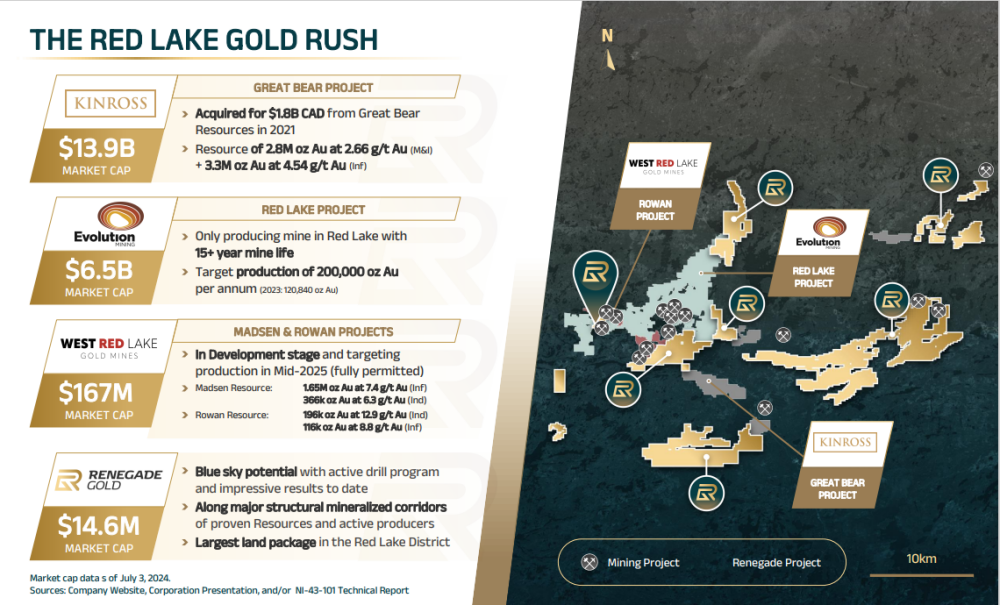

West Red Lake Gold Mines Inc. (WRLG:TSXV; WRLGF:OTCQB) is making significant strides in the heart of Canada's premier mining district, Red Lake, Ontario, known as the "Jewelry Box" of Canada.

With gold trading at record highs, the company is gearing up for near-term high-grade gold production, likely starting in mid-2025, driven by a relentless pursuit of increasing resources and leveraging strategic acquisitions.

The Transformation of West Red Lake Gold

West Red Lake Gold has undergone a substantial transformation, spearheaded by new leadership and backed by legendary mining investor Frank Giustra, with support from institutions like Sprott Lending, Van Eck Funds, and Accilent Capital Management.

A critical component of this transformation was the acquisition of the failed Madsen Mine from Pure Gold for a fraction of its sunk costs. This strategic move was driven by a clear understanding of past operational shortcomings and a vision to revitalize the mine for profitable production.

Learning from Past Mistakes

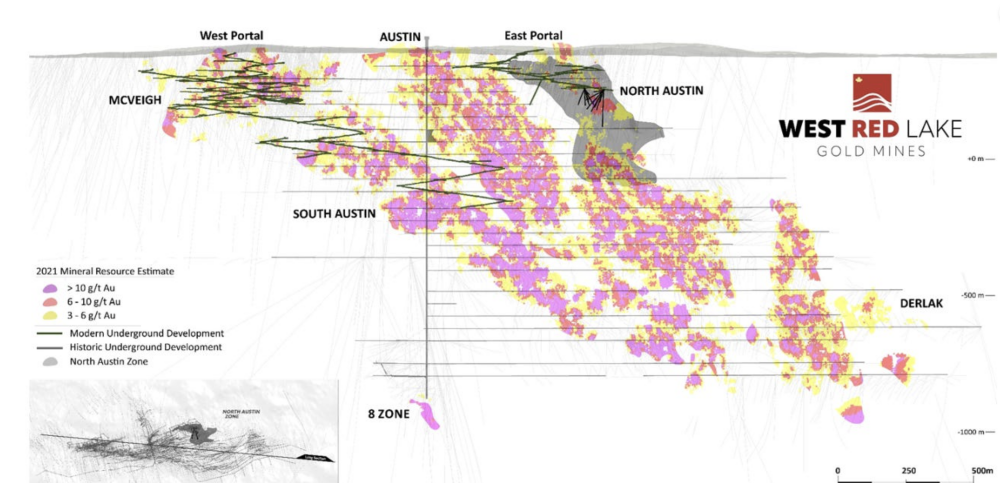

Upon reviewing the Madsen Mine's underground workings, it became evident that Pure Gold had failed to optimize the mining of high-grade gold zones. The underground development barely touched the high-grade areas, suggesting a significant oversight. West Red Lake Gold's approach involves addressing these past mistakes by focusing on more precise drilling and better planning.

A recent news release highlighted past production issues, such as low recovery rates in the mill and mining lower-grade portions of the zones. These factors, coupled with substantial debt and rushed production timelines without tight drill hole spacing, led to the mine's failure. West Red Lake Gold's acquisition strategy took these issues into account, resulting in a bargain purchase with significant potential for turnaround.

A Clear Plan for Revival

West Red Lake Gold's immediate focus has been extensive drilling, yielding promising results. A recent highlight was a drill hole with 13.40 grams per tonne (g/t) gold over 10 meters, close to the surface and near existing underground workings. This success indicates predictable gold mineralization and a well-planned drilling strategy.

The company is well-funded for aggressive drilling and test mining, aiming to restart production by the second half of 2025. This meticulous approach ensures that past mistakes are not repeated and the mine is brought back into production efficiently and profitably.

The Potential of the Rowan Project

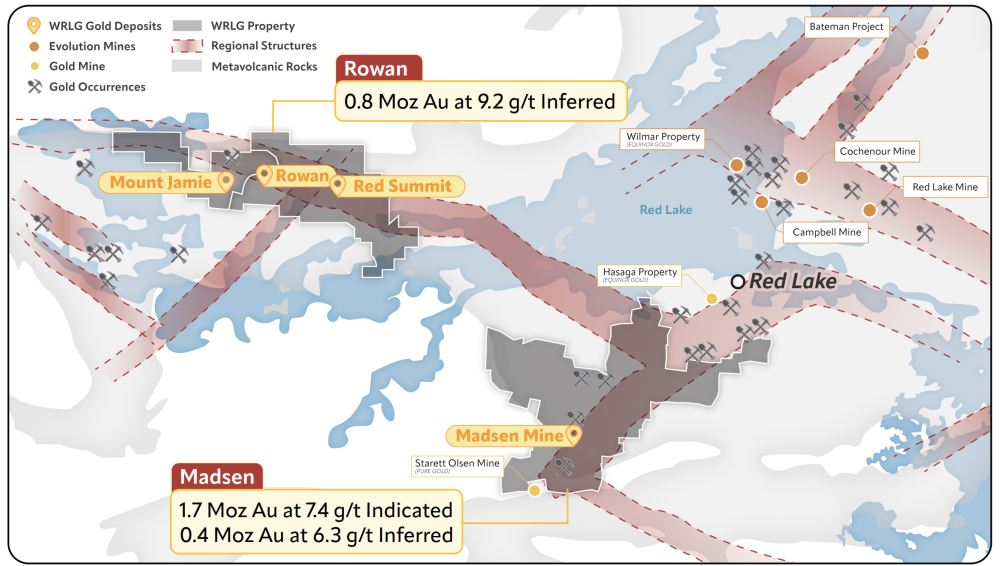

In addition to the Madsen Mine, West Red Lake Gold sees significant potential in the nearby Rowan Project. The Rowan property, with a 31 square km land package, includes three past-producing mines: Rowan, Mt. Jamie, and Red Summit.

The current inferred resources stand at 826,462 oz of gold at 9.2 g/t, with mineralization extending to the surface from 600 meters and remaining open in all directions and depths.

One notable high-grade hit at Rowan was to the east of the historical resource, suggesting untapped potential in the eastern part of the property. This area remains open for further exploration, and the company is committed to systematic underground development and drilling to increase confidence in the high-grade portions of the resource.

Strategic Vision and Future Growth

Frank Giustra's involvement brings a wealth of experience to the mining sector, particularly with the buy (many distressed) and build strategy, and surrounding himself with very capable individuals in all aspects of financing and mining building, something the previous operator may have been light on, as their strength was exploration.

We have seen this in Endeavor Mining in West Africa, Aris in Columbia, Equinox Mining, and Goldcorp, which was bought out by Newmont, to name a few. West Red Lake Gold plans to leverage this strategy, using the Madsen Mine as a platform for growth. The company aims to build high-grade resources in one of the richest gold districts in Canada, positioning itself uniquely in the market.

The recent surge in gold prices, with the second quarter of 2024 recording the highest average price for gold, provides a favorable backdrop for West Red Lake Gold. As generalist investors flock to gold miners, the company's strategic positioning and potential for high growth make it an attractive choice.

Shane Williams: Leading the Charge

Central to the Madsen Mine's revival is Shane Williams, B. Eng., M. Sc., who has been tapped to lead the project. Mr. Williams brings a wealth of experience to West Red Lake Gold. Prior to joining the company, he served as Chief Operating Officer for Skeena Resources, where he played a pivotal role in advancing the Eskay Creek Gold project toward a restart.

From 2013 to 2019, Mr. Williams was Vice President of Operations and Capital Projects at Eldorado Gold. Under his leadership, the Lamaque Gold project progressed from Preliminary Economic Assessment (PEA) to commercial operation in just 18 months. He also served as Project Director for Eldorado Gold's Greek assets, overseeing the development of the Skouries and Olympias projects with a combined capex of over US$1 billion.

Mr. Williams' extensive open-pit development experience includes his tenure with Rio Tinto at the Iron Ore Company of Canada and at Kaunis Iron in Northern Sweden. At Kaunis Iron, he was responsible for the successful staged development of a large open-pit iron ore operation, taking it from early exploration to commercial operation in a rapid 3.5-year period.

Mr. Williams holds a B.Eng. in Electrical Engineering from the Dublin Institute of Technology, Ireland, and an M.Sc. in Project Management from the University of Limerick, Ireland.

Conclusion

West Red Lake Gold's efforts to restart the Madsen Mine, coupled with ongoing advancements at the Rowan Project, showcase a comprehensive plan for near-term high-grade gold production.

With a strong team, strategic backing from Frank Giustra, strong institutional support, and a clear vision for the future, West Red Lake Gold is poised to capitalize on the opportunities in Canada's prolific Red Lake mining district.

As the gold bull market gains momentum, West Red Lake Gold stands out as a promising player in the industry, ready to deliver value to its shareholders and contribute to the growth of the gold mining sector.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of West Red Lake Gold Mines Inc.

- John Newell: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.