Western Exploration Inc. (WEX:TSX.V; WEXPF:OTC) announced the final results of the 2024 core drill program its Aura gold-silver project in Nevada's Great Basin, and they exceeded the explorer's expectations in terms of grade and extension, a news release noted.

"The company has continued to return favorable drill results from its 2024 drilling program," wrote Technical Analyst Clive Maund in a Jan. 8 report.

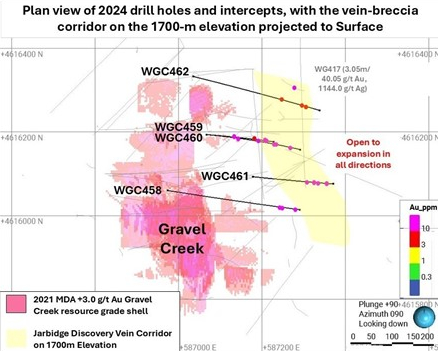

The campaign targeted the high-grade Jarbidge rhyolite discovery with five core holes, and new results are for two of them, WGC461 and WGC462, explained the release. These were placed to offset high-grade intercepts encountered in drilling done in 2023. The new high-grade Jarbidge discovery area is less than 200 meters east of the current mineral resource of Gravel Creek, one of Aura's three deposits. Wood Gulch and Doby George are the others.

WGC461 returned individual high-grade assays, up to 46.1 grams per ton gold (46.1 g/t Au) and 4,630 g/t silver (Ag). Intercepts included:

- 1.53 meters (1.53m) of 19.98 g/t gold equivalent (Au eq), or 10.39 g/t Au and 815.1 g/t Ag

- 0.85m of 21.26 g/t Au eq, or 4.08 g/t Au and 1,460 g/t Ag

This hole was placed 80m updip to the east on Section BL+500N.

Similarly, hole WGC462 showed high-grade individual assays, as high as 24.5 g/t Au and 1,070 g/t Ag. One highlight intercept encountered was 1.13m of 12 g/t Au eq, or 8.24 g/t Au and 318.9 g/t Ag. This hole was drilled 180m north of the Discovery Section on Section BL+680N.

The results of these two holes expand the high-grade vein corridor in Jarbidge rhyolite to 350m on strike and 250m on dip. The area is one of multiple high-grade targets in the Wood Gulch/Gravel Creek area with potential for near-term resource expansion, according to the release. It has had only 19 holes of drill testing to date and remains open in all directions.

Western Exploration's Chief Executive Officer Marud highlighted in the release that all five holes of the 2024 drill program intersected many vein/breccia zones demonstrating +10 AuEq g/t values. The two step out holes to the north (WGC462) and south (WGC458) intersected the Discovery trend as anticipated and showed continuation of high-grade gold and silver mineralization.

"There is scope for district-scale expansion of the resource at Gravel Creek/Wood Gulch," Maund wrote.

Takeout Target in the Making

Headquartered in Reno, Nev., Western Exploration Inc. is working to become North America's premier gold and silver development company, it said. It is solely focused on advancing its 100%-owned flagship asset Aura.

"Western Exploration has made notable progress at its Aura project," wrote Fundamental Research Corp. (FRC) in a Nov. 14 note. "With a 72% gold recovery rate in recent tests and promising drill results, [the company] is emerging as a strong acquisition target."

Aura is in Nevada, a Tier 1 mining jurisdiction and the world's fifth largest gold producer. The project is about 120 kilometers (120 km) north of the city of Elko and 32 km north of First Majestic Silver Corp.'s (FR:TSX; AG:NYSE; FMV:FSE) Jerritt Canyon mine, in production since 1981, FRC Analyst Sid Rajeev noted in an Oct. 31 research report. Near Aura, adequate infrastructure, including road access, water and power, already is in place.

Gravel Creek, Wood Gulch are epithermal vein systems while Doby George is a Carlin-type gold deposits. All three are hosted at the 6,000-hectare Aura property, each has its own mineral resource estimate. Together, they comprise an Indicated resource of 652,000 ounces (652 Koz) Au eq and an Inferred resource of 665 Koz Au eq, for a total Indicated and Inferred resource of 1,300,000 ounces (1.3 Moz) of Au eq.

"We believe there is potential for resource expansion as the deposits remain open in multiple directions," Rajeev wrote.

Gravel Creek hosts underground, high-grade sulfide gold resources. Preliminary metallurgical test results from there showed "impressive recoveries of 95%," noted Rajeev. According to Jordan Roy-Byrne of The Daily Gold, Western Exploration aims to grow Gravel Creek to a 2 Moz Au eq resource from its current roughly 700 Koz.

"Drilling near the Gravel Creek resource area continues to return high-grade intercepts, including bonanza values of 22 g/t Au and 977 g/t Ag, and 50 g/t Au and 2,110 g/t Ag," reported Rajeev in a Nov. 12 note.

Doby George, on the other hand, hosts at surface high-grade oxide gold mineralization extending 150−200m from surface and thus would be suitable for an open pit operation, explained Rajeev. The resource is amenable to heap-leach processing, meaning capex and opex likely would be relatively low. Recent metallurgical heap-leach tests at Doby George yielded a higher gold recovery rate than previously, 72% versus 69%. The latest recoveries at Doby George and Gravel Creek are in the upper range of what is typical for open-pit and underground operations.

Doby George could be a heap-leach mine producing 50 Koz Au per year, Roy-Bryne wrote, but "Gravel Creek is the real prize and hope." He pointed out, too, that Western Exploration is a well-managed company with an "excellent, tight structure."

Two Favored Investment Classes

Following a stellar 2024 for gold and silver, the outlook for precious metals prices this year remains positive.

"As we enter 2025, gold remains a highly relevant asset class and potential investment opportunity," wrote Crux Investor in a Jan. 7 article.

Gold and silver prices are expected to defy the over-riding belief among industry experts that generally, global commodity prices will decline this year due to a sluggish global economic outlook and a resurgent dollar, CNBC's Lee Ying Shan reported on Jan. 6.

Jeff Clark of The Gold Advisor likes Western Exploration, in large part, because its global Aura resource could be expanded to 2 Moz, based on high-grade stepout results

Silver has strong underlying deficit fundamentals, JPMorgan analysts told Shan. The metal remains in high demand for use in the green energy transition, such as for solar power, but supply still is limited. The analysts added, "We think a catch-up trade later in 2025, once base metals find firmer footing, could be quite potent."

Jaime Carrasco, senior investment advisor and senior portfolio manager at Canaccord Genuity Wealth, considers the white metal, which few investors own, the top asset class.

"With gold trading above US$2,500/oz, silver offers a great alternative as a monetary metal, and more importantly the current supply deficit will take years to correct," he wrote.

Investing Haven predicted on Dec. 29, 2024 that the silver price will touch US$49/oz this year. (The price now is US$30.51/oz.) Further out, the firm forecasts it will consolidate in 2026 at around US$50/oz, climb toward US$77 in 2027 and peak at US$82 in 2030.

As for gold price forecasts for 2025, JPMorgan and BullionVault, an online investment gold service, expect it to hit US$3,000/oz, Shan wrote. (Today's gold price is US$$2,673.60/oz.)

Nitesh Shah, commodity strategist at WisdomTree, expects US$3,050/oz gold by year-end "based on a 'consensus' economic view of dollar depreciation and falling bond yields," he told Reuters on Jan. 6. "Further escalation in tension in the Middle East could drive upside risk to our forecast," Shah said.

Investing Haven predicts the gold price will continue its rise and reach US$3,275/oz in 2025, the research service wrote in a Dec. 31, 2024 article. Longer term, it targets a gold price near US$3,800 in 2026 and a peak gold price of US$5,150 by 2030.

"A soft gold bull market is our thesis," Investing Haven noted. "An acceleration to the upside will take place later this decade."

Technical Analyst Clive Maund noted that factors in the stock indicate a pending upside and that Western Exploration was a "highly favorable buying opportunity." He concluded that Western Exploration was a Strong Buy for all time horizons.

More conservative estimates have gold's high this year in the US$2,700−2,800/oz range, noted Stewart Thomson of Graceland Updates on Jan. 7. He added that this more moderate outlook could turn out well for gold miners and silver bullion.

"A range trade for gold could see the miners and silver stage numerous 20% surges in 2025," he added. "Compounded, investor profits from the action could be stunning!"

According to Roy-Byrne in The Daily Gold's Jan. 7 issue, the setup in gold stocks now is "particularly bullish" and "nearly perfect." Gold stocks are vastly under-owned, and the exchange-traded funds and mining indices have multiple year technical bases. Gold stocks will burst from their base, he purported, when the macroeconomic situation aligns, meaning the economy slumps and Federal Reserve easing accelerates. Roy-Byrne recommended investing in quality mining companies, many of which now are 20−30% cheaper than they were only a few months ago.

"The breakout move, whether its two months away, nine months away or whatever. . .it's going to be explosive," he wrote.

The Catalysts

Significant catalysts for Western Exploration and its Aura project, reported by Rajeev on Nov. 6, include a resource update for the Gravel Creek and Doby George deposits in H1/25. A prefeasibility study of Doby George will follow, by Q4/25.

In his Oct. 31 research report, Rajeev wrote that another catalyst is the gold sector, the outlook for which is favorable. Also, mergers and acquisitions activity in the space has accelerated.

"We maintain a positive outlook on gold in light of the anticipated rate cuts by the Fed, and elevated geopolitical tensions," wrote the FRC analyst. "We see WEX as a prime acquisition target, with majors actively pursuing attractive projects to grow their portfolios."

Experts Like the Stock

For FRC, Western Exploration is one of its Top Picks among the gold companies in its coverage universe. Among its Top Picks, the stock was the top performer in the week ended Dec. 6, when it was up 9.7%. It took second place in the week ended Dec. 27 with a 6.7% gain. Rajeev has a Buy rating and a fair value estimate on Western Exploration that implies a 181% return.

In his Jan. 8 note, Technical Analyst Maund wrote that Western Exploration's stock charts suggest an "upside breakout from the base pattern is pending," and the dip that occurred over the past two months is a buying opportunity now. Bullish factors include the formation of a head-and-shoulders bottom, the volume buildup since mid-2024 and the large portion of the buildup being upside.

Jeff Clark of The Gold Advisor likes Western Exploration, in large part, because its global Aura resource could be expanded to 2 Moz, based on high-grade stepout results, he told Streetwise Reports on Dec. 16. Other company highlights include Mark Hawksworth, an experienced geologist who has made several discoveries, managing and overseeing exploration at Aura, and Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) and Golkonda LLC being strategic investors.

"If I didn't own any [WEX] shares, I'd build a position on days it's dipping," Clark added.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Western Exploration Inc. (WEX:TSX.V;WEXPF:OTC)

Brien Lundin, editor/publisher of Gold Newsletter, also is bullish on WEX. He wrote in his Dec. 17 edition, "I think Western Exploration makes for a compelling bet on rising gold prices and exploration success in 2025."

On January 13, Technical Analyst Clive Maund shared an update on the company. He noted that factors in the stock indicate a pending upside and that Western Exploration was a "highly favorable buying opportunity." He concluded that Western Exploration was a Strong Buy for all time horizons.

Ownership and Share Structure

According to Refinitiv, strategic entities own about 61% of Western Exploration. These include the Top 2 shareholders overall, Golkonda with 44% and Agnico Eagle with 14%. Insiders and management hold about 3%.

Institutional investors, Euro Pacific Asset Management LLC and U.S. Global Investors Inc., own about 4%. The rest is in retail.

The precious metals explorer has 45.43 million (45.43M) outstanding shares and 17.85M free-float traded shares. Its market cap is CA$30.04 million. Its 52-week range is CA$0.70−1.50 per share.

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Western Exploration Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Western Exploration Inc. and Agnico Eagle Mines Ltd.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.