Gold has been setting record highs all of 2024, but silver is far from its $50 record high. Silver prices usually follow gold but often with a delay, and when silver does start to move, it often outperforms gold.

When retail investors start to come back into the precious metals market, they often buy silver because gold has already moved up so much that it appears expensive to them.

Silver's recent up trend is intact and I believe 2025 is the year silver goes back to $50 and then record highs. My sources tell me that China is stockpiling silver for industrial use as they expect shortages and the market is getting tighter.

We did well adding some silver stocks to our list last year before the jump higher. With the recent correction, I want to add another one.

Right now, a very good buy and probably the most unique silver miner is. . .

Aya Gold and Silver

Shares outstanding 130.6 million: 15% management, 65% institution/family offices, only 20% retail

Aya Gold and Silver Inc. (AYA:TSX; MYAGF:OTCMKTS) is unique because it's mine in North Africa (Morocco) is a pure silver producer. Most silver mines are poly-metallic and also produce a combination of copper, lead, and zinc, or they are silver and gold mines that we see dominating in Mexico.

It is rare to have a pure silver-producing mine and rare to be very high grade. Their Zgounder has 96 million ounces of measured and indicated resources at 306 g/t silver. They have an industry-low discovery cost of just $0.10 per ounce of silver. The mine has produced 3 out of the top 10 and 15 out of the top 50 global silver drill intersects of 2020 to 2024 like:

- 21.6m of 3,956 grams per tonne silver (g/t Ag)

- 14.4m of 4,101 g/t Ag

- 9.6m of 5,691 g/t Ag

- 14.4m of 3,043 g/t Ag

- 27.0m of 1,611 g/t Ag

There is a very good 3-minute YouTube video on Zgounder here.

What is more, is the stock was beaten down under unique circumstances, and their production level in 2025 is about to increase over three times. From their presentation, this slide is a good snapshot of their mining portfolio.

Morocco and Management

Morocco is a top mining jurisdiction, rated #12 in Global Policy Perception by the Fraser Institute. They privatized state-owned mines in the 1990s, and mining codes are recent, revised in 2016. Morocco is the #1 producer of Phosphate and Barite in Africa, #2 in Fluorite, and #3 in Cobalt.

About 10% of GDP is mining with phosphates 90% of that. AYA has a proven and in depth management team with plenty of experience in Africa.

Benite La Salle President and CEO has 30 years of experience in West Africa. He is the founder of Semafo Inc., which went from explorer to 250,000 ounce gold producer. Since 2010 he has board positions on six public companies and founding three of them as West African-focused exploration companies. He is Chairman of the Board of the Canadian Council on Africa since 2013.

Mustapha Elouafi, President-Managing Director of Morocco, has 30 years of experience in mining and senior management in Morocco. He managed the world's largest phosphate processing hub in Jorf LasfarMorocco, with more than 4,500 employees.

VP Exploration and QT is David Lalonde with 24 years experience in senior exploration roles, mostly with Semafo Inc. and Kinross Gold.

Dr. Jurgen Hambrecht, Lead independent director, has 40 years of experience around the world with board positions on Daimler Truck AG, Mercedes Benz, Bosch, Lufthansa AG, and recently at BASF SE as CEO and Chairman of the Supervisory Board.

Around current prices, AYA offers very good value, a pure silver play, and its uniqueness, should be in everyone's portfolio.

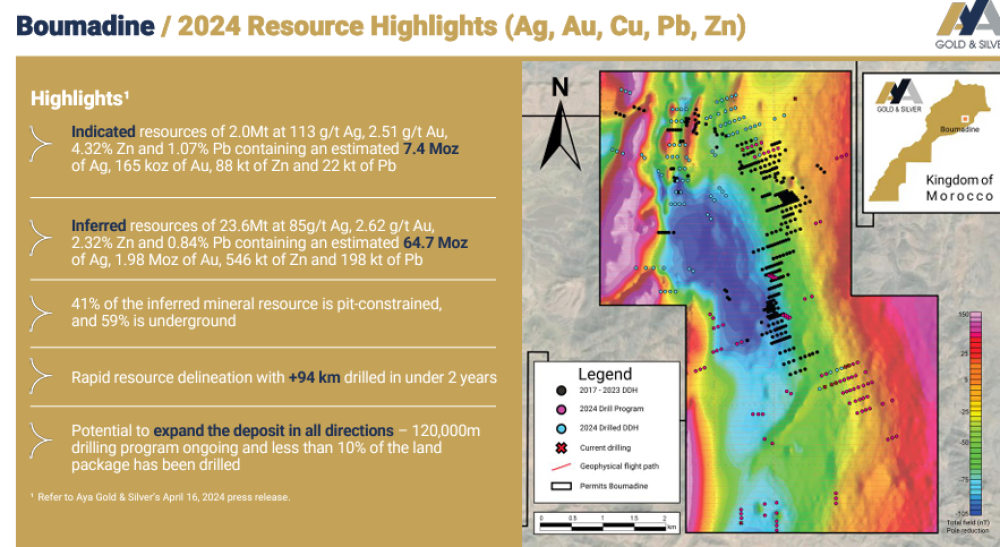

Boulmadine Advanced Polymetallic Deposit

Boulmadine is a silver, gold, and zinc discovery with some lead. They have completed 107,687 meters of a 120,000-metre program as of early January. Bolmadine has 34 million ounces silver equivalent (AgEq) at 515 f/t AgEq.

The inferred resources are a huge 318 million ounces AgEq ant 42) g/t AgEq, so the upside of this project is huge.

This resource was based on drilling up to 2023, so it does not include the ongoing 120,000-meter program.

There is a very good 2-minute YouTube video on Boumadine here.

Financial

The last statements on September 30, 2024, show $73 million cash and restricted cash with long-term debt of $96.5 million for the Zgounder expansion. With current mining rates they are operating around break even.

This will change dramatically in 2025 as silver production increases to 7 million ounces from the current 1.7 million.

Conclusion

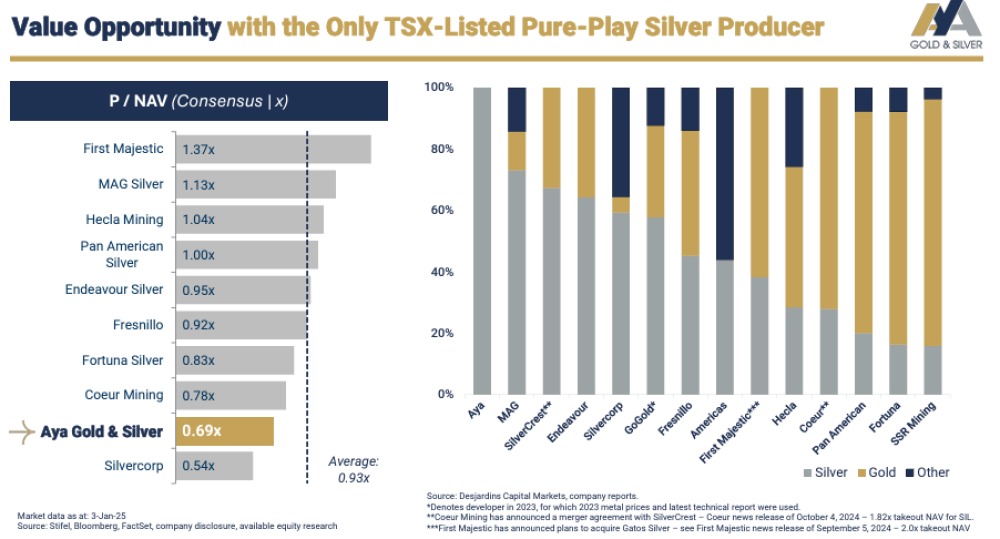

AYA is a pure silver producer with a strong growth profile, and because of that, it should have a higher valuation among its peers. This is my take on why the stock corrected this much to provide the current low valuation I see as an opportunity.

The stock started to correct with the silver price and went down further when AYA reported Q3 results with lower guidance. Strange as it is, AYA reported September 6 this lower guidance, that there would be a delay of two months on hot commissioning the mine ramp up.

This was because of a delay with the hydraulic unit of the ball mill, and a rework of the hydraulic unit piping was required. Revised production guidance was between 1.6 million ("M") to 1.8M oz silver for 2024 from the previous guidance of around 2.9 million.

I think it was ignored then because of the bullish sentiment with silver rising. However, when they announced Q3 results, silver prices were correcting, and the bearish sentiment was more prominent, so the market punished the stock on the lower guidance then. The stock then dropped further in December with year-end selling, and silver prices corrected further. The stock then bounced off of long-term support. The first resistance will be around $13.20, past support.

It is shortsightedness to focus on a 2-month delay when the real positive issue is annual production increasing from about 2 million ounces to 7 million ounces in 2025, peaking at nine million ounces in 2029 per the Zgounder feasibility study. The delay simply postponed about two months of production that was expected in 2024, nothing else changes.

Benoit La Salle, President & CEO, commented in Q3 results, "Our third quarter results came in below expectations due to non-recurring challenges at Zgounder, which postponed some operational milestones to the fourth quarter of 2024. These temporary setbacks are now behind us, and our team is on track to deliver commercial production at Zgounder before year-end. Zgounder will be central to our growth plans in the coming years, fueling higher production and increased free cash flow."

On December 30, 2024, Aya Gold & Silver announced they reached commercial production at its 100-per-cent-owned Zgounder mine. The new Zgounder mill first started processing ore on November 4, 2024. The first silver pour from Zgounder's new processing plant was achieved on November 27, with commercial production reached on December 29, less than two months after the mill began processing the first ore.

With the big drop in the stock price, it was overdone and a good Buy here.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Ron Struthers: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.