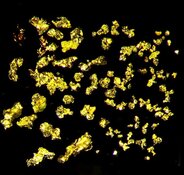

Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ) is the principle company behind the redevelopment of the Stibnite Gold Project in Idaho. This historically significant mining site contains one of the largest known antimony deposits in the United States (the only reserve in the country) alongside a rich gold reserve. The project's aim is to extract critical minerals essential for national defense, high-tech industries, and clean energy applications. Antimony is the key component in products such as munitions, semiconductors, and renewable energy storage solutions, which makes this project instrumental in their production.

In addition to securing a domestic supply of these resources, Perpetua is committed to environmental stewardship. The company's unique approach involves not only extracting minerals but also restoring the ecological balance of the site by improving water quality, reducing arsenic levels, and rehabilitating miles of fish habitat that have been inaccessible for over 80 years.

The Stibnite project features a dual-purpose initiative, combining resource extraction with comprehensive environmental restoration. By both reprocessing and safely storing legacy tailings while reclaiming previously mined areas, Perpetua aims to generate the funds needed to revitalize the environment. This strategy has allowed the company to focus on resource security and sustainable development.

Why Analysts Are High on Perpetua

Amy Legate-Wolfe of The Motley Fool Canada emphasized Perpetua's strong financial backing and promising future in her September 13 report for Yahoo! Finance. She noted that the company had secured US$1.8 billion in financing from the Export-Import Bank of the United States through a letter of interest. This funding has further solidified its ability to develop the Stibnite project. In addition, Perpetua received US$59 million from the Defense Production Act to advance its efforts. Legate-Wolfe pointed out that Perpetua's strong leadership, commitment to sustainability, and year-over-year stock performance growth of 148% position it as a compelling investment opportunity for those seeking exposure in the gold and critical minerals markets.

Mike Parkin from National Bank Financial rated Perpetua as "Outperform" on September 6, setting a share target of CA$19, significantly above the average target of US$12.48 after adjusting for the exchange rate.

Mike Parkin from National Bank Financial rated Perpetua as "Outperform" on September 6, setting a share target of CA$19, significantly above the average target of US$12.48 after adjusting for the exchange rate.

Parkin noted that the Stibnite project's potential to become the sole U.S. source of antimony was critical, especially given the looming export restrictions from China. He pointed to the recent U.S. Forest Service approval as a key derisking milestone.

This approval is a key indication that the project is on the path to full permitting, which has been a long-term overhang for the company. Parkin further mentioned that Perpetua's valuation, in terms of takeout potential and its long-term development prospects, was attractive compared to peers.

Cantor Fitzgerald analyst Mike Kozak also highlighted the significance of the Stibnite project's approval by the U.S. Forest Service in his September 10 note. Kozak reiterated a US$13.75 per share target price, implying a 70% upside. He stressed that this approval came at a critical time, just before China's antimony export controls were set to take effect, further underscoring the importance of Perpetua's ability to supply antimony domestically. Kozak referred to the approval as a "critical derisking milestone" for the company, noting that 14 years of scientific study and community engagement had brought the project to this point. With the permitting process nearing completion, he reaffirmed his Speculative Buy rating.

Mike Niehuser of ROTH Capital Partners underscored the strategic importance of Perpetua's Stibnite project in his September 4 report, particularly in light of China's imminent export restrictions on antimony. Niehuser emphasized that the U.S. is facing a critical shortfall in antimony, with current supplies insufficient to meet defense needs. He projected that the Stibnite project could provide half of the U.S.'s antimony consumption for six years, making it a key national asset. He maintained a Buy rating with a target price of US$10, reflecting a 12.4% potential return. Niehuser also noted that the elevated price of antimony due to global supply constraints could further enhance the project's economics, particularly when combined with rising gold prices.

Catalysts Driving Future Growth

Perpetua Resources is approaching several key catalysts that are expected to drive its growth and significantly enhance its value proposition. A major milestone was reached in September 2024 when the U.S. Forest Service granted draft approval for the company's Modified Mine Plan, a critical derisking event for the Stibnite project. This approval not only validates the company's efforts but also brings the project closer to production, with operations potentially starting by 2028, assuming the timely receipt of additional permits.

"We believe that the Stibnite Gold Project is a win-win-win," Jon Cherry, President and CEO of Perpetua Resources, said in the company news release. "It's a win for Idaho, it's a win for the environment, and it's a win for America's national security. Our independence from Chinese control over antimony is right here in our backyard, and Perpetua Resources is honored to provide a critical part of the solution to the United States' strategic need for antimony while also delivering an economically robust gold mine that will create new jobs in Idaho. It's time for the Stibnite Gold Project to help secure our future."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ)

Another important catalyst is the increasing demand for antimony. With China, the world's largest supplier, announcing export restrictions, Perpetua's ability to provide a domestic source of this critical mineral is becoming more vital. Analysts have pointed out that once in production, the Stibnite project could supply up to half of the U.S. antimony needs for several years. This would make it a strategic asset for national defense and industrial applications.

Additionally, the ongoing bull market in gold presents further upside for Perpetua, as higher gold prices could accelerate the project's payback period and enhance its profitability. With strong support from government agencies and increasing global demand for both gold and antimony, Perpetua Resources is well-positioned to capitalize on these favorable market conditions and become a leader in sustainable resource development.

Ownership and Share Structure

According to Reuters, management and insiders own approximately 0.55% of Perpetua, and institutions own about 33.09%. Strategic investor Paulson & Co. Inc. owns around 40% of the company.

Reuters reports that there are 64.54 million shares outstanding and 64.19 million free-float traded shares. The company has a market cap of US$569.63 million and trades in a 52-week range between US$2.69 and US$9.28.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Perpetua Resources Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.