In the mining industry, some of the most promising projects can be victim to poor management. Case in point: two companies where I held significant positions—one dropped 94%, and another went bankrupt despite having exceptional assets.

Irving Resources in Japan exemplifies this pattern. Despite surface samples assaying at over $25,000 per tonne in Hokkaido and backing from Newmont's technical teams, the company spent $38 million on unsuccessful exploration. My investment dropped 94% from its peak.

White Rock Minerals faced similar challenges with its Alaskan and Australian projects. COVID-19 border restrictions delayed crucial drilling at its $5 billion Red Mountain project. Then, regulatory changes in New South Wales increased its Mt Carrington project bond from $968,000 to $6.8 million, causing its joint venture partner to withdraw. Management's decision to redirect remaining funds to Woods Point backfired when Victoria raised that project's bond from $153,000 to $16.3 million, effectively ending White Rock's operations.

Enter Silver47 Exploration Corp. (AGA:TSX.V), initially focused on its Michelle Project in the Yukon.

This 158 square km property showed promise with impressive drill results in 2022: 15 meters of 907 g/t silver with 45% lead and 4% zinc, followed by 18.29 meters of 310 g/t silver with nearly 17% zinc and over 8% lead.

However, permitting issues with the Environmental and Socio-Economic Assessment Board halted their planned 60,000-meter drilling program. While legal proceedings continue, Silver47 pivoted strategically.

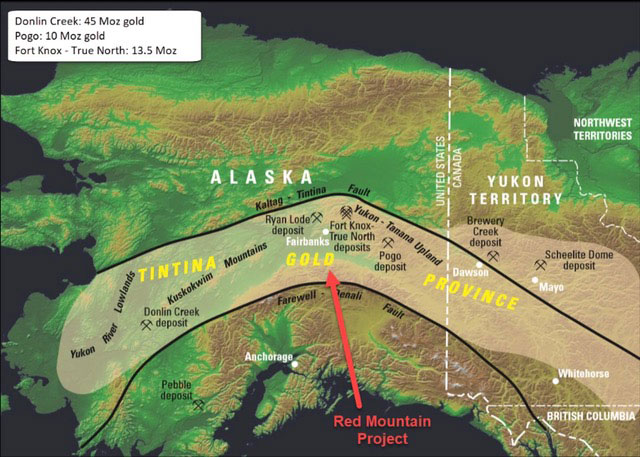

Recognizing an opportunity, Silver47 acquired the Red Mountain project from White Rock for approximately $6 million in cash and shares.

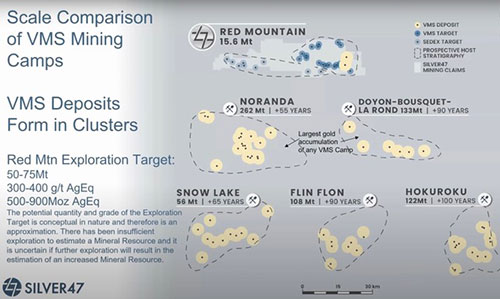

The 620 square km property, located 100 km south of Fairbanks, already has a 43-101 resource of 15.6 million tonnes at 335.7 g/t AgEq (168.6 million ounces silver equivalent). Silver47 aims to expand this to 50-75 million tonnes at 300-400 g/t AgEq, potentially reaching 500-900 million ounces silver equivalent.

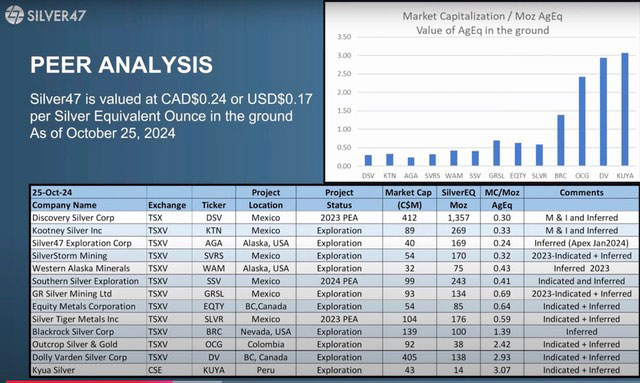

While reviewing projects, it's imperative to also review comparables to see the value of other companies with similar assets. Comparably, Silver47's $0.80 price is incredibly cheap.

The project benefits from existing infrastructure, with a haul road 30 km away, and sits on state-managed land free from federal jurisdiction and indigenous claims. At current prices, Silver47's valuation represents a fraction of comparable silver projects, offering investors exposure to silver at roughly one-tenth the cost of peer companies.

Being an investor in Silver47 for a few years now, I was pleased to hear it was going public. The market is keeping a keen eye out for a great silver story. With Silver47, you can buy silver for a major discount (around 10% less) than what others are paying for other companies that have less silver.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Silver47 Exploration Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver47 Exploration Corp.

- Bob Moriarty I, or members of my immediate household or family, own securities of: Silver47 Exploration Corp. My company has a financial relationship with Silver47 Exploration Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.