The sharp drop by Prosper Gold Corp. (TSVX: PGF; OTCQB: PGXFF) over the past couple of weeks back to a strong support level is viewed as presenting another opportunity to buy or add to positions.

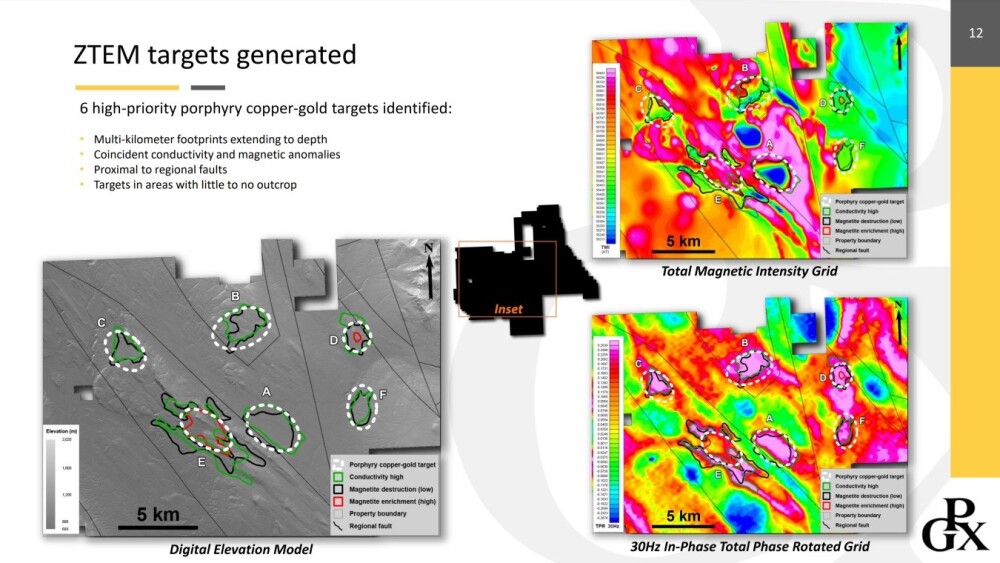

This appears to have been a classic "sell on the news" development for the results of the recent ZTEM survey, released on September 10, came back positive, with various targets identified, which means that the stock should stabilize here before starting higher again, and it may start higher again immediately. Before looking at this in the latest charts, we will briefly review the company's fundamentals.

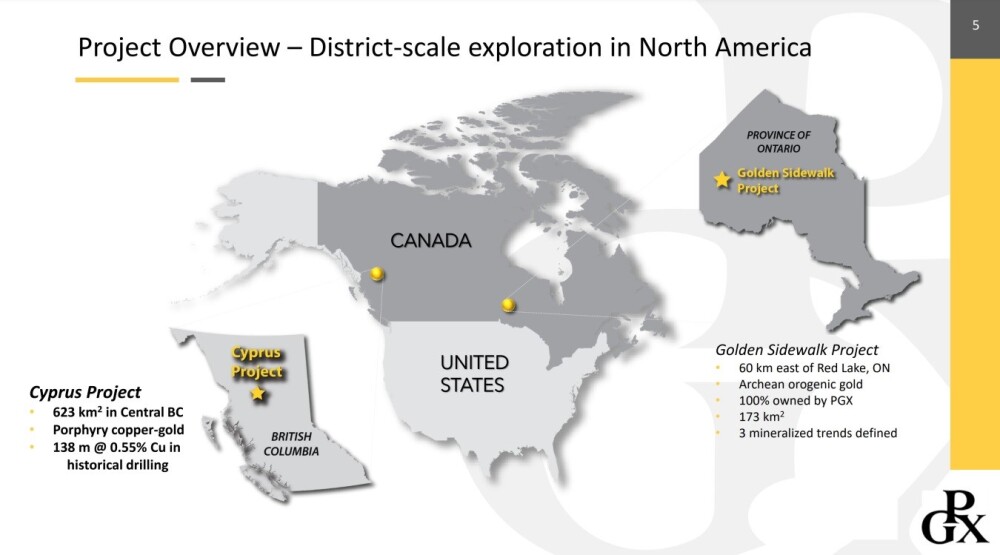

Prosper Gold continues to work on developing two potential district-scale projects in Canada, the Cyrus Project in British Columbia, where the ZTEM survey was undertaken, and the Golden Sidewalk Project in Ontario, as shown on the following slide from the company's new investor deck.

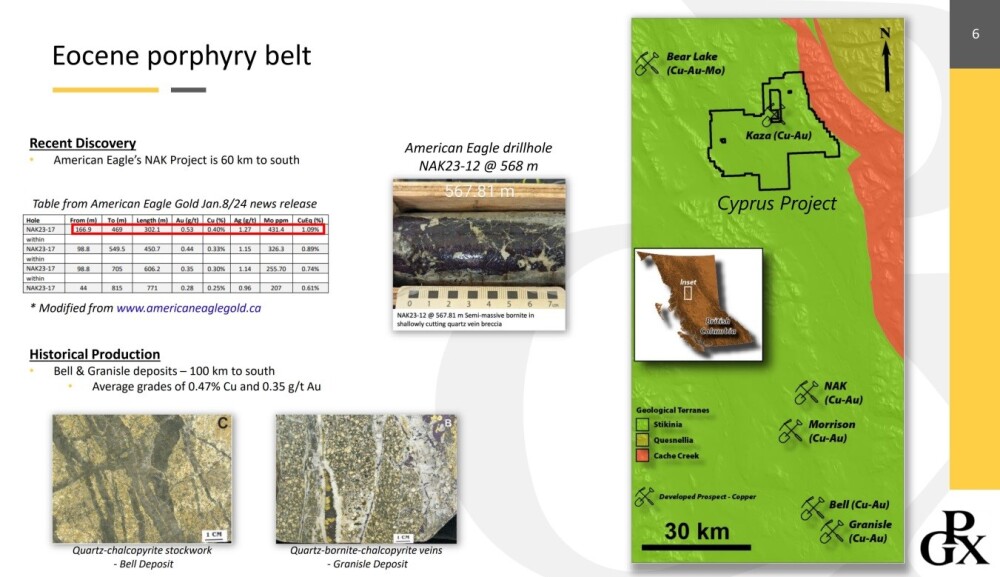

The Cyprus Project is in the same Eocene Porphyry Belt as American Eagle Gold Corp.'s (AE:TSXV) NAK Project 60 km to the south and other important projects, which bodes well for major discoveries on the property.

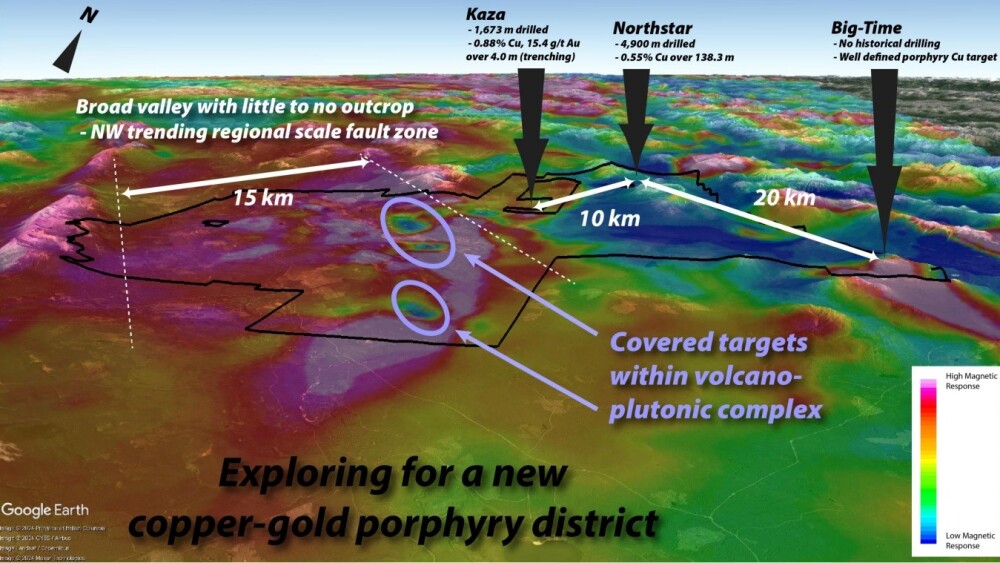

Within Cyprus, there are several main targets — Big Time, Kaza, and Northstar — where significant discoveries have already been made.

In addition to these three important targets, the recent ZTEM survey identified a further six high-priority porphyry copper-gold targets.

So there is now plenty to work on and work towards at the property and we should keep in mind that the President, CEO and Chairman of the company, Mr. Peter Bernier, earlier made a major discovery that resulted in his company Richfield Ventures being bought out by New Gold Inc. (NGD:TSX; NGD:NYSE.MKT) in 2011 for $550 million, and clearly he would not be wasting his time on properties that have no potential.

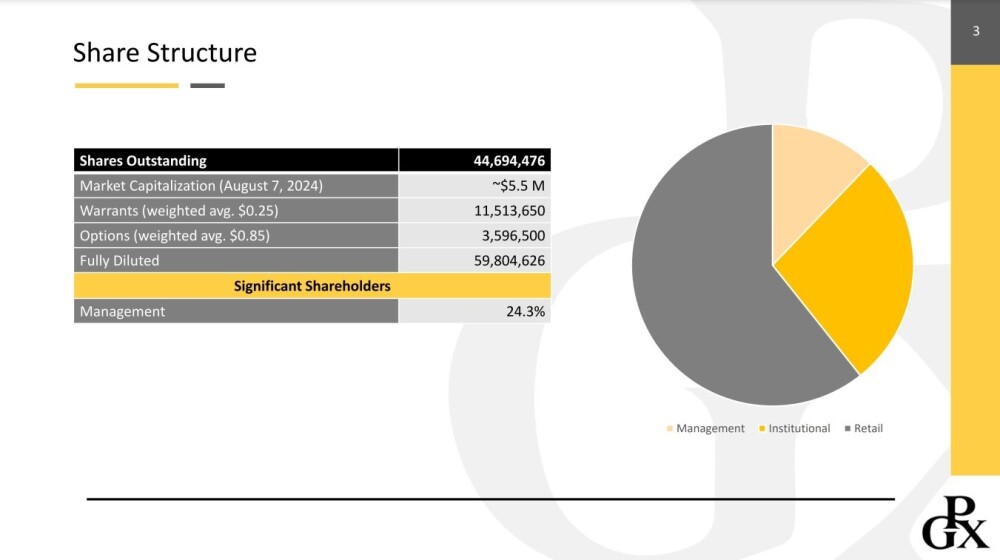

Lastly, this slide shows the share structure of the company, and on it, we see that management holds an impressive 24.3% of the stock.

Turning now to the latest stock charts for Prosper Gold, we see on the 1-year chart how the price dropped back following the release of the results of the ZTEM survey on September 10. At first sight, this makes no sense given that the results of the survey were very positive until we realize that this was a "sell on the news event" with short-term speculators simply taking profits and moving on — and some of them will doubtless be back now that the stock has dropped back to a zone of strong support.

The support in this area is really strong — it's where we first bought back in July — so we can expect the stock to advance anew from here, perhaps after some stabilization in this area to allow sentiment to recover after the drop of the past two weeks.

The long-term 5-year chart reminds us that Prosper Gold is basing at a very low level following a severe bear market from its 2021 highs and is very attractively priced indeed here, especially given the gathering sector bull market that will provide an improving background for quality copper-gold exploration stocks.

We are, therefore, thought to be at a very good point here to buy or add to positions, and Prosper Gold is rated an Immediate Strong Buy here.

Prosper Gold's website.

Prosper Gold Corp. (TSVX: PGF; OTCQB: PGXFF) closed for trading at CA$0.095, US$0.11 on September 27, 2024

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Prosper Gold Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of American Eagle Gold Corp.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.