Yes, we are still in a bull market for gold, but you wouldn't know it.

KEY POINTS

Gold

- Breached support again

- Major support not too far below

- Gold in most currencies at or near all time highs

Gold Stocks

- Volatility is this sector

- Sentiment still very low

- Back into support

ASX Gold Stocks

- Still working through that RHS

Palladium

- Gets hammered

- Back into long term support

- Sentiment worse than 2015 before subsequent 500% rise!

Stock Markets and Currencies

- S&P 500 about to surge

- Bond rally to pickup steam?

- US$ about to surge?

- Yen teetering

- Nikkei about to surge

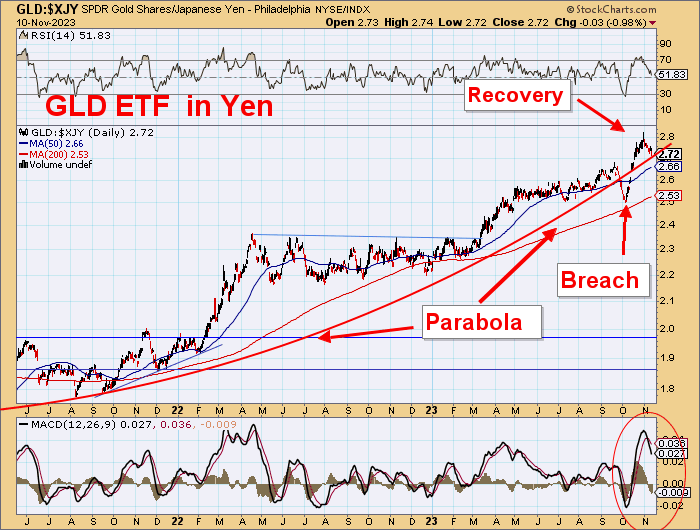

- Yen Gold at all time highs

- EURO about to crack as well?

- Gold in Euros about to surge

- German DAX near all time highs

- French CAC in strong uptrend

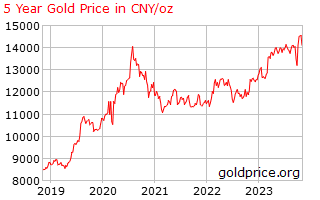

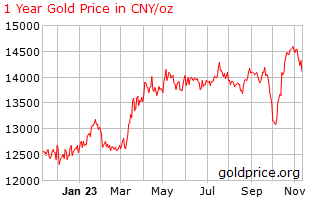

- Yuan still weak

- Shanghai about to surge?

- 17 year downtrend meets 32 year uptrend

- What a wedge!

- Gold in Yuan near all time highs

- back to key support

- All Ords in support

- About to run higher?

- Gold in A$ near all time highs

- A$ holding on downtrend

- Pankind walkathon for Pancreatic Cancer on 19 November

- Support Sonia Cottee in Canberra walkathon fundraiser

Gold continues to frustrate the bulls and continue to depress small-cap investors in a microcosm that is totally at odds with actions in other world markets.

Gold in most currencies has been making new all time highs and seems ready to run much higher.

That is what you would normally call a bull market!

But you are not feeling it. Sentiment is still so poor. The major currencies seem on the edge of another big decline. The Yen and Euro look very weak, and even small declines from here would suggest major breakdowns ahead.

Economic fundamentals ( whatever that means nowadays) are deteriorating, but stocks are heading higher and seem to want to run very hard to look over the valley and beyond the horizon.

The Israel/Hamas conflict gets stranger by the day, with journalists `embedded' in the Hamas adventure and the roles being challenged everywhere.

What to believe?

Heed the markets indeed.

What are they telling us?

Apart from yet another US$20 slapdown.

I'm still thinking about this a-b-c pull back into support.

Signs of powerful internal character in gold.

It could come down another US$20.

A lot of long-term support here.

That May 2023 downtrend is there.

And horizontal support.

Another US$20 lower would backtest the breakout and support on that downtrend.

What can you say about this after that fabulous 6% gain on the previous Friday?

Newmont hit the bottom of this wedge.

This ratio goes back to the lower edge.

Really oversold.

Silver

- Still building up pressure

- Will break to the upside soon

- Soonish

Palladium

- Hammered!

- Five waves down after an irregular `b' wave

- Sentiment as low as 2016 at US$500/oz

- 2016-2022 gave 500% gain!

Keep in mind the bigger picture is still looking positive for the mining sector.

Currencies, gold, and stock markets.

Is there a pattern here?

US$ is universally expected to crash, but it hasn't yet and just might not.

Still expecting 155.

- Bonds are in the early stages of a big rally

- Five waves down completed

- And an island reversal

S&P 500 Breaks Downtrend

- 4600 soon

- 4800 by year end?

The other currencies tell a slightly different story.

Weak currencies, strong local gold prices, and stock markets that could really surge.

Japanese Yen

- At very critical stage

- Very ugly chart

- Below the Devil's Number

Gold in Yen

- Small pull back from all time highs

- Heading much higher

Japan stock market

- About break 7-month downtrend

- Set to surge much higher

Euro

The Euro broke a 50-year uptrend and provided a goodbye kiss backtest before falling away again.

Closing below 105 would crack the Euro.

Gold in Euros is heading higher in a strong uptrend.

Backtesting 2022 downtrend.

German DAX is just off all time highs.

French CAC is just off all time highs.

Chinese Yuan

- Heading lower

Gold in Yuan

- Has pulled back from all time high

- Into major support

Shanghai Stock Market

- Is this about to surge as well?

- Same level as 2009

- 17 year downtrend just about to meet:-

- 32 Year uptrend

- What a wedge!

Australia

AU$ is weak, but it is holding onto a 12-year downtrend.

AU$ gold is heading higher.

All Ords holding onto uptrend.

The 7700 resistance seems more important to watch than the 15-year uptrend.

Sonia Cottee

A dear friend in Canberra with Stage 4 Pancreatic Cancer.

Walking on November 19 for Pankind — supporting research for Pancreatic Cancer.

Would you like to support a very brave lady?

PYFD 2023 - Canberra | Walk with Soni (putyourfootdown.org.au)

| Want to be the first to know about interesting Gold, Critical Metals, Base Metals and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.