A sure sign of a market bottom and turnaround in mining is increased merger and acquisition M&A) activity, and this is going through the roof. It does two major things that are very bullish:

- Shareholders of acquired companies get higher prices and cash;

- It reduces the number of mining companies on the market to buy.

So, basically, it increases demand and reduces supply at the same time.

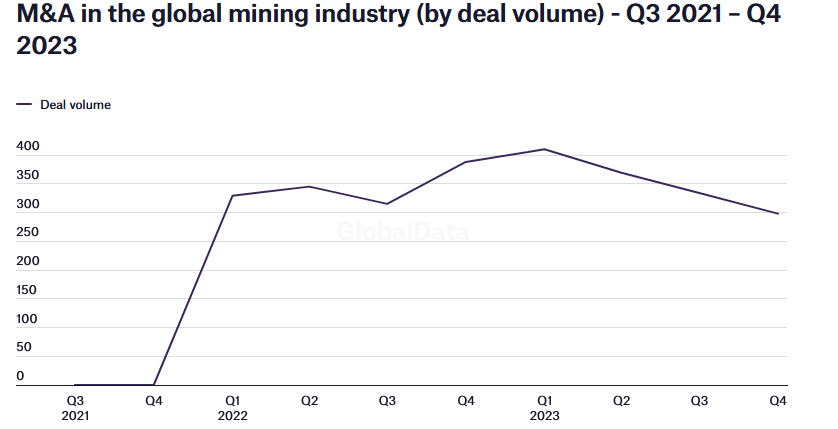

How active has M&A been?

Literally, hundreds of agreements have been signed, with most flying under the radar of mainstream media and retail investors. Just the last quarter of 2023 is amazing:

- In the global mining industry, there were 298 M&A deals announced in Q4 2023, worth a total

value of $33.9 billion, according to GlobalData's Deals Database; - In value terms, M&A activity increased by 142% in Q4 2023 compared with the previous

quarter's total of $14 billion; - In the Canadian mining industry, there were 100 M&A deals announced in Q4 2023 worth a

the total value of $8.1 billion, according to GlobalData's Deals Database; - According to Fitch Ratings — The rise in M&A activity across the mining industry over the past

year is likely to continue into 2024.

Those in the industry know the market best, and they have been buying hand over fist for the last two years at the bottom and turnaround. We should be buying, too.

A lot of junior explorers are being bought out as well. I was surprised this week when Great Pacific Gold announced a buyout of a private copper junior, Tinya Valley Copper, for $16 million in stock. What surprised me is how grassroots the project is, as it has not had one drill hole yet. It is in a known copper belt, though, to its credit.

The key reason for this is that copper is in high demand, there will be shortages, and prices are rising. All the major mining companies are scrambling, trying to find more copper. I did a major dive into the copper market in December, which you can review here on my Substack. I picked Capstone Mining CS, and it is our top-performing producer, up almost +50%.

In that report, I showed the next two levels of resistance on the chart, and copper just took out the 2nd resistance level this week. Copper is in a steep rising projection and will soon reach all-time new highs around $5. And copper is going to double digits. It is not a matter of if but when.

About 15% of copper supply comes from scrap, and usually, higher prices will bring out more scrap, but a lot of this has already happened in the past couple of years with the recent price rise. Copper mining is different and unique.

Copper mining is very rare in Canada as only about 1% of the world mine supply is from here. That means if Zonte or other juniors in Canada prove a copper deposit, it is quite unique and will be sought after.

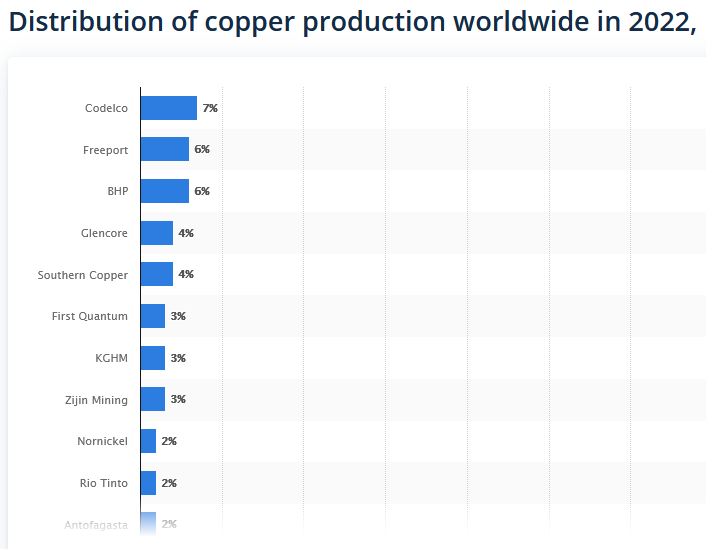

Another huge factor is there is really no junior copper producers, small production is coming as a byproduct of other mines such as zinc, gold and silver mines. There are a lot of junior and small gold producers that major gold miners can buy, but not so with copper. The majority of growth and acquisitions will be with juniors who have exploration projects. They are about the only real target for the big producers. That is why we see a deal like Great Pacific; more of these will come. The big producers of copper are spread out among many, many miners, as this chart reveals. The biggest producers just have around 6% of the market.

This copper market is a once-in-a-lifetime opportunity. Never before has there been such a strong rising demand and price for copper and mining companies at such low valuations. There are going to be 10-fold increases and more with junior copper explorers.

My two favorites right now are Zonte Metals Inc. (ZON:TSX.V), with a very low valuation, and Midnight Sun Mining Corp. (MMA:TSX.V; MDNGF:OTCQB), with their deal with Kobold Metals and proximity to large copper mines. I am looking at others and plan on adding to the list this year. I am also planning a video interview with Zonte and Midnight Sun.

For today, Zonte had very strong news. It is mostly technical, and I will do my best to explain.

Zonte Metals

Recent Price - $0.09

Entry Price - $0.09

Opinion – Strong Buy

Metal deposits all have one main mineralization event in their history, and many have two events over time. Three events are not as common in the same place, and that is what Zonte Metals Inc. (ZON:TSX.V) has proven in this news. The more events of mineral injection over time means higher grades and concentration.

What is more, the third event at Zonte's Cross Hills was Chalcocite, the strongest type of copper mineralization. I talked about the types in my January 8 newsletter.

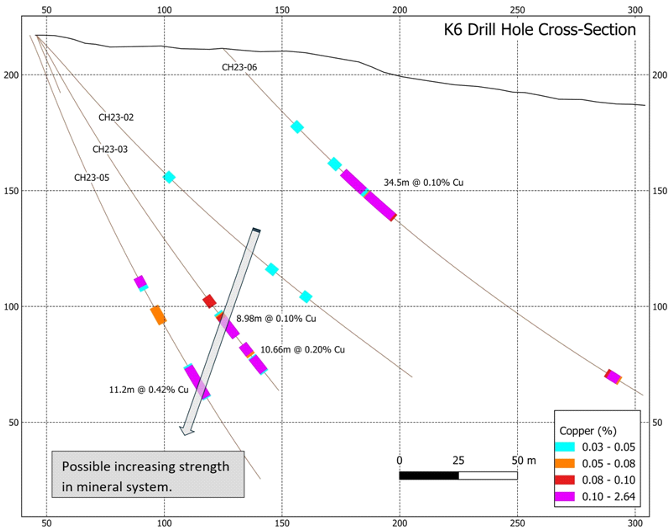

I was aware Zonte was doing more analysis on the drill core and have been eagerly waiting for this. In preparation for the follow-up drill program at the K6 target, Zonte commissioned a thin section (TS) and Scanning Electron Microscope (SEM) analyses of select samples from the recent drill core. These analyses were conducted by Hamilton Geoconsulting of Hamilton, Ontario. I am pasting Terry's comments as they explain this pretty well. It might be a bit technical for some, so read over twice. Hypogene refers to an event below the surface.

Terry Christopher, President and CEO, comments, "A number of samples from the recently completed K6 drill core were analyzed via thin section and scanning electron microscope. The findings from this examination, coupled with characteristics derived from core logs, reveal several significant aspects of the copper system at K6. Firstly, there were up to three distinct pulses of mineralization, with the final one manifesting as a hypogene chalcocite event that overlaid earlier mineralization. This observation is significant as these late overprinting chalcocite events can lead to elevated grades. Moreover, changes in the overall character of the mineralization offer insights into the copper system, suggesting a potential increase in grade with depth. These features are evidenced by a progressive increase in copper grade with depth in the drill holes, along with a notable augmentation in chalcocite content, particularly evident in the deepest drill hole, CH23-05. This hole exhibited higher mineral contents, with recorded grades in individual samples reaching up to 2.64%, as noted in our February 29, 2024 press release. These observations will be used to vector in on stronger parts of the mineral system in the up coming drill program."

Mineralization looks to start about 50 meters below surface, and higher grades begin at around 100 to 150 meters. Remember this is just early days and higher grades could come closer to surface elsewhere on the K6 target, plus there are 11 more targets to drill.

I know many have lost patience with this stock and other juniors, but you have to look ahead, not backward. History is just that, and too many project history into the future, which is quite unreliable. I find the best use of history is resistance levels on charts, and that is because too many investors judge by history, so it is good to know and make use of.

The most common comment I hear is: "When it gets back to this price, I am selling."

These investors are making emotional trades based on a price that relieves their past anguish. The majority of investors trade on emotion, mostly fear and greed, and this is not easy to overcome. It took me many years.

I have a strong buy because of the low valuation and a new future now that a discovery has been made and some of Mother Nature's secrets at Cross hills now revealed.

Looking at the history on the chart, I expect resistance to be around 15 cents and then around 23 cents. There is some resistance around 10.5 cents, but 15 is more important because it would be a breakout.

| Want to be the first to know about interesting Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Ron Struthers: I, or members of my immediate household or family, own securities of: Capstone, Zonte Metals, and Midnight Sun. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.