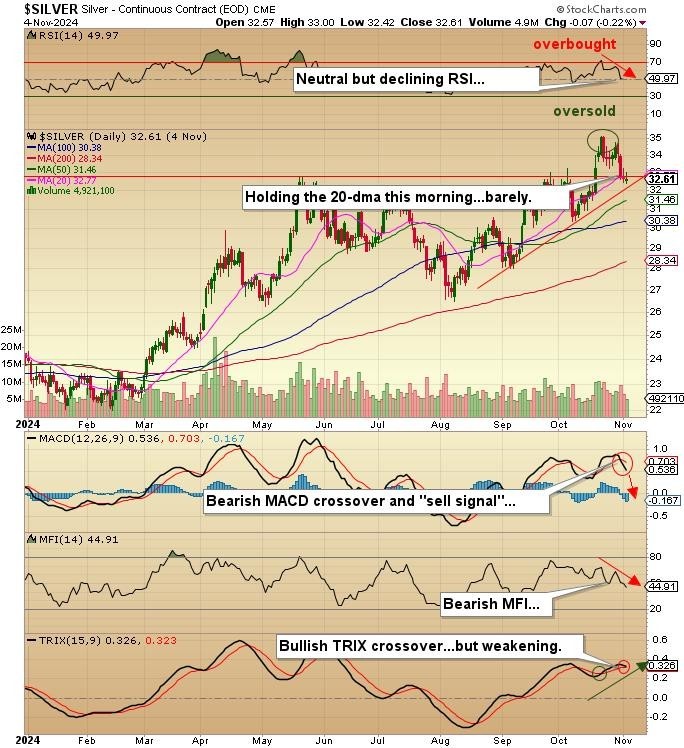

In last weekend's missive, I wrote about the frustration experienced by all who try to trade silver using conventional technical analysis because recent tape action suggests that silver, unlike technology or meme stocks, should never be bought based upon a "break-out" above resistance or a "break-down" below support. The bullion bank thieves that are allowed to mess around in the Crimex silver pit use these price points as levers by which to send the Large Speculators into buying or selling frenzies inviting the manipulators' opposing moves.

This morning, it is election day in the U.S., and all eyes of the world are watching with bated breath to see if previously unelected Kamala Harris can keep the incumbent Democrats in the White House or whether populist ex-president Trump will barnstorm the voting booths and regain the presidency. Either way, it would appear that the silver market is not casting a wager on either candidate because it has reclaimed the 20-dma this morning with its $0.22/ounce move to $32.83. It may well be that shorts sellers are moving to the sidelines in the event of a Democratic sweep, but I wager that the precious metals will have another leg up as soon as this pre-election position-squaring is over.

I am going to either add to my iShares Silver Trust (ETF) (SLV:NYSE) (and call option) positions or I am going to jettison the entire lot all based on the market's reaction to the election outcome. In the final analysis, the outcome will be adjudicated by the price action, so letting the market tell me what to do is far better than trying to second-guess a market that moves with a mind of its own bereft of any form of adherence to the rules of technical or fundamental analysis — which is precisely why I hate silver.

FTZ/FTZFF

I spoke with Fitzroy Minerals Inc.'s (FTZ:TSX.V; FTZFF:OTCQB) Chairman Campbell Smyth last evening, and after clicking off our WhatsApp call, I felt genuinely sympathetic to the man who has been working 18-hour days for the past three months in a Herculean effort to get the Buen Retiro deal over the goal line.

Back in the day, dealing with the Exchange and with IIROC was rarely confrontational because one was dealing with people who understood that exchange fees paid by the member clients (public companies listed on either the TSX or TSXV) paid their salaries. They were eager to allow companies the license to do business and raise the much-needed venture capital that is the lifeblood of the TSX Venture Exchange.

If two companies wanted to merge, they let the cards fall where they may, resulting in fast-flowing M&A activity, albeit not without the odd "shady deal" that slipped between the cracks. These days, the lawyers and the fuzzy-cheeked "baby lawyers" are pitted squarely against each other in what is almost a generational standoff, with the result being long, drawn-out approvals and, in some cases, like the FTZ-Buen Retiro deal, extended trading halts that usually send out negative vibes to shareholders as if something is "untoward" in the deal. In what is already a twitchy junior mining sector, these impedimentary rulings that are seen as "champions of the common working man" serve only to drive investors away for reasons that have nothing to do with the integrity or potential of the deal.

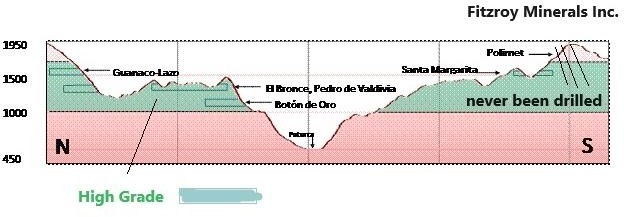

In the case of Buen Retiro, the regulators have prohibited all marketing of the 33,000 meters of drilling and compelling geophysical surveys that have isolated a magnetic anomaly larger than the one containing the Candelaria IOCG deposit located 45km up the road.

The three principals behind Buen Retiro, two of which are associated with Fitzroy Minerals Inc. (CEO Merlin Marr-Johnson and Gilberto Schubert) are escrowed for three years with a pre- defined release schedule for their stock positions. Furthermore, insider reports by Marr-Johnson and Chairman Smyth indicate that they are buyers of recent private placements. Lastly, the company has a massive list of prospective investors associated with Matt Gordon's Crux Investor subscriber base that is being deemed as "off limits" because of possible conflicts, which is nonsense. If Crux Investors are excluded from participating, that is a violation in itself, especially if FTZ/FTZFF becomes a multi-bagger. In the end, it is up to the individual investor and not whether they subscribe to any YouTube channel.

I urge all subscribers to focus on the raw potential and advanced exploration status of the Buen Retiro project and not let it detract from the drill hole potential for Polimet and Caballos, where a good portion of the current working capital position of CA$3.5 million has been "ring-fenced." I am on record as stating that Polimet could easily be the "sleeper" in the deal. Drilling it off in an area that has multiple mines producing high-grade copper-gold mineralization could be very exciting, and it is expected to happen before the end of the year. Four great exploration projects with one in the "advanced" category and all infinitely financeable, as proven by the CA$5 million already raised in 2024.

As has always been the case since the arrival of social media and internet "chat" rooms, trolls love to find the tiniest of threads upon which to pull in order to draw attention to their unremarkable lives. They will never report on the quality of the assets or management or the high-end shareholder base that has sought to invest over CA$5 million in 2024 in what would otherwise be deemed a colossal accomplishment, given the dismal state of the junior resource funding environment.

Subscribers to the GGM Advisory are poised to make a great deal of money on Fitzroy Minerals Inc., and I urge all of you to be ready to absorb any shares that are available for sale when it re-opens. As for the timing, I am uncertain whether or not the exchange is going to require that the CA$2.5-4.0 million mentioned in the press release be closed prior to them issuing a "Resume Trading" order.

If that is the case, then next week is a likely target for the closing. It must be remembered that until the result of today's U.S. election is determined, few large professional investors are prepared to write cheques for new deals, but once that is out of the way, I expect that a torrent of news will be flowing from FTZ/FTZFF with a lot of it regarding Buen Retiro that has not yet been seen by any prospective new investors, and that includes the major mining companies operating in and around the project.

Fitzroy is a "Strong Speculative Buy" with a target price multiples of the price at which it was halted.

| Want to be the first to know about interesting Silver, Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.