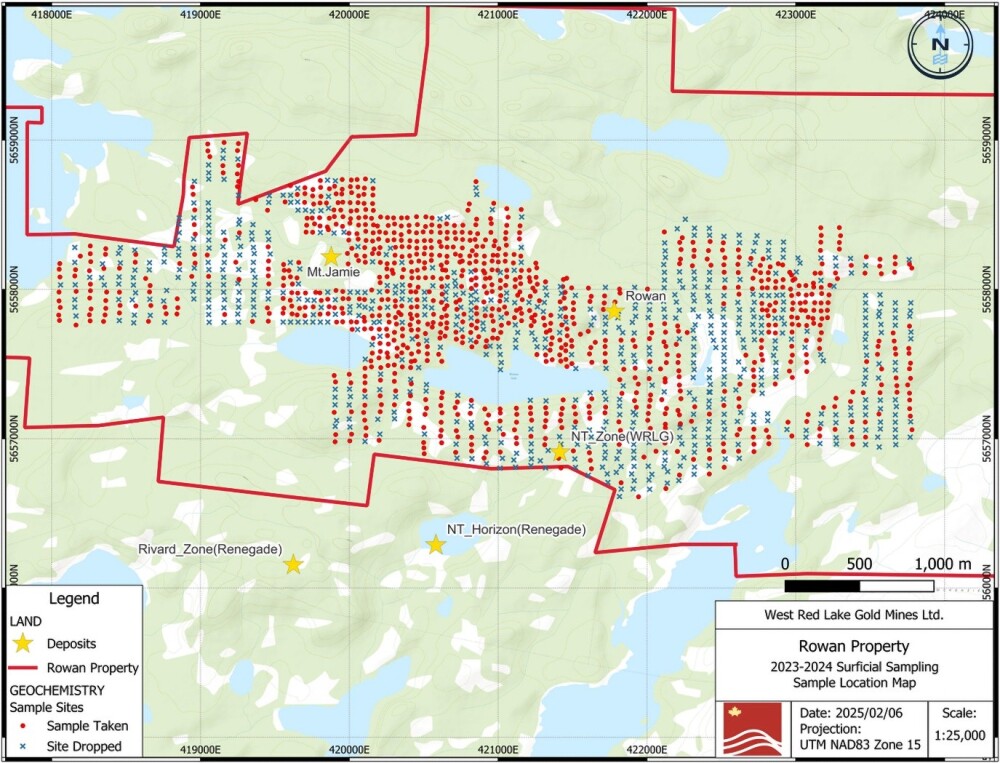

At Rowan last year, the company expanded the 2023 till sampling grid, relogged and sampled diamond drill core, and created a new geologic model to help delineate the structural and lithologic settings likely containing gold mineralization.

The Canadian explorer-developer collected 984 till samples in 2024 and integrated them with the 344 samples from 2023. This resulted in a footprint map of the main controlling mineralized structural trend, or shear, at Rowan.

The till program defined two new, high-caliber gold-in-till anomalies, one at Big Bend and another at Apex, which align spatially with deflections and folding in the main regional shear. These minimally drilled places, along with the Mount Jamie location and the areas just northeast and southwest along strike from the main Rowan deposit, are prospective for expansion and discovery potential.

"Inflections and folds in mineralized shears are great places to look for high-grade gold, and we are excited to test these new targets with future drilling campaigns," Robinson said.

The relogging program encompassed 16,830 meters (16,830m) of drill core, mostly from historical campaigns at Rowan, Mount Jamie, Red Summit, and the NT zone, and procured via 50 diamond drill holes. From 4,604m of core, 3,070 samples were collected to fill gaps in the historical data set and update mineralized domains at Rowan.

Near-Term Gold Producer

Headquartered in British Columbia, West Red Lake Gold Mines is preparing to commence production at Madsen in H2/25. This company invested about CA$140 million (CA$140M) in the high-grade Madsen mine after the prior operator spent CA$350M on rebuilding it, according to its Corporate Presentation.

Bulk sampling is in progress, and results are expected this month. If they show delivery of the planned grade and tonnage, this will validate the company's thesis regarding Madsen. The company has sufficient funds to bring the mine back online.

The economics associated with restarting Madsen were shown to be robust, according to the company. The after-tax, estimated net present value discounted at 5% was estimated to be CA$496M based on a US$2,600 per ounce (US$2,200/oz) gold price. The diluted head grade was an average of 8.2 grams per ton Au (8.2 g/t Au) and the all-in sustaining cost is US$1,681/oz.

One high-priority area at Madsen, the explorer is targeting for mine restart is the Austin zone. Recent results of underground drilling there returned high-grade gold, reported Streetwise Reports on April 3. Specific intercepts included 23.81 g/t Au over 5.4m, 30.16 g/t Au over 4.3m, and 12.43 g/t Au over 10.5m.

"The purpose of the company's ongoing drilling now is mostly to prepare for production at the Madsen mine starting this year," wrote Jay Taylor of Gold, Energy & Tech Stocks on March 31.

Austin's Indicated mineral resource is 914,200 ounces of 6.9 g/t gold, and its Inferred resource is 104,900 ounces of 6.5 g/t gold.

Additional targets at Madsen that West Red Lake Gold is drilling include Connection Drift, east Ramp, 13L East Drive and 10L West Drive. With limited mining but a high likelihood of hosting high grade gold mineralization, all are prospective for resource expansion.

The Fork deposit, slated for drilling in H2/25, and the Rowan deposit are two targets that could be incorporated into the mine plan. The Rowan deposit has an Indicated resource of 195,746 ounces of 12.78 g/t Au and an Inferred resource of 115,719 ounces of 8.76 g/t Au. The cutoff grade and gold price used in calculating the resource were 3.8 g/t and US$1,800/oz, respectively.

Madsen and Rowan are in a historical jurisdiction that hosts some of the world's richest gold deposits and from which more than 30 million ounces of gold from high-grade zones have been produced.

Gold To Climb Even Higher

The gold sector's current upleg has a long way to go, purported Technical Analyst Clive Maund in an April 14 note. This is evidenced, in part, by the low silver:gold ratio, indicating little retail interest in the sector. Also, the chart dating back to 2000 shows gold to be advancing "in an orderly uptrend from a cup and handle continuation pattern that is so gigantic, it can clearly support a bull market that will take it much higher than the current price," Maund wrote. At its current level, gold could use a break, the analyst noted, but in light of the events happening around the world, the current uptrend could accelerate and steepen soon.

"It looks like we are still in the early stages of what should prove to be an epochal bull market for the precious metals sector, that could dwarf all previous ones," added Maund.

At the last market close, gold was about US$3,306/oz, reflecting a 24% rise since the start of 2025.

According to Adrian Day of Adrian Day Asset Management, the factors now at play in pushing up the gold price are expected to persist for some time. These include central bank buying of gold, Chinese consumers worried about the loss of purchasing power, and a fragile banking system. Western investors are concerned about political uncertainty given many governments' unsustainable high debt.

On April 14, Velocity Trade Capital analyst Paul O’Brien gave West Red Lake an Outperform rating and a target price of CA$1.25.

"None of this is likely to change, and gold thus is likely to be higher a year from now, notwithstanding the possibility of a pullback at some stage," Day wrote earlier this month. "Gold, which has actually gained more than the S&P Index over the past four years, may continue to shine; it responds well to uncertainty, whether geopolitical, economic or monetary."

If the stock market experiences a long period of weakness, added Day, short-term Treasuries, gold, and other commodities should most likely do well, based on historical trends.

In the current economic environment, with a U.S. recession looming, "gold is emerging as the best bet," as shown by investors moving into exchange-traded funds (ETFs) and buying physical gold and central banks continuing to buy the metal, noted Financial Express' Sunil Dhawan on April 15. More money flowed into global gold ETFs in Q1/25 than in any quarter during the past three years, according to the World Gold Council.

Cuts to the real interest rate by the U.S. Federal Reserve and the increased amount of selling of U.S. Treasuries are likely to help the gold price climb.

"Overall, in 2025, unless the factors that are pushing the gold price higher change, the price of the yellow metal is expected to keep going higher," Dhawan wrote.

Goldman Sachs' new year-end 2025 gold price forecast is US$3,700/oz, recently raised from US$3,300/oz on the expectation of a surprising demand increase reflected in one of three ways, reported GoldFix on April 15. They are central bank accumulation, ETF inflows tied to growing recession concerns, and investor positioning spurred by macroeconomic volatility. Should demand from all three occur in large numbers, gold could reach US$4,500/oz. Investing Haven predicted a more conservative 2025E gold price, of US$3,275/oz.

"Whether gold prices move higher into uncharted territory remains to be seen," wrote Dhawan on April 12. He pointed out that many analysts believe gold is heading into its rally's last leg, and the metal's price will peak in April.

Avi Gilburt is one such analyst. "One of the most accurate market prognosticators of the past two decades," as described by The Gold Newsletter's Brien Lundin, Gilburt wrote recently, "While I do think we can still see higher levels over the coming year or so in the gold market, I am starting to see signs that we are moving into the final stages of this decade-long rally."

Further out, Investing Haven's "firmly bullish" year-end targets are US$3,805 in 2026, US$4,400 in 2027 and US$5,155, the peak, by 2030. Sporadic periods of weakness are expected characterized by gold price retreats.

Through the end of this decade, at least, growth is forecasted for the global gold market, according to a March Research and Markets report. Between now and then, the market is projected to expand in size at a 5.1% compound annual growth rate. Cited growth drivers include economic volatility and uncertainty, technological advancements, expansion of the middle class in emerging economies, new uses for gold, global trade policies, and geopolitical tensions.

"Investors should be prepared to add to positions on any short-term pullback in the price," Ronald Stewart, Red Cloud Securities Mining Analyst, advised in a recent sector update.

The positions, according to Lundin, should be in junior mining stocks because they offer one of the best ways to capitalize on the current, or any, secular metals bull market.

"The mining stocks remain near long-term lows," the newsletter editor and publisher noted. "Again, this is a generational opportunity and one that should not be wasted."

The Catalysts: Steps to Full Production

Red Lake Gold Mines is advancing toward steady-state production, as shown in its Corporate Presentation notes. This quarter, the company expects to report the results of the bulk sample reconciliation and begin processing ore, thereby producing gold. It will keep building stockpiles and maintain the rising pace of underground mining and development.

In H2/25, the company will ramp up mining and processing rates toward 800 tons per day and start selling its produced gold.

Stock on 'Golden Runway'

Jeff Clark of The Gold Advisor has a Strong Buy recommendation on West Red Lake Gold Mines. Approaching its first gold pour, the company's stock has substantial potential to rerate, Clark wrote on April 3.

"We're on the preproduction 'golden runway' with this stock," noted Clark. "It has the chance to rise both from gold's advance and the impending gold production at Madsen."

Chen Lin of What is Chen Buying? What is Chen Selling? expects a revaluation, too. If the mining company executes as its management expects, he wrote on March 27, West Red Lake Gold "should be a couple of dollar stock, and warrants should be 10x at least."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

West Red Lake Gold Mines Ltd. (WRLG:TSX.V; WRLGF:OTCQB; FRA:UJO)

Matthew O'Keefe, Cantor Fitzgerald analyst, has a Buy rating and a one-year target price on the mining company, implying a 114% return, he wrote in a March 19 research report. In it, he highlighted West Red Lake Gold's progress in preparing to restart production. Specifically, the analyst noted the 1.4-kilometer connection drift, essential for ideal material movement, was 94% complete, underground development was accelerating, and workers were staying in the new 114-person housing.

On April 14, Velocity Trade Capital analyst Paul O’Brien gave West Red Lake an Outperform rating and a target price of CA$1.25.

Ownership and Share Structure

Strategic investor Sprott Resource Lending Corp. holds about 8%. Institutions hold about 30%, management, insiders, and advisors hold about 10%, and the remaining shares are held by retail investors.

The company's market cap is CA$200.28 million. The 52-week range for the stock is CA$0.52 to CA$1.04.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- West Red Lake Gold Mines Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of West Red Lake Gold Mines Ltd.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.