Stillwater Critical Minerals Corp. (PGE:TSX.V; PGEZF:OTCQB; J0G:FSE) has announced new assay results from its ongoing resource expansion drilling at the Stillwater West PGE-Ni-Cu-Co + Au project in Montana. Significant rhodium ("Rh") intercepts include 1.13 g/t (grams per tonne) Rh within a 7.96 g/t Pt+Pd+Au+Rh ("4E") interval over 1.2 meters, starting at 308.8 meters depth in hole CM2023-03. This interval sits within a larger 14.6-meter section grading 1.38 g/t 4E, including 0.118 g/t Rh. Additionally, hole CM2023-01 returned 0.162 g/t Rh over 3.7 meters, starting at 407.8 meters, within a 0.99 g/t 4E interval.

These results are expected to expand upon the 115,000 ounces of rhodium defined in the January 2023 Mineral Resource Estimate. Rhodium's market relevance remains high, with prices averaging US$6,500/oz over the past two years, and supply constraints have kept values well above those of palladium, platinum, and gold. Stillwater West's proximity to Sibanye-Stillwater's world-class J-M Reef deposit, the highest-grade Platinum Group Element deposit in the world, and the district's potential for high-value co-product grades further highlight the project's strategic importance.

Michael Rowley, President and CEO, commented in the news release, "The strength and sheer scale of mineralization at Stillwater West continues to impress us as we add mineralization at several grade cut-offs, providing us with excellent optionality on potential mine methods as we advance towards our vision of becoming a primary source of critical minerals in the US. The polymetallic nature of our deposits is also strongly in our favor as the longest-lived and most profitable mines in the world are almost without exception large and polymetallic."

The Critical Minerals Mining Market

Wealth Daily, on October 25, reported that the critical minerals market dynamics have been heavily influenced by efforts to expand the extraction and processing of critical minerals like platinum group elements (PGEs), nickel, copper, cobalt, and gold. This publication emphasized that the urgency to develop domestic mineral resources has stemmed from a global push to decarbonize and reduce dependency on foreign suppliers.

Couloir Capital maintained a Buy recommendation, indicating confidence in the project's long-term value.

On November 4, Mondaq.com highlighted challenges and regulatory changes impacting the sector. The report particularly focused on the regulations concerning battery manufacturing and energy storage.

They noted, "The boom in battery demand . . . has raised concerns over the scale of the industry's dependence on critical materials in finite supply." The evolving regulations, such as the EU Battery Regulation Amendment and the TRACE Act, aimed to enforce supply chain transparency and recycling mandates. As these initiatives gained traction, industry stakeholders faced new compliance challenges, especially in sourcing and processing critical minerals.

According to the Department of Energy (DOE), ongoing efforts have been critical in addressing the United States' reliance on imported minerals. In an October announcement, the DOE discussed substantial investments aimed at bolstering domestic production capabilities. The DOE stated that the Thacker Pass project, supported by a US$2.26 billion loan, would "help finance the construction of a lithium carbonate processing plant at Thacker Pass… located next to a mine site that contains the largest-proven lithium reserves in North America." Furthermore, the DOE emphasized that these projects were crucial for national security and economic stability, given the need for a consistent supply of critical materials.

The Catalysts Driving Stillwater

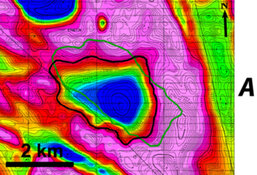

According to the company's investor presentation, the Stillwater West project's future growth is driven by increasing geopolitical concerns and securing domestic supplies of critical minerals, and related strategic developments and partnerships. An upcoming catalyst is the updated Mineral Resource Estimate, which incorporates recent high-grade rhodium assay results and insights from an advanced 3D geologic model. This model has improved targeting and will enhance resource expansion drilling on key deposits, highlighting bulk-tonnage mining potential.

Strategic partnerships amplify the project's momentum. The company has secured US$2.75 million in Department of Energy grants and is pursuing additional funding. Bipartisan political support from Montana's senators, combined with incentives from the Inflation Reduction Act, further strengthened the project's outlook.

Additionally, Glencore's US$7.04 million investment, with an option for more, provides critical financial backing and technical expertise, in addition to corporate guidance via a position on Stillwater's board of directors. This collaboration, coupled with supportive U.S. policies, positions the project for substantial expansion and operational success.

Analysts on Stillwater

Couloir Capital, in a report dated October 22, highlighted the resource expansion potential at Stillwater Critical Minerals Corp.'s flagship Stillwater West polymetallic project. The research note emphasized the significance, "This model effectively links the eastern and western extremities of a large, world-class area and serves as a guide for expanding the company's resource base." Analysts also pointed out that Stillwater West, known for containing nine critical metals, remains a rare project in the U.S. offering both grade and scale within a productive mining district.

Couloir Capital assigned a fair value price of CA$0.23 per share, which implied a return potential of 92% compared to the share price at the time of the report. They maintained a Buy recommendation, indicating confidence in the project's long-term value. The analysts also noted, "We believe Stillwater West is well positioned to rapidly advance as a potential large-scale, low-carbon source of nickel, copper, cobalt, palladium, platinum, and rhodium."

The report included strategic partnerships that could strengthen Stillwater's market position. Stillwater had signed a memorandum of understanding with U.S. Strategic Metals, aiming to develop supply chains for battery-grade metals.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Stillwater Critical Minerals Corp. (PGE:TSX.V; PGEZF:OTCQB; J0G:FSE)

Additionally, their collaboration with the Lawrence Berkeley National Laboratory and the U.S. Department of Energy, which granted US$2 million in research funds, underscored the company's role in supporting the green energy transition. "These endeavors position Stillwater as a leading U.S. company in meeting the growing demand for critical minerals and supporting the green energy transition," Couloir analysts stated.

Ownership and Share Structure

Management and insiders own approximately 20% of Stillwater, according to the company.

Executive Chairman and Director Gregory Shawn Johnson owns 2.86%, President and CEO Michael Victor Rowley owns 2.56%, Independent Director Gregor John Hamilton owns 1.65%, Independent Director Gordon L. Toll owns 0.44%, and Vice President of Exploration Daniel F. Grobler owns 0.23%, according to Reuters.

Institutions own approximately 25% of the company, high net-worth investors own about 37%, and Glencore Canada Corp. owns 15.4%. About 18% of the company's shares are in retail, Stillwater said.

There are about 227 million shares outstanding with 174.5 million free float traded shares, while the company has a market cap of CA$36.33 million and trades in a 52-week range of CA0.1000 - CA0.2200.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Stillwater Critical Minerals is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. \

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.