At the recent sixth International Municipal Conference, the BRICS nations again discussed creating their own payment system that would encourage trade among their group's members and allow for transactions in local currencies to reduce reliance on, and eventually abandon, the U.S. dollar, Modern Diplomacy reported.

"This would incrementally diminish the role and importance of dollars while creating a multipolar financial world where the next tier of economies would have significantly more say in global affairs," according to a U.S. News article.

If the dollar lost its reserve status, the article went on, "for the U.S., it would likely mean less access to capital, higher borrowing costs, and lower stock market values, among other effects. Having the world's reserve currency has allowed the U.S. to run large deficits in terms of both international trade and government spending. If foreigners no longer want to hold dollars for savings, it would force significant belt-tightening at home."

The BRICS bloc now comprises original members Brazil, Russia, India, China, and South Africa, and the new additions, Saudi Arabia, Iran, Ethiopia, Egypt, Argentina, and the United Arab Emirates. GoldFix indicated that 26 nations have formally applied to join BRICS, and 21 others have informally expressed an interest. Together, these 47 countries account for 40% of the world's population and 25% of its gross domestic product, according to a Seeking Alpha article. About 5,000 representatives from 500 cities attended the conference.

Countries Seek Alternatives

A key topic at the conference was growing the BRICS New Development Bank (NDB) to the point where it would rival multinational financial organizations like the International Monetary Fund and the World Bank, noted Modern Diplomacy. This, however, will take time as the NDB's current financial base is small.

Individual countries have been taking steps toward de-dollarization, establishing their own trading and payment systems, for example, as reported on AOL.com. India developed the Unified Payments Interface, or UPI, in 2016, domestic use of which is now widespread, and expanded it to include financial institutions in other countries, including France, the United Arab Emirates, and Singapore.

China has a system, the Cross-Border Interbank Payment System, or CIPS, in place since 2015 that processes payments in Chinese yuan or renminbi (RMB). Participation in CIPS keeps growing. China and Brazil have agreed to settle trade in RMB, Argentina stated it would agree to the same, and Saudi Aramco expressed an interest in transacting oil sales with China in RMB. July 2024 was the first time China used RMB more than the U.S. dollar for cross-border transactions.

Also in July, Russia and Iran agreed to connect their respective banking systems, Mir and Shetab, to one another to facilitate easier trade between their countries. Russia has had its own banking system, the System for Transfer of Financial Messages, an alternative to the most widely used network for transferring money globally, SWIFT (Society for Worldwide Interbank Financial Telecommunication) SWIFT, since 2014.

Gold Boom is Possible

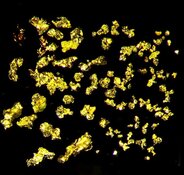

The American Institute for Economic Research pointed out that gold is the lowest cost, most marketable, and least manipulable way to shift away from the dollar. Countries and investors have been leaving the dollar for gold or stocking up on gold since the de-dollarization movement reignited in 2022, reported U.S. News. Central banks, for instance, have been buying record quantities of gold. In H1/24, the central bank's demand for gold was 483 tons, the greatest ever reported, according to the World Gold Council.

Of the total foreign exchange reserves that overseas central banks hold today, only 58% is in the dollar, a record low, the U.S. News pointed out. The amount in gold, however, is up, at 15%, compared to 11% six years ago.

Continuing efforts around the world to reduce the dollar's role in the global economy, together with investors' fears of de-dollarization and economic factors, may result in a gold boom, according to a Seeking Alpha article.

"Historically, gold has been the global standard for a safe store of value, and with the growing sentiment of de-dollarization among investors and the developing world, predicted economic contraction, and the U.S. debt downgrade, it may find itself in a situation with significant upward pressure once again," the contributor wrote.

Sector Outlook Strong

The overriding sentiment among analysts is the gold price will continue ascending throughout 2024, CBS News reported in a Sept. 3 article.

"Growing concerns around the geopolitical landscape, domestic unrest driven by a hypersensitive presidential election year, and heightened anxiety in a challenging economic environment set a backdrop for consumers to seek refuge in some semblance of safety," the article noted.

Goldman Sachs purported in a recent report that gold has the greatest potential for a near-term price rise as interest rate cuts by the U.S. Federal Reserve should bring Western capital back into the gold market, Live Mint reported on Sept. 3. The investment bank is now forecasting a gold price of US$2,700 per ounce ($2,700/oz) by early 2025.

A Sept. 10 Good Returns article suggested factors currently supporting a rising gold price will persist beyond early next year. Ongoing geopolitical risks and concerns about inflation and growth, globally, will be key drivers.

"Given current macroeconomic developments, gold will remain a preferred asset class until uncertainties surrounding the Russia-Ukraine and Middle East crisis subside, and will continue to attract investment as a proven hedge against other asset classes," the article noted.

Gold stocks are expected to have impressive rallies, too, wrote Jordan Roy-Byrne of The Daily Gold.

"Gold looks to continue to trend higher to its cup and handle measured upside target of US$3,000/oz," he wrote on Aug. 23. "There is still plenty of value and upside potential in high-quality juniors. Now is the time to act because it might be too late in the fall."

Here are four gold equities that could benefit from a sustained or rising gold price:

Seabridge Gold

Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT), an Ontario, Canada-based gold explorer-developer, is currently drilling at its 3 Aces project in the Yukon to expand known mineralized zones in the Central Core Area and identify new targets as noted in a news release.

Streetwise Ownership Overview*

Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT)

Regarding KSM in British Columbia's (B.C.'s) Golden Triangle, the company received approval, in the form of a "substantially started" designation, to move this gold-copper project forward to production. To do this, the company is seeking a partner.

"The status should help derisk the project and support Seabridge's efforts to attract a potential joint venture partner," wrote Red Cloud Securities Analyst Taylor Combaluzier in a Sept. 4 research report.

This analyst has a Buy rating on Seabridge and a target price implying a 193% return.

Jay Taylor of Hotline and Gold, Energy & Tech Stocks began covering Seabridge last month. He believes KSM will "be in play for acquisition and/or joint venture agreements," he wrote.

"I believe this story will soon capture some serious attention from major gold and/or base metal miners," he added.

Brien Lundin of Gold Newsletter described Seabridge as "the ultimate gold bug stock." It has 183 million ounces of gold and 89 million shares outstanding, translating to more than 2 ounces of gold per common share.

"That's much more than any other company on the planet," wrote Lundin, who recommended Seabridge in his Aug. 1 newsletter. Late in August, he wrote, "Seabridge has been perhaps the highest profile optionality play in the market for years, yet it has now become a highly economic project at current gold prices. The market has yet to realize this and appropriately value the company."

In terms of ownership of Seabridge, according to Reuters, 18 strategic entities own 2.8%, or 2.5 million (2.5M) shares. Of these, the Top 3 are Seabridge Chairman and Chief Executive Officer Rudi Fronk with 1.4% or 1.26M shares, Seabridge Senior Vice President of Exploration William Threlkeld with 0.48% or 0.43M shares and Seabridge Vice President of Finance and Chief Financial Officer Christopher Reynolds with 0.19% or 0.74M shares.

A total of 222 institutions holds 53.09% or 47.47M shares. The Top 3 are Friedberg Mercantile Group Ltd. with 13.08% or 11.7M shares, National Bank of Canada with 5.05% or 4.52M shares and Van Eck Associates Corp. with 4.16% or 3.72M shares.

Retail investors own the remaining 44.11% of Seabridge.

The company has 89.42M outstanding shares and 86.92M free float traded shares.

Its market cap is CA$1.4 billion. Its 52-week trading range is CA$12.62−25.82 per share. Dryden Gold Corp. (DRY:TSXV; DRYGF:OTCQB)

Streetwise Ownership Overview*

Dryden Gold Corp. (TSXV:DRY; OTC:DRYGF)

Dryden Gold

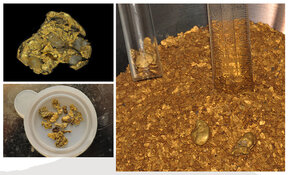

Dryden Gold Corp. (DRY:TSXV; DRYGF:OTCQB), a Canadian explorer, encountered more visible gold in the Elora system at its Gold Rock project in Ontario's Kenora mining district, it announced on Sept. 9.

The company drilled three holes in Elora, two of which, KW-24-017 and KW-24-024, showed visible gold. Assays for all three holes are pending.

Drilling of Elora is part of the current, phase five campaign also targeting the Big Master system, where Dryden just completed drilling of two high-grade shoots.

Drill core from there is being logged and cut.

The company has an impressive land package, and the Gold Rock camp has significant potential, Technical Analyst Clive Maund wrote in a Sept. 10 report.*

As for Dryden's stock, its technicals have been improving, such that it now is better positioned for a "sustainable advance soon." Therefore, it remains a Strong Buy.

Alamos is a major strategic shareholder of the company, owning 15.37% or 14.43 million shares.

Institutional investor Euro Pacific Asset Management LLC owns 8.48% or 7.96M shares, and retail investors own 76.14%, according to Reuters.

The mining company's share structure consists of 93.89M outstanding shares and 79.45M free float traded shares.

Its market cap is CA$8.69M, and its 52-week trading range is CA$0.095−0.40 per share.

Western Exploration

Western Exploration Inc. (WEX:TSX.V; WEXPF:OTC), a Nevada-focused precious metals explorer, launched a 4,000-meter drill program at its Aura project that encompasses the Doby George, Gravel Creek and Wood Gulch deposits, Newsletter Writer Lundin reported last month.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Western Exploration Inc. (WEX:TSX.V;WEXPF:OTC)

The aim of the program is to follow up on 2023 high-grade results from the Jarbidge rhyolite, east of Gravel Creek, to potentially expand this deposit's resource.

"This program at Aura is very likely to deliver more high-grade assays to the market in H2/24 and confirm a very significant new discovery zone," added Lundin. "With a target like this, the company is largely immune to the gold price action if it can deliver results as hoped. Thus, it remains a Buy."

Fundamental Research Corp. has Western Exploration as a Top Pick.

The gold-silver company is partly owned by six strategic entities, together having 71.32%, or 31.24M shares (the numbers quoted are from the company reports Reuters).

The Top 3 are Golkonda LLC with 45.6% or 19.97M shares, Agnico Eagle Mines Ltd. (Ontario) with 14.38% or 6.3M shares, and Auramet Capital Partners with 5.38% or 2.4M shares.

Two institutions hold 3.77% or 1.65M shares.

They are Euro Pacific Asset Management Inc. with 2.97% or 1.3M shares and U.S Global Investors Inc. with 0.8% or 0.0.35M shares. Retail investors own the remaining.

Western Exploration's capital structure consists of 43.8M outstanding shares and 16.21M free float traded shares.

The company's market cap is CA$45.6M. Its 52-week trading range is CA$0.455−$1.50 per share.

Important Disclosures:

- Seabridge Gold Inc., Western Exploration Inc., and Dryden Gold Corp. are billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Seabridge Gold Inc., Western Exploration Inc., and Dryden Gold Corp.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the Clive Maund article published on [Date]

- For the quoted article (published on [Date]), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.