Outcrop Silver & Gold Corp. (OCG:TSX.V; OCGSF:OTCQX; MRG1:DB) is primarily a silver project explorer and developer and is regarded as a worthy core holding in any precious metals and especially silver portfolio. The company has a range of projects in Columbia and is looking to expand into other favorable jurisdictions. These projects include the flagship Santa Ana property, which is a large project in the center of Columbia's silver belt where very impressive grades of silver have already been defined, and there is plenty of scope for further expansion of this resource with ongoing exploration.

Outcrop's stock is looking most attractive here as it is just starting to advance out of a massive multi-year base with the potential to ascend to much higher levels against the background of robust demand for silver and a shortfall of supply that promises to drive silver's price much higher regardless of any big bank manipulation as Eastern markets take precedence.

Before we proceed to look at the charts for Outcrop's stock, we will first overview the fundamentals of the company with the assistance of its latest investor deck.

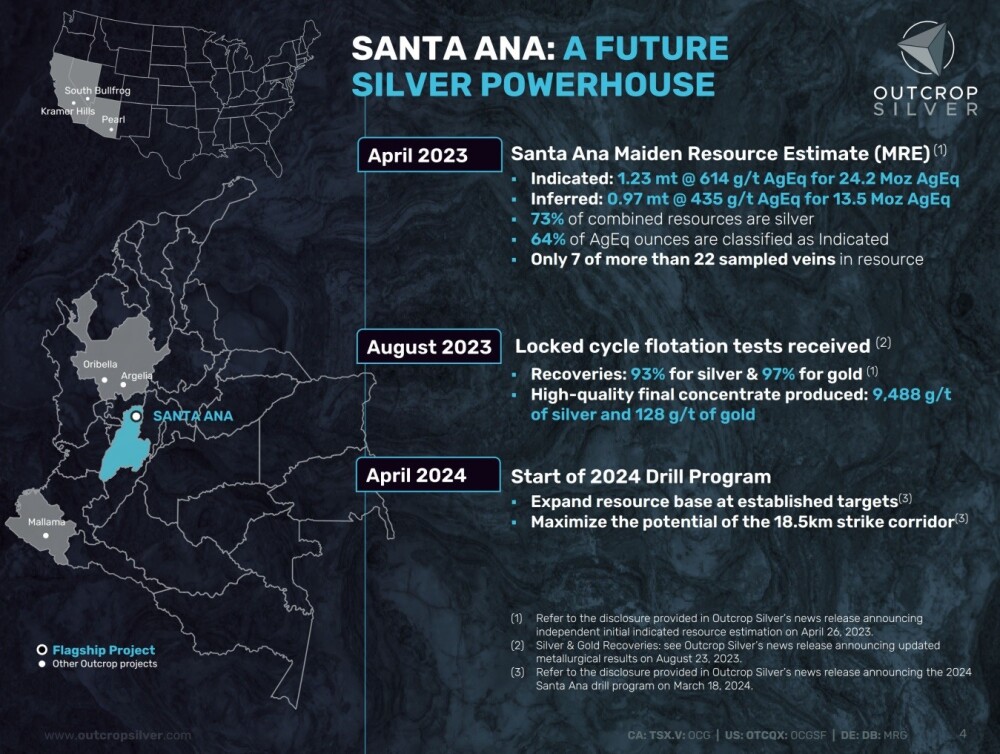

We start with a map showing the location of Outcrop's properties both in Columbia and in the southwestern U.S. This map highlights the flagship Santa Ana Project and provides details of its MRE (Maiden Resource Estimate).

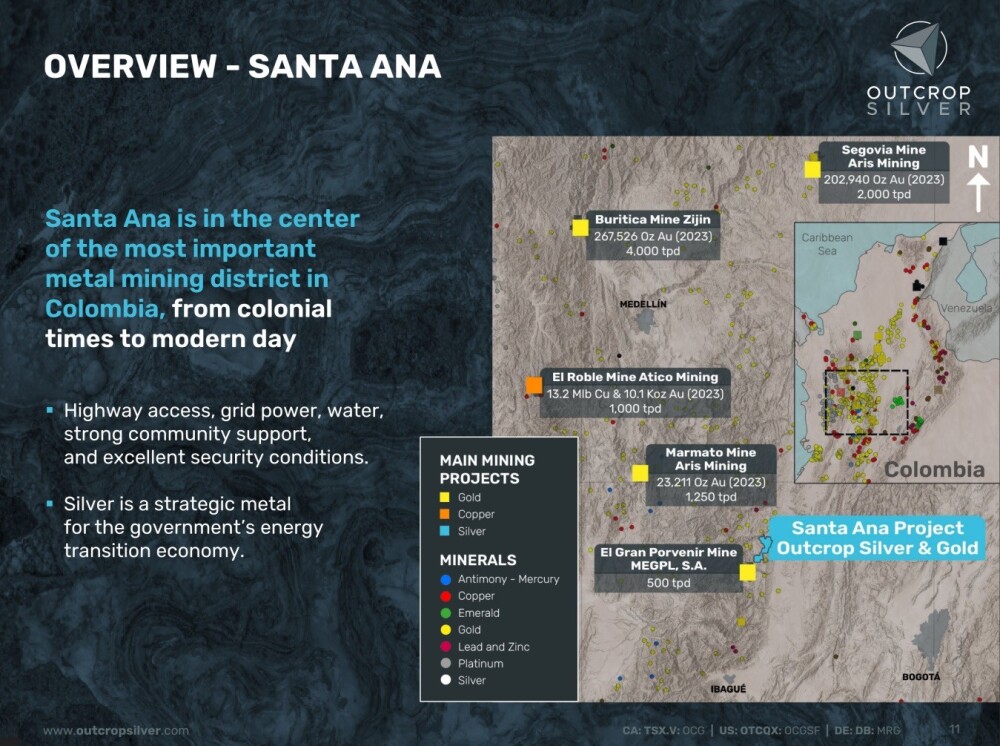

This next map shows how Santa Ana is in the center of the most important metal mining district in Columbia and the location of other important mines in the area.

Santa Ana is a high-grade resource as is made apparent by this comparison with the grades attained by Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCQX) and Panuco — and Dolly Varden is known as a "pure silver" company.

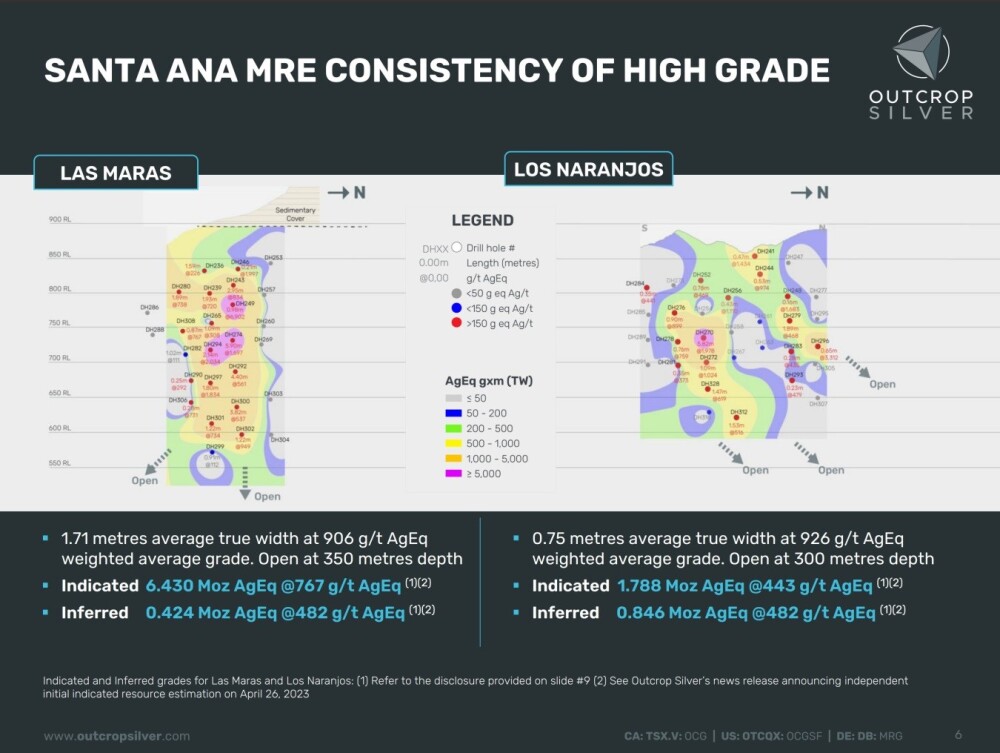

Santa Ana has consistently high grades across the property.

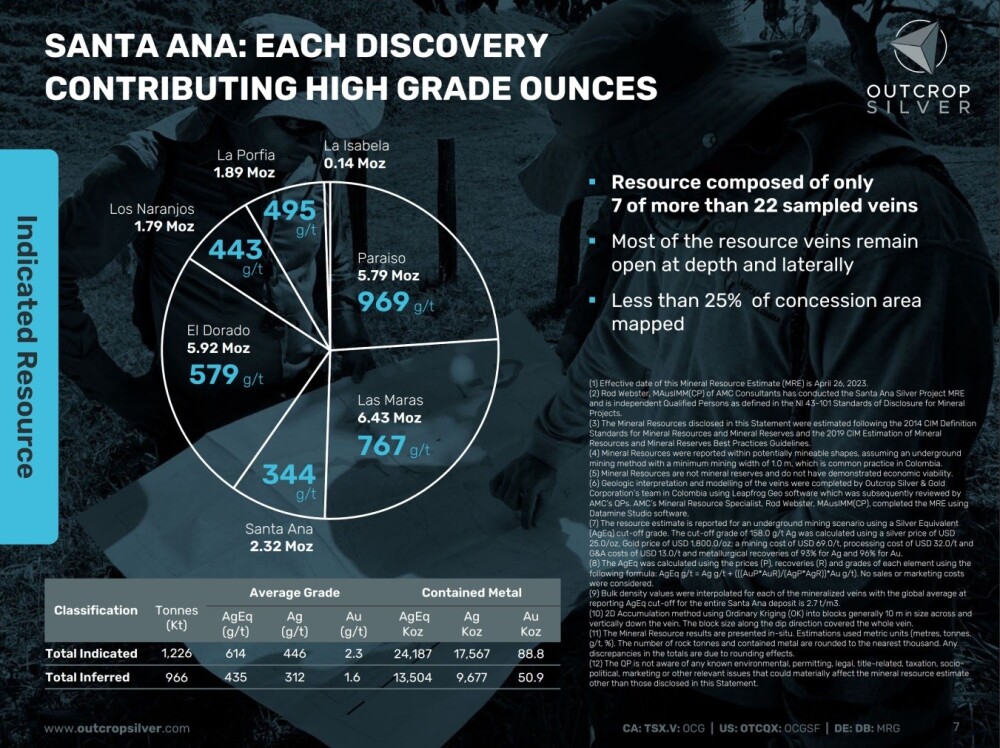

The following pie chart shows the grades attained at various discoveries within Santa Ana.

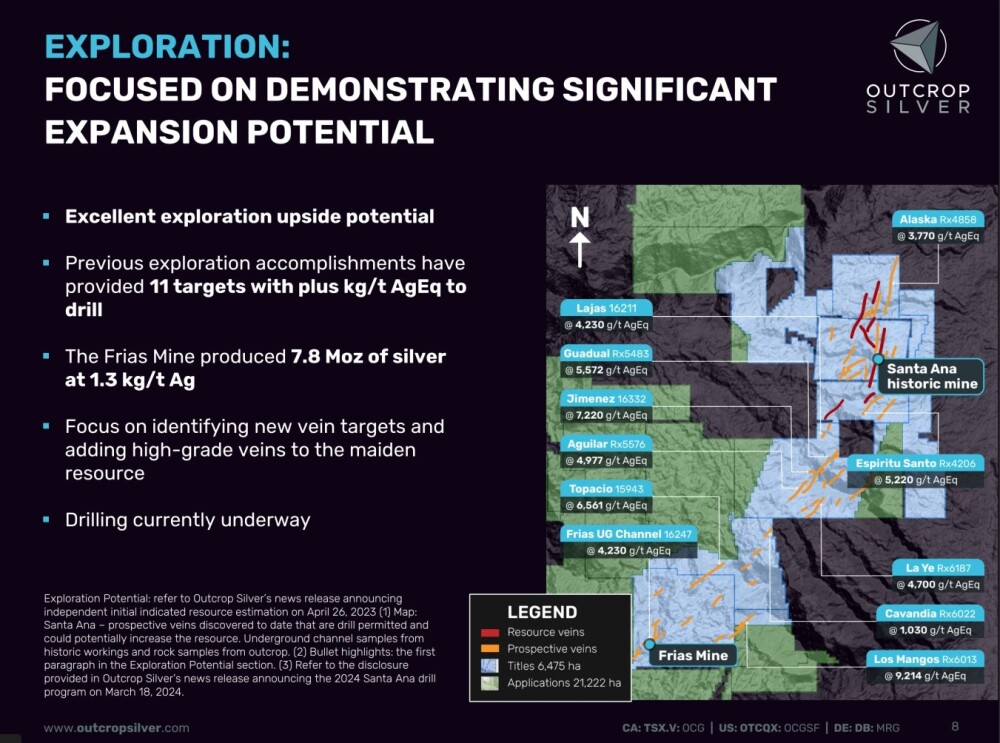

There is a lot of exploration upside at Santa Ana.

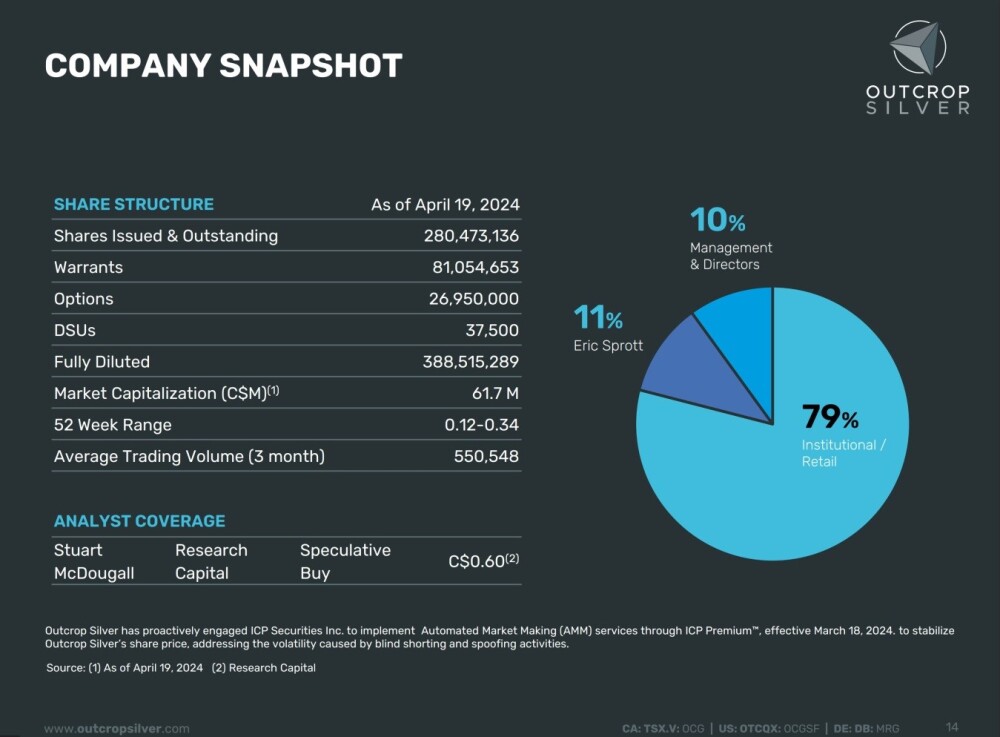

Although there are quite a high number of shares in issue, 10% are owned by management and directors and 11% by Eric Sprott and in relation to this we must factor in that the company has been around for a long time and has a wide range of properties with its flagship Anta Ana property in an advanced stage of exploration.

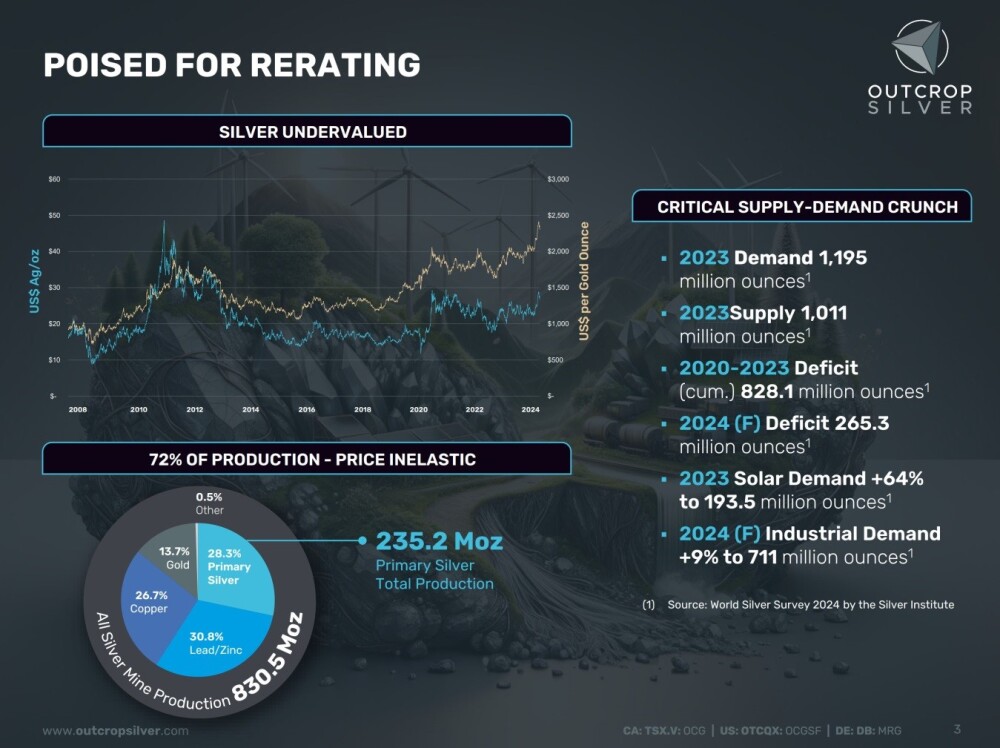

There are plenty of reasons for Outcrop Silver and Gold to be related, not least of which, as we have already observed, is the prospect of a much higher silver price as the decade continues to unfold.

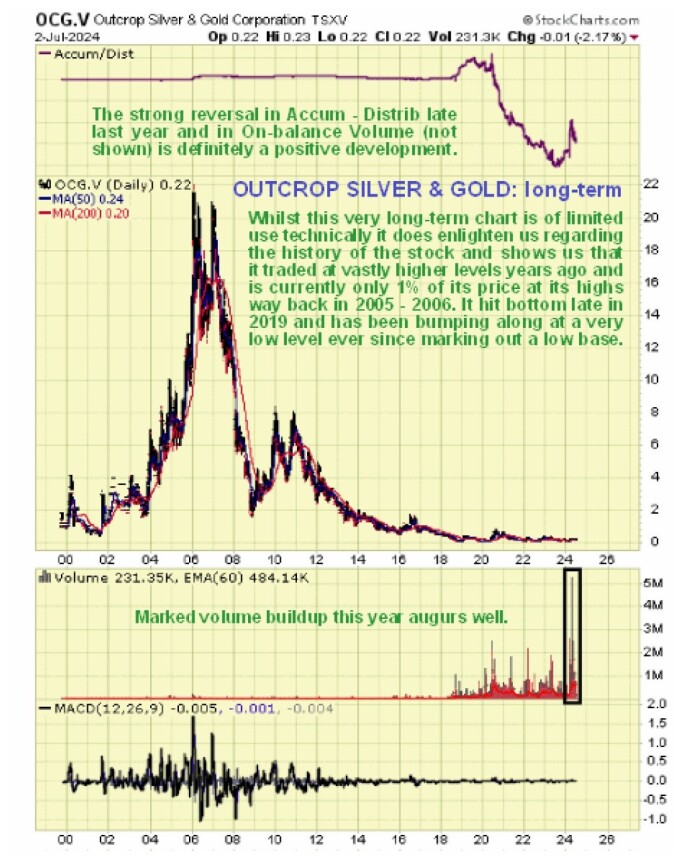

Turning now to the technical aspects of the stock, the charts for Outcrop Silver and Gold are saying that, after a very long time building out a giant base pattern at a very low level, the stock is in the earliest stages of what should turn out to be a major bull market. We will start by looking at a very long-term chart to gain a "big picture" perspective and then zoom in progressively in steps.

Beginning with a chart that goes way back to when the stock started trading in the late 90s, or if you prefer, at the end of the last century, we see that after a big bull market in the 2000s culminating in a parabolic blowoff top in the middle of that decade, the stock went into a severe bear market that continued all the way through to 2018 – 2019 when it hit bottom at a very low level, by which time it had lost virtually all of its value.

The only significant rally on the way down was when it took time out to pay "lip service" to the great sector bull market as it topped out in 2010 – 2011. Clearly, the stock has seen much better days, which is underlined by the fact that it is trading at a mere 1% of its price at its peak in 2005 – 2006. Apart from showing the history, this chart is of limited use technically, although even on this chart, we can see the marked volume buildup this year and how it has driven the Accumulation line (and On-balance Volume line) strongly higher, which is a very bullish development.

Zooming in now using a 10-year chart enables us to see how Outcrop hit bottom late in 2019 at a very low level and has been bumping along the bottom ever since, marking out a giant base pattern. The sharp rally in 2020 divides this base pattern into two distinct troughs, making it a giant Double Bottom, and within it, we can see that each of these bottoms is itself comprised of a smaller Double Bottom, so the whole thing can be described as a "Double Double Bottom."

Again, we see, this time more clearly, the volume buildup this year as the price has ascended out of the second low of the lesser order Double Bottom with the strong upside volume causing the Accumulation line to start ascending steeply, which means that this time it is different — this is a sign that it is, at last, starting to lift off into a major bull market.

Zooming in again via the 4-year chart allows us to see the second low of the Double Bottom in more detail. On this chart, we can see the resistance that marks the top of this base pattern in the CA$0.40 area.

Once the price breaks above this resistance, it should start to accelerate to the upside. We can also see that both main moving averages have swung into bullish alignment with the 50-day crossing over the 200-day, so both are now rising and in bullish alignment.

Lastly, the 6-month chart shows recent action in much more detail. On it, we can see the uptrend that has developed from the late February lows and how it has been driven by stronger volume, which is bullish. We can also see how the reaction of the past 5 weeks or so has completely unwound the earlier overbought condition and brought the price back to support at the lower rail of the uptrend channel shown (channel boundaries may need adjusting later) and in an area of support not far above its rising 200-day moving average which is coming into play beneath to support the price.

So this is a good point for the stock to turn higher again, and that is what is expected to happen, although in the event of adverse conditions across the sector over the short-term, the correction could turn into an A-B-C move back to the lower support in the CA$0.18 area.

Outcrop Silver & Gold is therefore viewed as a Buy in this area, especially on any near-term dip, which may not occur.

Outcrop Silver & Gold's website.

Outcrop Silver & Gold Corp. (OCG:TSX.V; OCGSF:OTCQX; MRG1:DB) closed at CA$0.22, US$0.1646 on July 2, 2024.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Dolly Varden Silver Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- For this article, Outcrop Silver & Gold. has paid Street Smart, an affiliate of Streetwise Reports, between US$1,500 and US$2,250.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Outcrop Silver & Gold Corp. and Dolly Varden Silver Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.