This week marks the return to the Office of the President of the United States of America, the 47th president of the richest and most powerful nation on earth, with stocks at all-time highs and approximately one-half of all American public spirits floating on a cloud of euphoria and hope while the other half is hiding in the emotional bunkers of defeat and alienation. I was speaking with one of my dear American Republican friends on Wednesday, at which time he told me: "I am old enough to remember the depressed mood of the nation in the Vietnam and post-Vietnam era . . . and then the resurgence of patriotism during the Reagan years. I feel as if we are about to see a replay of those Reagan years."

My reply was: "Be careful what you wish for."

Most of my conservative friends born in the mighty U.S.A. think fondly of the Reagan years largely because by the end of it, the Dow Jones Industrial Index had finally broken the shackles of the 1966-1982 Stagflationary nightmare residing at 2,912.54 on January 20, 1989, up from 1,008 eight years earlier to the day.

From Wikipedia: "Domestically, the Reagan administration enacted a major tax cut, sought to cut non-military spending, and eliminated federal regulations. The administration's economic policies, known as "Reaganomics," were inspired by supply-side economics. The combination of tax cuts and an increase in defense spending led to budget deficits, and the federal debt increased significantly during Reagan's tenure. Reagan signed the Tax Reform Act of 1986, simplifying the tax code by reducing rates and removing several tax breaks, and the Immigration Reform and Control Act of 1986, which enacted sweeping changes to U.S. immigration law and granted amnesty to three million illegal immigrants. Reagan also appointed more federal judges than any other president, including four Supreme Court Justices."

Most of my American friends were either involved in hockey or finance during the Reagan years, and while they all long for the soothing words of "Ronnie" with great quotes like "The most terrifying words in the English language are: I'm from the government, and I'm here to help." and "Government's view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it."

These platitudes are the template for most of the rhetoric coming from the lips of the current president. Reagan chose to use communism as the "common enemy," while Trump uses "illegal immigrants" and his North American neighbors. Both Reagan and Trump campaigned on "less government regulation" with policies that cannot fail but to increase the already-burgeoning national debt and interest rates along with it, a reality most citizens forget.

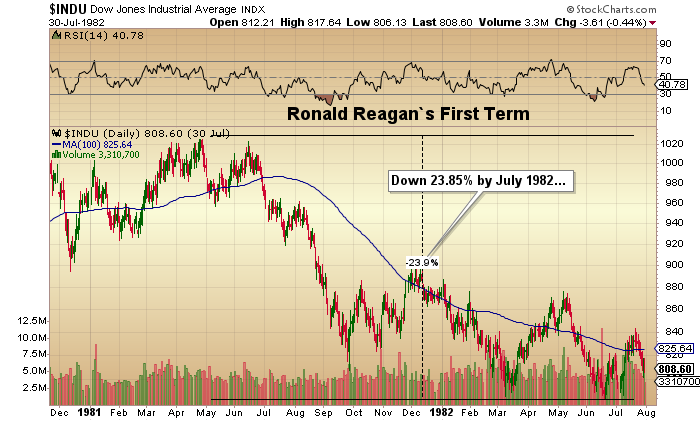

Most importantly, what the Republican bandwagon-hoppers conveniently choose to omit is the period of 1981-1982, during which then-Fed Chairman Paul Volcker violently constricted the availability of credit for the American banking industry, resulting in a mad scramble for reserves that created a bidding war within the banking system that took the Fed Funds rate to over 16% in a short nineteen months.

Reagan's handlers recognized that the best time to administer the anti-inflationary "tough love" that would send the U.S. economy spiraling into a devastating recession would be early in his first term, setting up the final six years of deficit-creating "growth" that forever etched the "Reagan Legacy" into the hearts and minds of the American public for eternity. However, there are many from the Texas oil patch and on Wall Street who do not have such fond memories of the first two years of the Reagan presidency. The rest of the world including Canadians felt the wrath of the Volcker death grip as well especially young people struggling to reset mortgages at 19% saddled with a tripling of monthly payments established in 1977.

The markets took off this week on news of a "Stargate" initiative designed to establish America as the world leader in artificial intelligence, with Oracle's Larry Ellison predicting that a cure for cancer was in the offing thanks to this magnificent government-corporate partnership engineered totally by Donald J. Trump. What was carefully left ambiguous was where the $500 billion cost was going to come from, but notwithstanding a Goldman Sacks underwriting to shore up their working capital positions, the lion's shares will undoubtedly come from the deep but very ragged pockets of Uncle Sam as was the case with those corporate tax cuts and military spending increases under Reagan.

The problem I have with the mainstream financial media these days is that they all march to the same drummer that earns his paycheque from a consortium of Wall Street banks and hedge funds that require the all-consuming pattern-recognizing algorithms to blindly gobble up the bullish "stocks to da moon!" narrative that is the lifeblood of not only the big banks but of the entire U.S. economy these days. I recall a time when the equity markets were harbingers of future business conditions, but that has been replaced with a scenario where the level of the NASDAQ 100 IS the U.S. (and global) economy.

So, the next time you read another exhilarating Trump-inspired headline that has Oracle or Meta or NVidia all galloping ahead, do not forget that the same events were happening in January 1981 to Raytheon and McDonnell-Douglas and General Dynamics just before the 1981-1982 recession constituted a rug-pull of epic proportions.

The Good News

As I have been writing about ad nauseum since the middle of last year, gold has acted in spectacular fashion and going into the weekend, it is sitting a paltry $24 from an all-time high despite a charging USD and the 10-yr. yield at 4.62%. Gold has decided of its own volition to spit merrily into the eyes of the Bitcoin anti-gold throng and forge its own new high and disciples in the face of MSM opposition and Wall Street ambivalence.

Furthermore, as much as I have used the gold miners and silver as confirmation of the golden bull market, gold has not had as much as a feather of aid from the miners (excepting, of course, from the mighty Agnico Eagle Mines) or that shiny metal either despite the constant email blasts and "X" tweets thirty-five times an hour trying to bludgeon the investing world into believing that there exists a silver shortage, something I have been listening to for nigh-on 45 years and yet to see one.

Gold has taken on a life of its own, and whether the silver bulls want to bombard our inboxes and social media feeds with stories about the Indians buying silver for its use in solar panels and the greater electrification movement, I would beg to differ because those silver buyers I have met from Mumbai or Vancouver or Brampton, Ontario are buying it only because they see it as "gold's little brother" and when they take delivery, they hide it underneath their multi-generational pile of Krugerrands, Canadian Maples, and American Eagle Buffalos.

The GLD:US chart is now approaching overbought status with an RSI now at 67.58 so another $20 pop next week and I will be refraining from any my own email blasts and social media feeds spreading stories about an impending short squeeze about to vapourize those bullion bank behemoths that are constantly tampering with prices and our collective net worth statements.

Speaking of sentiment in the gold space, my darling little junior developer — Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) — released their long-awaited Preliminary Economic Assessment in which the authors concluded that their Nevada-based Fondaway Canyon Gold Project is not only economically-viable, but it sports an IRR over a 10-year mine life of over 47%. That is, spews out cash despite a relatively modest CAPEX requirement was a pleasant plus in light of the fact that at $2,750 gold, it will generate over a billion dollars (USD) of after-tax earnings and that for a portion of the known resource that approximates 65% of a 2.317 million ounce resource wide open to depth and along strike. (News release can be found here .)

The stock traded down a half a cent on over a million shares volume as I once again stared in absolute astonishment at the quote terminal on Thursday, my jaw hitting the desk several times in between a plethora of "deleted expletives" and ashtrays disguised as supersonic missiles headed for the computer screen bearing the news. The bottom line for the junior developers is this: Until the industry can show the kiddies that are now up to the brim with Bitcoin and NVidia (paid for with the $500,000 inheritance bequeathed upon them by their late grampa) the mining stocks can do better, superb news releases like that of Getchell Gold will go unheeded in the same manner in which a Swahili Viagra ad goes similarly unnoticed. Unless it has a blockchain application that is crypto-friendly, junior miners would be better off following the former gold bug Frank Holmes' model of defecting to the dark side and pumping Hive Digital Technologies once per hour on BNN.

Despite the lack of response, Getchell went out on a positive note after closing up CA$0.025 per share on over half a million shares volume, which, it should be added, was barely US$75k of dollar volume but not before I added a minuscule 50,000 shares which were all I could muster up after eating out of a dogfood can for the past few weeks.

We will have our day with the juniors, but when asked at what gold price will the stampede occur, I simply roll my eyes and confess the total lack of knowledge and absence of conviction. That is what this market has done to us. But — when the last of the "diehards" throw in the proverbial towel you know we are close.

Silver

I dare not depart from a discussion of the precious metals without a clarification of my thoughts and outlook on silver. This is because, in my earlier remarks on gold, I bemoaned the fact that the miners and silver are both lagging behind gold in performance, but if I leave it as I did, my inbox will be jam-packed with nasty reprimands from all over the planet from silver bulls that view their ownership of silver as a religious pilgrimage of sorts with the ultimate destination being not only obscene wealth but true spiritual awakening and revival.

Despite the fact that it is the only asset on the planet in the last few years to fail to hit an all-time high, I have little doubt that if my revised 2025 forecast for gold of $3,550 per ounce rings true, silver will most certainly break out above that concrete resistance band between $33 and $35 per ounce and make a run for the 1979 and 2011 highs around $50 per ounce.

Tactically, I usually wait for any asset to break out above resistance, but in the case of silver, those masterful traders under orders from the bullion banks do such an incredible job of luring in the big funds and CTA's by purposefully creating heart-stopping breakouts that it is hard to stay flat. These pit-session ambushes appear to even the most seasoned of tape readers to be "unmistakeable break-outs," after which they all collectively pile in, creating the kind of mammoth volume that the behemoths need to execute a rug pull with unparalleled precision and damage. I would love to be a fly on the wall when they report the P&Ls to their superiors because the illicit profits they have pocketed over the past thirty years are in the billions.

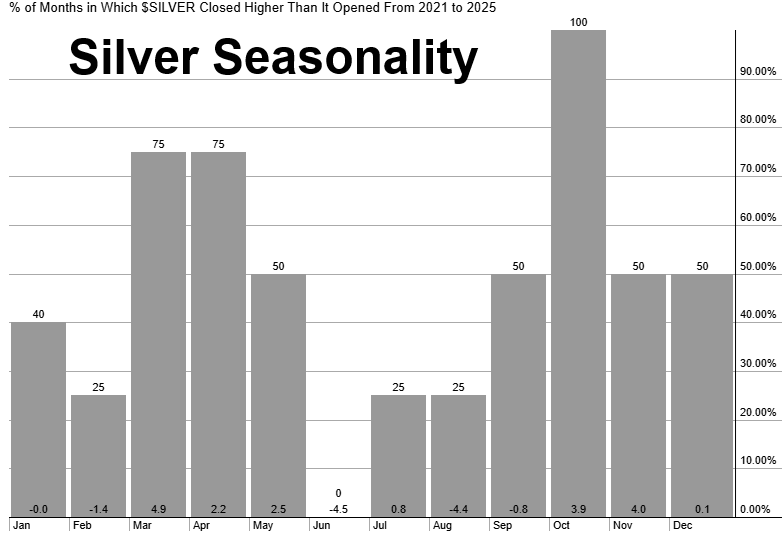

I will probably take a position during the next big drawdown, assuming the bullion banks' behemoths have their way in the seasonally weak month of February, also a month in which stocks have typically struggled as well. What I will not do is chase the break-out above that upper boundary of the wedge formation, sitting around $32 per ounce (spot). I will also refrain from selling silver on a bread-down under the lower band at $30. If there is one thing that persistent trading errors have taught me in only the silver market, it is that you sell break-outs, and you buy break-downs.

As for the silver stocks, there is a whole basket of them that all proclaim to be the next coming of United Keno Hill (a name of the late 1970s that rocketed from CA$0.69 to CA$69 per share during the bungled Hunt brother's attempt to corner the silver market, which they actually did beautifully until the bullion banks pulled about 2 million government and regulatory strings that changed every imaginable Rule of Engagement bankrupting the brothers and enriching the banks that shorted the move to $50. (Sound familiar?)

To give you an idea of the magnitude of silver's hypnotic effect on the masses, as a young stock salesman (there were no "wealth managers" or "financial advisors" back then), I would meet prospective clients in the late 80s who had been investing since the 1960's all of whom were saddled with massive silver holdings on their respective books at $30, $40, $50 per ounce during a period in which it languished in the single digits from 1988 to 2006. I would hear stories from 1980 of line-ups all the way down King St. in Toronto with people waiting in the wintery frost to buy silver from the local Scotia-Mocatta outlet. As I have written before, silver bugs are like gold bugs on steroids, Red Bull, and crystal meth. At the precious metals conferences, I could always tell the topic of the speaker by the look of the audience.

If every other attendee had a hunting cap and vest along with an NRA baseball cap and a totally angry look in his eyes, the speaker was flogging silver, and the audience was in full awe and reverence.

To appease the silver bugs, let it be known that I will at some point in the next few months make a serious commitment to a whale-sized silver position. I cannot tell you what will prompt it but I vow to let you all know because based upon my track record in trading silver since 2011, the exact nanosecond that you learn that I am long silver, you should sell every ounce you own.

Forewarned is forearmed. . .

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp. and Agnico Eagle Mines Ltd.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Getchell Gold Corp. My company has a financial relationship with Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.