This article has been paid for, and is issued on behalf of, Goldshore Resources Inc.

There is a clear road ahead for Goldshore Resources Inc. (TSXV: GSHR; OTCQB: GSHRF ; FWB: 8X00) and also for its stock especially as, despite strong gains last year, it still has not broken out of a giant base pattern that we will look at later against the background of an expected major precious metals sector bull market.

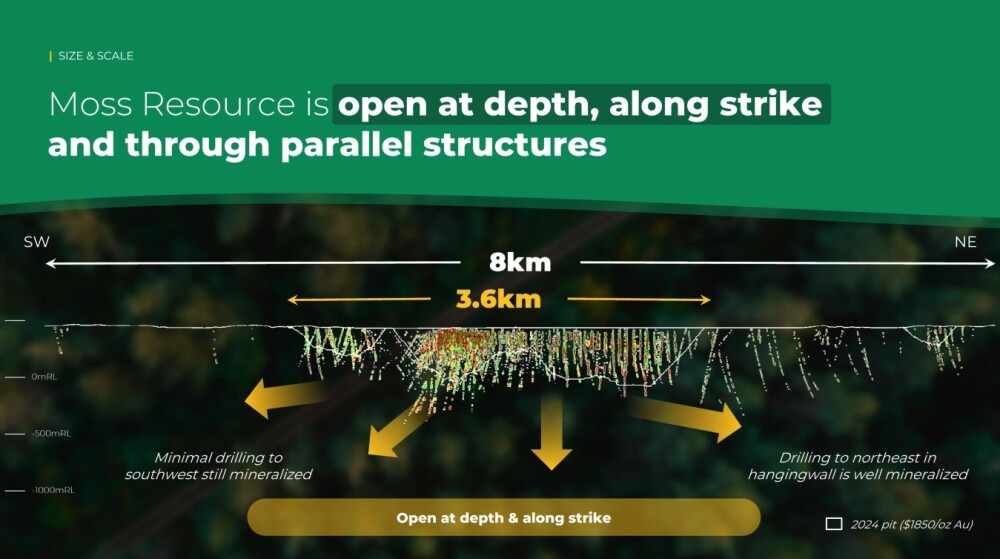

Goldshore Resources has already delineated a substantial gold resource in Ontario, its flagship Moss Project which I believe is well on its way to becoming a district scale project with very significant expansion potential.

Now, we will proceed to overview the fundamentals of the company using slides taken from its new January 2025 investor deck and other illustrations from the company website.

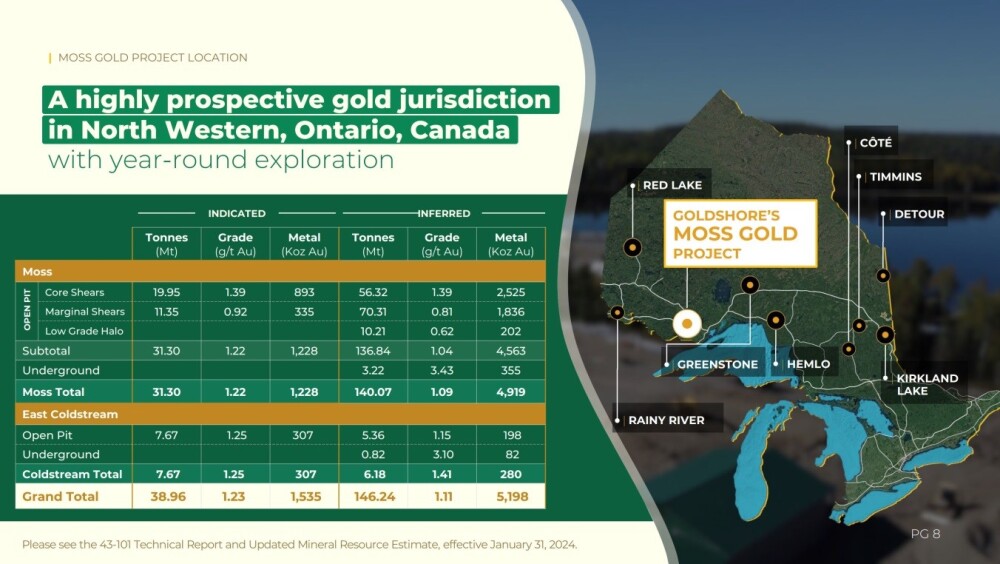

We start by orienting ourselves with this first slide, which shows the location of the Moss Project in Ontario and its position relative to other major projects in the province and the Great Lakes and summarizes the resources at the Moss Project and the lesser East Coldstream resource.

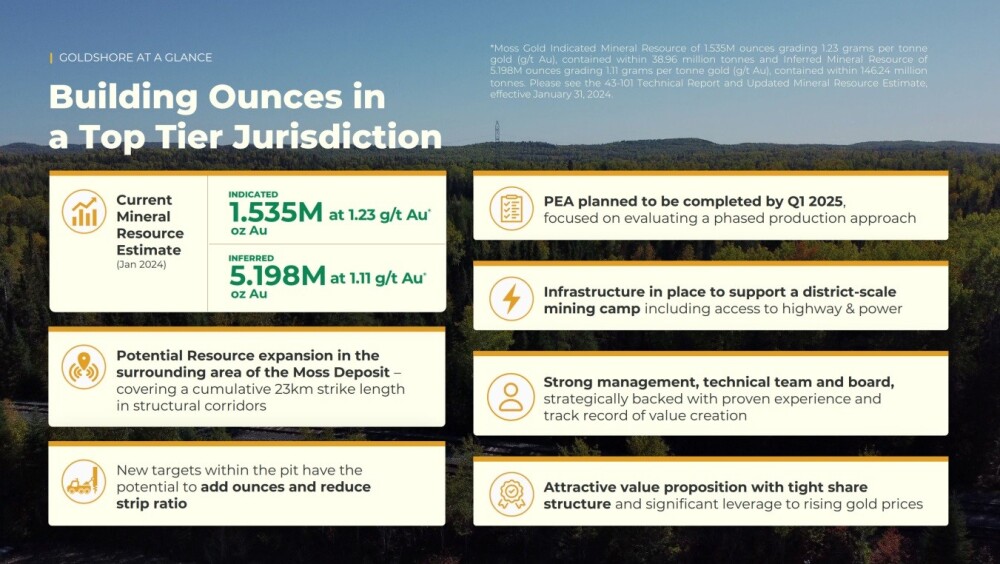

Next, below you will see an overview of the company and its project.

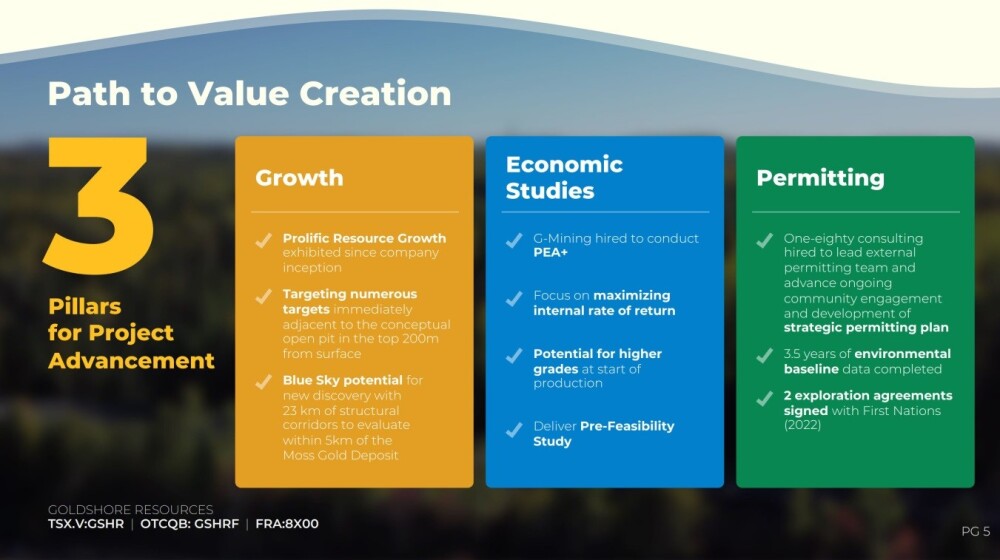

The next slide shows the clear path Goldshore has ahead of itself.

This useful slide below shows the geography of the Goldshore land package, the location of the Moss deposit within it, and the location of the lesser East Coldstream Project.

It also makes clear that the project has excellent infrastructure, being close to a major highway and power supply.

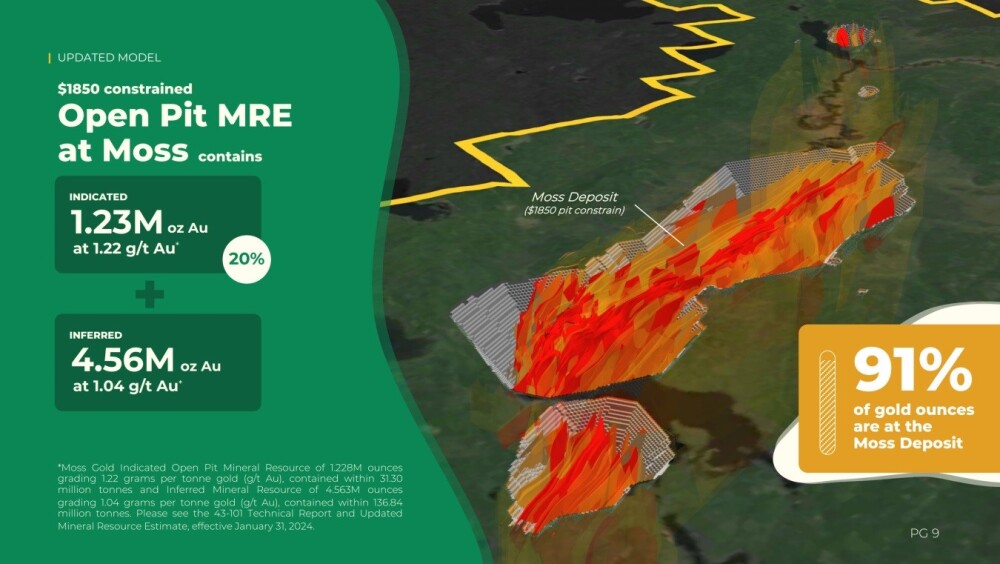

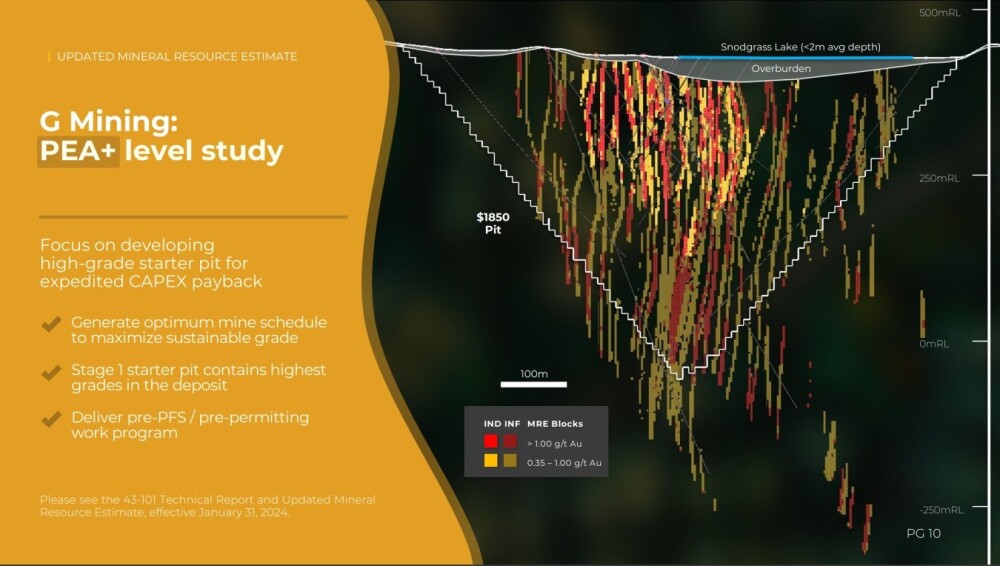

A substantial part of the Moss resource is open-pitiable, which means that extraction costs are relatively low.

A high-grade starter pit will provide significant cash flow to fund the project's advancement.

There is also plenty of scope for expansion.

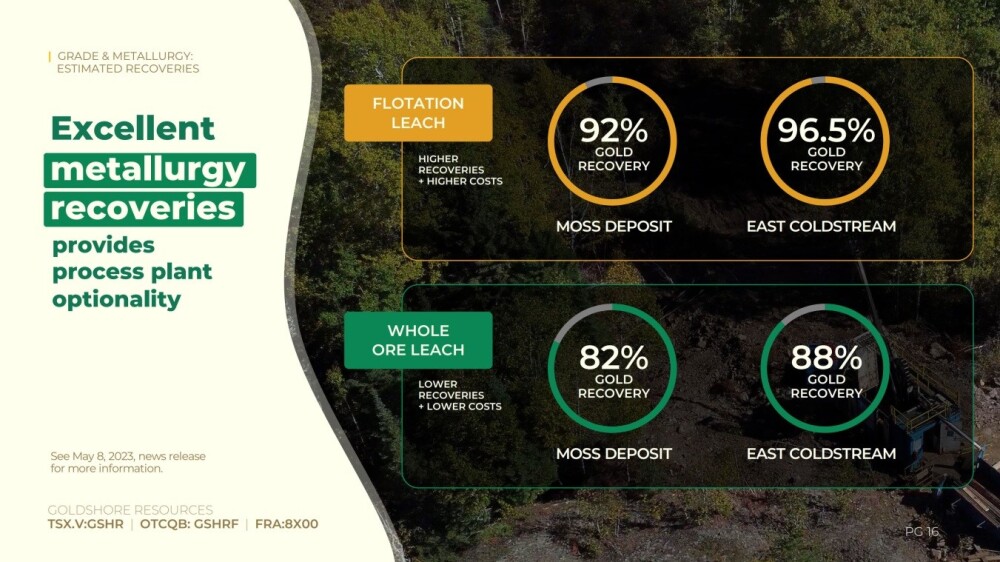

The metallurgy recoveries are very good.

For further details of the geology of the project, please refer to the company's website and / or the investor deck.

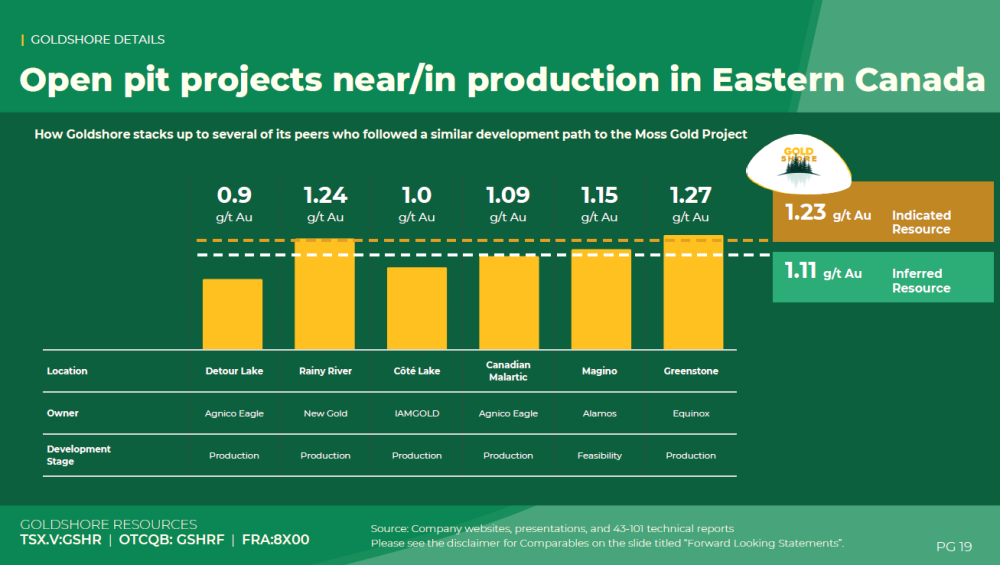

Here is how Goldshore's Moss open pit will measure up against other big open pit projects that are near / in production in Eastern Canada…

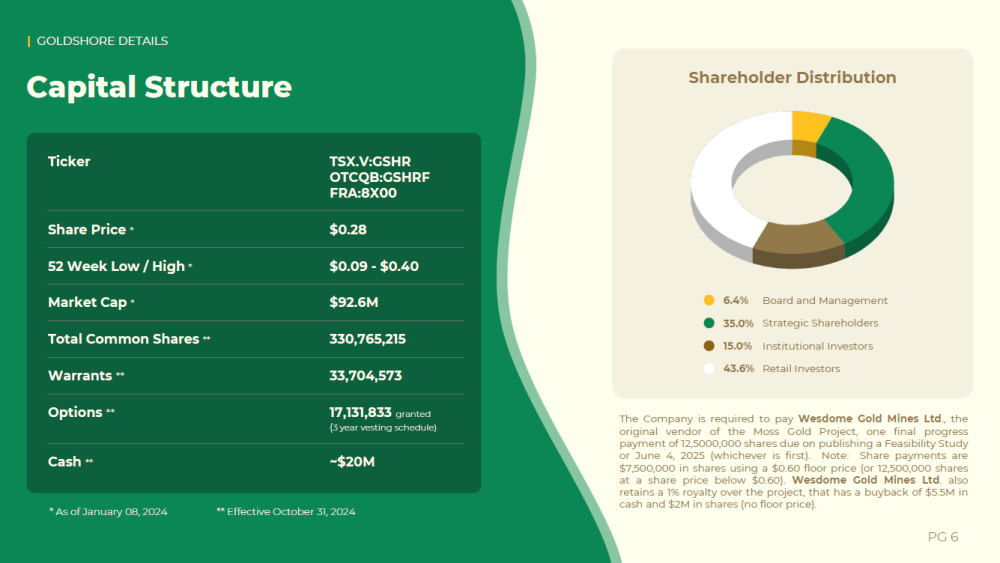

Lastly, this slide showing the capital structure of the company helps to clarify that, even though the number of shares in issue may initially seem high at 330.7 million, more than half of them are owned by board and management, institutional investors and strategic investors.

Now, we will review the latest stock charts for Goldshore Resources. Goldshore Resources has done well since we first looked at it almost a year ago when it was priced at CA$0.10.

On the latest 5-year arithmetic chart, we can see that last year's sizable uptrend served to complete the right side of the "Head" of the giant Head-and-Shoulders bottom shown. As a result there is a the potential for the stock to improve once it succeeds in breaking out of this base and given the persistent heavy volume accompanying last year's uptrend that has previously driven an uptrend in the On-balance Volume line.

GoldShore Resources' website.

Goldshore Resources Inc. (TSXV: GSHR; OTCQB: GSHRF ; FWB: 8X00) closed for trading at CA$0.285 US$0.20 on January 6, 2025.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Goldshore Resources Inc. is a billboard sponsor of Streetwise Reports.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Goldshore Resources Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.

Goldshore Disclosures

Qualified Person

Peter Flindell, PGeo, MAusIMM, MAIG, Vice-President, Exploration, of the Company, and a qualified person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has approved the scientific and technical information contained in this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains statements that constitute “forward-looking statements.” Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur.

Forward-looking statements in this news release include, among others, statements relating to expectations regarding the exploration and development of the Moss Gold Project; the timing and release of assay results; re-rating of Goldshore; investment prospects; timing and release of technical studies; potential success of Goldshore; price of gold; and other statements that are not historical facts. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect the Company’s business and results of operations; and the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company’s securities, regardless of its operating performance.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.