World Copper Ltd.'s (WCU:TSX.V;WCUFF:OTCQX; 7LY0:FRA) primary focus now is advancing the past-producing Zonia copper oxide porphyry project in Arizona to a bankable feasibility study and then proceeding into construction and production, according to a corporate update.

"Our seasoned team are looking to put the asset into production within three to five years and at a quarter of the costs of conventional concentrate operations," the company said in the release.

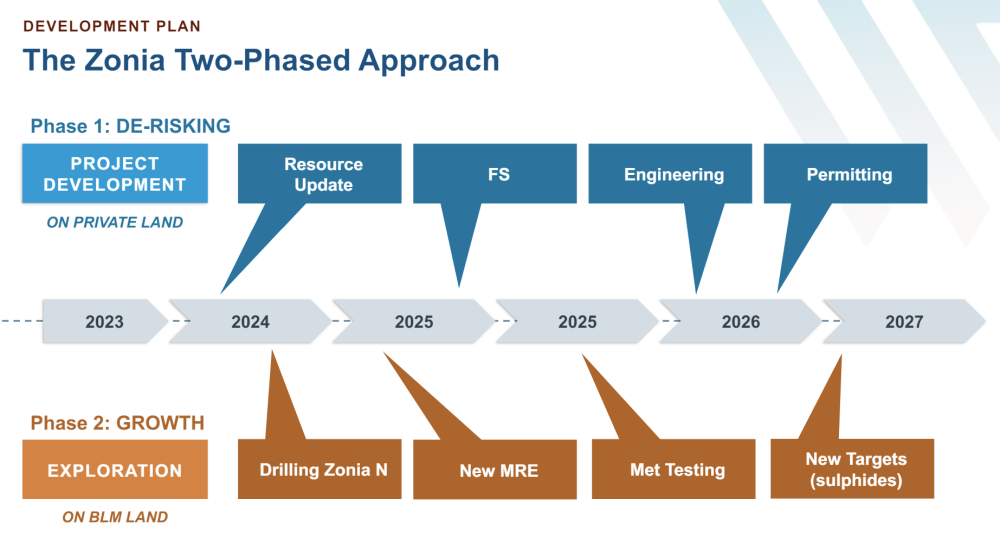

The Vancouver, British Columbia-based mineral explorer-developer's new plan for Zonia involves two phases of work, which will be carried out concurrently. Phase one pertains to the part of the project on private land. It will entail converting a large portion of the existing Inferred resources outlined in the 2022 resource update, 122,000,000 tons (122 Mt) of 0.24% copper, into the Indicated category. (Measured + Indicated resources are 75.7 Mt of 0.33% copper.) This resource conversion likely will require some infill drilling to be done.

Other activities slated for this phase are obtaining land and water use permits and carrying out metallurgical studies, mine planning, engineering, financing modeling, and construction planning.

Phase two will target copper mineralization on the U.S. Bureau of Land Management (BLM)-owned land that surrounds Zonia. This will involve obtaining permits, a longer process than in phase one, as well as doing environmental studies and exploration drilling.

"Our BLM lands are three times the size of our private land package and have the potential to increase our copper resource exponentially," the release noted.

Zonia also boasts a strategic location, said the company, in that the project could supply the domestic U.S. refined copper market. Arizona, where about 71% of the global copper supply is produced, is deemed by the Fraser Institute to be the world's seventh most attractive mining jurisdiction.

To see Zonia through to production, World Copper created a Technical Advisory Committee to which it appointed two mining professionals, Derek White and Joe Philips, the release noted. White, most recently, built the Premier gold mine in British Columbia and, previously, as KGHM International's former chief executive officer, the Sierra Gorda mine in Chile and the Carlota mine in Arizona. Philips has led construction at 14 different mining operations in 11 countries.

World Copper's second copper oxide project, Escalones, is in another favorable jurisdiction, Chile. Regarding this asset, the company is in discussions with Chilean authorities about drilling permits and the recently established nature sanctuary encompassing the company's mining property.

The corporate update also noted that earlier this month, World Copper received an extension of its CA$1.958 million (CA$1.958M) loan from E.L. II Properties Trust for two years (as of May 18, 2024) with an interest rate of 8% per annum.

Further, the copper company engaged Upcountry Strategy Ltd. for marketing services for six months for US$600,000 starting May 2, 2024.

Key Economic Advantages

Because World Copper's Zonia and Escalones projects are copper oxide versus copper sulfide deposits, they have several, significant economic advantages when it comes to mining and processing ore, highlighted Zacks Small-Cap Research Analyst Steven Ralston in a 2023 research report.

Compared to the copper sulfide variety, copper oxide deposits are easier, greener, and less expensive to mine and process. As such, they are easier to get permitted. Copper oxide deposits tend to be shallower, translating to a lower strip ratio in open-pit mining.

On World Copper, Red Cloud has a Buy rating and a target price reflecting a return of 488%.

As such, Zonia is a viable, smaller-scale and lower-cost solvent extraction-electrowinning operation producing copper cathodes, as outlined in the 2018 preliminary economic assessment (PEA). The project could be permitted in half the time required for a new, larger copper concentrate mine, the company said. With the mineralization at Zonia already stripped, due to historical production, the strip ratio for future operations is 1:1.

As defined in the PEA, Zonia would require US$198M in initial capex, and operating costs would be about US$1.46 per pound (US$1.46/lb) of copper. At a US$4/lb long-term copper price, the project would have a US$192M after-tax net present value discounted at 8% and a 29% internal rate of return.

"Zonia has the potential to become a net-zero facility benefiting from low energy consumption, favorable energy mix, and emission compensation returns," the company said.

Copper Supply "In A Crisis"

Copper is a critical metal in the U.S., as determined by the federal Department of Energy in 2023, due to its "key role" in green energy and tech, electrification, defense, and consumer electronics. As such, demand for the red metal is rising, a Reuters article pointed out.

Yet, the global supply, tight and impeding refined production, "is in crisis," according to Bank of America's metal strategists. They predict the copper price will continue climbing to an average of US$10,750 per ton in 2025 then climbing to US$12,000 per ton in 2026. Investments in green technology, thin inventories and worldwide economic recovery are among the causes they cited.

Rising copper prices are good for the mining industry, and investors in copper equities wrote Ron Struthers in a recent issue of his Struthers Resource Stock Report.

"This copper market is a once-in-a-lifetime opportunity," Struthers asserted. "Never before has there been such a strong rising demand and price for copper and mining companies at such low valuations. There [are] going to be tenfold increases and more with junior copper explorers."

The Catalysts: Progress at Zonia

Several stock-moving events are expected this year and next for World Copper and its Zonia project. With respect to phase one of its advancement plan, catalysts include an update of the resource on private land this year, followed by a feasibility study in 2025, as outlined in the company's May 2024 Corporate Presentation.

Regarding phase two, expected catalysts include the drilling of Zonia Norte in 2024 and the results, as well as a subsequent new mineral resource estimate, to include mineralization on BLM-owned land in 2025.

"We believe there is further room to upgrade and grow the resource with future drilling," Red Cloud Securities Analyst Taylor Combaluzier wrote in a research report. Zonia Norte, a 2.5 kilometer by 1.5 kilometer copper-molybdenum-manganese anomaly near the Zonia deposit, "could potentially help increase the size and scale of the project."

On World Copper, Red Cloud has a Buy rating and a target price reflecting a return of 488%.

Zacks' Ralston also rates the explorer-developer Buy. His target price on World Copper implies a 136% upside from its current share price.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

World Copper Ltd. (WCU:TSX.V;WCUFF:OTCQX; 7LY0:FRA)

Further, World Copper is a Top Pick of Fundamental Research Corp. (FRC) and has been for months now. Of FRC's Top Picks, WCU, in each of the past four weeks, has been the best performing stock or one of the Top 5 performing stocks, FRC reported. During last week, ended May 9, World Copper was up 36.4%, Analyst Sid Rajeev highlighted in a new report.

Ownership and Share Structure

Wealth Minerals Ltd. (WML:TSX.V; WMLLF:OTCQB) owns about 11.51% of World Copper. About 27% is owned by management and insiders, including Director Robert Kopple with 8.37% and Board Chairman Hendrik van Alphen with 1.14% or 3.25 million shares. CEO Neal holds about 0.96%. The rest is retail.

As for share structure, the company has 178.02M outstanding shares and 126.06 free-float traded shares, according to Reuters.

It has a market cap of CA$43.13M. Its 52-week trading range is CA$0.055–0.33 per share.

| Want to be the first to know about interesting Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- World Copper Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of World Copper Ltd.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.