Bonterra Resources Inc. (BTR:TSX.V; BONXF: US; 9BR:FSE) has congratulated its partner, Gold Fields Limited, on its successful acquisition of Osisko Mining Inc. The transaction was valued at approximately CA$2.16 billion on a fully diluted basis and overwhelmingly approved by Osisko Mining shareholders on October 17. The acquisition is expected to close around October 25. Gold Fields will assume the role of operator for the Phoenix JV, a joint venture between Bonterra and Gold Fields, located in the Urban-Barry camp near the Windfall gold deposit.

Bonterra is a Canadian exploration and development company with a strong presence in Quebec's Urban-Barry gold district. The company holds key assets, including the Gladiator and Barry deposits, and has been actively advancing exploration projects through strategic joint ventures. The Phoenix JV, a significant part of Bonterra's portfolio, could play a pivotal role in the future consolidation of this gold-rich region.

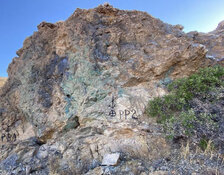

Under the earn-in and joint venture agreement, Gold Fields has the right to acquire up to a 70% interest in the Phoenix JV by investing CA$30 million in work expenditures (commencing from signing) over three years, with a minimum commitment of CA$10 million per year. Since the agreement was signed in November 2023, Osisko Mining has drilled 60,000 meters and invested over CA$15 million into the project. The exploration has led to a significant discovery at the Moss target, revealing high-grade mineralization similar to the Windfall-Lynx Zone.

Cesar Gonzalez, Executive Chairman, commented in the company's news release, "The arrival of Gold Fields, a renowned global gold producer, opens a new chapter in the development of our Urban-Barry property and at the Windfall gold project. The recent discovery of Lynx-type mineralization demonstrates the potential for finding new deposits near the future Windfall mine. We look forward to continuing the earn-in and joint venture with our new partner Gold Fields and to the shared success that lies ahead."

The Allure of The Gold Sector

In an October 18 report from Reuters, gold reached a historic milestone, surpassing US$2,700 per ounce. This rally has been fueled by escalating geopolitical tensions and expectations of looser monetary policies. Analysts noted, "Investors are flocking to gold," driven by concerns over conflicts and market instability.

As Goldfix reported on October 17, Bank of America strategists highlighted that "gold may become the asset of choice" as U.S. debt levels soar and traditional safe-haven assets like Treasurys face increasing risks. Their bullish sentiment reflects the ongoing appeal of gold as a hedge against inflation. As pointed out in the report, gold prices are expected to rise to US$3,000 per ounce by the end of next year. This creates a favorable environment for companies actively engaged in gold exploration.

In an October 3, report, Eight Capital described Bonterra Resources Inc. as a company that "offers exposure to its strategic land package" near the Windfall project, one of Canada's largest undeveloped gold projects.

According to Ahead of the Herd on October 18, gold stocks are nearing a "crucial psychological tipping point," where a shift in trader sentiment could trigger massive gains for the sector.

Adam Hamilton noted that this shift comes after years of relative apathy, with gold miners poised to see significant uplegs that could result in "doublings-plus" across the board. He explained that as gold prices climb, the undervaluation of miners relative to these record highs suggests a strong case for mean reversion, with gold stocks potentially benefiting from the surge.

Hamilton also highlighted that gold had defied expectations despite facing selloff risks, with prices continuing to rise, which has increasingly attracted the attention of investors. He mentioned that "Gold's defiant march to more record highs is putting it on more traders' radars," further increasing the bullish outlook for gold miners, especially as they approach their best levels in over a decade.

Company Catalysts

Bonterra has outlined several key catalysts that demonstrate the potential for further development and discovery in the Urban-Barry camp. According to the company's October 2024 presentation, the joint venture with Gold Fields opens new opportunities for exploration and development in the region.

As noted, the extensive drilling at the Moss target has revealed Lynx-type mineralization at depth, marking a promising direction for future discoveries. The support from a global gold producer like Gold Fields validates the potential of the camp, and Bonterra's strategic land position in the region places it in a strong position to benefit from ongoing exploration success.

Third-Party Expert Analysis

In an October 3, report, Eight Capital described Bonterra Resources Inc. as a company that "offers exposure to its strategic land package" near the Windfall project, one of Canada's largest undeveloped gold projects. The analysts viewed Bonterra's Phoenix JV as a key asset, suggesting that the properties could play an important role in future consolidation in the Urban-Barry gold district. They noted that "Bonterra is currently trading at an EV/oz multiple of CA$8.5/oz of gold in total resources." This is a significant discount compared to its Canadian peers, positioning the company attractively for potential M&A activity.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Bonterra Resources Inc. (BTR:TSX.V; BONXF: US; 9BR:FSE)

Eight Capital also emphasized that the Phoenix JV could yield significant exploration upside due to its proximity to Osisko's high-grade Lynx Zone. They pointed out that Bonterra's assets, including the Gladiator and Barry deposits, have room for further resource growth. They also noted it "could provide resource upside value to a potential consolidator." Bonterra's continued drilling efforts were highlighted, with over 110,000 meters completed since the 2021 mineral resource estimate.

Furthermore, the analysts noted that Bonterra has a fully-permitted operational mill and strong exploration assets, Eight Capital viewed Bonterra as well-positioned for regional consolidation in the Quebec gold mining sector.

Ownership and Share Structure

According to the company, 24% of Bonterra is held Strategic shareholders including Wexford and Agnico Eagle. 20% is owned by institutions and high net worth individuals including Fidelity, Stephens, R. Vora, Ruffer, CDPQ, and Horizon Kinetics. 2% if held by management and the board. The rest is retail.

Bonterra has a market capitalization of CA$46.6 million and 23 million free float shares. The 52-week range is US$0.16 – $0.34

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Bonterra is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.