Avino Silver & Gold Mines Ltd.'s (ASM:TSX.V; ASM:NYSE.MKT; GV6:FSE) Q1/24 financial results were as Alliance Global Partners expected, reported analyst Jake Sekelsky in a May 13 research note.

"We expect the Avino mine to continue to operate at a steady state in a cash flow positive manner at current metals prices as management continues to focus on the significant growth opportunity at La Preciosa," Sekelsky wrote.

Rating Buy, Upside 102%

Based on the quarter's results, the analyst reiterated Alliance Global's Buy rating and target price on the British Columbia-based producer.

The target is US$1.70 per share on Avino, and its price at the time of the report was about US$0.84 per share. Thus, the implied return to target is 102%.

Declining Cash Costs

Sekelsky presented the highlights of Avino's Q1/24 results. Revenue was US$12.4 million (US$12.4M), in line with Alliance Global's estimate of US$13.6M.

Adjusted net earnings per share also was as expected, at US$0.02 per share.

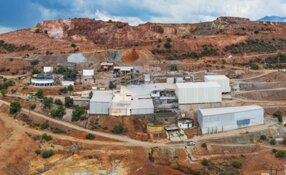

Costs at the Avino mine in Mexico were lower quarter over quarter (QOQ) for the second quarter in a row, the analyst pointed out, an indication management's cost-effective measures are working.

Cash costs in Q1/24 averaged US$14.89 per ounce (US$14.89/oz), compared to US$15.04/oz in the previous quarter. Similarly, the all-in sustaining cost in Q1/24 was US$20.23/oz versus US$21.67/oz in Q4/23.

Sekelsky also noted improved metals prices drove EBITDA of US$1.7M for Q1/24, about 50% higher QOQ.

Next Leg of Growth

The La Preciosa project, which, according to Sekelsky, is "to drive stepchange growth" for Avino Silver & Gold Mines, is in the last stages of permitting. Avino expects capex for this asset to be low as the company intends to process ore from La Preciosa through the Avino mill.

Once La Preciosa is developed, it could more than double Avino's current production rate to more than 8,000,000 ounces of Ag eq per year, wrote Sekelsky.

"We believe La Preciosa presents Avino with the opportunity to transition from a junior silver producer to an intermediate producer—driving a rerating of shares over the next year," the analyst added.

On the Horizon

One upcoming event that could boost Avino's stock price is the start of processing, through the Avino mill, material from surface stockpiles at La Preciosa, which could happen as early as this quarter, Q2/24, noted Sekelsky.

Another catalyst likely to occur in H2/24 is Avino receiving the remaining permits it needs to advance La Preciosa.

| Want to be the first to know about interesting Base Metals, Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for Alliance Global Partners, Avino Silver & Gold Mines Ltd., May 13, 2024

"Firm" used in the this section of the report entitled "Disclosures" refers to A.G.P. / Alliance Global Partners or Euro Pacific Capital, a division of A.G.P. / Alliance Global Partners. The Firm expects to receive or intends to seek compensation for investment banking services from all companies under research coverage within the next three months. The Firm or its officers, employees or affiliates, other than the research analyst authoring this report and his/her supervisor, may execute transactions in securities mentioned in this report that may not be consistent with the report’s conclusions. Sources referenced in this report: The information and statistics in this report have been obtained from sources we believe are reliable but we do not warrant their accurance or completeness. Acted as Sales Agent for At-the-Market Offering Disclosure - The Firm or its affiliates served as sales agent in an Atthe-Market offering to raise capital for Avino Silver & Gold Mines Ltd. within the last 12 months. As such, the Firm or its affiliates have received compensation for these "investment banking services" in the last twelve months. Regulation Analyst Certification ("Reg AC") — The views expressed in this report (which include the actual rating assigned to the company as well as the analytical substance and tone of the report) accurately reflect the personal views of the analyst(s) covering the subject securities. An analyst's sector is the universe of companies for which the analyst provides research coverage. Accordingly, the rating assigned to a particular stock represents solely the analyst's view of how that stock will perform over the next 12 months relative to the analyst's sector average. Furthermore, in accordance with FINRA Rules 2711, 2241, and their amendments related to disclosure of conflicts of interest, the analyst preparing this report certifies: • The analyst or member of the analyst's household does not have a financial interest in the company that is the subject of this report, including a position in the debt or equity of the company, without limitation, whether it consists of any option, right, warrant, future, long or short position. • The analyst or member of the analyst's household does not serve as officer, director or advisory board member of the company that is the subject of this report. • The analyst has not received any compensation from the subject company or from investment banking revenues, directly or indirectly, for preparing this report.The report discloses all material conflicts of interest related to the analyst, the member firm, and the subject company that are known at the time of publishing this report.

Ratings Buy: Expected to materially outperform sector average over 12 months and indicates total return of at least 10% over the next 12 months. Neutral: Returns expected to be in line with sector average over 12 months and indicates total return between negative 10% and 10% over the next 12 months. Sell: Returns expected to be materially below sector average over 12 months and indicates total price decline of at least 10% over the next 12 months. Not Rated: We have not established a rating on the stock. Under Review: The rating will be updated soon pending information disclosed from a near-term news event. Volatility Index 1 (Low): Little to no sharp movement in stock price in a 12 month period 2 (Low to medium): Modest changes in stock price in a 12 month period 3 (Medium): Average fluctuation in stock price in a 12 month period 4 (Medium to High): Higher than average changes in stock price in a 12 month period 5 (High): Extremely sharp movements in stock price in a 12 month period All financial information is taken from company disclosures and presentations (including Form 10Q, 10K and 8K filings and other public announcements), unless otherwise noted. Any prices or quotations contained herein are indicative only and are not a commitment by A.G.P. / Alliance Global Partners to trade at any price. If A.G.P. / Alliance Global Partners acts in a principal capacity with respect to the instruments mentioned herein it will be disclosed in the previous section of this report entitled “Disclosures.” In the event that A.G.P. / Alliance Global Partners does act in a principal capacity, the commentary is therefore not independent from the proprietary interests of A.G.P. / Alliance Global Partners, which interests may conflict with your interests. Opinions expressed herein may differ from the opinions expressed by other divisions and/or business units of A.G.P. / Alliance Global Partners. The Firm does not undertake any obligation to update this material. This material is current as of the indicated date and as of the time it was sent to you. This material was prepared from information believed to be reliable, but A.G.P. / Alliance Global Partners makes no representations or warranties as to its accuracy or completeness. This communication and the information contained herein is neither an offer to buy or sell nor a solicitation of an offer to buy or sell any security or instrument or to participate in any particular trading strategy. This report should not be used as a complete analysis of the company, industry or security discussed in the report. Additional information is available upon request. Any opinions or estimates in this report are subject to change without notice. An investment in the stock may involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. Additionally, an investment in the stock may involve a high degree of risk and may not be suitable for all investors. No part of this report may be reproduced without the express written permission of A.G.P. / Alliance Global Partners, member FINRA/SIPC. Copyright 2024.