Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT) has finished and received the assay results from its initial drill program in 2022 at its 100%-owned 3 Aces project in the Yukon.

Time constraints meant only four holes were sunk at the project, which was acquired by the company in 2020. But the results set up a much more extensive exploration program for this year.

"We are confident we have moved closer to our goal of defining a large resource in (the) coming seasons," Seabridge Chairman and Chief Executive Officer Rudi Fronk said.

The company received its exploration permit for the project from the Yukon government last fall. Weather conditions and a mandated cutoff date meant the company was only able to drill four holes for about 1,200 meters of the 1,500 to 1,800 meters it had planned.

Mike Kozak from Cantor Fitzgerald agreed. "KSM is in a class of its own as the world’s only standalone development-stage mining project capable of producing +1 MMoz Au annually for decades from open-pit operations only."

Seabridge has high hopes for the project. "Our expectation is that over time, we will be able to deliver a high-grade gold resource with grades significantly higher than our existing gold resources at our other projects" at 3 Aces, Fronk said.

The company believes the project could host higher-grade gold than its massive flagship project, KSM in British Columbia’s Golden Triangle. Jim Rickards, editor of the Strategic Intelligence newsletter called KSM "one of the most attractive gold-copper acquisition targets in the world."

Analyst Mike Kozak from Cantor Fitzgerald agreed. "KSM is in a class of its own as the world’s only standalone development-stage mining project capable of producing +1 MMoz Au annually for decades from open-pit operations only," he wrote last year.

Kozak has rated Seabridge a Buy with a CA$43.50 target. It was CA$15.47 on Thursday afternoon.

"According to management, Seabridge has had discussions with over half a dozen potential large-tier joint venture partners," Kozak wrote last summer.

ROTH Capital Partners analyst Joe Reagor has rated the stock a Buy with a target of US$36 per share. He called the company’s results from drilling at its Iskut project in British Columbia last year "encouraging."

"We believe this drill program was supportive of management's belief that a porphyry deposit exists at depth on the project and of our inclusion of a US$88 million valuation for the project," Reagor wrote on Jan. 9.

The Catalyst: A Road Map for More Exploration

The company said the 3 Aces results will help it prepare for further drilling.

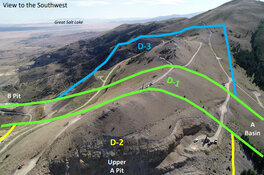

Previous exploration at the site had identified a broad area of "gold-in-soil occurrences extending more than 20 kilometers along strike," the company said. Historical drilling focused on a 13-kilometer-square region known as the Central Core Area. Good widths of high-grade gold were discovered, but not enough of the continuity needed for a resource estimate.

"We were hoping to accomplish more in 2022, but the late start and challenging conditions slowed progress," Fronk said.

One of the holes was "highly rewarding, as expected," the company said. The other three were used to test for controls on downdip extensions to the high-grade.

Hole 3A22-355 intersected 3.53 grams per tonne gold (g/t Au) over 22.5 meters, Seabridge said, including 11.97 g/t Au over 5.2 meters.

The remaining three holes all assayed for less than 1 g/t Au, the best intercept being 0.96 g/t Au over 1.8 meters in hole 3A22-357.

The company acquired the 35,700-hectare project consisting of more than 1,700 claims in March 2020, and it’s located in a readily accessible part of the southeastern Yukon.

Work by previous operators had identified four separate areas for the company to drill and test its three-dimensional model of the site. Informed by these results, the company plans to follow with a more extensive exploration program this year.

Flagship One of ‘Most Coveted’ Projects

KSM is the company’s flagship with resources totaling more than 88 million ounces gold (Moz) Au.

Seabridge is working toward getting "substantially started" status for the project from British Columbia’s Environmental Assessment Office (EAO), so it can get its environmental assessment certificate there extended indefinitely.

ROTH Capital Partners analyst Joe Reagor has rated the stock a Buy with a target of US$36 per share. He called the company’s results from drilling at its Iskut project in British Columbia last year "encouraging."

Rickards called KSM "one of the most coveted gold-copper projects in the world."

The company released a preliminary feasibility study (PFS) last year for KMS that predicted a 33-year mine life with an annual production of 1 Moz Au, 178 Moz copper (Cu), and 3 Moz silver (Ag) from an open pit for three deposits.

It released a preliminary economic assessment (PEA) in August for a separate, underground block cave mine with a small open pit at two other KSM deposits. That mine is expected to produce 14.3 billion pounds Cu, 14.3 Moz Au, 68.2 Moz silver, and 13.8 million pounds of molybdenum over 39 years.

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT)

About 36% of the company is held by institutional investors, according to Reuters. Management and insiders own more than 30%, the company said. The rest is retail.

Seabridge is covered by a myriad of analysts. Click the "See More Live Data" tab in the data box at the top right for more information.

It has a market cap of CA$1.24 billion and has about 81.3 million shares outstanding, with 67.9 million free-floating. It trades in a 52-week range of CA$28 and CA$13.83.

Sign up for our FREE newsletter

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Seabridge Gold Inc. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.