Prosper Gold Corp. (PGX:TSX.V; PGXFF:OTC) was the subject of an update as recently as August 16, and it is therefore not necessary to repeat what was set out there, which can be read by following the link above.

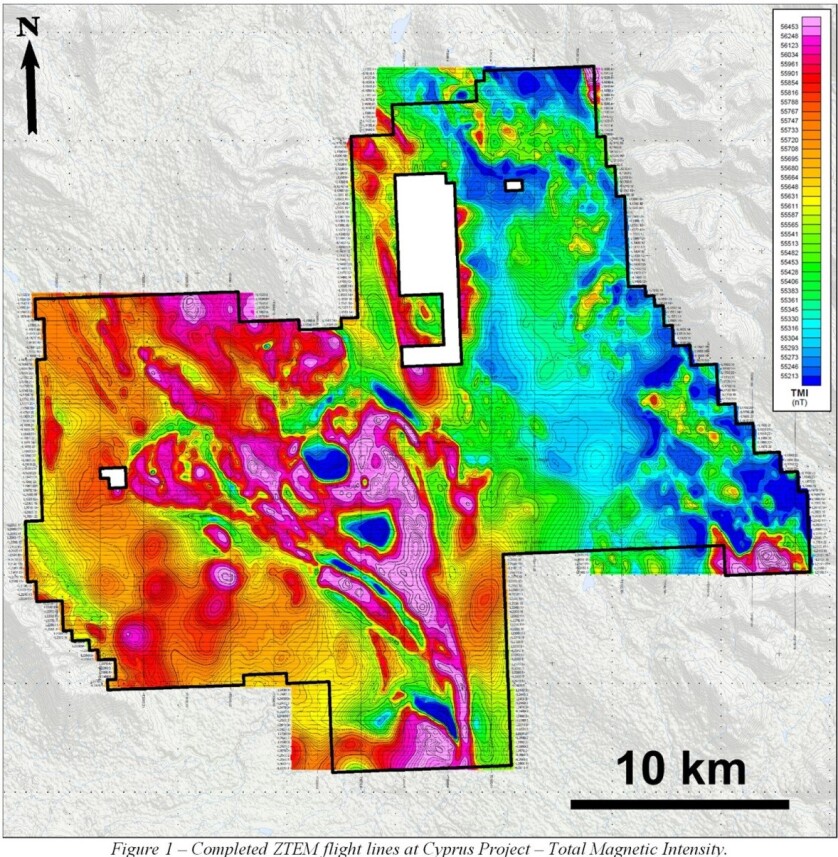

The reason for this update relatively soon after is that the company has just published the results of a property-wide ZTEM geophysical survey at its Cyprus Project in north-central British Columbia, which is a district-scale porphyry copper-gold project with several historically defined prospects and significant drill results including 138.2 meters at 0.55% copper.

The results from the ZTEM survey look very positive indeed.

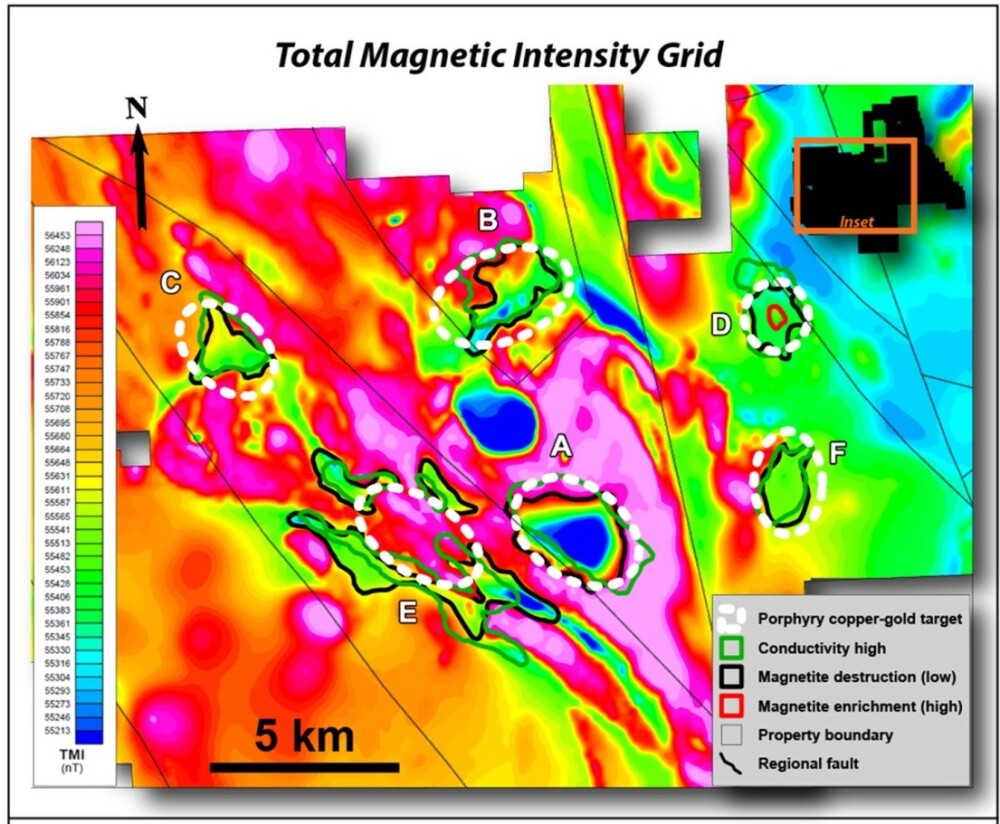

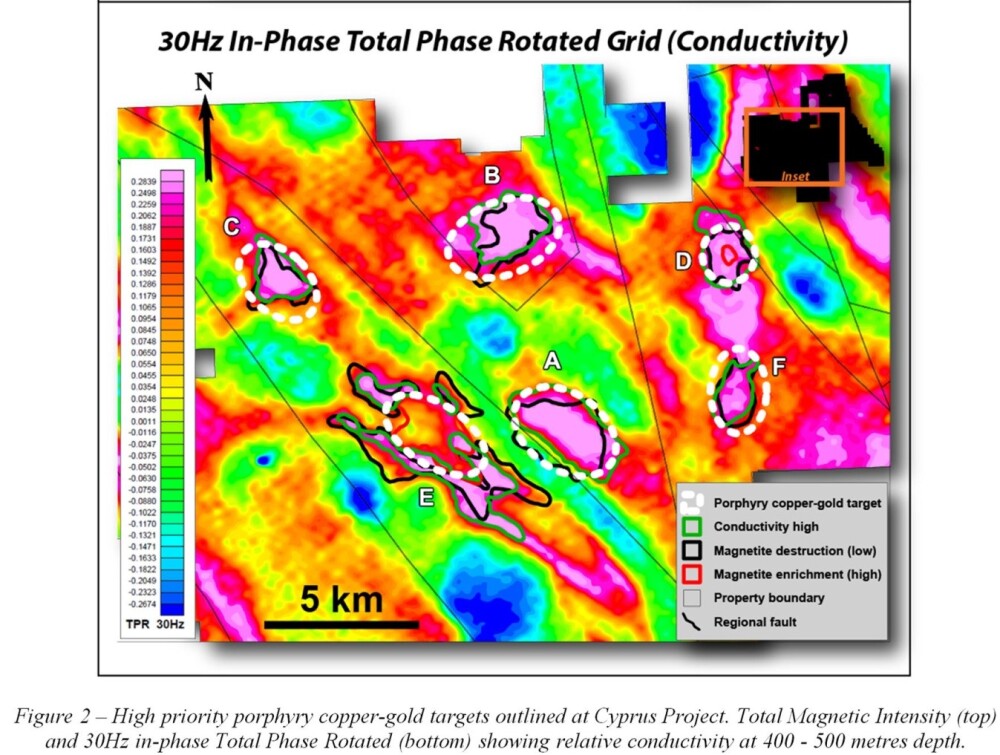

CEO Peter Bernier commented, "The results of the recent ZTEM survey completed at the Cyprus Project have outlined several large porphyry copper-gold targets under cover. We are particularly excited about Target A. It is a two-by-four-kilometer conductivity anomaly adjacent to a regional fault that coincides with a pronounced magnetic low, representing a very attractive porphyry target."

Most importantly, numerous multi-kilometer-sized exploration targets have been outlined from the survey results, six of which are considered high-priority targets and will be followed up on with ground-based exploration activities immediately. The heli-borne ZTEM survey comprised 3,760 line-kilometers covering 683 square kilometers. The survey collected magnetic and electromagnetic field data that helped define structural lineaments and conductive anomalies that may represent mineralization, alteration, and widespread veining associated with porphyry copper-gold systems.

For the benefit of those of you who understand such mapping, a couple of pictures from the survey are shown below.

Turning now to the latest stock charts for Prosper Gold, we see on the 10-month chart that, following the sharp advance in July that we preempted, the price has been marking out a consolidation pattern, which is actually the "Handle" of a Cup and Handle base pattern.

With the earlier somewhat overbought condition having almost fully unwound and its moving averages crossing into bullish alignment, it is in position to advance anew and break out of the pattern, and these very positive ZTEM results may well be the catalyst that triggers a breakout from the base pattern, hence this update.

The long-term 5-year chart, as before, shows an exceedingly positive setup with the price at the tail end of a long low base pattern and persistent accumulation evident for almost a year now.

A base of this magnitude can support a major bull market.

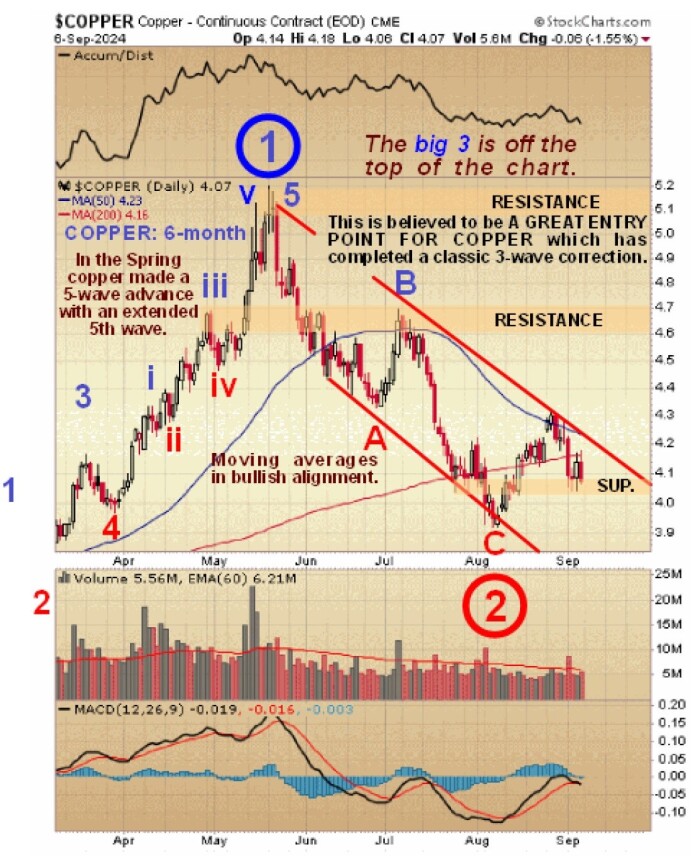

Lastly, given copper's importance to the company, the outlook for the copper price is clearly of great significance.

So, it is worth taking a look at the copper chart. On copper's 6-month chart below, we can see that its reaction appears to have run its course. It now looks like it is shaping up to begin another major uptrend, which is hardly surprising given the huge copper supply deficit that is right now starting to bite and is set to get a lot worse as this decade unfolds.

We, therefore, stay long, and the strongly positive results from this ZTEM survey make the stock even more of a Buy than it was before.

Prosper Gold's website.

Prosper Gold Corp. (PGX:TSX.V; PGXFF:OTC) closed for trading at CA$0.14, US$0.1026 on September 9, 2024.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.