Just as the Federal Reserve cut interest rates last month, the Chinese government was preparing to institute a slew of stimulus measures, including also reducing bank lending rates.

Gold is the surest beneficiary of the new stimulus. For the last two years, the gold price has moved consistently higher on the back of both central bank buying and Chinese consumers.

With barely a mention in the financial media, gold has outperformed the S&P for the past one, two and three years, as well as since the start of this century.

This buying has been for idiosyncratic reasons of each, detached from the global macroeconomic environment. It is noteworthy that the central bank buying is from many banks around the world; even since the Peoples Bank of China paused purchases in May, net bank flows have remained strongly positive

There Is a Broadening Base of Gold Buyers

Private sector buying is also broadening. We are now seeing large non-official purchases from India and Saudi Arabia, in addition to China. But Western investors, until just the last few weeks, largely shunned gold, though not completely illogically. The macro-environment, with high interest rates, (apparently) low and declining inflation, high real interest rates, and a (seemingly) strong economy is precisely the environment that is not conducive to gold.

As for gold equities — which have also silently outperformed the S&P for the past one, two, and three years — one additional factor suppressed interest, and that was the strong, broad stock market.

The Macro-Economic Environment Is Turning in Gold's Favor

This is now changing. The first rate cut from the Fed in a new cycle has, for the past 40 years, always sparked a gold rally, and this time was no different. In addition, it is increasingly obvious that the U.S. economy is not as strong as the headline reports suggest, notwithstanding Friday's strong jobs report, indicating additional rate cuts ahead.

In turn, this could lead to further significant weakness in the dollar. Currently, at a two-year low, the dollar remains above its levels for the two decades prior. The change in macro conditions is being reflected in fund flows. Whereas the past six months, even through August, saw consistent outflows from both the physical gold ETFs and from gold equity funds, there has been a turn this past month. In September, the GDX saw about $440 million of net inflows, compared with net outflows of $406 million in the prior three months.

Both sentiment and the macro environment are turning in gold's favor.

Sentiment Remains Subdued Amid Low Valuations

This is just the beginning. Overall, investor sentiment remains weak; however, U.S. investors, on average, hold only about 0.5% of their portfolios in gold, compared with longer-term averages of about 2%. In terms of price, while gold is at new all-time (nominal) highs, the stocks are significantly below the 2011 highs; the HUI index (which excludes the royalty companies and is called "the gold BUGS index") stands at barely 50% of that high. And the stocks remain undervalued relative to their historical metrics, indeed on many metrics close to their multi-decade lows. Importantly, the gold miners are not only undervalued relative to their historical metrics, but the industry is in far better shape, with stronger balance sheets and better financial discipline than at previous gold highs.

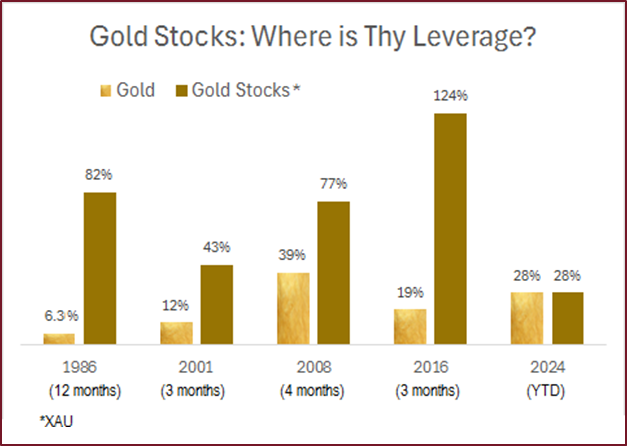

Significantly, though the major gold stocks (per XAU) are up a very respectable 27% this year (as of Friday's close), the reality is that they have not yet exhibited the kind of leverage to bullion that is typical, particularly at the start of a bull market.

The table graph shows how gold stocks have typically multiplied the returns of gold after it bottoms. The current disparity reflects that gold has gone up over the past two years for reasons quite distinct from the normal economic factors that make gold move. We are nowhere near the end, nor even at the beginning of end. Rather, to quote Winston Churchill, we are perhaps at the end of the beginning.

Upcoming Earnings Reports Should Be Strong

Now that the Federal Reserve has embarked on a rate cutting cycle and flows started to enter the market, we may see that leverage exhibit itself. In addition, this quarter's results should be strong, since the average gold price is about $160 an ounce higher in the third quarter than in the second, even as the price of oil (the main cost input for mines) has declined. A third consecutive quarter of high and rising cash flows should garner some investor attention.

Osisko Makes New Investment

Osisko Gold Royalties Ltd. (OR:TSX; OR:NYSE) continues to make new investments, buying an 18% royalty on the Dalgaranga project in Western Australia, as well as a 1.35% royalty on regional exploration land. The total paid was $50 million. Project operator Spartan Resources will complete a feasibility study in the first half of next year, and production is expected in two years.

Although the mining royalty is expected to have an IRR of around 5%, it is a good sign if Osisko continues to deploy capital in a top mining jurisdiction into a project with an exploration upside. Separately, in a recent conversation, CEO Jason Attew told me that the Eagle Mine, currently halted after a heap leach pad failure in June and on which Osisko holds a royalty, "will come back." The royalty on Eagle was one of Osisko's largest royalty assets.

Hold.

Barrick Reaches Agreement With Mali Following Arrests

Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) reached an agreement with the government of Mali, settling disputes and finalizing tax and ownership levels for its Loulo-Gounkoto mine.

This comes after four Barrick employees were arrested in Mali on unknown charges; they were released as part of the agreement, which comes after discussions Barrick's CEO Mark Bristow called "challenging."

The mine represents 11% of Barrick's NAV and 12% of its forecast production. The terms will be announced once the settlement is finalized.

Hold.

Lara Sells One Project and UPS Its Interest in Another

Lara Exploration Ltd. (LRA:TSX.V) has now earned 70% (up from 33%) in the Mantaro Phosphate Project in Peru.

Lara continues to work on studies to use its crush phosphate rock on local test plots to demonstrate the increased crop yields available.

Separately, the company completed the previously announced sale of its Curionópolis Iron Project to a Brazilian company for $2 million; Lara retains a 3% royalty with advance royalties of $150,000 per year after three years.

Both these transactions exemplify Lara's strategy of enhancing the valuation of its projects around Latin America.

It remains a Buy

Agnico Looks at Rationalization and Growth Opportunities

Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE), at recent events in Colorado, emphasized its plans for production growth (focused on per-share metrics), cost controls, and its regional strategy of being dominant in areas where it operates. In light of the last, I asked the Agnico team in a private meeting at the Gold Forum in Colorado about its thoughts for Australia, Finland, and Mexico, in which it is operating essentially a single asset.

In Australia, it is operating Fosterville, which the team emphasized was a strong mine, generating over $1 million a day in cash flow and with six years of relatively high-grade reserves. There was thought to be upside from brownfields exploration. In addition, given the difficulty in getting new plants permitted in the current anti-mining State of Victoria, Fosterville could become a regional hub for other deposits. Recent speculation in the Australian media had Agnico buying De Grey, a mid-tier local producer, which the supposed target denied.

In Finland, Agnico operates the Kittila mine, which is the only mining infrastructure in the area. Kittila has 17 years of reserves with further potential. It has invested in some exploration companies active in the region and is known to have eyed the potential acquisition of the Ikari advanced project from Rupert.

In Mexico, its gold business was described as "in run-off," but Agnico did form a joint venture with Teck to develop the latter's San Nicolás copper project in Zacatecas State two years ago, which somewhat took the market by surprise

Agnico Has an Interest in Critical Minerals

We also discussed the possibility of Agnico getting involved in small metals and critical minerals, which CEO Ammar Al-Joundi last year in our meeting said the company was actively looking at. In addition to the copper investment in San Nicolás, Agnico, at the beginning of this year, invested in a Canadian nickel explorer.

Agnico was interested in looking for deposits of small critical minerals (such as lithium or phosphate) in regions the company knew well, if the capital was provided by other partners, thus providing opportunities for outsized returns. It was noted that the Canadian Malartic mill, which now has excess capacity as mining moves underground, could readily be used for other minerals. Agnico continues to use cash flow to pay down debt, at $0.9 billion net debt as of Q2.

Agnico is a top holding. It can be bought on any weakness as we await what should be strong third-quarter results to be released at the end of this month.

Altius' PG Portfolio Increases in Value

Altius Minerals Corp. (ALS:TSX.V) said the value of equities in its Project Generation portfolio increased 18% to $65.3 million as of quarter end, boosted by a gain from its ownership in Orogen Royalties Inc. (OGN:TSX.V).

The increase excluded $6.5 million in proceeds from various sales.

So far this year, it has generated net proceeds from sales of $18 million. Altius is a core holding for us for broad exposure to commodities from among the smartest teams in the business.

If you do not hold, Altius is a Buy here.

Gladstone: Nothing To Worry About

Gladstone Investment Corp. (GAIN: NASDAQ) fell sharply Friday after the shares went ex for a 70-cent cash distribution, so there is no need for concern.

Indeed, the shares had moved up over a dollar over the past seven days in anticipation of the dividend.

Hold.

TOP BUYS this week include, in addition to above, Nestlé SA (NESN:VX; NSRGY:OTC), Franco-Nevada Corp. (FNV:TSX; FNV:NYSE), Kingsmen Creatives Ltd. (KMEN:SI), and Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE).

| Want to be the first to know about interesting Critical Metals, Silver, Gold and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Osisko Gold Royalties Ltd.,Barrick Gold Corp.,Lara Exploration Ltd., Agnico Eagle Mines Ltd., Altius Minerals Corp., Orogen Royalties Inc., Franco-Nevada Corp., and Fortuna Mining Corp.

- Adrian Day: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Adrian Day Disclosures

Adrian Day’s Global Analyst is distributed for $990 per year by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. www.AdrianDayGlobalAnalyst.com. Publisher: Adrian Day. Owner: Investment Consultants International, Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. © 2023. Adrian Day’s Global Analyst. Information and advice herein are intended purely for the subscriber’s own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.