Although we last looked at Silver North Resources Ltd. (SNAG:TSX; TARSF: OTCQB) relatively recently on September 18, it is worth taking a fresh look at it now because the company released positive drill results on the 16th of this month, which confirmed a fourth silver vein target at their Haldane property and although the stock has not made much progress yet in response to these results, technical action was very positive with it rallying on the strongest volume for well over a year indicating that it is in the process of reversing to the upside.

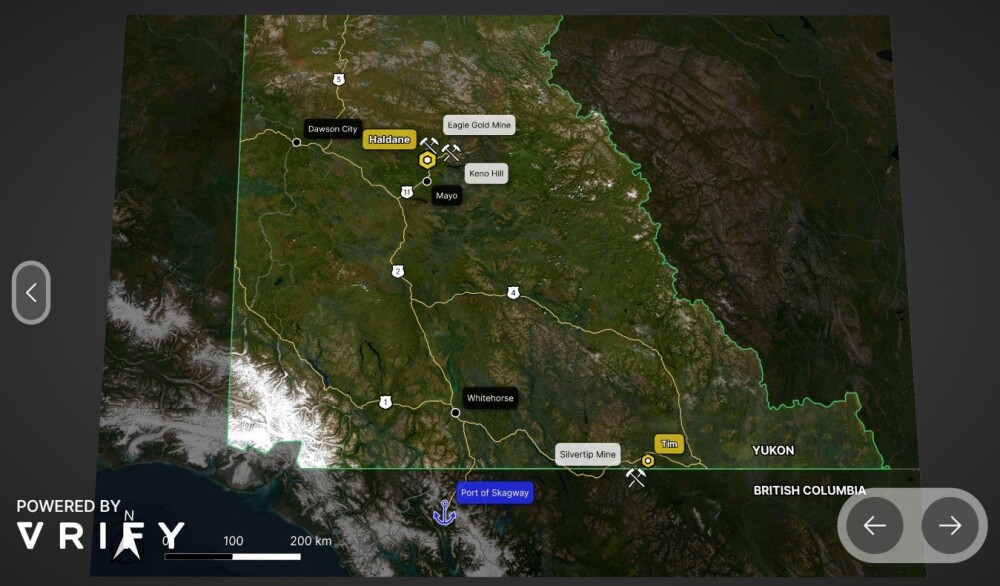

The company's two main properties are both located in the Yukon, at the locations shown on the following slide lifted from the latest investor deck, and it also has some other lesser properties and prospects.

The following slide provides some information on the Haldane property.

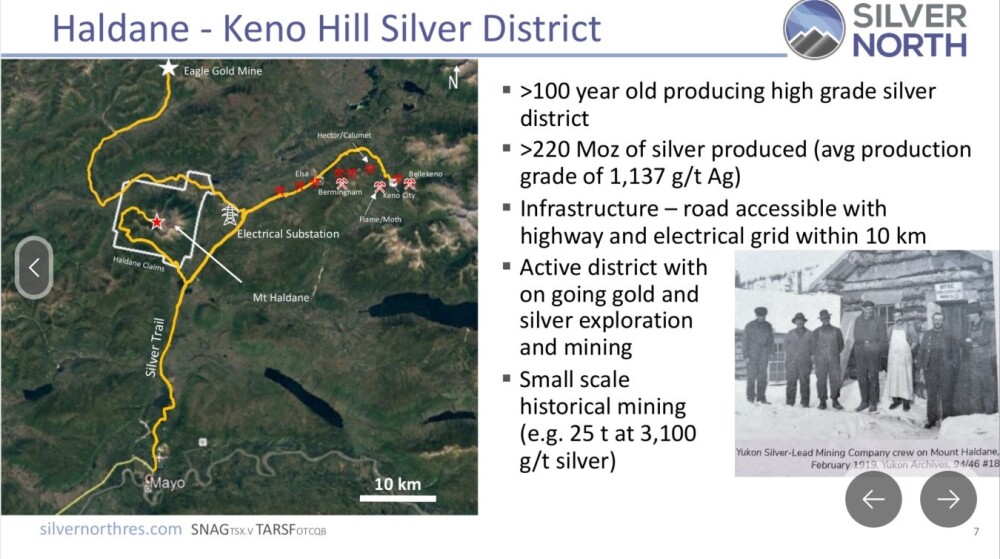

The next slide provides an overview of the Haldane – Keno Hill Silver District.

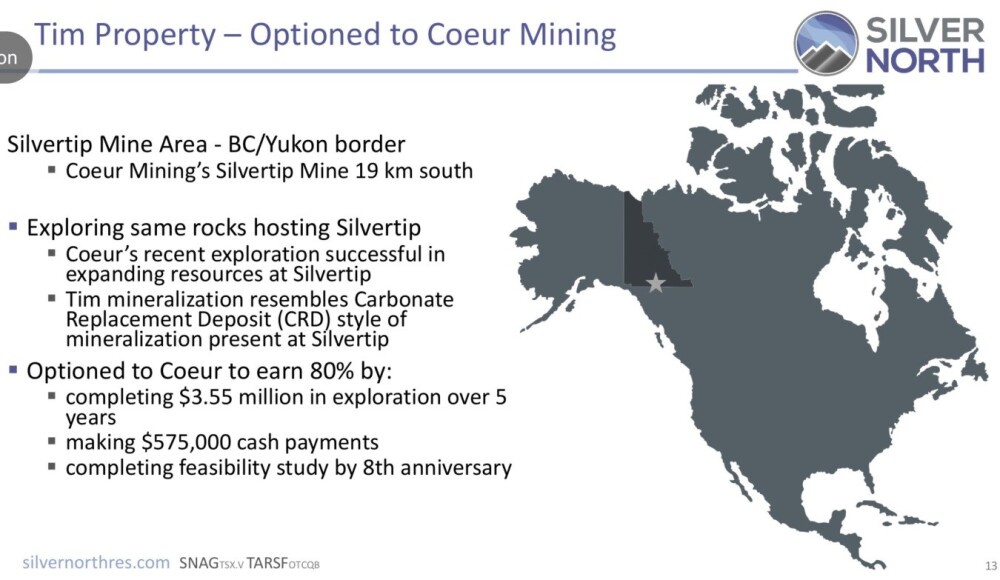

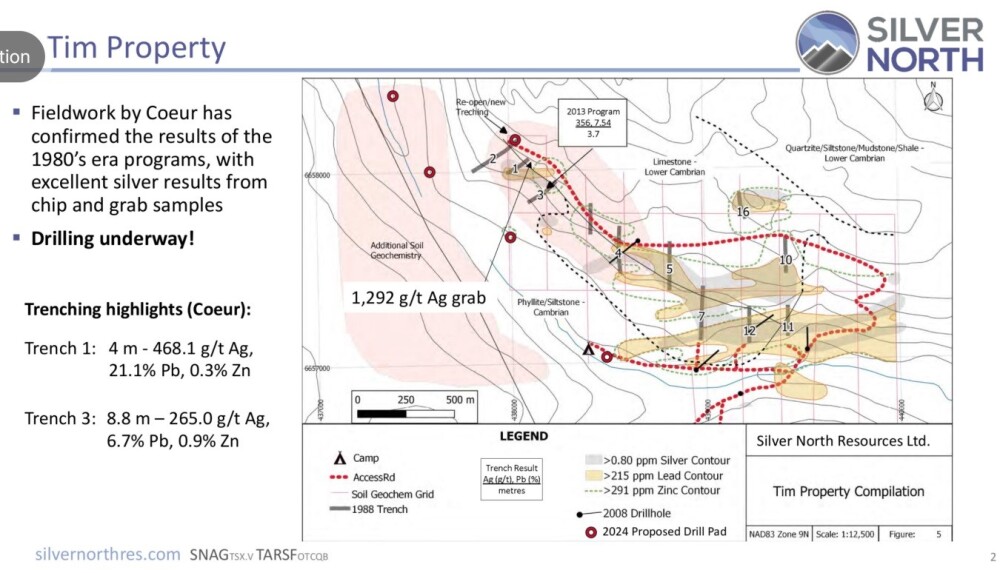

Meanwhile, at the company's other main property, the Tim silver property to the south of Yukon, very near to the British Columbia border, the company revealed on August 19 that, up until that point, 1300 meters of drilling in 4 holes had been completed.

The analytical results from this program are expected to be received very soon, and again, this has the potential to act as a catalyst for the stock. The Tim Property is under option to and operated by Coeur Mining Inc. (CDE:NYSE), which has the advantage that Coeur pays for the exploration.

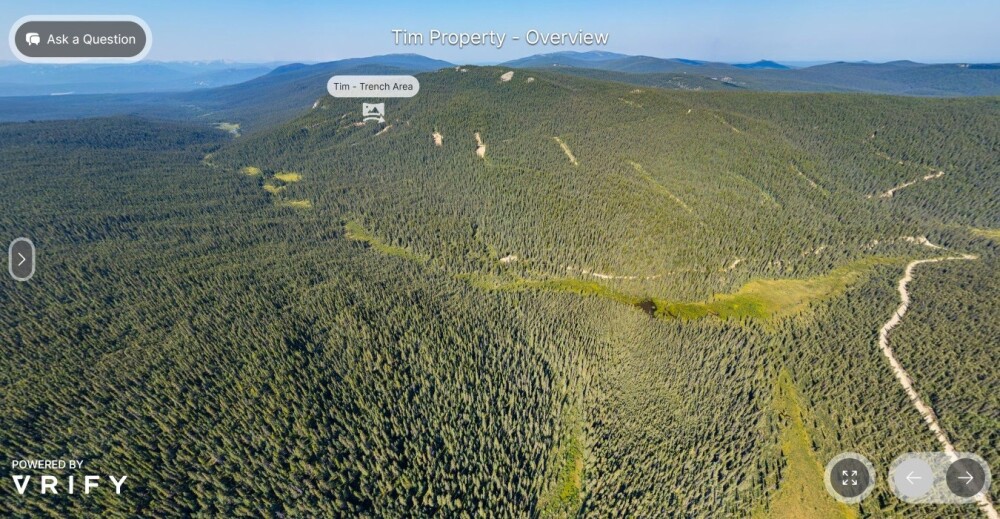

This next slide provides an aerial view of the Tim Property.

These slides provide some information about the Tim Property.

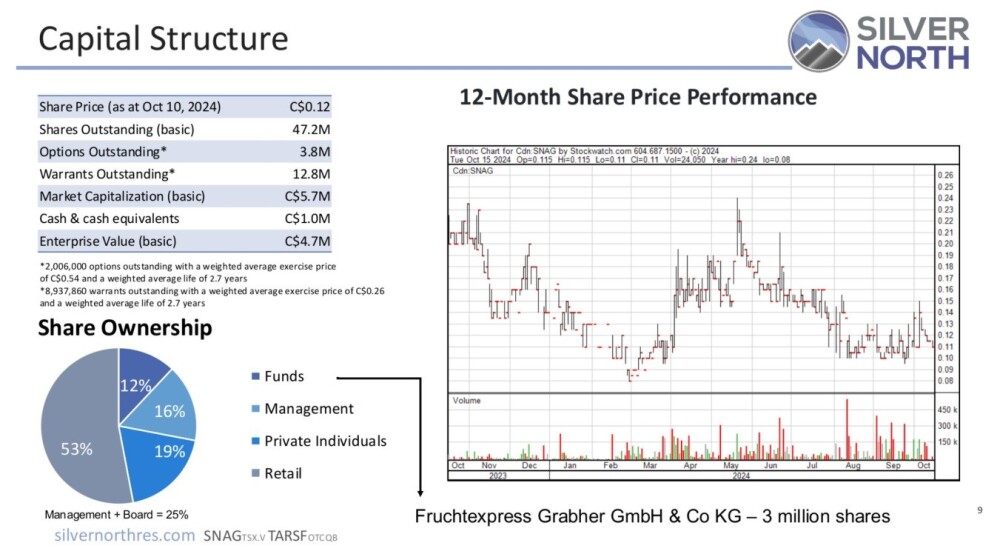

This last slide sets out the capital structure of the company and shows that funds, management, and large private investors own about 53% of the stock, leaving 47% in the float.

Turning now to the charts and starting with the 7-month chart, we see that Silver North has reacted over the past five months to another "buy spot" with strong support, which is viewed as very attractive. It is thus very interesting to observe that after it dropped to a new low for this move in the middle of this month ahead of the release of the important drill results from Haldane, it flipped to the upside on the strongest volume for well over a year upon the release of the results because they were good as they confirmed a fourth silver vein target at Haldane.

This is, therefore, regarded as a turning point that marks the start of a new uptrend out of this month's lows, especially as the strong upside volume following the news caused the Accumulation line to spike, which certainly augurs well for a new uptrend to develop in the stock and in this it will, of course, be helped by the gathering bull market in silver itself.

The 2-year chart enables us to appreciate the significance of this support, for the price has risen off it four times already during the life of this chart, and given the positive outlook for the sector, it is considered very likely that it will rise off it again, which should result in good percentage gains quite quickly for buyers in this area.

Zooming out again, the 9-year chart "opens out" the giant base pattern that has formed from 2015 and on it we can see that, within this base pattern, and from the start 2021 highs, there has been a severe bear market that brought the price down to a very low level where a trading has developed over the past 2 years that looks like a base pattern which the price is now near to the bottom of, and hence this is considered to be a very good point to buy. (The reason for using a 9-year chart instead of a 10-year one is that going back 10 years includes much higher prices that flatten out subsequent action, making it more difficult to see what has been going on).

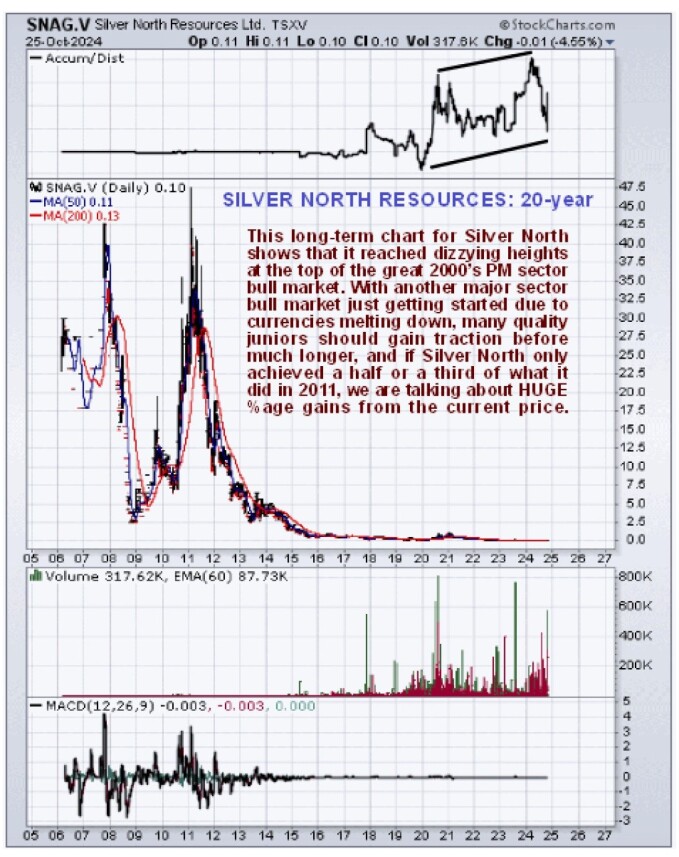

Finally, we will look at the very long-term chart going back 20 years. This chart shows us that Silver North traded at vastly higher prices at the peak of the great 2000s PM sector bull market, which was in 2011.

The main value of this chart is that it shows us what juniors like Silver North are capable of when a major PM sector bull market grips the investing public's imagination, as happened in the late 2000s with gold plodding ever higher and looking set to accelerate and silver destined to follow suit looks on course to happen again.

The conclusion is that Silver North is at another favorable "buy spot," and it is rated a Strong Buy for all time horizons.

Silver North Resources' website.

Silver North Resources Ltd. (SNAG:TSX; TARSF: OTCQB) closed for trading at CA$0.105, US$0.0774 on October 25, 2024.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Silver North Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver North Resources Ltd.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.