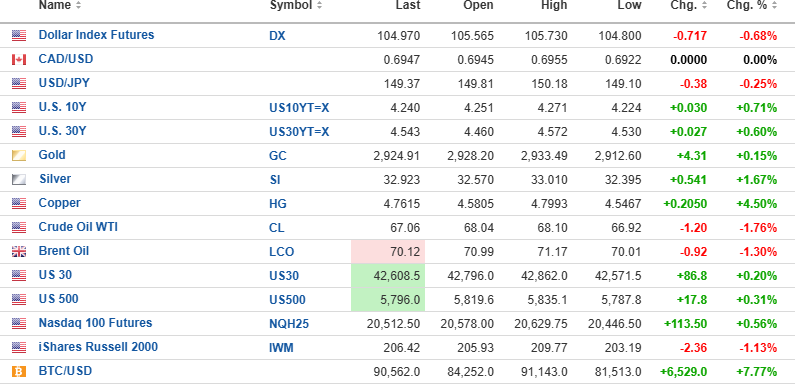

The U.S. dollar Index futures are lower by 0.717% to 104.970, with the 10-year yield up 0.71% to 4.24% and the 10-year yield up 0.60% to 4.543%.

Gold (+0.15%), silver (+1.67%), and copper (+4.50%) are all up, but oil (-1.76%) is lower.

The DJIA futures (-0.20%) are up 86.8 points; the S&P 500 futures (+0.31%) are up 17.8 points; and the NASDAQ 100 futures (+0.56%) are up 113.50 points.

Risk barometer Bitcoin is up 7.77% to $90,562, with intraday volatility rising sharply.

Stocks

No fewer than three of the services I monitor are all preaching the "Buy the dip" mantra this morning, as yesterday's lows might be construed as a "successful test" of the 200-dma that sits right around the $568.74 level for the SPY:US.

With RSI going out at 33.61 and the MACD and MFI readings now also fully oversold, the decline yesterday matured from "gradual" to "vertical," with everything getting chucked overboard as margin calls flooded the airwaves.

President Trump spoke to the House of Representatives last evening and went on for an hour ranting and raving about his "amazing" presidency after only six weeks and how he is the second-best president "ever," with only George Washington ranked above him.

The term "malignant narcissist" comes to mind whenever I hear Trump talk, and while his policies are to be applauded with a particular standing ovation for his attempt to "drain the swamp," his positions on tariffs and government waste and corruption are going to have a grave impact on both corporate earnings and civilian employment.

The last time the SPY:US broke below the 200-dma was in late October 2023 at around the $412.50 level, but it was very brief and resulted in a 15-month advance that stayed well above the 200-dma until yesterday.

Although the market held the 200-dma, it will take very little selling pressure to take the price below the 200-dma and the RSI below 30. S&P 500 futures were up over 30 points shortly after the Trump address to Congress but are up less than a third of that this morning.

The SPY:US was down over $3.00 at 3:30 pm yesterday, so I refrained from putting on any of the calls mentioned in the late afternoon alert. This morning, I am going to stand aside and focus on buying back the volatility position if stocks can muster up enough strength to launch a tradable rally into oversold conditions.

My instincts tell me that in order to set up the next rally, there needs to be more pain, and only a crash in the RSI down to 20-25 and a big violation of the 200-dma will inflict that type of pain. Rallies from here will beg to be sold, so stand aside for now.

Gold

April gold futures are acting very well, having recovered over $75/oz from the late February low of $2,847.50. One sign of a strong market in anything is when it can shrug off bad news and forge higher. Gold is often held as a "risk on" asset, so when tariffs and fiscal austerity threaten to derail growth, it is supposed to have a deflationary effect on the precious metals.

We saw that during the COVID Crash (2020) and the Great Financial Crisis (2008) as crashing stocks forced those in need of liquidity to sell their gold hedges, causing a freefall in gold and silver as "risk asset" get liquidated. Into what has been a 6% drawdown in the S&P 500 from the peak, gold closed a mere 1.68% off its all-time high of $2,974, meaning to me that it is diverging from the decades-long habit of being 100% correlated to stocks. Back in the 1980s, gold always moved opposite to stocks, so perhaps we are witnessing a reversion to that era.

I hold a modest position in the GLD April $265 puts from $4.35. They went out at $3.65 after the $2.32 advance in the GLD:US yesterday, but the $8 gain after the Trump speech is now a $1.25 drop with the opening bid-ask at $267.70-267.75 against yesterday's 4 pm close at $269.04.

As you can see from the gold chart, all the indicators are pointing to lower prices. However, I see it as a much-needed correction (Don't you just hate that term?) within a powerful bull market. Needless to say, I will not hold those GLD April $265 puts for much longer as the $3k level is a no-brainer breakout in due course.

In the GGMA 2025 Trading Account:

- Ø 25 contracts GLD April $265 puts at $4.85.

I will need a move to the $265 level to get my sell price but based on the technical set- up, I think it is inevitable.

Copper

No comments other than this chart.

Something is happening in the copper market that currently eludes me, but it looks spectacular! (Go Fitzroy!)

Fitzroy Minerals Inc.

Fitzroy Minerals Inc.'s (FTZ:TSX.V; FTZFF:OTCQB) assays from the Caballos drill hole reported on February 10 are due to arrive in the hands of management in about another week or so. These are the "check assays" sent to Lima as opposed to the first batch that was tested in Santiago.

They wanted a broader scan on the minerals present in the core and could only get that kind of testing facility in Lima, which means they had to go through customs and whatnot, creating a minor delay.

I only mention this because it is yours truly that loves to use the phrase: "Good news comes on an express train; bad news comes on a Missouri freight barge." I assure you that the assays from Caballos will arrive on the Shinkansen Bullet Train once the testing has been completed.

The last thing I want to learn is that subscribers have taken this pause in the news flow as a negative and been panicked out of their Fitzroy stock. Be patient and add to holdings where applicable. This "quiet period" is our friend.

| Want to be the first to know about interesting Base Metals, Critical Metals and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.