This year, Blackwolf Copper & Gold Ltd. (TSXV.BWCG; OTC:BWCGF) and Treasury Metals Inc. (TML:TSX: TSRMF:OTCQB) signed a merger deal to combine the two companies to advance the Goliath Gold Complex project (GGC project) in Ontario toward production with a strengthened leadership, balance sheet, and capital markets team with the merger expected to complete on July 3.

The combined company's Niblack copper-gold development project in Alaska and other exploration properties also represent promising upside projects for future growth. The benefits of this merger can be summarized as the synergies produced by the companies combining their assets, expertise, and experience, as well as the resulting economies of scale as they combine forces.

The combined company weill aspire to mid-tier producer status and move in this direction through strategic acquisitions under the guidance of key investor Frank Giustra. The expected cash position of $16 million after the merger will allow the company to execute on its development and exploration plans thus realizing value and increase mineable resources at the Goliath Gold Complex in Ontario, final permits for which are in process.

After the merger, TML shareholders will own approximately 68% of the new company, which will be called NexGold, while BWCG shareholders will own approximately 32%. BWCG shareholders will swap in their shares at a ratio of 0.607% TML shares for each BWCG share held, while options and warrants will convert at the same ratio, i.e., 1-for-1.

In furtherance of the transaction, Treasury Metals is doing a financing, which has been raised to $6.4 million at a unit price of 23 cents, which is very near to what the shares are now priced at, and Frank Giustra will be taking $2 million of them which is viewed as a positive indication as is the upscaling of this financing from a minimun of $4 million to $6.4 million. TML shares are therefore regarded as attractive here being as they are near to the issue price of the financing. Following the merger, there will be a 1-for-4 consolidation or reverse split of the stock.

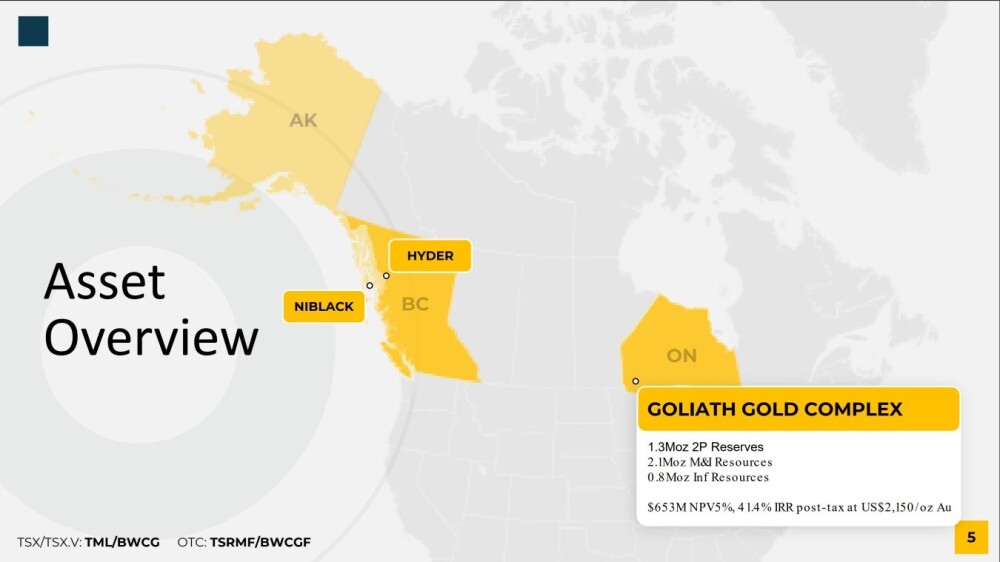

The following map gives an overview of the combined company's assets, and in terms of revenue-generating power, the Goliath Gold Camp is clearly the most important as it is well along the road to becoming a significant gold producer, in addition to which it holds significant potential for further exploration and expansion of the resource.

The Goliath Gold Camp is in a prolific gold bearing zone in Ontario and is surrounded by an impressive array of mines and prospects with big players involved like Kinross Gold Corp. (K:TSX; KGC:NYSE) and New Gold Inc. (NGD:TSX; NGD:NYSE.MKT).

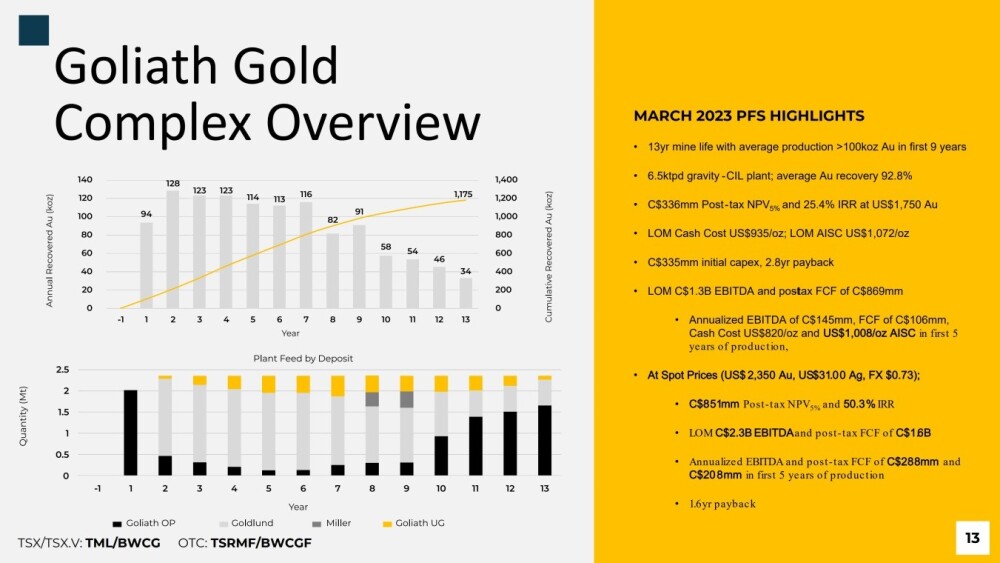

The following slide gives an overview of the Goliath Gold Complex and also shows a bulleted list of the 2023 pre-feasibility study highlights.

This one provides a summary of the PFS highlights.

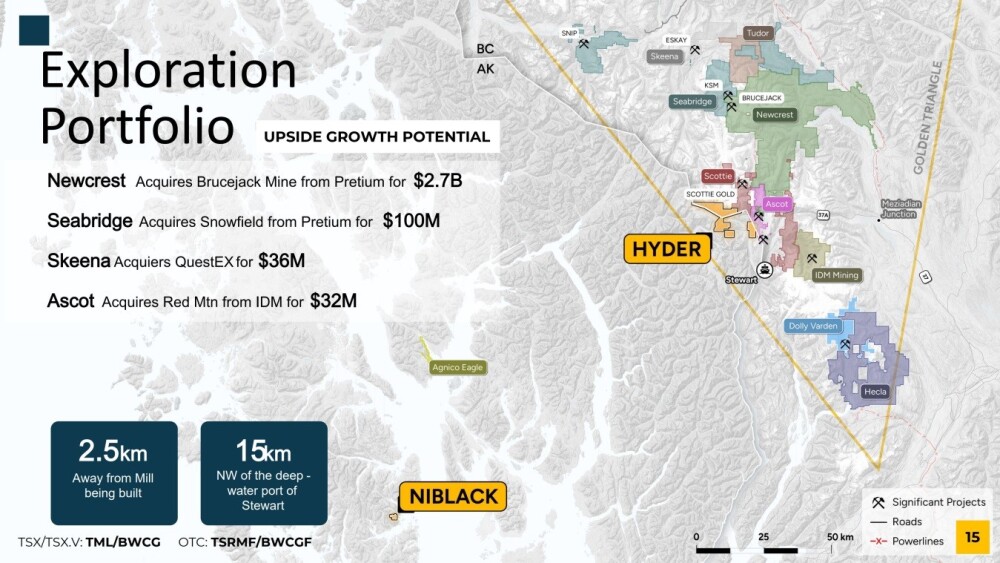

Turning now to the combined company's other properties over in the west, in Alaska and British Columbia, the following slide makes glaringly obvious the potential of the Hyder property in The Golden Triangle since it is very close to significant properties owned by other important mining companies such as Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCQX), Hecla Mining Co. (HL:NYSE), Newcrest Mining Ltd. (NCM:ASX), and Scottie Resources Corp. (SCOT:TSX.V), to name just some of them.

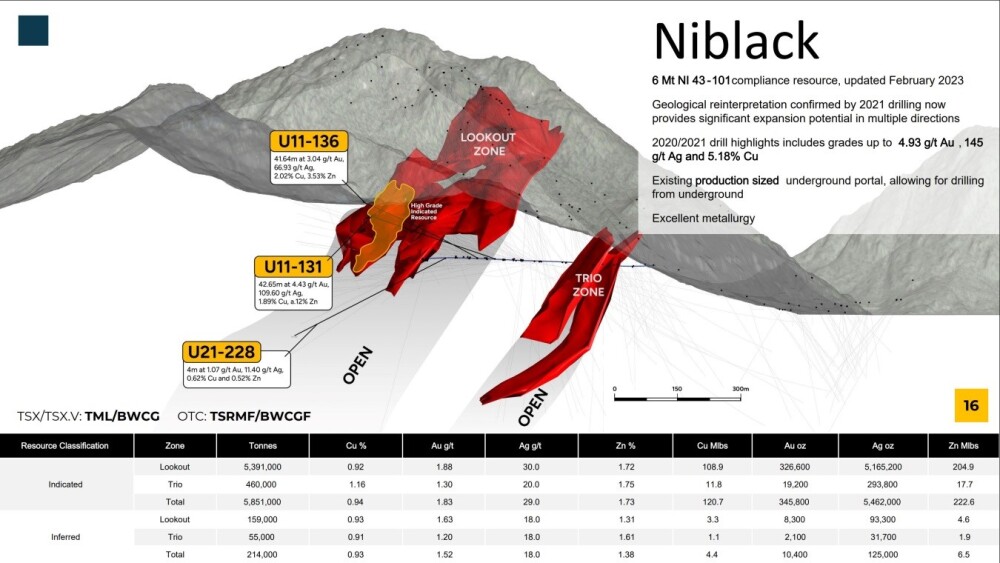

After noting the position of the company's Niblack property on the slide above, just across the border to the west in SE Alaska, the following important and interesting slide presents a profile view of it and gives a range of details of the project, including stats on its indicated and inferred resources.

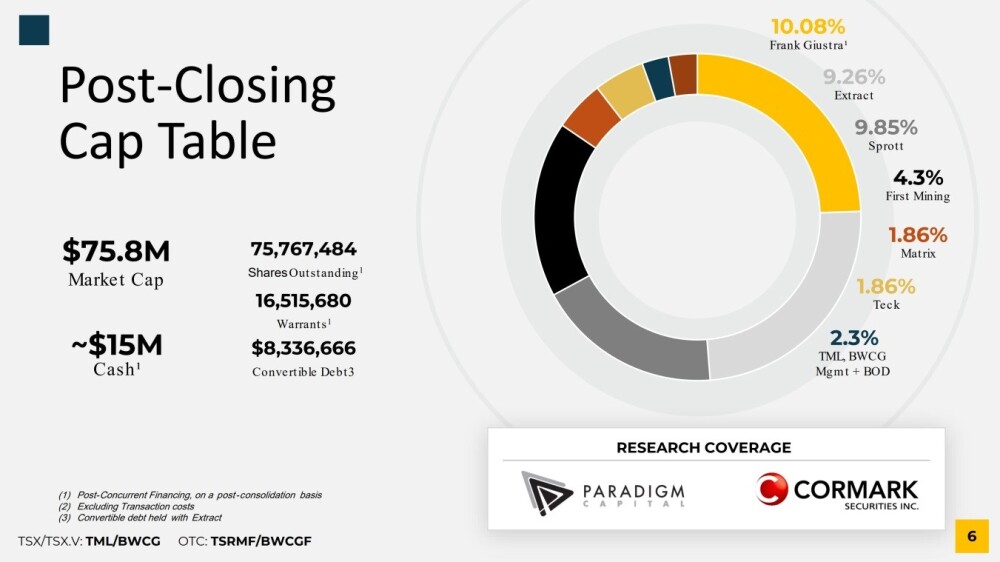

The following slide shows the post-merger ownership of the stock and here we see that the significant stakeholders together own about 39.5% of it, meaning that 60.5% is in the float.

The last slide summarizes the benefits to the combined company resulting from the synergies produced by combining forces.

Now, with the merger fast approaching, we will review the stock charts for both companies.

A general point to make at the outset is that with a merger pending and imminent, both the stocks we are looking at will soon cease to exist and be replaced by a new stock for the merged entity NexGold — does that mean that the current charts have no predictive value?

No, it doesn't, because the state of the companies and, therefore, of their charts going into the merger will determine how things work out for the merged company and also its stock.

Looking at the long-term charts for both Blackwolf Copper and Gold and Treasury Metals it is easy to see why merging and combining forces is an attractive option for both companies at this time because the capitalisation of both of them has been greatly reduced by the severe bear markets that have plagued them over the past several years, which has limited their options and presumably threatened liquidity problems.

Starting with the long-term 11-year chart for Blackwolf, we see that it got as high as CA$2.80, albeit briefly, early in 2017, so that now, with it priced at just 12 cents, it has lost well over 95% of its value, and top put it mildly, this has cramped its style. However, as is a lot more clear on its shorter-term charts, Blackwolf is showing definite signs of basing at a low level in recent months.

It's a similar story with Treasury Metals, although in Treasury's case it has lost a mere 90% of its value relative to its early 2017 peak and it is showing clear signs that it has been basing in recent months on its long-term 11-year chart.

These two long-term charts make abundantly clear why merging is an attractive option for both companies — combining forces makes possible valuable synergies and economies of scale that will enable them, as the newly merged entity, to advance their projects as one company, especially as the outlook for the metals sector is set to vastly improve before much longer, because when the debt markets meltdown, a development that is drawing ever closer, enormous amounts of capital will flood into tangible assets with base and precious metals set to soar.

So, regardless of any near-term pause or correction, the outlook for companies such as the newly merged NexGold could scarcely be better.

Turning now to the shorter-term 1-year charts, we see that both companies' stocks have been marking out base patterns in recent months with Blackwolf starting a basing process early this year and Treasury Metals starting its basing process back last October.

In Blackwolf's case, we see that the base pattern that formed in January is a hybrid Cup & Handle base / Head-and-Shoulders bottom — it is both at the same time, and both are bullish. It has been rather weak in recent days with selling on rather high volume and its Accumulation line dropping, which, when comparing it to the parallel performance of Treasury Metals, suggests that Treasury Metals' shareholders will come out of the merger somewhat better than Blackwolf shareholders, although both should benefit. This quite high downside volume in recent days means that we cannot rule out that it won't drop further ahead of the merger.

In the case of Treasury Metals, there seems to be a more definite base pattern with a Cup and Handle base having formed from last Fall that includes an embedded Double Bottom whose first low occurred last November, with the second low being in February / March which was the low point marking the end of the long bear market.

This is a bullish-looking chart with the "Handle" part of the pattern allowing time for the price to consolidate and unwind its earlier overbought condition following its clear and decisive break above its 200-day moving average early in April and it has also allowed time for the 50-day moving average to make a bullish cross above the 200-day and catch up to the price, all of this setting the stock up for a breakout above the resistance shown at the upper boundary of the pattern which will mark the start of a major new bull market.

So to sum up — the outlook for both stocks looks favorable on their respective charts, especially Treasury Metals, and this means that the outlook for the merged company NexGold is even better, since it is set to benefit from synergies resulting from the merger and also from economies of scale and in due course it will benefit greatly from the major sector bull market that is building.

Both Blackwolf Copper & Gold and Treasury Metals are rated Strong Buys ahead of the merger, with a slight preference for Treasury Metals for the reasons discussed.

Blackwolf Copper & Gold's website.

Blackwolf Copper & Gold Ltd. (TSXV.BWCG; OTC:BWCGF) closed for trading at CA$0.12, US$0.0826 on June 25, 2024

Treasury Metals' website.

Treasury Metals Inc. (TML:TSX: TSRMF:OTCQB) closed for trading at CA$0.205, US$0.153 on June 25, 2024

| Want to be the first to know about interesting Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Blackwolf Copper & Gold Ltd. and Dolly Varden Silver Corp. are billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$4,000 and US$5,000. For this article, Blackwolf Copper & Gold Ltd. has paid Street Smart, an affiliate of Streetwise Reports, US$1,500 in addition to the monthly consulting fee.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Blackwolf Copper & Gold Ltd., Treasury Metals Inc., and Dolly Varden Silver Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.