Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) is focused on identifying, reviewing, and acquiring late-stage copper, silver, and gold assets in response to the growing global demand and diminishing supply of precious metals. This surge in demand is largely driven by initiatives like the Green New Deal in the U.S. and similar programs in other developed nations aimed at combating climate change. These initiatives rely heavily on metals like silver, gold, and particularly copper for the production of electric vehicles (EVs), renewable power sources, and the infrastructure required for clean, affordable electricity.

As global industries move toward a greener future, copper is becoming a critical component in the fight against climate change. From EVs to AI centers and renewable energy systems, copper's importance cannot be overstated. In this context, Giant Mining Corp. presents an interesting investment opportunity within the junior mining space. This article explores why Giant Mining's Majuba Hill Copper Property in Nevada has the potential to become a major player in the copper supply chain.

Majuba Hill Copper Property: A Strategic Asset

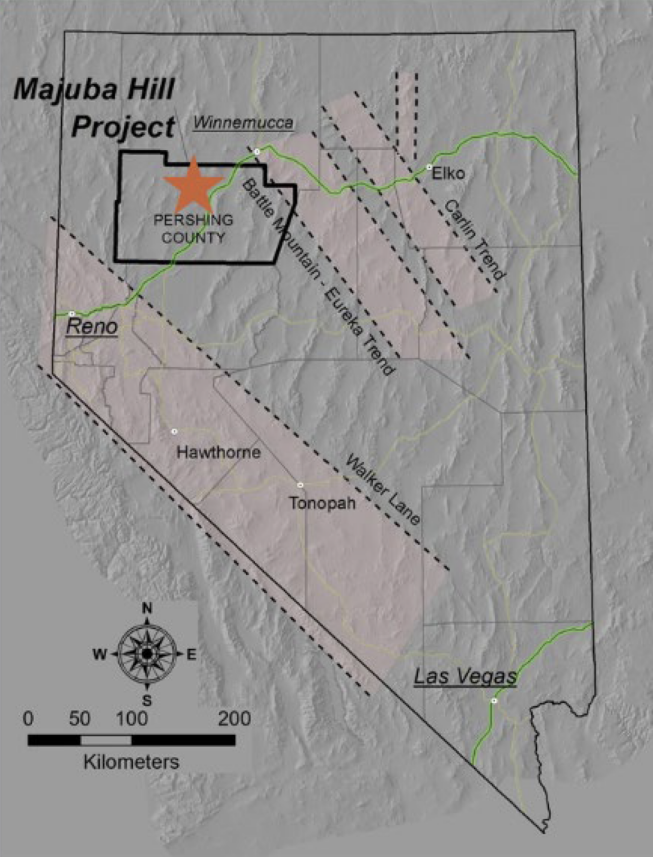

Situated in mining-friendly Nevada, the Majuba Hill property offers an excellent combination of geology, infrastructure, and location. Nevada is a top-tier mining jurisdiction known for its strong regulatory support, extensive infrastructure, and access to a skilled workforce.

Majuba Hill is conveniently located 113 kilometers (70 miles) from Winnemucca and 251 kilometers (156 miles) from Reno, making it both accessible and sufficiently remote to avoid conflicts with residential development.

Key Highlights of the Majuba Hill Copper Property:

- Historical small-scale production of copper, silver, gold, and tin, dating back to the early 1900s.

- Modern exploration, including over 104 drill holes and advanced geophysics, revealing a much larger copper, silver, and gold system.

- Promising drill results, such as 44.5 meters at 1.41% Cu and 113 meters at 0.45% Cu, confirming the presence of economically viable mineralization.

- Potential for both oxide and sulfide copper systems, with oxide copper mineralization extending up to 490 meters (1,600 feet) below the surface and remaining open in all directions.

Copper's Critical Role in the Global Economy

Copper is not only crucial for today's industries; it is essential for future innovations.

The EV revolution alone is expected to drive unprecedented demand for copper, with each EV requiring roughly 183 pounds of copper — significantly more than traditional vehicles.

Copper also plays a key role in renewable energy infrastructure, including solar panels, wind turbines, and electric grids.

Currently priced at approximately $4.00 per pound, down from an all-time high earlier this year.

However, copper is expected to see continued price growth as demand exceeds supply.

The International Copper Study Group projects global copper demand to grow by 2% to 3% annually through 2035.

Companies like Giant Mining Corp. are well-positioned to benefit from the increasing need for new copper resources.

For a more in-depth look at the fundamentals of copper, you can review the articles I wrote earlier this year on copper, which you can read here and here.

Proven History and Upside Potential

Historic Production at Majuba Hill:

- 2.8 million pounds of copper

- 184,000 ounces of silver

- 5,800 ounces of gold

- 21,000 pounds of tin

These historic figures represent just a fraction of Majuba Hill's potential. Modern exploration suggests the property could hold between 50 million to 100 million tonnes of copper, with grades ranging from 0.15% to 0.30% Cu. Additionally, higher-grade zones could contain between 10 million to 20 million tonnes, with grades as high as 0.80% Cu.

Between 2020 and 2022, Giant Mining conducted multiple drill programs, focusing on expanding known copper oxide and sulfide zones. These efforts led to the discovery of several high-grade copper zones, as well as gold and silver mineralization. Data from over 16,000 meters of modern drilling has been integrated into 3D geological models, setting the stage for a formal resource estimate in the near future.

A Strong Team Leading the Charge: Giant Mining's Management and Advisory Board

One of the distinguishing features of Giant Mining Corp. is its experienced and capable management team. Under the leadership of CEO David Greenway, the company is supported by a growing team of seasoned professionals, each with decades of experience in the mining and resource sectors.

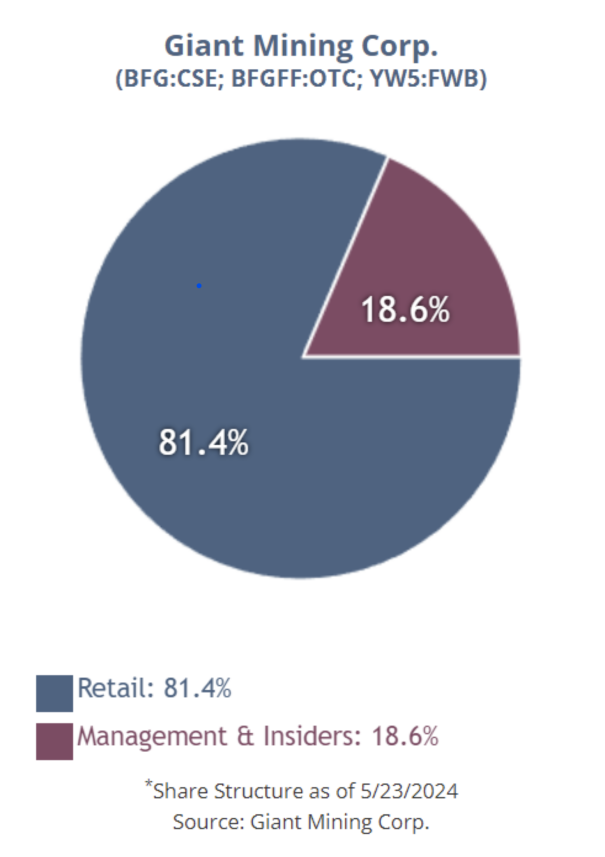

They also have aligned values with existing shareholders as management has a meaningful position in the common share outstanding, with share ownership of around 20% and retail holding the balance.

- David Greenway, CEO, has a proven track record in creating value and advancing mineral projects. His strategic vision and business acumen have been instrumental in the growth of several resource companies, positioning Giant Mining for success.

- Natasha Sever, CFO, brings over a decade of senior finance experience across industries, including mining, retail, and technology. With dual CPA designations in Canada and Australia, Sever ensures the company's financial health and strategic planning are solid.

- Joel Warawa, VP of Corporate Communications, plays a key role in public and investor relations. With over 20 years of experience in business development, mergers, and acquisitions, Warawa ensures that Giant Mining's story reaches key stakeholders and the broader investment community.

- Bradley J. Dixon, a partner at Givens Pursley LLP, specializes in natural resource sector litigation, further bolstering the company's leadership team.

- Larry Segerstrom, a veteran geologist with over 38 years of experience in porphyry copper-gold projects, adds significant technical expertise to the team.

Tight Share Structure

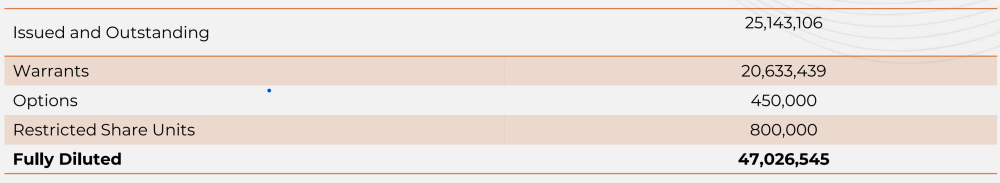

Giant Mining has a tight share structure, with only 47 million shares fully diluted.

This tight structure, combined with the recent financing, positions the company well for potential share price appreciation as exploration results will continue to be released as the company advances the property.

Leo Hathaway Joins the Advisory Board

A recent addition to the advisory board is Leo Hathaway, a geologist with extensive experience in the exploration and mining sectors. Hathaway has held senior roles at Lumina Gold Corp and Lumina Copper Corp, and his work on some of the largest copper discoveries in South America positions him as a valuable asset for Giant Mining's exploration strategy at Majuba Hill.

Hathaway remarked, "Majuba Hill represents a near-surface leachable copper target with several exciting primary copper targets laterally and at depth. I'm eager to help unlock Majuba Hill's full potential and work alongside this dedicated team." See the news release here.

With this combination of technical expertise, business leadership, and strategic vision, Giant Mining Corp. is well-positioned to capitalize on its exploration efforts and deliver value to its shareholders.

Upcoming Catalysts

Giant Mining Corp. has already initiated its 2024 diamond core drilling program and plans to complete an NI 43-101 resource estimate. This milestone could advance Majuba Hill from exploration to development and attract the attention of larger mining companies.

Additionally, the Whittle Pit modeling process is underway, evaluating the deposit's economics by simulating various mining scenarios. This process will help refine the project's economic potential.

Why Majuba Hill Could Be a Big Discovery

"The project location, jurisdiction, and potential processing methods are relatively favorable if quantities of copper and related elements can be defined to meet requirements for classification as Mineral Resources. At this point a copper Exploration Target has been estimated with a range of between 50 million tonnes and 100 million tonnes. Estimated grades of the Exploration Target range from 0.15% Cu to 0.30% Cu."

Nevada's mining history and infrastructure offer a supportive environment for Giant Mining Corp.'s operations. The state has several world-class mining operations and the infrastructure necessary to support large-scale projects.

Majuba Hill benefits from:

- Pershing County maintains year-round road access.

- Nearby regional mining hubs, such as Winnemucca and Reno, which offer mining services, skilled professionals, and equipment.

- Proximity to utilities like power, water, and transportation, including access to the Union Pacific railway and major highways.

Technicals

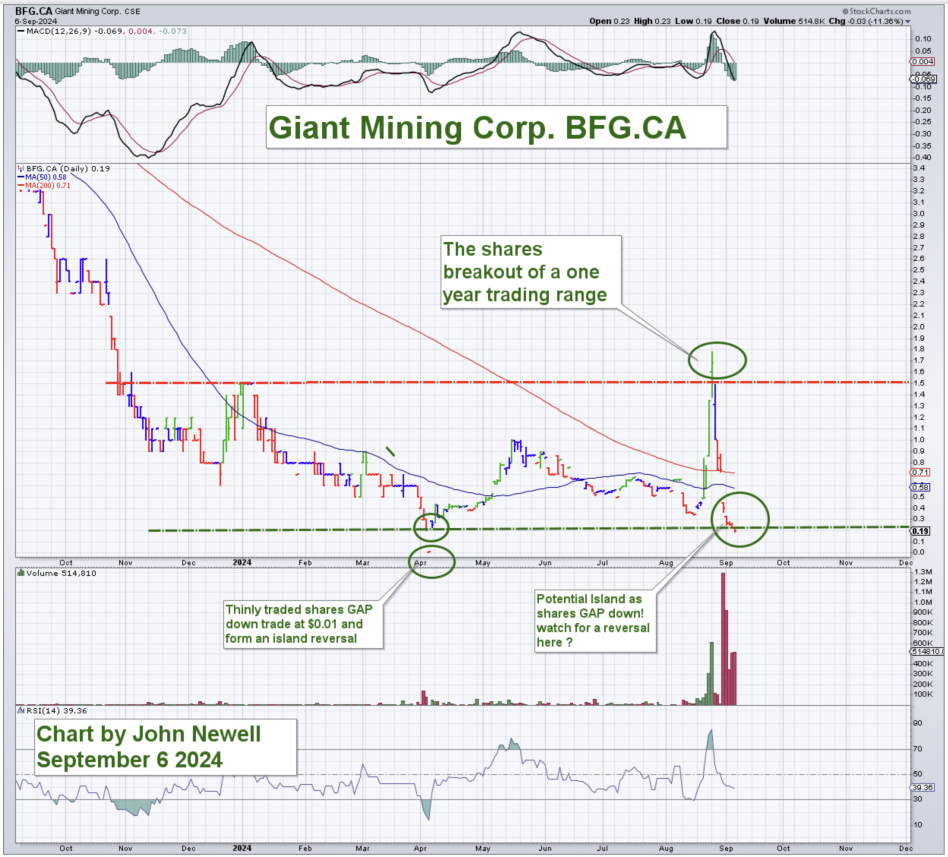

The shares of Giant Mining Corp. have built a one-year trading range, and in April gapped down in a thin market and quickly gapped back up, forming an island reversal; we could be in the same situation now, as the shares have gapped down, on very little fundamental news that would warrant this price action.

We believe the shares represent good value at the bottom of the share trading range, and therefore we have a Buy recommendation on the shares as a good contrarian value play.

Conclusion

With its prime location in Nevada, robust infrastructure, promising geology, and strong potential for large-scale copper production, Giant Mining Corp. stands out as an attractive speculative play in the junior mining space. The company's systematic exploration of the Majuba Hill property could unlock a world-class copper resource, capitalizing on the growing demand for copper driven by the electrification of the global economy.

For investors seeking exposure to copper in a stable and mining-friendly jurisdiction, Giant Mining Corp. offers a compelling investment opportunity with significant upside potential. Giant Mining represents an enticing opportunity in the copper exploration sector, given the share's sharp decline.

Therefore, Giant Mining Corp. is a Buy.

Giant Mining Corp.'s website

Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) closed for trading at CA$0.1950, US$0.1451 on September 6, 2024.

| Want to be the first to know about interesting Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Giant Mining Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, Giant Mining Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$2,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Giant Mining Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.