Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT), throughout its 20-year history, has focused on buying assets with exploration upside in low-risk jurisdictions during down times and selling noncore assets during good times, using the proceeds to fund exploration at its larger and more advanced projects, thereby minimizing equity dilution. This strategy has paid off; its flagship KSM project located in the center of British Columbia's Golden Triangle boasts a Proven and Probable reserve of 38.8 million ounces of gold plus 10.2 billion pounds of copper, and a 50-year mine life. The Courageous Lake project, in Canada's Northwest Territories, holds a reserve of 6.5 million ounces of gold. The company has a tight share structure, with 66 million shares outstanding fully diluted.

"We came away impressed with the potential at KSM and believe the growing resource base provides optionality to an incoming JV partner." - Joe Reagor, ROTH Capital Partners

Rudi Fronk, CEO of Seabridge Gold, explains the strategy, "When we took over the shell in 1999, there were 17 million shares outstanding. We increased that to 27 million over three years to buy assets, so by the end of that period, we had roughly half an ounce of gold per share, 15 million ounces gold and 27 million shares. As the gold price then started to move higher, we realized that finding accretive acquisitions was going to be difficult, so we turned to the drill bit, first at Courageous Lake and then at KSM, and we were able to deliver significant growth in mineral resources. We also sold some assets at the top of the market. One property that we purchased for around $4 million and put $1 million into it, we sold a year later for over $35 million in cash."

That cash Seabridge deployed into Courageous Lake and KSM thereby minimizing its need to issue new shares. The company's rule of thumb is to grow ounces of gold in the ground faster than shares outstanding.

KSM is Seabridge's flagship; the company has spent about $250 million over the past 13 years defining "the largest undeveloped gold project as measured by gold reserves," Fronk stated. It is shovel ready and has completed its preliminary feasibility study and has its environmental approvals in hand. When Seabridge bought the property in 2000, there was little infrastructure. There is now a major highway just east of KSM, and governments of Canada and British Columbia have spent $700 million extending the power grid. Seabridge has preliminary agreements in place with BC Hydro to buy 250 megawatts of power from this line for about 5 cents a kW hour. And at the town of Stewart, two new port facilities make it possible to transport supplies year round, Fronk stressed.

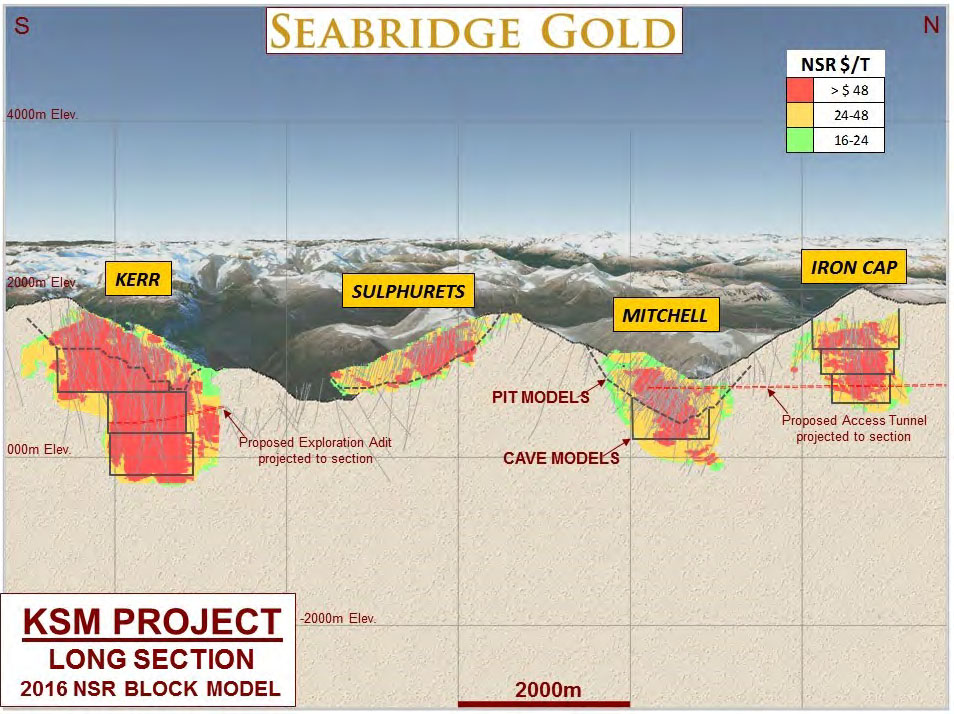

The tailings capacity at KSM has been approved for about 2.3 billion tons of material; the company is playing around with mine plans to maximize the financial returns with that capacity. The Deep Kerr and a new zone under Iron Cap are higher-grade than the average reserve grades, and changing some open-pit mining to underground also saves on waste rock. An alternative mine plan Seabridge released in 2016 still captures around 40 million ounces of gold, but increases copper from 10 billion pounds to 17 billion pounds, and drops the cost per ounce of gold from $671/ounce to $359/ounce. The company expects to release a new mine plan next year and anticipates a further reduction in costs as higher grade zones are integrated into it.

The huge size of the project is daunting for a small company. "We admitted very early on that KSM is beyond our capabilities, so we have been searching for a partner. There are maybe only seven companies in the world today that have the technical, the financial and the social license to build a mine the size of KSM. We continue to speak with potential joint venture partners for both the gold and the copper side, and we have turned down several proposals over the past five years. Our view is we only get to do this once and it's got to be with the right partner with the right terms," Fronk explained.

"This is a project that up and running at today's metal prices will generate about $1.5 billion of cash flow a year for the first ten years of mine life," Fronk stated.

ROTH Capital Partners covers Seabridge. In July, analyst Joe Reagor, after visiting KSM, wrote, "We came away impressed with the potential at KSM and believe the growing resource base provides optionality to an incoming JV partner. . .Our most significant takeaway from the KSM tour was that as the resource base has grown the project has gained optionality as to the timing and method of development. . . we came away with renewed confidence that SA will attract a JV partner for KSM in the coming quarters."

Seabridge also has the Snowstorm project in Nevada, which sits at the intersection of three prolific gold belts, the Getchell Trend, the Carlin Trend and the Northern Nevada Rift Trend. South of the project lie a number of producing mines, including Twin Creeks and Getchell, two of the mines that form the basis of the recent joint venture between Barrick Gold and Newmont Goldcorp. "We believe that the potential at Snowstorm is similar to what the potential was at Getchell when Placer Dome bought that outfit in the 1990s," Fronk stated.

The aim of this year's drill program at Snowstorm has been to confirm the geologic model. "I can say that what we've seen so far has confirmed the model and we look forward to what comes next. We'll have subsequent programs over the next several years," Front stated.

ROTH analyst Joe Reagor, after visiting Snowstorm in October, wrote, "We believe there is potential for the company to make a significant discovery on the project. . . While we believe the project is well located and that SA has a significantly better handle on the geology than the prior operators, we also believe it would be unreasonable to expect a discovery in the near-term. . . we believe it is in the company's best interest to take a slow and steady approach to drilling the project."

On the macro side, Fronk firmly believes that gold is going higher. "Many people believe that gold is doing a nice bottoming process right now from its recent highs and is poised to go substantially higher," Fronk stated. He points to global debt of about $260 trillion, compared to a world economy that only generates GDP of about $80 trillion. "That's more than 300% debt to GDP, which is at record levels on any measure throughout history. In addition, global equities are now about $80 trillion, and a lot of the high debt and equity values in our opinion have been driven by central bank policy of easy money over the past decade or so."

"Our belief is that the coming recession will pop the credit bubble, generating defaults, corporate and potentially sovereign, creating unemployment, then huge government deficits, and central banks will try and prevent this collapse by aggressive monetization. As a result of that, we foresee currencies falling really hard and gold will soar."

Seabridge shares have outperformed gold by more than five to one. While gold has risen 433% from 2000 through October 2019, Seabridge's shares have increased 2,324% during that period.

ROTH analyst Joe Reagor wrote in September, "We believe a rising gold and silver market should benefit the company and could help the company attract a JV partner. . . Additionally, we believe the company could take advantage of rising precious metals prices and divest of non-core assets."

ROTH has a 12-month target price of US$17 on Seabridge. The company's shares are currently trading at around US$12.42. Insiders own over 30% of common shares, while institutional investors, including National Bank, Century Management, Van Eck, Weiss, TD Bank, Sprott, Fidelity and Paulson & Co., own about 25% of common shares. Seabridge has no debt and more than $20 million in working capital.

Seabridge Gold Website.

Seabridge Gold Mobile site.

KSM Project.

Read what other experts are saying about:

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Seabridge Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Torchlight Energy, a company mentioned in this article.

Disclosures from ROTH Capital Partners, Seabridge Gold Inc., Company Note, October 16, 2019 and July 15, 2019

Regulation Analyst Certification ("Reg AC"): The research analyst primarily responsible for the content of this report certifies the following under Reg AC: I hereby certify that all views expressed in this report accurately reflect my personal views about the subject company or companies and its or their securities. I also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

ROTH makes a market in shares of Seabridge Gold Inc. and as such, buys and sells from customers on a principal basis.

ROTH Capital Partners, LLC expects to receive or intends to seek compensation for investment banking or other business relationships with the covered companies mentioned in this report in the next three months.