The fundamental and technical reasons for buying StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB) stock were set out in the article about it published on February 22, and since that time, it has broken out of a base pattern as predicted, and the reason for posting this article on it now is that we have seen a typical post-breakout reaction back to support that has thrown up another good "buy spot" ahead of the next expected upleg, which may well be triggered by the drill program now underway at the Cuprite Project in Nevada, with the results from this drill program expected sometime next month.

There is no point in repeating the fundamental information set out about Strikepoint presented in the original article, so instead, we will take the opportunity to include some additional information from the company investor deck, which was not included in the original article for space reasons.

Because the company's Flagship Cuprite project in Nevada was described in some detail in the original article, assisted by slides from the Investor Deck, it does not require to be repeated, and this affords us the space to look briefly at the company's lesser but still significant projects in British Columbia which should more significant as gold and silver's emerging major bull market gains traction.

The location of the company's two properties in the Golden Triangle in BC, the Porter Silver Project and the Willoughby Gold Silver Project is shown on the following slide, which shows a map of the Golden Triangle. This slide is repeated here for convenience.

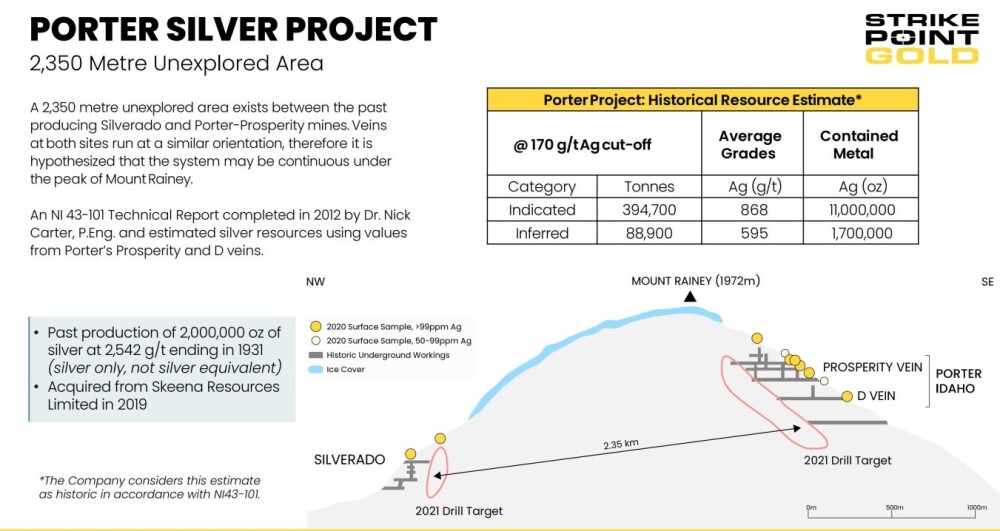

Details of the Porter Silver Project are as set out on the following slide.

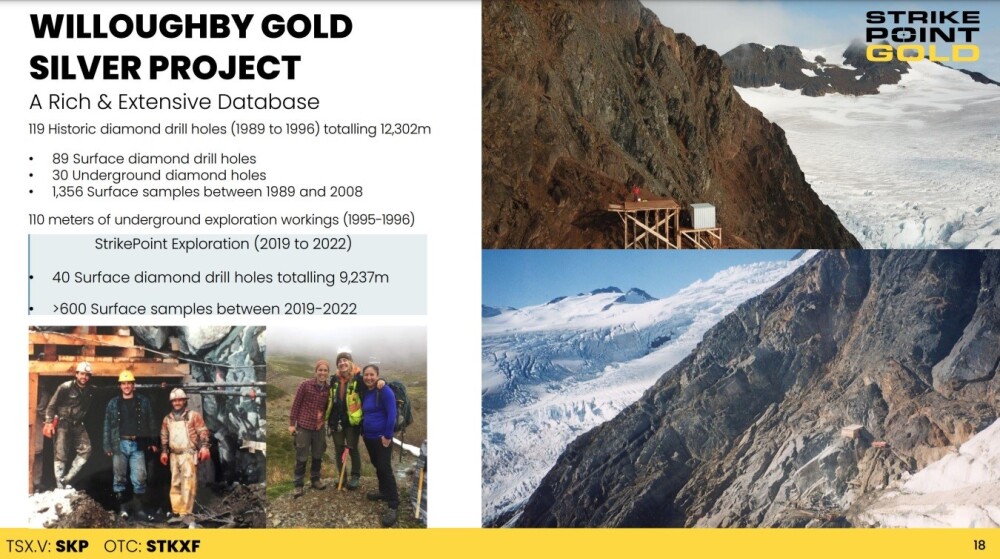

Details of the Willoughby Gold Silver Project are included in this one.

Now look at the charts for Strikepoint Gold stock. Starting with the 1-year chart, we can see that it is doing well, having last month broken out of the Double Bottom base pattern as predicted in the original report.

Upon breaking out, the price ran up to CA$0.07 before a normal post-breakout reaction back to support at the breakout point set in as gold itself consolidated its major breakout. Meanwhile, the moving averages are swinging into bullish alignment with the 50-day crossing the 200-day, signifying the birth of a new bull market.

So this is an excellent buy spot as a new second upleg should develop from here.

On the 5-year chart, we can see that the Double Bottom followed a 3-year long bear market from the peak at the start of 2021 that took the form of a 3-rc Fan Correction. Everything about this chart is now positive, with upside volume building, the Accumulation line even higher than it was at the start of 2021, momentum (MACD) strengthening and now entering positive territory, and, as mentioned above, the moving averages swinging into bullish alignment and the great news for investors here is that this bull market is still in its infancy with the post-breakout reaction bringing the stock price back to a perfect buy spot very soon after the closing of a financing.

The obvious first target for the price is the resistance approaching and at CA$0.12.

The most exciting of the company's projects is, of course, the Cuprite Gold Project on the Walker Trend in Nevada, which is the biggest catalyst for appreciation of the stock, especially as a drilling program is currently underway that started this month and from which results are expected as early as next month and the following information set out in the original article is of such importance that it bears repeating.

For historical reasons, the Cuprite Gold Project is on virgin ground as it was formerly unavailable, meaning that it has never been drilled, and the property is surrounded by the following impressive mines and deposits:

- Comstock - 8.3M oz Au historic

- Round Mountain - 15M oz Au produced, 3Moz P&P

- Bullfrog - 2.3 Moz Au historic production

- AngloGold - expanded Silicon (4.22Moz Au plus 6-8M oz Au target at Merlin)

- Sterling - 0.9M oz Au resource

- Castle Mountain - 4.33 Moz Au M&I

- Centerra-Gemfield - 3.9M oz Au In-Situ Reserve.

Last year saw a lot of activity on the Walker trend nearby, especially by AngloGold Ashanti Ltd. (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE), so for all these reasons, the chances of Strikepoint finding something very worthwhile this year at the Cuprite Gold project are considered to be high.

The conclusion is that, with a second upleg looking imminent, Strikepoint Gold is a Strong Buy for all timeframes.

Strikepoint Gold's website.

Strikepoint Gold's investor deck.

Strikepoint Gold closed at CA$0.06, $0.045 on March 20, 2024.

Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- StrikePoint Gold Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of StrikePoint Gold Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.