Maurice Jackson: Joining us for our conversation is Bob Moriarty, the founder of 321 Gold, and 321energy.com, and a world-renowned author.

Bob, everyone is discussing the election, but you pointed out that there is a bigger elephant in the room that American needs to confront, which is our national debt.

Well, one thing is for certain, you always know where Bob Moriarty stands on any given topic. Speaking of topics, give us your thoughts on the election.

Bob Moriarty: If you want to understand democracy and why it's such a terrible form of government, democracy is two wolves and a sheep arguing over what to have for lunch. Democracy is literally mob rule. And Antifa and BLM would like to run the United States, would like to kill anyone who doesn't agree with them, and it's going to get worse. And somebody's funding these idiots.

Maurice Jackson: Bob, you shared a book with me earlier this year that touched on a lot of the vices that are confronting America. A lot of focus right now is on the election, but there is a much more serious, bigger problem facing our nation and that's our national debt. Earlier this year you introduced me to a book entitled Common Sense 2.0. Tell us about the book, and why readers should consider reading this book today as America is spiraling out of control.

Bob Moriarty: That's a good question. I'm glad you brought that up. It is not my opinion, it is the opinion of everybody who passed economics 101 with a D grade or higher. The world is bankrupt. Now, that has happened a thousand times throughout history and is nothing new to it. I mean, governments are a bunch of brain-dead idiots out to steal everything they can, and they eventually drain the treasury and the country goes bankrupt.

If you go back to St. Petersburg in 1917, or Paris in 1789, we're seeing the precursors to a revolution/civil war. And people may not understand these, but those are all absolutely economic in nature.

And that's a really good book, "Common Sense 2.0." The guy talks about all the very real problems the United States has such as student debt. Students getting out of college with $32,000 apiece in student loans. They were in handcuffs. They're in chains. They are slaves. When they should be just starting their career, they're slaves. They're debt slaves. And that's just simply wrong. And the banks and the colleges have taken advantage of that, and college tuition has increased 700% when overall inflation only went up to 200%. The banks don't care because they're guaranteed they're going to get the money paid back. After all, you cannot discharge the debt in bankruptcy. Now, Joe Biden has just said something in the last day or two about student loans and $50,000. Are you aware of what he said, Maurice?

Maurice Jackson: I think he was sharing debt forgiveness, is that correct?

Bob Moriarty: He called it debt forgiveness, but we've decided we're going to stop lying to each other, so what is it he's proposing? What is it in real terms?

Maurice Jackson: Well, basically, the debt gets deferred to taxpayers.

Bob Moriarty: What he's going to do is he's going to transfer the student loan debt from the student to taxpayers, so the students don't have to pay it back anymore, their parents do. What a great idea. Damn, why did I not think about that? If I got all that debt, like half a million dollars in debt, because the United States is fighting all these stupid wars, why don't I transfer it to my kids and my grandkids and my great-grandkids? Then I don't want to pay for it. Damn, I think that's just a wonderful idea.

Maurice Jackson: And you see the disguise, it's in the title: "debt forgiveness." It is a play on words when hear the word forgiveness, as the public this is a genuine person that understands we're going through hard times. But then if you look further, as we're asking everyone to do, look further into what it means. If I don't have kids, I'm paying for someone else's kids to go to college. Now look, if you want to go to college, great, but that's your decision, not mine, why am I paying for it? And then once you do receive your degree, and I paid for it, what's the benefit to me? What do I receive? Are you going to come back and pay me for what I put into your education?

Bob Moriarty: It's worse than that, Maurice. You're paying for the colleges to have way too many people working there at too high a salary, and you're paying the money to the banks. It is a corrupt system. And it is a corrupt system because we have dishonest money. And you cannot have a legitimate economy, you cannot have an honest economy until you have honest money. It's that simple.

That crazy thing is people think I'm a gold bug. Hell, I'm not a gold bug. You could do it with salt, you can do it with big round rocks, you can do it with shells, you can do it with beach, you can do with anything. It just has to be honest money, and we don't have honest money. And we've got so much corruption.

This election, unfortunately, the rest of the world has looked at this and is just totally disgusted. Whatever credibility the United States built up over the last 200 years, it's gone.

Maurice Jackson: And here's some evidence to that. The Bank of International Settlements has passed Basel III, which you and I have discussed that in the past, which has now classified gold as a tier-one asset, wherein the past gold has been a tier-three asset. You have the new "Bretton Woods 2.0" being discussed. And what that's saying is the central banks of the world, our allies are saying, "Hey, why are we using the U.S. currency to trade between one another to solve each other's debts, problems, if I owe you and you owe me? The Americans are lazy, they're not manufacturing, and they're just printing away?" It makes complete sense. And so the Common Sense 2.0 is extremely timely.

The cost about $10 buck online. I benefit nothing financially from it. 10 bucks on Amazon, one of the best investments you can make, an investment in yourself, an investment in your family, an investment in your country. Speaking of that, one of the solutions, one of many solutions in that book is owning and having some physical precious metals. What precious metals are you buying right now?

Bob Moriarty: Silver.

Maurice Jackson: Why silver? Someone new to our conversation, we've discussed this many times, but one would assume, "Okay, Maurice, you just referenced Basel III and you said gold? Why is Bob saying silver?"

Bob Moriarty: Because it's cheap.

Maurice Jackson: In that same category, what about platinum?

Bob Moriarty: Platinum's cheap but it's not as cheap as silver.

Maurice Jackson: If Bob Moriarty were to make his first purchase today in physical precious metals would you start with some gold or would you go strictly silver, platinum?

Bob Moriarty: I would begin with silver because you can buy silver rounds or you can buy Eagles or Maples without substantial premium. If readers have 25 bucks, you can own an ounce of silver. And obviously, that's not true of gold. The smallest reasonable size of gold would be a tenth of an ounce. That's almost $200. Okay. That's not necessarily cheap. It's not cheap, and it's a lot of money. Hang on, let me kill that. I wish I knew how to do this.

I'll tell you a funny story, you'll get a big kick out of this. When I buy metals, I cheat.

Maurice Jackson: Give us the formula for cheating.

Bob Moriarty: Of all people you know, who would be more in touch with what people are buying and selling on a day to day basis? There is somebody that you know who absolutely would have their finger on what's going on in the market. Who would that be?

Maurice Jackson: Well, I'm going to be a little biased, I would say maybe someone in my position.

Bob Moriarty: Exactly. Here's what's crazy, everybody else has got an opinion. Now opinions are absolutely worthless. You go into Starbucks and order a cup of coffee, and say, "Hey, how much does it cost?" "Five bucks and an opinion." "How much is it without the opinion?" "Well, it's five bucks." Opinions are worthless. However, the guys who are in the trade know exactly what it's happening. And I have close contact with someone who runs a precious metal storage place. And when I've got some excess money, I call him up and I say, "Hey, somebody is going to want to sell something soon. When they do, call me, and I'll be a buyer." And I think I've done this like half a dozen times in the last two or three years. And every single time it nails it to the day. And about 10 days to go, he calls out and said, "Somebody wants to sell some big silver bars. Are you a buyer?" And I said, "Yeah."

I'm not smart enough to know when gold and silver top or bottom. However, the people who trade in those commodities can see, on a day-to-day basis, if people are buying or people are selling. So since I'm not smart enough, I guess, cheat.

Maurice Jackson: And if you wish to cheat along with Bob, you're welcome to contact me I am licensed to buy and sell physical precious metals through Miles Franklin Precious Metals Investments where we offer physical gold, silver, platinum, palladium, rhodium delivered directly to your house. We do not sell you a sheet of paper with a claim. We deliver your order directly to you, along with precious metal IRAs, and offshore depository accounts. And you're correct.

One of the things we pride ourselves on Proven and Probable is we don't bring someone on to give us an opinion on what the gold or silver price is going to be at said date, we just use the ratios, a formula that you've taught me, and it makes sense. And that's how you're able to just simply say, "Silver and platinum is on sale." You didn't reference gold in particular, and you definitely didn't reference palladium and rhodium. But anyone listening to our work, go back three, four years ago, Bob and myself, we were foot-stomping rhodium, and rhodium at that time it spiked. It went down to around $590 just briefly, didn't it?

Bob Moriarty: It got cheap. I had talked to somebody and told him to buy rhodium at 1,200 bucks an ounce because it was cheap, and got a call, $700 or so, that said, "You stiffed me. You lied to me. You were dead wrong." And I said, "No, you should be buying more." Tell them what rhodium is now?

Maurice Jackson: $15,200, last time I checked.

Bob Moriarty: Rhodium went from under $600 to $15,200. Now, some people absolutely claim to be gurus. I'm not one of them. You need to look at the silver gurus and the gold gurus and ask yourself, have these guys ever said anything that you could make money from? And the funny thing is some guys have been around for 20 years; there isn't any time the last 20 years you could have made money listening to them because they're going to tell you what you want to hear. I'm not going to tell people what they want to hear. The fact that people get pissed at me means I'm probably correct.

Maurice Jackson: And the important thing is you didn't give a number. I hear this all the time, I get phone calls, "Maurice, did you hear this interview on this other program?" "No, I didn't, because I don't follow my peers in the industry." But they'll tell me about the interview. And the person says, "Silver is going to be at 40 bucks at this certain date." Well, okay, that doesn't mean anything to me. And how many times has that person said that and that's why we don't bring them on this program, but you reference as well, there are other factors you have to look at. What is the ratio between silver and any other metals? And what is the currency doing? That is a big factor because you're using the number $40, which is currency. So what's going on with the currency at the said time?

More factors go into it than just being told that you're manipulated, naked short sales, or the COMEX. There's more to the story, and we like to be objective and provide just empirical evidence.

Bob Moriarty: Actually, there's less to the story. If you keep it simple and understand that somebody's saying gold is gone to $3,000 in a year, it's a meaningless statement. They're telling you what you want to hear. Discard the noise and listen to the signal. You should buy precious metals when they're cheap. You should buy gold stocks when they're cheap. I just provided an example of how you can buy low and sell high on stocks. Somebody would like to make a 1,000% return, all you got to do is sit on your hands until 200 companies are selling for less than the cash they've got on hand, and then throw money at any piece of crap stock out there. In a bull market, even the crap stocks go up. And in a bear market, even the best stocks go down. Don't make it complicated. I'll give you a number, Maurice. Would you like to live in a world if gold is selling at $50,000 ounce?

Maurice Jackson: Well, I would not.

Bob Moriarty: Exactly. All of these guys who are trying to pick numbers and trying to impress everybody with, "Oh God, I listen to this. My gurus said silver is going to $200 an ounce, holy cow, I got to own gold or silver." You don't want to live in a world with $50,000 gold, because what it means essentially, is the economy has stopped, we've had a total crash of the dollar, we're in Zimbabwe terms.

Maurice Jackson: Well, speaking of gold, how about gold Stocks? And there are companies out there that you and I like, that may reward readers. Let's introduce some them now. I like to call them the Dr. Quinton Hennigh companies. Let's begin with Novo Resources Corp. (NVO:TSX.V; NSRPF:OTCQX), what can you share with us?

Bob Moriarty: I have followed NOVO for literally 13 years now. And I said in the first article that I wrote about him in 2012, Novo was going to be somewhere between 10- and a 100-bagger, and so far it's correct. It went from 25 cents to about nine bucks. So far it's been up 3,500%. They're going into production probably the first two weeks of February. They're going to have great cash flow. They have a lot of irons in the fire. They got one of the greatest gold deposits in history. I am in the process of writing the book that's going, to tell the truth, the whole truth, and nothing but the truth. Maybe not all of it, but I will publish that book on the day they pour the first doré bar.

Check our interview with Novo Resources published on Streetwise Reports: (CLICK HERE).

Maurice Jackson: Let's go to Fiji and visit Lion One Metals Ltd. (LIO:TSX.V; LOMLF:OTCQX), which hosts the Tuvatu alkaline gold deposit.

Bob Moriarty: There are eight alkaline gold deposits that I'm aware of in the world. They have anywhere from 5 to 20 million ounces. Lion One has 100% ownership of one of them in Fiji. They had extraordinarily good results. They've got kind of an interesting situation. They believed that what they needed to do was get into production as fast as possible, so they came up with a plan and they're actually permitted to go with production.

But they were trying to do things cheaply, and they bought some used drills. You just can't do that in the mining business. Walter Berukoff the CEO has done a great job of raising money. It's got about $65 million in the treasury now. Quinton Hennigh is an advisor to them. They're drilling deep, they're coming up with extraordinary intercepts. Because it's been no news because of the assay labs being dilatory, the stocks dropped from about four bucks to I think about a buck 60 right now. And it's cheap.

Maurice Jackson: Let's go to British Columbia and visit the Exodus Gold Project, and then down in Nevada with the Slumber and Sandy, and that's with NV Gold Corp. (NVX:TSX.V; NVGLF:OTC) and Peter Ball.

Bob Moriarty: I have known Peter for a long time and he's a very qualified guy. Quinton is again an advisor. I don't know very much about their BHC Project, but I know they're moving forward on that. And they've got some good projects in Nevada, and they're fixing to drill the Slumber Project. They are in the home run country, and you could fail nine out of 10 times and still be a 10-bagger.

Check out our interview with NV GOLD published on Streetwise Reports (CLICK HERE).

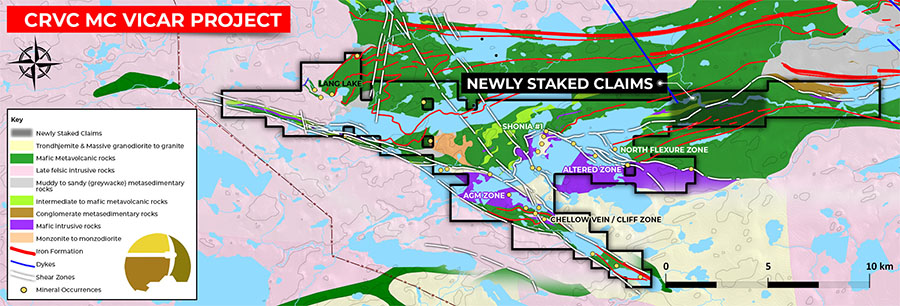

Maurice Jackson: And the team that they have, just the investors, the intellectual capital they have on NV Gold, it's remarkable. It's second to none. All right. Let's switch over to Greg Johnson in the Metallic Group of Companies. And let's begin with an interview we recently released on Streetwise Reports (CLICK HERE). And that's on Group Ten Metals Inc. (PGE:TSX.V; PGEZF:OTCQB; 5D32:FSE) out of Montana at the Stillwater West and Michael Rowley.

Bob Moriarty: That's a really interesting situation because they have the mirror image of the Stillwater deposit. And that Stillwater mine is actually in production. It's an extremely valuable asset. They don't get much credit. Platinum is cheap, but palladium is like $2,100 bucks an ounce right now. And Stillwater is very palladium rich, so they should be getting a lot more credibility than they actually have. It would absolutely be worth listening to the interview.

One of the first companies that I wrote up was NovaGold, and NovaGold only had five employees at the time. And of course, Greg was one of them. I think Greg's bright. He's very bright. He's running three companies, he's got the platinum company, he's got a copper company, he's got a silver company, and they are all exceptionally well run in a great district. They are going to be beneficiaries of what I believe it's going to be the biggest gold rush in history.

Maurice Jackson: Speaking of a 10-bagger, Metallic Minerals Corp. (MMG:TSX.V; MMNGF:OTCMKTS), which is the silver company, has done just that. But let's go right back to Group 10 Metals there. So, palladium platinum results just got released, 11 grams per ton. Nickel at 0.7%. And they just completed their 2020 exploration program. They did some mapping, sampling, and the IP survey is going to be coming out 6 grams per ton on rhodium. That's remarkable. The market is just ignoring these guys.

Bob Moriarty: 6 grams per ton of rhodium, let me think about this. That is a fifth of an ounce, so that's almost $3,000 a ton.

Maurice Jackson: Group Ten Metals is a growth stage exploration play. Every press release is just been remarkable. They're doing a great job. Let's switch now to the silver company we just referenced and that is Metallic Minerals. Take us there, please.

Bob Moriarty: Metallic Minerals is one of the richest silver districts in history the Keno Hill Silver District. They're moving forward. And if you like silver, you absolutely have to like the very few true silver companies, and they've got it.

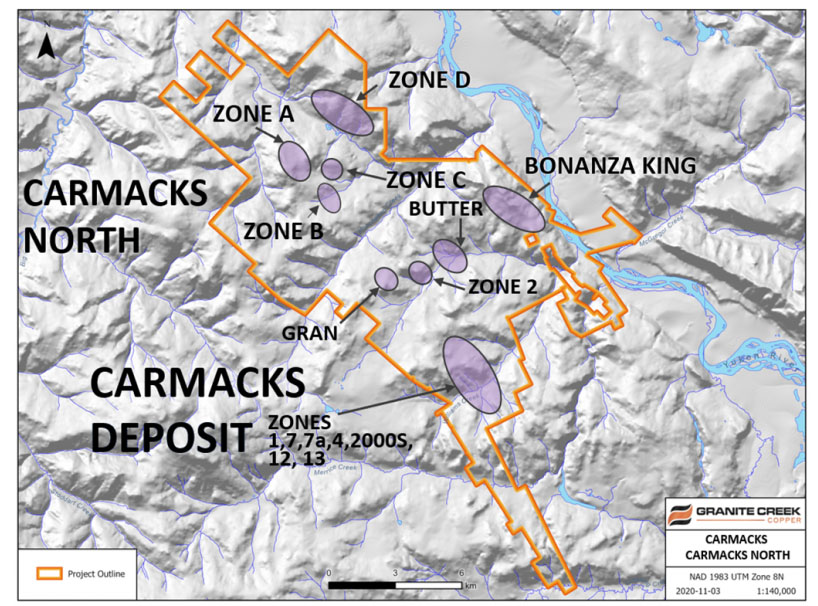

Maurice Jackson: All right, let's finish up with the third company, in the Metallic Group, and that is Granite Creek Copper Ltd. (GCX:TSX.V; GCXXF:OTC).

Bob Moriarty: It's copper. I'm kind of mixed emotions about electric vehicles. There's a lot we're not being told. Wind power and solar power tend to be a 3% solution, so we pay a lot of attention to it, but it isn't necessarily valid economically. When a wind turbine wears out, it's incredibly destructive to the environment, because you can't do anything with those wind things, they're carbon. They create a big mess. I'm not a believer in alcohol from corn or wind power or, so far, solar power. They sound good, but they're feel-good solutions. They're 3% solution solutions. Of course, nobody wants to tell you that, because they want you to invest in it.

However, if you believe that electric vehicles are the future, then we're going to have the biggest damn shortage of copper you ever saw. And anybody who's in copper, it is going to have substantial demand now. Copper is about three bucks a pound, it's been as high as four and a half bucks now in the last 10 years. You're going to see some substantial increase in the value of copper if electric vehicles are what they're told. And I could tell you, I believe it, but a lot of people do.

Maurice Jackson: The research we've conducted, the world is going to consume more copper in the next 25 years than all of recorded history combined. And then you take a look at the Granite Creek Copper, they're in the rich Minto Copper district. They have oxide versus sulfide, that's important to note to that story. Oxide versus sulfide. And they just made an acquisition with Copper North on the Carmack deposit. There's some good stuff going on there on GXC!

Bob Moriarty: You said something important for readers to note. Oxide versus sulfide copper. Oxide is so much cheaper to process. If you have an oxide copper deposit you could throw pieces of iron scrap in a little pond, and put in some acid and the copper will plate the iron. Copper moves easily to iron. It has an affinity to iron so it's very, very, very cheap and easy to permit and to actually process. If you've got sulfides, you've got a float this stuff, and the old process is a lot more complicated, it's a lot more expensive. Oxide silver projects and they're not the only one. Keith Barron’s got an oxide silver project in Ecuador and Peru. My preference is always is an oxide deposit.

Maurice Jackson: Check our exclusive interview recently with Granite Creek Copper published on Streetwise Reports: (CLICK HERE).

And again, some brownfield plays, all of the Metallic Group companies are brownfield plays in good mining jurisdictions, which is important to note because a lot of the copper companies are not.

All right, let's go to Saskatchewan and visit Tim Termuende of Taiga Gold Corp. (TGC:CSE; TGGDF:OTCBB) where they just had a breaking news release on the Fisher Project where SSR just announced a 60% earning interest in a joint venture on the Fisher Project, and that also starts the clock one year from today on an additional 20% interest with $3 million in cash. And keep in mind here that Taiga retains a 2.5% net smelter returns royalty on the Fisher Gold Project, which is along the Trans-Hudson Corridor. It's loaded with potential, in an area that just hasn't had much attention due to the laws there in the past.

Bob Moriarty: It's totally off subject, but it's a good project. That deal, by the way, is an exceptional deal, because Taiga is getting $800,000 reimbursed, and will get another $3 million handed to them a year from now. Do you remember what the original name of SSR was?

Maurice Jackson: Oh, it slips my mind right now.

Bob Moriarty: Silver Standard Resources.

Maurice Jackson: That's it.

Bob Moriarty: Silver Standard was one of the greatest stories of the early 21st century because they had invested in dozens of silver projects, they were picking up ounces of silver for two and three cents an ounce. In the bull market that ran from 2001 until 2008, companies were getting $1, $2, $3 an ounce. Silver Standard made out like a bandit. And some bozo came up and said, "We need a better name." So SSR stands for Silver Standard Resources. They took one of the greatest names in mining and they turned it into SSR Mining. God, I hope they fired that guy.

Maurice Jackson: Check out our interview with Tiaga Gold on Streetwise Reports: (CLICK HERE).

Well, one more little caveat to the deal as well is that there will be no exploration costs here for Taiga, which' is a spin-out of Eagle Plains, I know they're a partner of 321 Gold and Tim Termuende there. But Taiga has implemented the concept of a project generator, brought in a joint venture partner, that joint venture partner is going to do all the drilling, at no cost to the shareholders. It's a good business acumen.

Bob Moriarty: And the stock is especially cheap.

Maurice Jackson: All right, let's go visit Judson Culter, Rover Metals Corp. (ROVR:TSX.V; ROVMF:OTCQB) at the Cabin Lake Gold Project. They just announced some drill results where they twinned a historical Cabin Lake Gold Project there.

Bob Moriarty: This is one of those interesting stories that you need to pay attention to very closely. They haven't discovered anything, but what they have done is they have duplicated what they believe was there. Rover has gone from a historical resource into a real resource. They had 22 meters of about 8 grams of gold. Eight-gram gold is worth about $440. So, $440 times 22 meters is great. Rover Metals has a market cap of under $6 million.

To have those kinds of numbers, they duplicated what they believed was there. There were twin holes. This is not a new exploration. They're not step-outs, they're not in-fills, they're twinning what they believe was there. But what they believe was there was accurate, and now they're going to go into phase 2 program in early 2021. They're going to start adding ounces. When you got a gold company worth six million bucks, that's pretty damn cheap.

Maurice Jackson: Rover is under 10 cents right now. This is a company to definitely take a look at. And again, it's Rover Metals, Judson Culter. And the symbol is ROVR.

Check out our interview with Rover Metals on Streetwise Reports: (CLICK HERE).

And onto our last company, how about Shawn Khunkhun and the work he is doing at Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCMKTS), what can you share with us?

Bob Moriarty: I love Dolly Varden. Dolly Varden, some company names are just great names. Dolly Varden was one of the greatest silver mines in Canadian history. Dolly Varden Silver is up in northern BC. They are surrounded by majors and mid-tier companies. I believe someone is going to have to do a deal with Dolly Varden, and I think it will be very favorable for Dolly Varden shareholders. Now, whether Dolly Varden takes somebody else's project over, or somebody does a deal with Dolly Varden, I think they're going to do very well.

Now, here's how you can make a lot of money. I've said it 100 times, and you're going to hear it 100 times more, buy things when they're cheap, sell them when they're expensive. In March, when everything crashed, Dolly Varden got down to 16 and a half cents. In August, when silver and gold topped, it got up to $1.17. So you had about 700% increase. If you weren't smart enough to buy it when it was cheap, nothing changed about the company. Just because some market panics, doesn't mean you have to panic. You could have made this up 100%. It has corrected. That is a healthy thing. It is not a sign of, "Oh my god, they're dumping silver, it's a conspiracy." That's bull. Stocks go up and stocks go down. Stock went from 16 and a half cents to $1.17, then it corrected. It's 84 cents now, that's a healthy thing. It is ready to move higher.

Maurice Jackson: In all fairness, we forgot to reference Granite Creek Copper. They were at three and a half cents and jumped up to 17 cents. So three and a half cents, I want to say it was May, and they've recently reached 17 and a half cents. These are the companies we've been sharing with you. Bob and I have shared the same names. It seems like the thesis and price don't seem to match for somebody. They sell at the wrong time or they buy at the wrong time. Listen to the interviews and just listen to what the gentleman just shared. He said, "Buy low and you sell high." It's that simple. And we're looking for some type of additional narrative to qualify why we sold at the wrong time or bought at the wrong time.

And I do want to share, I forgot to reference this as well, ladies and gentlemen, I'm going to be doing an interview exactly in about an hour with Taiga Gold and Tim Termuende, so look forward to that interview right after this interview. And last week, we just interviewed Rover Metals, and the week prior, NV Gold. So take a look at our website. All those interviews are there, and, Bob, I do appreciate the fact that you share them with your subscribers as well.

In closing, give us any last parting words. My favorite question always is, what keeps you up at night, and what did I forget to ask? So I'll leave that to you, sir.

Bob Moriarty: One other thing that I do want to comment on. I think that if you buy ‘Nobody Knows Anything’ and or Basic Investing in Resource Stocks, depending on whether you're in Canada or the UK or France or the United States, it's like $25 bucks. If you cannot afford 25 bucks to buy both of those books, you have no business in resource stocks. They are good books. They give excellent advice. Don't believe me, read the hundreds of reviews, including a lot of people who say they were the best books on investing they've ever read.

Maurice Jackson: It's interesting you reference that. And I second that. I do not benefit financially from anyone purchasing these books, but I want to foot stomp, just as I referenced Common Sense 2.0, of which I have benefited financially and intellectually. My kids read both of the book you just referenced. My twins are 10, and we were discussing the word contrarian. It seems like for some reason it resonated with them. The mass psychology of how we were on the interstate last night and there was an accident.

They were referencing how everybody has to stop and stare, and how the crowd just emulates one another, why not just take the exit and go a different route? It seems like that just resonates with them, and when they talk about contrarian, they reference Nobody Knows Anything. That was just last night. And here you are referencing it. Don't follow the crowd, go a different path.

Bob Moriarty: Well, there are things that we know, we just don't know that we know. We've got to ask the right questions. You don't have to know anything about resource stocks, but you can make money if you can learn to think for yourself and ignore everybody. Less, it's your money. If I get really bad advice, and you follow it, it doesn't hurt me, it hurts you. If I give good advice, I don't expect a commission. You're making decisions for your future. And if you think that there's somebody you can go to and you can pay money and everything he tells you, it's going to be correct, it ain't going to happen. I've been looking for that guy for 70 years, and I can't find him.

Maurice Jackson: Well, add on 45 years here. So, yeah, combined years, we haven't found him. I trust that you're one of the most reliable, trusted sources that I can find out there, so thank you for all your time and your expertise. And Bob, if somebody wants to find out more about your work, please share the website address.

Bob Moriarty: It's 321 Gold and 321 Energy. We're fairly quiet on 321 Energy right now because nobody cares about energy. But the central banks of the world have pretty much murdered fiat currencies, and that's not a good thing. It's a bad thing. But you can buy an insurance policy on government stupidity, even as you observe the stupidity. And that's all gold, silver, platinum, and rhodium stock bar. They're just a bet on government stupidity.

Maurice Jackson: Ladies and gentlemen, if you're looking to purchase any gold or silver or platinum or palladium or rhodium, give me a call at 855-505-1900 or you may email [email protected]. And again, that is physical delivery to your house.

Bob Moriarty of 321 Gold and 321 Energy. Thank you for joining us today on Proven and Probable, wishing you the absolute best, sir.

Bob Moriarty: Very good. Thank you. It's been fun.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Lion One Metals, Novo Resources, Taiga Gold, Granite Creek Copper, Group Ten Metals, Metallic Group of Companies, Metallic Minerals, NV Gold, Rover Metals and Dolly Varden. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Lion One Metals, Novo Resources, Taiga Gold, Granite Creek Copper, Group Ten Metals, Metallic Group of Companies, Metallic Minerals, NV Gold, Rover Metals and Dolly Varden are sponsors of Proven and Probable. Proven and Probable disclosures are listed below.

2) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Lion One Metals, Novo Resources, Taiga Gold, Granite Creek Copper, Group Ten Metals, Metallic Group of Companies, Metallic Minerals, NV Gold, Rover Metals and Dolly Varden. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Lion One Metals, Novo Resources, Taiga Gold, Granite Creek Copper, Group Ten Metals, Metallic Group of Companies, Metallic Minerals, NV Gold, Rover Metals and Dolly Varden are advertisers.

3) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Lion One Metals, Metallic Group of Companies, Metallic Minerals, Granite Creek Copper, Group Ten Metals, Dolly Varden. Click here for important disclosures about sponsor fees.

4) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

5) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Lion One, Metallic Minerals, Group Ten and Granite Creek Copper, companies mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.