Last week I told the world that I would never again try to short gold even as a hedge against the legions of junior gold miners currently springing to life in my heretofore unsightly portfolio. Stack after stack of Gideon's Bibles lay before me where I swore upon them that I would refrain from buying as much as thimble full of GLD:US put options. However, with the Sword of Damnation hanging perilously over my head, I relented to temptation and took out a modest position in those evil put options, immediately expecting that seeing my frailties, gold would spring to action and vault northward thereby rendering my foolish endeavour into the "Dark Side" (of gold shorting) an exercise in capital erosion, as has happened oh-so-many times in the past five years.

Recalling my words from a week ago — "The price action since last December has been thoroughly remarkable to the extent that the GLD:US shown above is still a full $7.15 above the now-vertical 20-dma which sits at $263.59. The 200-dma is now $33.93 below Friday's closing price and that is several standard deviations from the norm setting up a high probability for a correction." — the gold price did exactly what I thought might happen. It took its queue from the vertical "rope" that appeared during the month of February and executed what might be seen as a "blow-off top" with literally everyone scrambling to get positioned in gold or the gold miners.

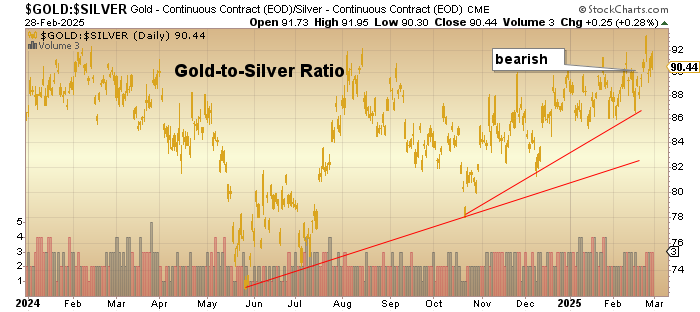

Unfortunately, the harbinger horribilis of the precious metals arena — silver — once again telegraphed the top by failing to register a new 52-week high while the HUI peaked a couple of weeks ago around 340. The ominous Gold-to-Silver-Ratio ("GSR") remains stuck above 90 as silver continues to underperform gold despite breathless cries of "Shortage!" reverberating within the walls of bullish unanimity. If I hear one more "influencer" staring into their laptop camera with yearning eyes and solemn voice, beseeching us to believe that there is a looming silver squeeze just around the corner, I will equally beseech them to pick up the phone and call BHP or Freeport-McMoRan or Glencore and ask them for a rundown on the mountains of silver-rich slag they are stockpiling as "waste" from their copper and zinc mining operations.

From Wikipedia: "The principal sources of silver are the ores of copper, copper-nickel, lead, and lead-zinc obtained from Peru, Bolivia, Mexico, China, Australia, Chile, Poland, and Serbia." Principal sources. How many copper-zinc-lead-nickel miners are in the habit of calling the World Silver Institute with a full report on their silver inventories?

The action in the silver market tells us that silver is well-supplied, and whether or not it is "paper" supply or "physical" supply, demand for the junior silver developers and explorers is governed by price — period. More importantly, gauging the health of any precious metals bull depends squarely on silver assuming a leadership role for the entire group. Sadly, a GSR above 90 represents a glaring non-confirmation and was one of the primary alarms blaring in the background last week as I told the world that the gold market looked "stretched."

Alas, before you all run out and place orders to "Sell at market" all gold and silver miners and explorers adorning your precious portfolios, the good news (verging upon great news) is the RSI for gold that has plunged from that steeply overbought 85 reading of three weeks ago to the current level of 45.25 which is a neutral-heading-to-oversold state of flux. Markets normally do not crash from RSI readings under 50, although capitulation "flush-outs" have occurred, such as in mid-March 2020. This is not one of those times.

The GLD:US has shed over $11 from the 52-week and all-time high registered on February 24 (last Monday!) and while there was a short-covering bounce late Friday, the next level of support is the 50-dma at $254.86 while the 100-dma is at $250.74 and the 200-dma at $238.11. I doubt seriously whether the latter two dma's will get breached because by the time it gets to the 50-dma, RSI will probably be under 30 and officially oversold. It could still work lower but it is unlikely.

As for the juniors, PDAC curse notwithstanding, they have, as a group, started to wake up, but there is still nowhere near enough profit for any serious selling to manifest itself. I continue to accumulate shares in my favourite juniors and will continue if I see any weakness next week.

Stocks

The "Titanic Struggle" seen on Friday signalled a near-term bottom as the buyers appeared late in the day after Veep J.D. Vance executed his role as attack dog and scolded Ukrainian President Zellenskyy for being "ungrateful." Traders took that as a queue for celebrating "U.S. exceptionalism" taking the SPY:US from a mid-session low of $582.44 into full "ramp" mode with the S&P 500 ETF going out near the day's high at $594.18 allowing it to reclaim the 100-dma and settle just below the 50-dma at $597.86 and the 20-dma at $602.28.

I attribute a great portion of the move to short-covering as the hedge fund community has been a net seller of stocks into the voracious appetites of the retail public for most of the month of February, Given the speed and amplitude of the decline off the all-time high last seen on February 19, the peak-to-trough move was 5.1% in a matter of nine days where Friday was the first day in six that stocks could muster up a gain.

With the passive flows expected to arrive on Monday through Wednesday, I expect a modest bounce to test the resistance between the 50-dma and the 20 dma but failing a peace deal between Russia and Ukraine, stocks are now focusing on tariffs and DOGE which are effectively removing all of the fiscal stimulus that kept the U.S. economy buoyant for the better part of last year. Without those 800,000 bogus jobs created by the former Democrat White House, the unemployment rate is certain to rise as are jobless claims.

As good as that might appear for the bond market, the tax inflow from capital gains due to a booming, momentum-driven stock market is going to create a revenue shortfall that may match the spending cuts being engineered by Elon & Company which leaves the debt monster in the same or worse shape than before Trump was inaugurated.

I flattened most of my leverage volatility bets into last week's decline but I still hold a core position in the 2X Long VIX Futures ETF (UVIX:US) which will remain in place until I see evidence that the breadth is improving along with the economic data which has been weakening through most of 2025.

As for the "big picture" outlook, I still think that markets are in the early stages of a cyclical decline that only in the fullness of time will prove out to be a cyclical "bear."

The greater fear that most of the elder statesmen traders carry into battle each and every day is that the secular bull market ended in February into that clearly-defined orgy of greed, FOMO, and complacency.

Copper

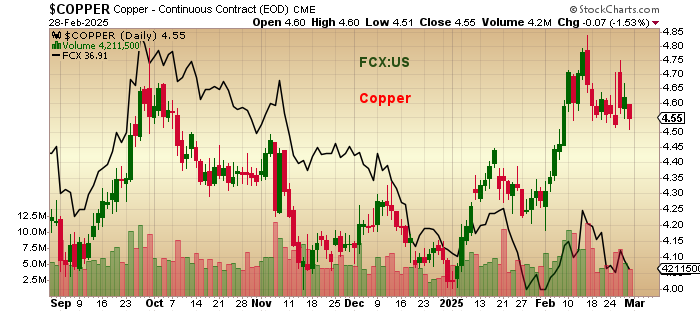

In early January, the copper market broke out of a ten-month correction during which it sank 16.5% driven mainly by fears concerning Chinese demand. However, it shrugged off concerns over the slowing macro outlook and in fact responded bullishly to Trump tariff threats designed to protect the U.S. domestic copper supply by launching a near-vertical ascent off the lows moving from US$4.00/lb. to over US$4.80/lb. in a few short weeks. That move took the RSI well through the overbought 70 reading to a level just under the 80 mark as the ascent barely resembled anything "gradual" instead resembling a 90° explosion tacking on 15.5% in mere eleven days early last month.

Since then, it has been closely correlated to stocks with the mid-February peak occurring in both the S&P 500 and copper. Still very much in an uptrend, it looks as though it is riding the 20-dma around USD $4.55/lb. which is just above the uptrend line drawn off the January and February lows.

I wrote in January in the GGMA 2025 Forecast Issue: "Since demand for the main beneficiaries of the electrification movement (copper, lithium, and uranium) cannot dodge the ordnance levied by tariffs, the bullish narrative megaphoned throughout these pages last year will need to be tempered until the words become actions (i.e. legislation)."

However, that caution is now being put to the test by the manner in which copper responded to the tariff threat which for all subscribers is a joyous development, given the exposure we all have through top pick Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) as well as copper explorer Vortex Metals Inc. (VMSSF:OTCMKTS; VMS:TSX; DM8:FSE). I learned a great many years ago that it is never wise to try to analyse a news item but rather the market's reaction to a news item.

It falls into the same wheelhouse as "Good news in a bull market is bullish; good news in a bear market is bearish." So, as long as copper can hold that zone of convergence around the 50, 100, and 200-dma levels (US$4.32-4.36), I will have to throw caution to the wind and assume that the duality of shrinking global supply and accelerating Chinese demand will be sufficient to allow the red metal to see new highs above US$5.19/lb. later in 2025.

Whatever the case may be, one of the puzzling divergences in the copper market is the behaviour of Freeport-McMoRan Inc. (FCX:NYSE) which is now down over 36.5% from its high of $55.23 last seen in May/2024. With the relatively superb action in the copper market, FCX:US is trading at the same level it was at when copper was back at $4.15. It is as if the markets have decided to ignore the 30% of revenues derived from gold production despite recent record highs. It has ignored the moves in both metals and instead been mired in a sideways "chop" that is always concerning for me. If the leading gold miners like Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) or Kinross Gold Corp. (K:TSX; KGC:NYSE) were sporting downtrends all through February as gold raced to new all-time highs, I would be trimming my gold holdings aggressively. Is the tepid action in FCX a similar call-to-arms?

The only negative that I can identify with FCX is their exposure to jurisdictional risk by way of their non-U.S. operations but the only operations they have outside of North America (albeit nothing in Mexico) are in Chile and Peru, two mining-friendly countries with a long history of cooperation with multinationals. That leaves Grasberg in Indonesia but they have operated there for decades without incident. In fact, President Prabowo Subianto Djojohadikusumo is an Indonesian politician, businessman, and retired army general serving as the eighth president of Indonesia since 2024 and would appear to be carrying business-friendly policies.

That suggests that recent weakness can only be attributed to "street expectations" where concerns over the macro outlook are keeping allocations to the economically-sensitive cyclicals like FCX to a minimum. However, investors cannot ignore $4.55 Cu and $2,867 Au for very long without once again adding the world's largest copper producer to portfolio allocations.

I think FCX is a "Strong Buy" for a test of the May 2024 highs before the end of 2025.

PDAC

The largest mining convention in the world — PDAC — begins Sunday, March 2 in Toronto, and judging from the traffic jams all through the convention centre streets, I would say that these near-record metal prices for gold and copper are creating a great deal of "buzz."

As I have said in more than a few mid-week email alerts, I do not expect the PDAC "curse" so prevalent in prior years to be a factor this year. I am seeing a massive rotation out of the technology and momentum spaces into the cyclical and value spaces, which implies that the commodity producers, developers, and explorers should enjoy a seat at the banquet table after years of scavenging scraps at the back of the hall.

As long as the Goldman Sachs Commodity Index can continue to maintain its uptrend, the move into the junior developers and explorers as replacements for "MEME stocks" and EOD options on the "Mag Seven" names will continue to dominate the day-trader's narrative, an environment not seen in decades for the juniors and one that will be most welcome.

| Want to be the first to know about interesting Critical Metals, Silver, Gold and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Vortex Metals Inc., Fitzroy Minerals Inc., and Agnico Eagle Mines Ltd.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.