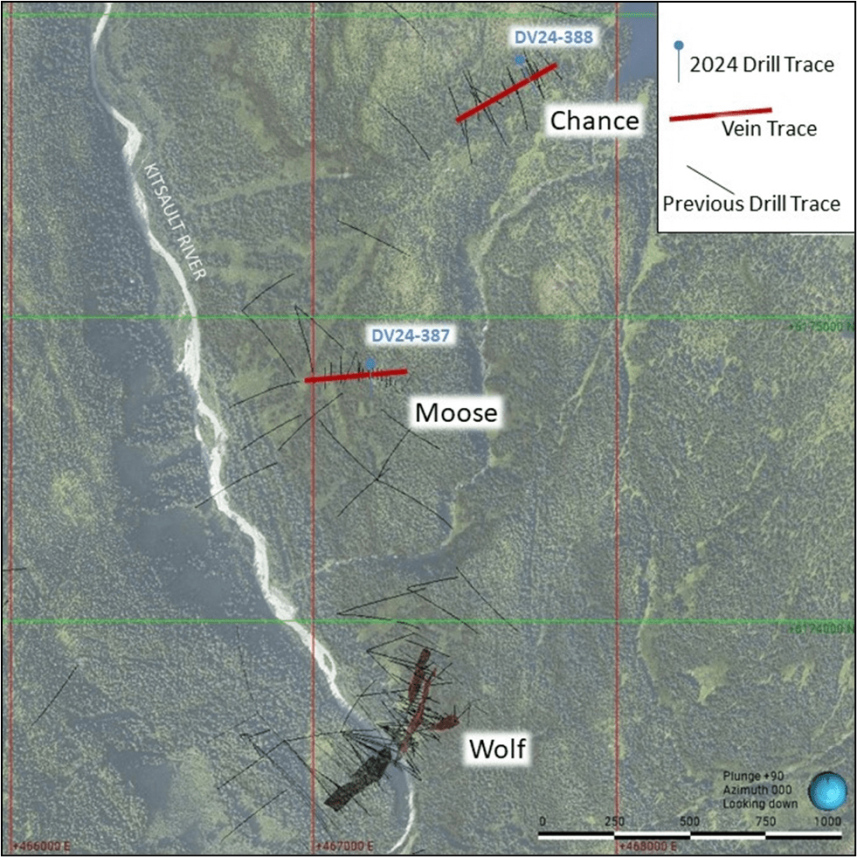

Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCQX) released the first drill results from its 2024 exploration program, intersecting high-grade silver mineralization at the Moose and Chance veins of its 100%-owned Kitsault Valley project in British Columbia's Golden Triangle.

Hole DV23-387 at the Moose vein assayed 977 grams per tonne silver (g/t Ag) over 5 meters, including 3,670 g/t Ag over 0.79 meters.

Hole DV24-388 at the Chance vein intersected 206 g/t Ag over 23.03 meters, including 597 g/t Ag over 1.4 meters and 749 g/t Ag over 0.5 meters.

"These excellent results from the first hole at the Moose Vein from the 2024 program (exhibit) similar geological and mineralization features to the Wolf deposit located 1,400 meters south," said Chief Executive Officer Shawn Khunkhun. This "suggests that this area has potential to emerge into the northernmost silver deposit along the 5-kilometre-long trend that also hosts the Dolly Varden, Torbit, and North Star deposits."

The "robust nature of the mineralized structure" at Moose "suggests a strong mineralizing system." He said the first results over a significant width from the Chance vein were also encouraging.

The "robust nature of the mineralized structure" at Moose "suggests a strong mineralizing system." He said the first results over a significant width from the Chance vein were also encouraging.

Three rigs are currently drilling with 25 holes completed or in progress at the project, the company said.

In addition to Moose and Chance, an initial target is also the North Star Deposit step-out.

The program will be split about 50/50 between the Dolly Varden and Homestake Ridge properties (which together make up the Kitsault Valley project).

The drilling will also be split into thirds overall between the Homestake Silver deposit area, the Wolf deposit, and project-wide exploration for new discovery targets.

"This season's introduction of directional drilling technology will allow for highly accurate placement of drill intercepts," Khunkhun has said.

Analyst Stuart McDougall of Research Capital Corp. on Wednesday released an updated research note, maintaining his Speculative Buy rating with a CA$1.45 per share target price.

"Although it's still early days, the grades and widths are similar to those in the known zones located to the south," McDougall wrote. "Accordingly, we continue to value the company on the basis of its successful expansion of existing resources, using our benchmark in situ metrics of US$3/oz Ag and US$75/oz Au (gold), adjusted for options and our future equity financing assumption."

'I Am Holding Tight Onto This Stock'

Dolly Varden's stock went up 0.08% on the release of the results Wednesday. On May 22, Technical Analyst Clive Maund wrote that Dolly Varden was among several stocks that could see some upward movement due to a possible "major upleg" in gold and silver stocks.

"A fine countertrend Pennant has formed in Dolly Varden over the past month that has brought it back to support above its rising 50-day moving average and unwound its earlier overbought condition," Maund wrote. "The next upleg should start soon, and it could be big."

Jeff Clark, author of The Gold Advisor, wrote Thursday that the area Dolly Varden is drilling in is bigger than it looks on the map with plenty of places to still find resources.

Jeff Clark, author of The Gold Advisor, wrote Thursday that the area Dolly Varden is drilling in is bigger than it looks on the map with plenty of places to still find resources.

"The Moose Vein is 1.4 kilometers from Wolf and remains wide open for expansion," he wrote. "The Chance Vein is 1.3 kilometers from Moose, and drilling is in an area that hasn't been previously tested."

Dolly Varden is "up 21% YTD, but I expect it to kick into high gear once the silver price breaks out decisively," Clark wrote. "That's ahead, so I am holding tight onto this stock, one I anticipate not only giving us a nice return from current levels but also a premium when it's eventually bought out."

Both Bob Moriarty of 321gold.com and the Golden Opportunities newsletter are among the other experts who like Dolly Varden Silver.

The company offers investors "a big silver-equivalent resource in British Columbia's Golden Triangle to leverage rising silver prices and exciting, discovery-driven growth," Golden Opportunities stated.

The silver-gold company also has a Buy rating from Raymond James analyst Craig Stanley.

The Catalyst: White Metal Helping Drive Energy Transition

Silver, the most conductive element in nature, is important to the green energy transition because it's used to coat electrical contacts in computers, phones, cars, and appliances. It's also an important element in solar technology.

Silver spot prices rose to a new all-time high of US$32.43 per ounce on May 20 and have continued to hover around US$30 since. The price was US$31.16 on Thursday.

According to the Silver Institute's World Silver Survey, global demand for silver "massively exceeded" supply last year, a deficit that is expected to extend into a fourth consecutive year in 2024.

Mordor Intelligence noted that the white metal is expected to register a compound annual growth rate (CAGR) of more than 5% between 2024 and 2029.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCQX)

"An increase in the demand for new technological products is expected to help the market expand in the future," Mordor analysts wrote. According to a U.S. Geological Survey report, "27% of the silver produced in the United States was being utilized in electrical and electronic applications."

Ownership and Share Structure

According to Dolly Varden, 48% of the company is held by institutional investors, including Fidelity Management & Research Company LLC, Sprott Asset Management LP, U.S. Global Investors Inc., Delbrook, and Extract Capital.

About 44% is with strategic investors, including 19% with Fury Gold Mines, 15% with Hecla, and Eric Sprott owns 10% himself.

The rest, 8%, is with retail and high-net-worth investors.

The company has 285.57 million outstanding shares. Its market cap is CA$302.82 million, and its 52-week trading range is CA$0.58–1.29 per share.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Dolly Varden Silver Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dolly Varden Silver Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.