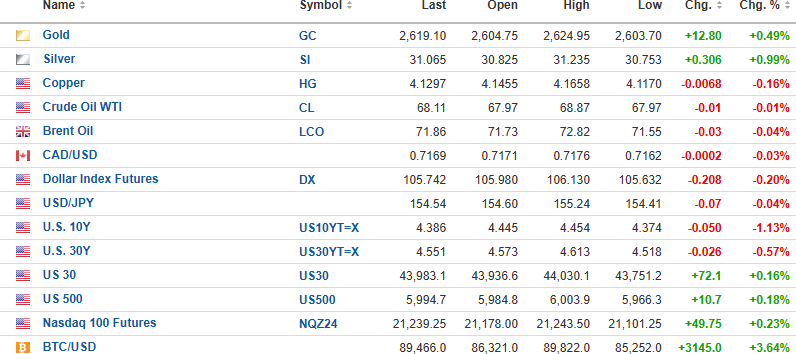

USD Index futures are down 0.20% to 105.742 with the 10-yr. yield (- 1.13%) down to 4.386%, and the 30-yr. yield (- 0.57%%) down to 4.551%. Metals are bouncing, with gold (+0 .49%) up $12.80, silver (+ 0.99%) up $.301, and copper (- 0.16%) down $0.0068.

Oil is down 0.01% to $68.11. Stocks are up, with the DJIA (+ 0.16%), S&P 500 (+ 0.18%), and NASDAQ (+ 0.23%) all higher. Risk barometer Bitcoin is up 3.64% to another record high at $89,446.

CPI Day

CPI came in at 0.2% (month-over-month), while annual CPI reaccelerated to 3.3% (year-over-year). Inflation in the service sector remains elevated, while goods inflation has resumed its uptrend after a number of deflationary reports in 2024.

Gold and silver bounced on the news and stocks have turned green after being red in the overnight session.

Copper

At $4.126/lb., the copper producers are making a ton of money, but it certainly has not caused a green light to shine on all those greenfield projects that are seeking production funding.

With the incoming U.S. President-elect talking about tariffs and corporate tax cuts, the outlook for the U.S. currency is anything but rosy, and if the USD heads into a debt-deficit-driven sell-off, copper prices are going to head substantially higher.

Technically, prices look to be headed toward oversold status, and with the MACD finally completing a bearish crossover along with the Money Flow Indicator, the August lows under $4.00/lb. are likely. This is why I canceled the Buy order on Freeport-McMoRan Inc. (FCX:NYSE), and while I am holding on to the existing positions, I will be adding them before year-end. Rallies to the high-$40's will be a selling opportunity.

Aftermath Silver Ltd.

One of the dumber moves I made in 2024 was the premature sale of American Eagle Gold Corp. (AE:TSXV; AMEGF:OTCQB) in the $.40-.55 range immediately after the October 21 release of drilling results that came a full eight weeks after reporting lower-than-expected copper values from their “Gold Zone" on August 20th. My thinking was that it does not take eight weeks for assays to be completed, inferring that the delay in the results might be an indication that poorer-than-expected assays were probable.

The October 21 results were not a disaster, but they certainly ranked a distant second to the January 2024 results that resulted in the first assault on the CA $0.50 level.

At the time, I followed the breakout in silver above $33.00 (basis December) and used the breakout to reposition the AE:TSXV funds into a 50% position in Aftermath Silver Ltd. (AAG:TSX.V; AAGFF:OTCQX; FLM1:FRA) on the basis that Eric Sprott had just increased his holdings to 25% which was (and is) a huge testimonial to the Berenguela Project in Peru and to the stewardship of Chairman and Founder Michael Williams.

With AE:TSXV hitting a 52-week and all-time high yesterday at CA $0.97 and with AAG/AAGFF hitting a reactionary low of CA $0435, I am down 30% on the first tranche bought two weeks ago and am now awaiting a signal to add to AAG/AAGFF. I see lower prices for silver until mid- late December and while there will be rallies, the trend is now lower.

There are times when the planets all align perfectly, and the outcome is sublime, and then there are other times when they don't, and the opposite outcome occurs. While my rationale for making the switch was sound (I would do it again if presented with the same set-up), the outcome is not what I expected — YET.

I will judge this trade after I have added the remaining 50% in AAG/AAGFF and the silver market gets back into gear, which I expect to be in early 2025. In the interim, remember that I bought it in the $0.25 range early in 2020 before the COVID Crash took it under a dime, only to recover to $1.70 by January 2021.

I expect the same to happen in 2025. Evidently, so does Eric Sprott. . .

| Want to be the first to know about interesting Base Metals, Critical Metals and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of American Eagle Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.