As gold prices continue to break higher this summer and predictions of a lasting bull market continue, there is no shortage of explorers prospecting for that next big strike in the world's goldfields, and northwestern Ontario is no exception.

The gold standard for success stories may be Great Bear Resources' 2022 sale of its Dixie Project in the Red Lake district to Kinross Gold Corp. for CA$1.8 billion without even publishing a resource estimate.

Red Lake and its other projects have seen renewed interest from explorers and investors as a result. But there may be yet another sleeping giant close by that could be the next Red Lake.

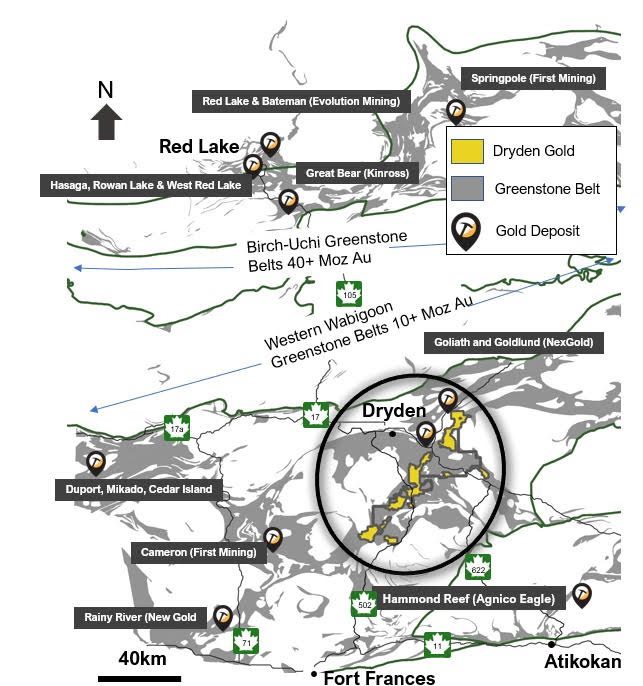

The Gold Rock Camp is in the same prolific region as Red Lake. It has historically seen less mining, but has similar geology.

Dryden Gold Chief Executive Officer and Director Trey Wasser recently said Great Bear could be a blueprint for success at its Gold Rock Project there.

"This kind of property package and high-grade gold is what the majors and mid-tier producers are looking for these days," Wasser told Northern Ontario Business last year.

Ontario was the top producer of the yellow metal in Canada in 2022, producing 41% of the country's gold for a value of CA$5.4 billion.

The area is starting to draw some notice, with companies like Kinross, Kenorland, and Dynasty Gold all active nearby.

Similar Geology, Less Exploration

Dryden Vice President Exploration Anna Hicken told Streetwise Reports that past efforts in the goldfield literally only scratched the surface, only going as far as 140 meters down.

About 75% of the historic mining in the district happened at the turn of the 20th century in mostly small mines was in the Gold Rock Camp. Exploration and mining have been limited since then, as the area has focused mainly on forestry, she said.

"I think what these small-scale mines show is that there's a lot of potential here," she said.

Only 33,200 meters of drilling have been done in the camp historically, Dryden said.

Global Analyst Adrian Day told Streetwise Reports in mid-August that Dryden "has as good a shot at making a meaningful discovery as any."

According to the company's presentation for investors, Gold Rock is "a robust gold system with a large footprint and near-surface, high-grade gold" with "sheared basalts carrying high-grade mineralization like Red Lake Mine."

The area has a similar geological setting and rock types, near-surface high-grade free gold, a gold-bearing shear corridor with secondary splay structures, and favorable geological gold traps for high-grade shoots, the company said.

Since large-scale mining began at Red Lake in 1938, more than 26 million ounces gold (Au) have been produced from underground mines there.

"The area (Red Lake) is known for exceptionally high-grade Au, with one famous sample, the Campbell Mine Whopper, containing 431 ounces in a football-sized rock," wrote Ian Burron for Geology for Investors.

Nearly a century later, "the last few years have seen the tide once again turn in Red Lake's favor," Burron wrote.

Companies like Dryden are hoping a similar Renaissance is in store for Gold Rock.

"We're really happy that this area is getting more coverage and having more companies come in," Hicken said. "I do think we were good to be one of the first movers."

Outlook for Gold Remains Positive

Gold hit its highest price ever of US$2,483.35 last month. After some volatility, it was back up to US$2,475.40 on Tuesday.

Bloomberg Senior Commodity Strategist Mike McGlone has predicted that it will only be "a matter of time" before gold hits US$3,000.

Focus this week is on consumer price index data from the U.S. due on Wednesday that is expected to show inflation eased slightly in July.

But why is gold a great investment?

Technical Analyst Clive Maund wrote on May 20 that Dryden's position in the gold sector was fundamentally strong, with significant potential for growth.

"Gold is an asset that many like to own for inflation protection," Fortune's Kimberlee Leonard wrote on August 5. "Rising prices tend to erode the purchasing power of a currency like the U.S. dollar while gold generally increases in value over the long term."

Ben Hernandez, writing for VettaFi ETF Trends, noted that "increased recession fears have sparked a move to safe haven assets like gold. But prices can also head in an upward direction as those fears dissipate. Capital markets are eagerly anticipating the first interest rate cut. That should push down the dollar while propping up gold."

“In the medium term, the outlook for gold remains positive, with any dips likely to be short-lived due to underlying macroeconomic factors,” said Zain Vawda, market analyst at MarketPulse by OANDA, according to Hernandez's report.

Also having a major effect this year is the increasing role of central banks in buying the metal. The World Gold Council's 2024 Central Banks Gold Reserves Survey showed four in five respondents expected reserve managers to increase their gold holdings in the next year, the website reported, according to a report by Stockhead on June 18.

According to analysts at J.P. Morgan, the "bull case for gold remains intact."

"Gold's resurgence has come earlier than expected, as it further decouples from real yields," said Gregory Shearer, head of base and precious metals strategy at J.P. Morgan. "We have been structurally bullish (on) gold since the fourth quarter of 2022, and with gold prices surging past US$2,400 in April, the rally has come earlier and has been much sharper than expected. It has been especially surprising given that it has coincided with Fed rate cuts being priced out and U.S. real yields moving higher due to stronger labor and inflation data in the U.S."

Kinross Gold Corp.

Active in the area is Toronto-headquartered Kinross Gold Corp. (K:TSX; KGC:NYSE), a senior gold mining company with mines and projects in the United States, Canada, Brazil, Chile, and Mauritania.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Kinross Gold Corp. (K:TSX; KGC:NYSE)

The Red Lake success story Great Bear Resources Ltd. and its Dixie Project are at the center of the company's portfolio in Canada.

The Dixie project "has excellent potential to become a top-tier deposit that could support a large, long-life mine complex and bolster Kinross’ long-term production outlook," the company noted on its website.

Last month, the company released its quarterly financial results and noted that it "remains on track to meet its 2024 annual guidance for production, cost of sales, all-in sustaining cost, and capital expenditures."

The company produced 535,338 gold equivalent (Au Eq) ounces in the second quarter, with production cost of sales of $848 per Au eq. ounce sold and margins of $1,494 per Au eq. ounce sold.

The company noted that it remains on track to release a Preliminary Economic Assessment (PEA) in September for Great Bear.

"At Great Bear, the drilling campaign continued to demonstrate positive results, including intersecting high-grade mineralization in the deepest drill hole to date, outside the current resource," said Kinross Chief Executive Officer J. Paul Rollinson.

According to TipRanks, a total of 12 Wall Street analysts follow the stock, including seven who rate it as a Buy. The average price target was US$10.23.

Reuters reported that about 0.35% of Kinross is held by management and insiders, about 0.01% by strategic entities, and about 66.17% by institutions. The rest is retail.

Top shareholders include Van Eck Associates Corp. with 9.86%, The Vanguard Group Inc. with 3.66%, Norges Bank Investment Management with 3.57%, BlackRock Investment Management with 3.5%, and Renaissance Technologies LLC with 2.35%.

It has 1.23 billion shares outstanding, including 1.22 billion free-float traded shares. Its market cap is US$11.09 billion. It trades in a 52-week range of US$9.45 and US$4.32.

Kenorland Minerals Ltd.

Kenorland Minerals Ltd. (KLD:TSX.V; 3WQO:FSE) has several projects in the Gold Rock area, including its 64,000-ha Western Wabigoon Project, its 57,000-ha Flora Project, its 88,000-ha Algoman Project, and its 37,000-ha Stormy Lake Project.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Kenorland Minerals Ltd. (KLD:TSX.V; 3WQO:FSE)

The company in June announced it had started multiple regional-scale surface exploration programs at the projects.

“The scale of grassroots exploration which is now underway in Ontario cannot be understated," Kenorland President and Chief Executive Officer Zach Flood said. "Collectively, these campaigns will cover over 331,000 hectares of ground, within highly prospective greenstone belts, and in areas which have seen limited modern systematic exploration."

"This strategy will allow us to continue developing a strong pipeline of exploration targets with real potential for new discoveries," he said.

Based in Vancouver, Kenorland said it is a mineral exploration company focused on project generation and early-stage exploration in North America. Its exploration strategy is to advance greenfields projects through systematic, property-wide, phased exploration surveys financed primarily through exploration partnerships including joint venture agreements.

According to Reuters, about 24% of Kenorland is held by management and insiders, about 10% by strategic entities, and about 12% by institutions. The rest is retail.

Top shareholders include John Tognetti with 14.72%, Sumitomo Metal Mining Canada Ltd. with 9.92%, the CEO Flood with 7.25%, Euro Pacific Asset Management LLC with 5.17%, and Commodity Capital AG with 3.79%.

It has 75.14 million shares outstanding, with 49.44 of them free float traded shares. Its market cap is CA$78.13 million and it trades in a 52-week range of CA$1.19 and CA$0.57.

Dryden Gold Corp.

Dryden Gold Corp. (TSXV:DRY; OTC:DRYGF) also is continuing to explore at Gold Rock. It announced significant developments in its Phase 5 drill program at the project this week, where visible gold was seen multiple times in the diamond drill hole KW-24-017.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Dryden Gold Corp. (TSXV:DRY; OTC:DRYGF)

The ongoing Phase 5 drill program is designed to further explore and expand high-grade gold zones within the Elora and Big Master gold systems. The program includes approximately 1,300 meters of planned drilling, with a particular focus on understanding the structural controls of high-grade gold and expanding the known mineralization footprint within the Gold Rock Camp.

In a news release, Dryden said an upcoming fall drill program will target new areas north of the Kenwest Patents, further increasing the project's potential.

*Technical Analyst Clive Maund wrote on May 20 that Dryden's position in the gold sector was fundamentally strong, with significant potential for growth.

He noted the strategic importance of Dryden Gold's partnerships and stakeholder confidence, citing that industry legends like Eric Sprott and Rob McEwen held significant shareholdings in the company. This confidence was further reinforced by the involvement of Alamos Gold Inc., which has a considerable stake in Dryden Gold.

Maund said he believed that the company was on the verge of a major bull market, driven by a strong bullish volume pattern and the increasing strength of gold itself. He concluded that this was likely the "last chance" for investors to buy Dryden Gold at an excellent price before it started to rise into a major bull market, rating it an Immediate Strong Buy.

Global Analyst Adrian Day told Streetwise Reports in mid-August that Dryden "has as good a shot at making a meaningful discovery as any."

"The best place to look for gold is where there has been gold, and this is a very prospective area," said Day, who said he owns the stock. "Looking at all the old core again through new (eyes) idea is a very low-cost and potentially high-potential way of finding ounces. I am also very impressed with the team, particularly the president and head geologist, Maura Kolb, who is not only very competent but can tell the story well."

VP Hicken said the company had all of the key pieces in place for success.

"We have a strong team, a strong asset, and good metallurgy," she said of the Gold Rock Project.

According to Refinitiv, Stategic entities own 15.27% of Dryden with Alamos Gold Inc. (AGI:TSX; AGI:NYSE) has an almost 15.4% stake in it, Eric Sprott owns 4.26%, Rob McEwen owns 3.55%, and other important stakeholders including management and insiders own 11.87%. Less than half of the 93.89 million shares are available to retail investors.

According to Reuters, Euro Pacific Asset Management also owns about 8.48% of the company.

Its market cap is CA$10.33 million, and it trades in a 52-week range of CA$0.40 and CA$0.10.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Dryden Gold Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own Dryden Gold Corp securities.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the Clive Maund article published on May 20.

- For the quoted article (published on May 20), the Company has paid Street Smart, an affiliate of Streetwise Reports, between US$1,500 and US$2,250.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.