Gladiator Metals Corp. (GLAD:TSX; GDTRF:OTC) recently announced promising drilling results from its Cowley Park program within the Whitehorse Copper Belt, Yukon, demonstrating high-grade copper mineralization. Two new drill holes, CPG-045 and CPG-049, returned significant intercepts of copper and associated minerals, notably 26 meters at 3.31% copper (Cu) within a broader intercept of 79 meters at 1.37% Cu in CPG-049. The CPG-045 hole similarly yielded 38 meters at 1.01% Cu, including 12 meters at 1.73% Cu and a higher-grade section of 4 meters at 2.50% Cu. These holes confirm mineralization continuity, a vital component in resource estimation, with consistent copper grades and associated elements such as molybdenum, gold, and silver across intercepts.

Jason Bontempo, Gladiator CEO, commented in the news release, "These results at CPG-049 and CPG-045 confirm our belief that copper mineralization including molybdenum, gold and silver at Cowley Park continues near surface, is high grade and remains open along strike and down dip in all directions with significant resource expansion opportunities both within AND outside the area of historic drilling. I am very much looking forward to receiving results from the 28 remaining drill holes from this summer's program over the next two months."

The drilling strategy has involved twin holes and shallow infill drilling. The focus is on expanding known mineralization along a 220-meter down-plunge zone in CPG-049 and other significant mineralized extensions. Gladiator has now completed 34 drill holes covering 6,104 meters in Cowley Park. This program aims to validate historical data, test new high-grade skarn targets, and assess the broader economic potential of the area. Gladiator has stated that additional assay results from 28 drill holes are expected soon. That could further elucidate the continuity of mineralized zones at Cowley Park.

Digging Into Copper

As Ahead of the Herd reported on October 5, the copper market had recently experienced a surge, with prices climbing to US$10,000 per tonne (US$4.53/lb) at the end of September. This rise reflected heightened market confidence in copper's role as demand for the metal increased across sectors. The ongoing energy transition and anticipated infrastructure expansion were also expected to drive long-term demand, with BloombergNEF forecasting an investment of US$2.1 trillion to support raw material needs through 2050.

In an October 18 video, Jeffrey Christian from CPM Group described a positive outlook for copper. He underscored the metal's "bright future" in both the short and long term. Christian pointed out that strong economic performance in key markets like the U.S. and Canada, alongside increased investor interest in copper, had driven prices higher throughout 2024. While noting a temporary market surplus, he anticipated a significant supply deficit by 2026 due to the energy transition's high copper demand, which he expected would ultimately lead to stronger prices over the next several years.

According to Precedence Research's Copper Market Report, global copper demand has been bolstered by growth in electric vehicles. With copper now integral to motors, wiring, and charging infrastructure, it has become linked to this emerging market. Additionally, with a 5.11% compound annual growth rate projected over the next decade, the report emphasized that copper's applications in high-tech industries and infrastructure would continue to fuel its market resilience.

What's Driving Gladiator

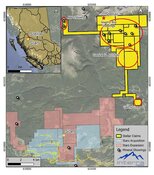

According to Gladiator Metals' September 2024 investor presentation, several key catalysts are expected to support the company's exploration efforts and position in the copper exploration sector. Cowley Park is part of the Whitehorse Copper Belt, known for its 35-kilometer copper-gold mineralized belt in Yukon, Canada, a Tier 1 jurisdiction with established infrastructure. Gladiator's high-grade targets at Cowley Park are supported by year-round accessibility and cost-efficient resources, including a skilled local workforce, hydroelectric power, and proximity to Whitehorse, which may help reduce production costs and environmental impact.

With more than 300 historical drill holes confirming copper-molybdenum mineralization over a 700-meter strike, Gladiator's current program seeks to extend mineralized zones both laterally and at depth, leveraging untested anomalies and previously identified targets. These plans include extending existing resources within Cowley Park and exploring additional high-grade trends, including the Arctic Chief and Cub trends, which, according to Gladiator, are expected to enhance the company's overall copper resource profile.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Gladiator Metals Corp. (GLAD:TSX;GDTRF:OTC)

Ownership and Share Structure

According to Reuters, 15.96% of Gladiator Metal's stock is held by management and insiders. Howard Coyne owns the most with 10.50%. Director Darren Devine has 1.34%, Director Shawn Khunkhun has 1.67%. CEO and Director Jason Bontempo has 1.47%. Director Ian Harris has 0.77%.

Institutions hold 4.25%.

The rest is held by retail investors.

According to Market Watch, as of October 3, Gladiator Metals had a market cap of US$14.8 million, CA$19.95 million (on Canadian ticker), with 46.4 million common shares outstanding. It trades in the 52-week range between US$0.1679 and US$0.4600, CA$0.26 and CA$0.51.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Gladiator Metals Corp.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.