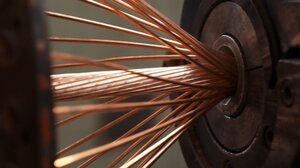

In a strategic move, World Copper Ltd. (WCU:TSX.V;WCUFF:OTCQX; 7LY0:FRA) decided to advance its Zonia project in Arizona now instead of its Escalones asset in Chile, currently at a standstill, reported Taylor Combaluzier, Red Cloud Securities vice president and mining analyst, in a May 23 corporate update note.

"Given the current robust copper market environment, we believe the company's focus on developing its smaller-scale Zonia project is prudent and more feasible for a junior mining company to tackle," Combaluzier wrote.

New Target, 129% Implied Return

Upon this news, Red Cloud revised its model on the Canadian copper company to reflect the new direction, revised timelines, and "uncertainty surrounding Escalones," explained the analyst. The changes resulted in a lower target price, CA$0.80 per share, versus CA$2 previously.

Given World Copper's price of CA$0.35 per share at the time of the report, the target implies a potential gain for investors of 129%.

Red Cloud reiterated its Buy rating on the resources firm.

"With a new management team and technical committee, along with a current cash balance of about CA$4.9 million, we believe the company is well positioned to execute on its refined U.S. strategy," wrote Combaluzier.

Why The Change in Focus

Combaluzier reported the reasons why World Copper chose to concentrate on its U.S. assets. A major one is the current situation with Escalones, in an area recently designated by Chile as a nature sanctuary. The company is in discussions with governmental authorities about moving forward with Escalones and obtaining drill permits.

Given the uncertainty about this South American project's future, Red Cloud now estimates a production start there in 2035 instead of in 2030.

Also, according to World Copper, the U.S. currently is a better choice of jurisdiction in which to pursue a copper project and potentially mergers and acquisitions activity. The country is home to numerous mining-friendly jurisdictions, offers various governmental funding programs for critical metals and has a robust domestic demand for the red metal.

Two-Phased Approach

Combaluzier relayed how World Copper intends to go about advancing Zonia. The general plan is to complete a feasibility study then move to construction.

The company divided the work into two phases, to be carried out simultaneously. In phase one, efforts will be limited to the part of Zonia consisting of private land and will include infill drilling to convert Inferred resources to Indicated ones.

The focus of phase two will be the portion of Zonia on non-private land (i.e.,) owned by the U.S. Bureau of Land Management, which will take longer to get permitted. Along with applying for permits, this phase likely also will include doing environmental studies and some exploration drilling.

World Copper estimates a production start at Zonia in three to five years. Red Cloud's updated forecast for the same is 2030, previously 2028.

| Want to be the first to know about interesting Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- World Copper Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of World Copper Ltd.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for Red Cloud Securities, World Copper Ltd., May 23, 2024

Red Cloud Securities Inc. is registered as an Investment Dealer and is a member of the Canadian Investment Regulatory Organization (CIRO). Red Cloud Securities registration as an Investment Dealer is specific to the provinces of Alberta, British Columbia, Manitoba, Ontario, Quebec, and Saskatchewan. We are registered and authorized to conduct business solely within these jurisdictions. We do not operate in or hold registration in any other regions, territories, or countries outside of these provinces. Red Cloud Securities bears no liability for any consequences arising from the use or misuse of our services, products, or information outside the registered jurisdictions. Part of Red Cloud Securities Inc.'s business is to connect mining companies with suitable investors. Red Cloud Securities Inc., its affiliates and their respective officers, directors, representatives, researchers and members of their families may hold positions in the companies mentioned in this document and may buy and/or sell their securities. Additionally, Red Cloud Securities Inc. may have provided in the past, and may provide in the future, certain advisory or corporate finance services and receive financial and other incentives from issuers as consideration for the provision of such services. Red Cloud Securities Inc. has prepared this document for general information purposes only. This document should not be considered a solicitation to purchase or sell securities or a recommendation to buy or sell securities. The information provided has been derived from sources believed to be accurate but cannot be guaranteed. This document does not take into account the particular investment objectives, financial situations, or needs of individual recipients and other issues (e.g. prohibitions to investments due to law, jurisdiction issues, etc.) which may exist for certain persons. Recipients should rely on their own investigations and take their own professional advice before investment. Red Cloud Securities Inc. will not treat recipients of this document as clients by virtue of having viewed this document. Red Cloud Securities Inc. takes no responsibility for any errors or omissions contained herein, and accepts no legal responsibility for any errors or omissions contained herein, and accepts no legal responsibility from any losses resulting from investment decisions based on the content of this report.

Company Specific Disclosure Details

In the last 12 months preceding the date of issuance of the research report or recommendation, Red Cloud Securities Inc. has performed investment banking services for the issuer.

Analysts are compensated through a combined base salary and bonus payout system. The bonus payout is determined by revenues generated from various departments including Investment Banking, based on a system that includes the following criteria: reports generated, timeliness, performance of recommendations, knowledge of industry, quality of research and client feedback. Analysts are not directly compensated for specific Investment Banking transactions.

Dissemination Red Cloud Securities Inc. distributes its research products simultaneously, via email, to its authorized client base. All research is then available on www.redcloudsecurities.com via login and password.

Analyst Certification Any Red Cloud Securities Inc. research analyst named on this report hereby certifies that the recommendations and/or opinions expressed herein accurately reflect such research analyst’s personal views about the companies and securities that are the subject of this report. In addition, no part of any research analyst’s compensation is, or will be, directly or indirectly, related to the specific recommendations or views expressed by such research analyst in this report.