The wedding between the American electorate and Donald J. Trump that occurred on November 5, 2024, was a blessed event for not only American conservatives but also for holders of shares in "all things American" as the ensuing four-day honeymoon took all of the major averages to record high ground.

As the champagne corks were popped and the marriage consummated with CNBC anchors in full celebratory regalia each and every day, not one of them dared mention that the 10-year and 30-year yields were raising their middle fingers in fiscal and monetary protest to the mere idea of tariffs, let alone the notion of firing several million government employees and its concomitant effect on the domestic economy. U.S. bond yields are now a full 84 basis points (0.84%) higher than where they sat in September when Fed Chairman Powell took out the monetary bazooka and lowered the Fed Funds Rate by a whopping 50 basis points.

While the Fed can move around the short end of the global interest rate structure, it is the bond-holding "inflationistas" that determine yields on durations in excess of two years and, as such, anything vaguely resembling a softening of the anti-inflation policies of the 2022-2024 Fed was bound to send a resonating shiver down the spines of the global bond market and that it certainly did.

That Monday was "Veteran's Day" in the U.S. and "Remembrance Day" in Canada was little solace to the stock markets because they took no solace in the safety of stock market devotion and instead put in an inside reversal day, opening higher but then closing "hard on the lows" and thus punctuating the Trump Victory lovefest with terminal ferocity.

I was taught decades ago that "bad news in a bear market is bullish, but bad news in a bull market is not," which is to say that one should always "buy bad news" when stock prices are in an uptrend. However, when one is a fundamental analyst who masquerades as a technical analyst, as am I, it throws one into a quandary when the Buffett Indicator shatters all prior measures of overvaluation and one is forced to watch stock prices continue climbing their respective "Stairway to Heaven" (with great respect to the founders of "heavy metal") with a busload of cheering CNBC anchors all wagging their fingers at the naysayers and tsk-tsk-ing any poor slob that ever used prudence as an investment premise.

Stocks under a re-visited Trump presidency are not going to find a "mercy bid" as occurred in 2016. What will occur is the same thing that happens when an ill-fated union between two unassuming humans lets animal physicality take the place of genuine compatibility, resulting in the end of the "Honeymoon Phase" of their union.

I submit that stocks were shocked into reality and away from their Trumphoric bliss while the wreaths of fallen soldiers were trotted out and honored. Since the obvious distribution that has been going on in the days immediately preceding and then following the election, I purport that what we may have just seen was the ultimate "blow-off" top, the likes of which I have not seen in years in the U.S. markets.

And it is all driven by yields. . .

Gold and Silver

Up until the election results came in, I was unequivocally convinced that gold was headed to well beyond $3,000/ounce by the arrival of 2025. Today, I am not so sure. In fact, I could see the Trump advocates (led by the Wall Street masters) taking gold down right into New Year's Day by another $200/ounce, which would be right at the 200-dma.

As for silver, the more Eric Sprott stands up and chortles about "$200 silver," the more I cringe. The problem is that all the wrong people I know own silver for all of the wrong reasons, and while I think Eric is steadfastly "on the money" in his prediction, I have a problem with his timing — that is to say — he rarely provides timing, nor do any of the silver bull podcasters espousing the prospectivity of a $200 silver price.

If I counted the number of times I have been taken out behind the woodshed for trumpeting silver, it would be well beyond fingers and toes and approaching hair follicles in my teenage years. Silver is an absolute certainty to see $200/ounce, but if a junior silver producer has to wait another twenty years to see that price, the question remains: "What have operating costs done in the same time period?" How much dilution occurred during that time horizon to minimize the immediate benefit to shareholders?

This has been the problem with Newmont Corp. (NEM:NYSE) since the Dawn of Creation. They love to be seen as the "Biggest Gold Mining Company in the World," but the problem remains that they can barely get past the concept of being a profitable gold mining company, and when I read that their new "All-In-Sustaining-Cost" was over $2,000 per ounce, I was scrambling to find the nearest waste bin into which I might deposit my recently-ingested lunch.

Gold moves from $1,050 in December 2015 to $2,800 by October 2024, and Newmont moves into full "nose dive" status. Ridiculous.

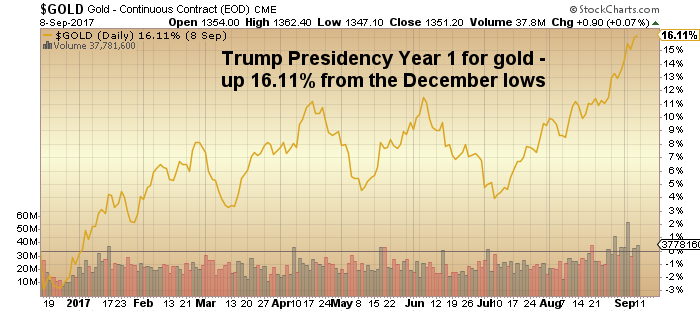

If I take the 2016 election outcome as a guidepost for how the masters of capitalism will treat gold, it is important to note that in the eight weeks immediately following the surprise trouncing of Hillary Clinton, gold fell approximately 13% from a high of $1,274.50 on the eve of the election to $1,124.30 by December 15.

However, from the middle of December, after the honeymoon phase ended and reality returned to the financial arena, gold began an ascent that took it up to $1,351.20, a 16.11% advance for the first year of the Trump presidency.

Applying these figures to 2024, if I take the high for gold on November 5 (2024 election Day) of $2,759.50 and give it a 13% haircut, it arrives at $2,400.76/ounce sometime between now and year-end. If I then take $2,400 and mark it up by the same percentage gain it enjoyed in the first year of the last Trump presidency, I get a figure of $2,787.50, a very slight improvement over the closing price on the eve of the 2024 election.

Now, given that the VanEck Gold Miners ETF (GDX:NYSEARCA:) is down 20.42% since the October 22 peak, once again, the gold miners are underperforming the metal price and are either an incredible buying opportunity or a harbinger of even lower gold prices on the immediate horizon. In a couple of weeks, tax-loss harvesting will begin, and with so many gains everywhere else in the markets caused by the post-election halcyon, gold (and silver) miners are probably one of the few losing sectors for the calendar year 2024. This suggests that there will be additional technical selling of the gold miners right through mid-December, which coincides exactly with the 2016 analogy.

As for silver, I am embarrassed to confess that I sent out an email alert to subscribers on Monday of the past week advising them that I was "biting the bullet" on "all silver positions," including the iShares Silver Trust (ETF) (SLV:NYSE) and a hefty position in the December calls. I am currently flat all leveraged gold and silver positions but elected to hold my core 50% position in copper through Freeport-McMoRan Inc. (FCX:NYSE).

Silver has been the singular most frustrating metal that I have ever encountered, and while it has advanced 26.35% YTD, it has beguiled me into thinking (erroneously) that it would adhere to the normal tenets of technical analysis. What is maddening is that I have written for decades about the need to ignore technical break-outs and break-downs because they are "inverse signals" where breakouts should be sold, and breakdowns bought and what did I do in mid-October with the break-out above $33? I violated my #1 rule for trading silver and bought the break-out. Shame on me.

It was at the lows in early August during the Japan "carry trade crash" that I liquidated all volatility position with some of the best gains for the year but then waited for early September to use them as a hedge against drawdowns in what has historically been the two worst months of the year a seasonal basis.

While they did not do anything noteworthy in either of those two months, the VIX remained rangebound between 15 and 24 for most of that period forcing me to exit all volatility positions in late October.

For the first time in years, I decided to avoid any hedges going into election day fearful that the record amount of corporate buyback filings would provide ample buying support to offset any negative election outcome (or heaven help us a contested outcome). That was a very fortunate stance to take because, as it would turn out, the Trump sweep set off a buying stampede of panic proportions that not only took short sellers and hedgers out behind the proverbial woodshed, it hammered the CBOE Volatility Index (VIX:US) down over 40% to the mid-summer lows and the UVIX:US to a 52-week low of $3.28 registered on Thursday making its 2024 return a revolting – 71.81% YTD.

The following morning, I sent out an alert telling subscribers that I was buying the VIX December $10 calls at the $5.50 level and the UVIX:US with a $3.50 limit. Needless to say, the dip-buyers were predictable in their actions as they all unanimously bought the Friday opening dip but then recoiled in horror as stocks did the impossible – they actually had a down session! The VIX opened in a subdued manner with price a mere 0.30 higher, but as the traders began to buckle one by one, the VIX finally caught a bid around 10:00 a.m. and then rocketed to an intraday high of 17.55. Although some late afternoon bargain hunting took the S&P 30 points of its low, it still closed down nearly 80 points, with the VIX:US closing up 13.82% to 16.14 but still well below the range in which it traded prior to November 5.

I think that once the world realizes that there is very little that any president can do to fix the current fiscal time bomb that is certain to explode in their faces before the next four-year term has ended, stocks will begin a reversion to the mean that will usher in years of sub-par returns for investors. With the S&P 500 hitting an intraday, all-time high at 6,017.31 on Veteran's/ Remembrance Day, that print threw the Buffett Indicator into record territory with a market cap of over 220% of U.S. GDP.

This level of overvaluation has Buffett's Berkshire-Hathaway now sitting on over $350 billion of cash. Old Warren has been flying in the face of the current Wall Street narrative and selling all the way up in 2024, and while the younger centurions that guard those Hallowed Halls of Wall St. would have us believe that we are only just now entering a "new bull market" with Donald J. Trump leading the parade, I will place my faith in the veracity of the Buffett Indicator over the Talking Heads of CNBC and their illustrious and heavily-conflicted "guest commentators."

While I have not yet forgotten about those record buybacks looming out there, it may just be that the insider selling numbers are going to reveal that they are taking full advantage of the buybacks to unload their positions, and once it has been expended, the inevitable air pocket of evaporating bids and accelerating offers will descend upon Wall Street. There is also the question surrounding Nvidia Corp. (NVDA:NASDAQ), whose all-time high of $149.77 secured its seat at the Table of Overvalued Companies with a P/E of 70 times forward earnings and a $3.4 trillion market cap. Interesting to note that their third largest customer, Super Micro Computer Inc. (SMCI:US) is down nearly 85% having had their auditor quit over wonky accounting practices. The next earnings date for NVDA is on Wednesday of next week (Nov. 20) so we will see whether or not the pin pierces the bubble.

In the interim, I see the volatility trade as a viable way to protect against a popping bubble while I await the ultimate bottoming of the precious metals sector between now and year-end.

Junior Resource Companies and the TSXV

Back on April Fool's Day, 1997, I was in Boston awaiting a meeting with the Fidelity Select division analysts when the headline in that morning's Globe and Mail Report on Business blared "Strathcona Minerals Confirms Bre-X a Fraud," which ushered in not only a brutal five-year bear market in the junior Canadian resource sector but also a new regime in regulatory scrutiny for the juniors. Within a couple of years, the Canadian regulators, deemed "clowns and incompetents" by the global financial media, a reputation still prevalent nearly twenty-seven years later, surfaced with a series of "New Rules" for the junior mining industry. They brought in "National Instrument 43-101," which forced companies to hire a third party "Qualified Person" to complete reports on projects and properties, which had to be filed with the regulators before any press releases could be made. A typical 43-101 could cost the juniors up to CA$50k plus expenses such as travel and accommodation placing undue stress on the working capital positions of these juniors that are seemingly always in the hunt for additional funding and rarely able to justify these costs. In recent months, from what I am hearing, difficulties with regulators are accelerating where these "protectors of the public good" are going overboard to throw up roadblocks for reasons unrelated to shareholder welfare. In fact, it is as if the industry itself has been targeted for elimination because with increased exchange fees and now harassment by the regulators, it has become a severe impediment to become a public company.

The entire raison d'etre for the old Vancouver and Alberta Stock Exchanges was to provide a venue by which the public could finance exploration activities for the juniors and in doing so, engage in the art of speculation which, back in the day, demanded intense due diligence and close attention to market behaviours. In the pre-Bre-X period before the regulators decided to become fire-breathing watchdogs, there was a stretch of about fifteen years where volumes on the junior exchanges eventually consolidated into one major exchange — the TSX Venture Exchange — were breaking records and stealing a great deal of the thunder normally reserved for the TSE 300 and the NASDAQ.

Major world-class discoveries created major world-class companies like Teck Corp. and Echo Bay Mines and DiaMet Minerals and this was without the need for regulatory oversight the likes of which we have today. Prior to the Bre-X Fraud, there were more than a few scandals but in the world of money, there are always scandals and shady operators. Look no further than the U.S. markets during the dotcom boom where companies like Enron, WorldCom, and Tyco had CEO's that were eventually indicted but at shareholder expense many times the estimated $3 billion that were lost in the Bre-X fiasco. The sad part of it all is that nobody went to jail over Bre-X but in 1964, lady prospector Viola McMillan went to the slammer for eight months after being convicted for wash trading in the Windfall Oil & Mines scam where the real crime was phony assay results.

If the TSX Venture Exchange and its legions of kiddies that are acting as Conservators of the Canadian Dream are not careful, there is going to come a point in time where the publicly-traded junior exploration industry ceases to exist and instead becomes populated with private companies all funded by the private speculators with the propensity for risk and in need of the incredible excitement of a new mineral discovery that changes family fortunes and creates entire industries.

What started out in the 1800s with wealthy farmers from southwestern Ontario grubstaking prospectors in northern Ontario and Quebec without the salivating watchdogs at CIRO monitoring their every move, has today morphed into a bureaucratic nightmare of filings and submissions and "requests for additional data" that are clogging the plumbing in what has over the years proven to be the most skilled group of minefinders on the planet. Without the benefit of exchange fees, an entire generation of fuzzy-cheeked "regulators" are going to be unemployed, standing in line at Manpower looking for a new job defending the public good.

Forgive the rant but the juniors need to be cut a large dollop of regulatory slack. . .

| Want to be the first to know about interesting Silver, Gold and Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.