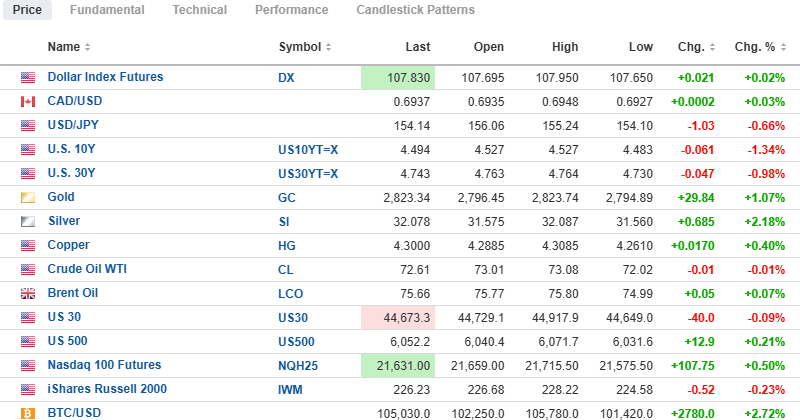

USD index futures are up 0.02% to 107.830, with the 10-year yield down 1.34% to 4.494% and the 30-year down 0.98% to 4.743%.

Gold (+1.07%), silver (+2.18%), and copper (+0.40%) are all u,p, while oil (-0.01%) is down. Stock futures are mixed, with the DJIA (-0.09%) down 40 points, but the S&P 500 (+0.21%) is up 12.9 points, and the NASDAQ (+0.50%) is up 107.75 points.

Risk barometer Bitcoin is up 2.72% to $105,030.

Gold's New High and the Gold Miners

The price of gold has broken out to a new record high above $2,801, with the April contract trading at US$2,823.65. RSI is not yet overbought, and MACD is still on a "buy signal," although the Money Flow Indicator ("MFI") is quickly approaching overbought status. Silver and the gold miners ("HUI") are lagging, but that seems to be the norm these days rather than a warning sign.

The HUI index of unhedged miners is barely above 300 and is trading 14.24% below its 52-week high of 354.39, last seen on October 22 of last year. It reminds me of 2016 when it traded below 100 despite gold putting in a solid bottom in early December of 2015. That year, 2016, the HUI went from under 100 to 286 in eight months, constituting one of the best rallies that I can recall.

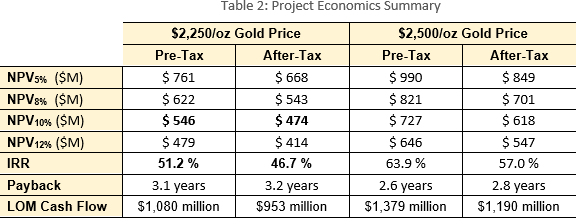

As I have been crowing about for over four years, the junior gold developers represent maximum leverage to the gold price, with Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) demonstrating extreme leverage, as shown in the recent PEA numbers.

At $2,500 gold, cash flow over the 10-year life-of-mine is US$1.190 billion, making Getchell an incredible Buy for its paltry market cap of only US$26.14 million.

Given the ridiculous level of the HUI versus the current price of gold, it is not surprising to see the juniors suffering the same fate as the senior and intermediate producers. However, the operating cash flow being generated by companies like Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) and Kinross Gold Corp. (K:TSX; KGC:NYSE) provides them with a lot of firepower in making acquisitions in optimal jurisdictions like Nevada with large deposits (2.317m ozs.) that are wide open along strike and to depth.

FOMC and the January Barometer

The Fed made no moves in the Fed funds rate yesterday, but stocks are still sold off. With two days to go until month-end, the S&P 500 is up 2.57% for the months and barring any disastrous downturn today and Friday, statistically there will be an 83.8% probability of an "UP" year for the market.

I will not fight the JB despite my bearish view, but I will point out that the first year of the Reagan Presidency in 1981 started off with a negative January but sported a 6% gain by April of that year before closing out the year down over 9%.

While the "disruptor" influence of the Trump Team is being celebrated everywhere, I choose to make a large wager on increased volatility — which means we may wind up with an "UP" year but not before experiencing a 15- 20% correction along the way which would mean that the VIX:US would be a place to be.

I was unable to buy the VIX March $15 calls yesterday, but with the VIX:US down .73 this morning pre-opening, I am pulling my bids back and will execute the following:

- Buy 100 VIX March $15 calls at $2.75

This replaces the 90 calls Feb $15 sold at $3.55 on Monday's opening.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp. and Agnico Eagle Mines Ltd.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: VIX and Getchell Gold Corp. My company has a financial relationship with Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.