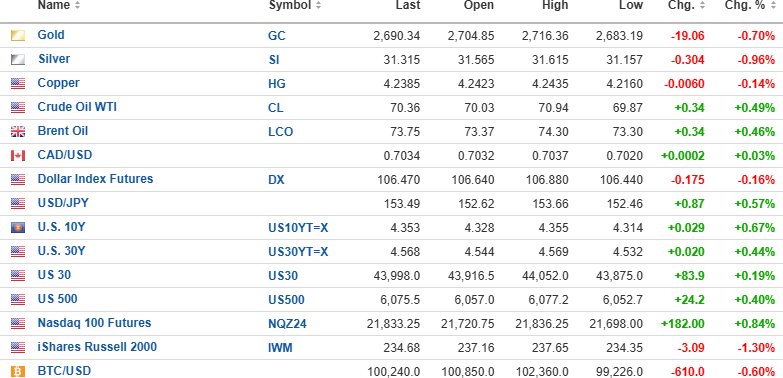

USD index futures are down 0.16% to 106.47 this morning, with the 10-year yield (+0.67%) up 0.029 to 4.353% and the 30-year yield (+0.44%) up 0.020 to 4.568%. Metals are lower, with gold (-0.70%) down $19.06 to $2,690.34, silver (-0.96%) down $0.304 to $31.315, and copper (-0.14%) down $0.0060 to $4.385.

Oil (+0.49%) is up $0.34 to $70.36/bbl. Stock index futures are higher, with the DJIA (+0.19%) up 83.9 points, the S&P (+0.40%) up 24.2 points, and the NASDAQ (+0.84%) up 182.00 points.

Risk barometer Bitcoin is down 0.60% to $100,240.

Christmas Present

I was having a debate with a colleague last evening over the outlook for stocks in 2025, and as a card-carrying Trump disciple, it is difficult to record a debating point that actually registers with this maniac because he sees Trump through the same tainted lenses that Canadians viewed Justin Trudeau back in 2015 when he was considered a "messiah" for spearheading the legalization of marijuana across the country.

You ask this Trump-o-phile about the proposed tariffs, and he spews out 10 reasons why they will "protect American exporters" (followed by 10 exclamation marks) while conveniently omitting the impact of the Smoot-Hawley Tariff Act of 1930 as being "not relevant in 2024" to which I throw up my arms and roll my eyes and wait patiently for the foam to dissipate from his mouth.

The belief currently carried by a vast number of stock market gurus is also found in the same format, with the Bitcoin crowd who can argue incessantly for hours why Bitcoin does not require physical possession in order to remain a safe haven. It will still survive if a nuclear holocaust knocks out all electrical power (as in computing power) and wipes out all memory banks containing the blockchain with all relevant ownership records.

It is the price action in markets that exert <Command and Control> over the narrative, whether it is copper or gold or crypto or stocks. These arguments will persist until they do not, with the ultimate outcome being determined not by a panel of experts or an overseer with years of economic history but rather by the bid-offer in any particular market and one's profit-and-loss statement at year-end. Everything else dominating the narrative is simply noise.

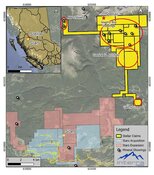

The junior resource stocks that dominate my GGMA 2024 Portfolio/Trading account are a great example whereby history would dictate that they are all "ridiculously cheap" based upon the values being assigned to in-ground resources (think Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB)), proximity to existing discoveries or mines also known as "closology" (think Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) or Vortex Metals Inc. (VMSSF:OTCMKTS; VMS:TSX; DM8:FSE)), or proximity to production start-up (think Aftermath Silver Ltd. (AAG:TSX.V; AAGFF:OTCQX; FLM1:FRA) or GTCH/GGLDF).

However, one can safely argue that the bullish narrative based solely upon historical valuations is defunct and has been largely since the last resource bull ended in 2011. Notwithstanding brief pops in lithium and uranium in the post-pandemic spending orgy, the real bull markets have been in gold, silver, and copper, with most of the base metals (ex-copper) lagging badly. The lag has been especially acute in the juniors because whereas the 1988-1997 period was the "Golden Era" for discoveries, with 2002- 2011 a distant second, the more recent golden bull that began in late 2015 at $1,045 has seen very few new needle-moving discoveries (Great Bear's Dixie discovery / Filo Mining's Filo del Sol) that were more than simply pump-and-dump campaigns (Novo Resources / New Found Gold's Newfoundland "discoveries"). The narrative that many of the followers of the junior mining space have adhered to has proven to be an elusive one, but for this writer of stories and purveyor of provocativity, it is based upon in-ground reality and not an above-ground fantasy that I continue to own and add to the juniors.

The competition for the junior explorers and developers is obviously the outstanding (and outrageous) performance of the U.S. stock markets as well as the unarguable success of Bitcoin in capturing the attention of the new and now very large constituency of youthful investors that look at physical gold ownership in the same way they look at a rotary-dial telephone or a cable TV set. Everything the new generation does, from dating to restaurant reservations to grocery shopping, is done with their mobile phones, and that includes investing. Only when the price action in U.S. stocks and crypto begins to treat them poorly will they seek the greener pastures of junior resource investing, and I, for one, think that it is coming in 2025 on a wave of universal disillusionment over the Trump campaign promises.

Non-resource stocks are by and large over-owned and over-promoted, as is Bitcoin, and whereas the Euphoria Gauge is now at record levels dating back over thirty years to its inception, gold mining stocks, as represented by the HUI or the GDX, are anything but expensive. In fact, the entire resource sector is struggling to rejoin the rest of the U.S. markets in their lovefest with all-time highs.

Look at Freeport-McMoRan Inc. (FCX:NYSE), one of the best-run companies in the world. They have a 16.43% return on capital, which is acceptable as the world's largest copper producer, but compare that to Nvidia Corp. (NVDA:NASDAQ), whose ROC is 106.07%. It is hard to convince a Gen-Z-er studying finance for the first time to favor FCX over NVDA as a portfolio component.

I believe that the safest trade in the junior space going into year-end is Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB), which has in recent days come under pressure due to year-end tax-loss harvesting and portfolio rebalancing but also because for many investors in this name, the "shelf life" or "Sell by date" has expired.

This is what happens to great little companies that fail to gather any degree of price performance because the new breed of investor cares not a whit about "value-per-ounce" or "jurisdictional safety." They only care about how the investment is affecting their profit-and-loss statement, and GTCH/GGLDF has been unable to convince the markets that their Fondaway Canyon Gold Project is going to be re-rated by analysts and investors alike. So, they sell, and I buy because the upcoming PEA in January is going to reveal the economics that lay in store for the project, and my speculation is that it is going to arrive as a "robust" PEA that will be ever more "robust" once they resume drilling next spring.

The delicately wrapped gift under the Hannukah Bush this year is going to be GTCH/GGLDF on the expectation that the recently-appointed IR firm, Capital Markets Advisory, under the tutelage and direction of seasoned veteran Karen Mate, will take the PEA and use it as a calling card to the vast list of high net worth and institutional investors that populate her database.

Many investors have discounted that corporate development from last October, but not this investor. As Karen said to me after agreeing to take Getchell on as a new client, "All this needs is a new set of eyes." And she is absolutely right in that assumption. (Note: Her campaign was intended to commence in November with the expected arrival of the PEA but had to be postponed due to the machinery issues that cropped up unexpectedly in November.)

As a contrarian trade and as my 2024 Christmas present,

- Buy Getchell Gold Corp. at CA$0.135 limit / US$0.095

- Target: CA$0.30 / US$0.21 by end-of-January

| Want to be the first to know about interesting Cryptocurrency / Blockchain, Critical Metals, Base Metals and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., Fitzroy Minerals Inc., and Vortex Metals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.