The Gold Report: In a report from RBC Capital Markets in late January, the firm said gold could reach as high as $1,200/ounce ($1,200/oz) in the short term but remains in an overall downward trend. Does ROTH Capital Partners share that view?

Joe Reagor: A lot of people are reacting to a bounce in the gold price here in early February and need to set a number, but they still believe the factors that have held gold down over the last few years remain intact. Our view is a bit different. Gold at $1,100/oz is not a sustainable long-term scenario. The costs of production are still relatively high, and they're only going to get higher as companies mine higher grades to lower costs. Miners did this in the late 1990s, and that's why gold moved higher for 12 straight years in the 2000s before we had a healthy pullback. We think we're heading toward the end of the 1990s time frame again, where the fundamentals will drive the gold price higher.

"Integra Gold Corp. continues to drill more than any other Canadian company on a single project."

TGR: Please explain those fundamentals.

JR: Gold can't go much lower without costs having to adjust lower. The strength of the U.S. dollar helps non-U.S. producers somewhat, but in general, the fundamentals suggest that if you want an industry to survive, it needs a 20% profit margin. If all-in sustaining cash costs are $1,100/oz for gold, then you already need over $1,300/oz to sustain the business. That is where gold needs to be in the long run or we won't have as much gold production for the world to consume.

TGR: The Bank of Japan recently cut its interest rate on bonds to minus 0.1%. In fact, much of the global economy now is in a negative interest rate environment. Is deflation now the global economy's greatest threat?

JR: Deflation and inflation are difficult to peg. The governments of the world are good at spinning numbers to make them look like what they want them to look like. But loose monetary policy usually drives inflation—it just doesn't always drive the type of inflation that the government is seeking. Governments might insist we're in a deflationary environment, but that doesn't mean that the consumer or the investor is seeing deflation. Loose monetary policy is usually good for gold, and gold generally goes up with inflation. It's hard to say exactly what side of that fence we're on. The inability of lower interest rates to drive more economic growth is a real concern in the near term.

TGR: The global economy clearly has more faith in the U.S. dollar than in gold. Is that a case of misplaced faith?

JR: Yes. We're the best of the worst, and the U.S. dollar is valuing up as most other currencies are devaluing. That can only go on for so long before the global recession finds its way back to the United States. Eventually the U.S. dollar momentum trade could come to an abrupt end and that would be good for gold. People know that but they're making money in the U.S. dollar trade. Similar to mortgage-backed securities and credit default swaps, people are taking advantage of it and hoping that they aren't the last person into the trade.

TGR: How does ROTH Capital Partners expect gold to fare amid all this uncertainty and fear in the global economy?

JR: In the near term, we expect to see a slow, steady recovery in gold prices—$1,200/oz seems reasonable. A healthy, slow, steady recovery in gold is possible based on more and more people moving away from the U.S. dollar and into gold as a store of value. If there is a global recession and it becomes obvious that it is going to be a multiyear issue, gold could see a big increase in value.

"By the middle of 2016, MAG Silver Corp. should have all the necessary permits to break ground on construction."

The big key is China. If China's growth rate continues to decline, that would significantly impact the world economy. Perhaps China can find new ways to spur its economy to continue to grow at closer to Third World than First World rates. If it does, there's some question as to how it funds that. It could sell our debt, which would likely result in a devaluing of the U.S. dollar and give it the funds it needs to start public works projects. The rest of the world could, in a sense, come out of recession but at the same time still cause gold to go up by devaluing the dollar. There are lots of avenues where gold goes up, and very few where we see further decline toward that infamous $1,000/oz level.

TGR: So you don't dismiss what's happening in gold as a strictly seasonal event.

JR: There's usually a bounce in January following a down year, and in December we were talking to our clients about this possibility. But at the same time, we expected that without the world economy slowing and the U.S. stock market pulling back. Now there are potential concerns about how the U.S. Federal Reserve reacts or overreacts to the pullback in the market. The first move from $1,050/oz to $1,100/oz was seasonality. Now it's a little bit of a fear trade, in our view. Therefore, there's more room for it to run.

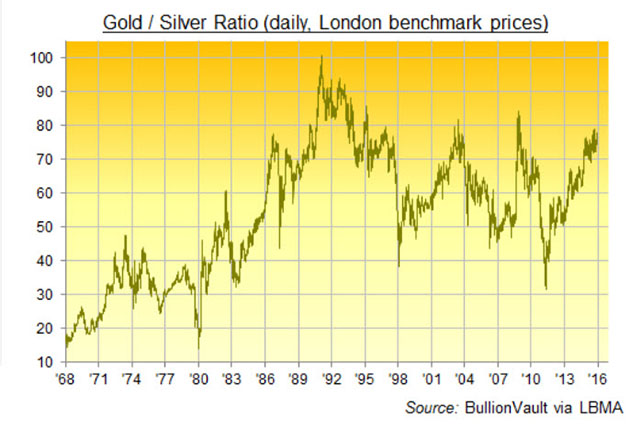

TGR: Silver typically fares worse than gold in a bear market given its heavy industrial use. How do you expect silver to perform in 2016 and into next year?

JR: A lot of silver production comes from byproduct production, but the straight silver producers are not in a position to weather a lower silver price. The silver-only producers are near break even with their all-in cash costs. Maybe the silver-gold ratio could expand to 80:1 or 82:1, but we're expecting gold and silver to start to recover, and then as you get a recovery, the ratio usually contracts. The gold market is so many magnitudes larger than the silver market, so as people try to buy into the silver market, they can really move the needle. Once the recovery takes hold, we expect some form of contraction of the silver-gold ratio back to 70:1 or 65:1.

TGR: Do you see the U.S. adopting a negative interest rate policy?

JR: I don't think the Fed would re-lower rates. If the Fed decides to do some additional form of quantitative easing, it would do so in other ways. Lowering interest rates would send a very negative signal.

"Private equity is confident that Pretium Resources Inc. is derisking Brucejack as much as it can before production."

TGR: Is it more imperative now for a precious metals research analyst to have a firm grasp of the macroeconomic picture than it was pre-2007?

JR: It's important for us to be aware of macroeconomic events but the investment strategy that we are recommending to investors is not one that relies on gold going up or gold going down in order for them to make a profit on an investment. Our approach targets the right companies in the right positions at the right times. That's been lost in this downturn. The fundamental side of equities has gone by the wayside, and stocks are trading very much with the gold and silver price until these companies make an announcement that no one was expecting.

TGR: So it's a stock picker's game.

JR: In a down market it has to be. In an upmarket, everybody is a winner. In a downmarket, it's a matter of picking the winners and avoiding the really big losers. If you can avoid those and invest in names that have upside, whether gold is up, down or flat, then you can still make money in this market.

TGR: Please give us your investment thesis for precious metals producers and development-stage equities.

JR: There are two types of producers that we look at as good investments. The first type are generally larger-cap defensive names that have succeeded in growing production and revenue, despite the down gold market, like Randgold Resources Ltd. (GOLD:NASDAQ; RRS:LSE). If you think a gold recovery is coming and you invest in these names, you're holding them with a long-term view on gold. We don't specifically cover these names because they're usually above our target market-cap range.

"Gold at $1,100/oz is not a sustainable long-term scenario."

Another type of producer is one that has made material changes in terms of costs, production, acquisitions, balance sheet or a change in company philosophy, yet really hasn't received much credit for those changes because these stocks typically trade with the gold and silver price. For example, Coeur Mining Inc. (CDE:NYSE) has made acquisitions that are key to the company's future and it continues to make investments to lower costs and increase production to get to free cash flow. But this year the company is not free cash flow positive, so it trades with the gold and silver price. But you can see the path to improvement. We like stories where the market has overlooked fundamental changes made by management.

TGR: What is the thesis for developers?

JR: There are two types of development-stage companies we like to target. First are those companies approaching a construction decision on an asset. This generally results in some short covering. One example is Pretium Resources Inc. (PVG:TSX; PVG:NYSE). Last year, after it made its construction decision and announced its financing without any equity component, its stock value improved significantly despite a flat gold and silver price because there was short covering on the name. Stories like that are easy to forecast. We like targeting those six months ahead of a construction announcement.

"Loose monetary policy is usually good for gold, and gold generally goes up with inflation."

The other comes down to companies that own assets that are clearly needed by a neighbor that's a larger company. We used to cover Paramount Gold and Silver Corp., which Coeur purchased in March 2015. Coeur needed to own the asset for a number of reasons, and it was only a matter of time before the valuation made sense. You can usually spot these ahead of time because they're often close to existing assets that are nearing the end of their mine lives or are transitioning, in the case of Palmarejo, to an underground operation that needed additional ore to fill the open pit-sized mill. So we target companies where we believe a buyout is coming.

TGR: Prior to our interview you talked about how larger companies are increasingly taking positions in the junior market, even with the view that the gold price will remain relatively stagnant for some time. What are some examples?

JR: A perfect example would be Integra Gold Corp. (ICG:TSX.V; ICGQF:OTCQX), which we cover. It received a 15% investment from Eldorado Gold Corp. (ELD:TSX; EGO:NYSE) in August 2015. Eldorado is investing in what appears to be an elite asset early on with the intention to be at the front of the line to acquire Integra by already owning 15% of the stock.

TGR: Did Eldorado gain some influence with its cash infusion?

JR: It has had some influence on the company's approach to moving the project forward. It clearly wants Integra to continue to conduct underground infill drilling, exploration drilling and a bulk sample to continue to derisk Triangle.

TGR: Integra continues to hit solid gold grades in the C zone structures that it has outlined at about 1,000 meters below surface at its Triangle deposit in Val-d'Or, Quebec. Are these results changing the market's perception of Integra?

"Once the recovery takes hold, we expect contraction of the silver-gold ratio back to 70:1 or 65:1."

JR: The market is starting to realize the potential of Lamaque South, but Integra has yet to see much of an improvement in valuation. We attribute this to what occurred last year with Rubicon Minerals Corp. (RBY:NYSE.MKT; RMX:TSX). In our view Rubicon rushed into production and it backfired, to say the least. Now investors are more cautious about assigning value to high-grade intercepts. They want companies to go underground and do bulk sampling to make sure that drills are not accidentally hitting the best grades or that the geological structures do not have such an orientation as to make the company believe that its intercepts are wider than their true width. Once the results of bulk sample come out, the market would assign the correct value to the potential in the C zone structures.

TGR: What's the next milepost for Integra?

JR: The next big step would be to get the permits for its underground bulk sample and exploration drilling. Obviously, the company will have lots of drill results as it continues to drill more than any other Canadian company on a single project.

TGR: You mentioned Coeur Mining and its takeover of Paramount Gold & Silver. When will investors start to see that acquisition's positive impact on the balance sheet?

JR: The key to that acquisition was the Independencia vein, the majority of which was on Paramount's property. Production from Independencia will be unencumbered by the Franco-Nevada Corp. (FNV:TSX; FNV:NYSE) streaming agreement, which will mean a big change for the company's cash flow starting later this year. The all-in cash costs from Independencia should be significantly below that of Guadalupe, which is 100% on Coeur's property next door and subject to the Franco streaming agreement. With both veins producing simultaneously, Coeur should see improved operating results, and then investors should be able to assign a better valuation to Palmarejo. The first production from Independencia is expected early this year. Coeur is drifting underground from Guadalupe to Independencia, while still producing from Guadalupe and the Palmarejo underground mine.

TGR: Why do Coeur shares continue to underperform?

JR: Our position is that Coeur has made significant improvements through acquisitions, which have been underappreciated by the market. It falls into that second group of producers in that it has made the necessary changes but the market generally is ignoring the fundamentals of the company. We believe this is a "show-me" situation that could result in a significant improvement in the valuation.

TGR: Are there other companies that fit your "larger neighbor" thesis?

JR: MAG Silver Corp. (MAG:TSX; MVG:NYSE) has a new discovery that is different from the bonanza zones that make up the existing preliminary economic assessment (PEA) and resource estimates at its Juanicipio project in Mexico, a joint venture with Fresnillo Plc (FRES:LSE). The intercepts so far on the new deposit tend to be closer to 20 meters thick versus perhaps 6 meters on the bonanza zones. The grade tends to be a touch higher, too. In a sense, it could be a second mine, which demonstrates to Fresnillo that there is upside beyond the Juanicipio and the Valdecañas veins and leaves some meat on the bone for a potential acquirer. Also, as we mentioned earlier, we like companies that are nearing construction decisions and MAG Silver is roughly six months away from making one.

TGR: Could the new deposit alter the relationship between Fresnillo and MAG Silver?

JR: Under the joint venture agreement Fresnillo can't make a hostile bid to acquire MAG Silver. It would need to make a friendly offer. I don't expect any tension in the relationship created by the upside of that deposit.

TGR: What's next to come in the MAG Silver story?

JR: There's going to be an updated PEA that will include an additional resource and a rework of the mine model, which should show improved economics even with flat gold and silver prices. By the middle of 2016, MAG Silver should have all the necessary permits to break ground on construction. MAG Silver was responsible for 44% of the $312 million capital budget originally estimated for the project. That should come down in the new PEA, given the money already spent to date. The next step after the PEA is a construction decision.

"If there is a global recession, gold could see a big increase in value."

TGR: What are some other names that you're following?

JR: I mentioned Pretium. A lot of investors expected it to be bought by now but the Rubicon situation has deterred companies from acquiring high-grade but highly variable deposits. Highly variable deposits are always difficult to estimate. Pretium's Brucejack has a unique geological structure that is more geologically similar to a Pacific Island than a traditional high-grade Canadian gold deposit. As such, a lot of Canadian producers have balked at acquiring Pretium—they'd rather let it prove itself in production and pay more later than have it underperform and be punished by the market. The company is in a holding pattern until it reaches production, but it trades at a healthy discount to its net asset value.

TGR: Pretium negotiated a deal last year with a private equity group. Does that limit the potential for a takeover?

JR: We don't think so. If this company were able to get to the production levels and cash costs in the current mine model, it would be remarkably similar in size and cost level to what used to be Osisko Mining Corp.'s Canadian Malartic mine. Something close to that valuation would probably make the private equity folks very happy. It would be a multiple of what it paid for its investment.

TGR: Does it give you greater confidence in the Brucejack deposit given that private equity took such a significant stake in Pretium?

JR: Any large private equity investment in a company is usually a vote of confidence, but it's not to say that they were privy to anything that the rest of us weren't. Pretium is still using the same models and information. There may be confidentiality agreements to get additional information, but in a project of this nature, the vast majority of the information you want to know to make an investment is publicly available. Private equity is just confident that management is derisking it as much as it can before production.

TGR: Investors remain nervous about precious metals equities and the resource sector in general. What would you tell them to allay their fears?

JR: It's a matter of risk tolerance and time horizon. If you're expecting to invest in gold and silver stocks and see an immediate return, it's probably not the right investment for you. But if you have the mentality that you're going to buy some defensive positions or some positions where there's a clear catalyst 6 to 12 months out and you're going to hold them with that time horizon, things could work out.

TGR: How do investors muster the courage to dip their toes in these waters?

JR: Any investments in this space need to be part of an overall portfolio that balances out the potential swings in the overall economy. When the economy is pulling back, generally speaking, that's good for gold and silver, and you need to have a small piece of those investments to properly balance out your portfolio so that when things slow down—as they are this year—not everything on your screen is red.

TGR: Thank you for talking with us today, Joe.

Joe Reagor is a research analyst with ROTH Capital Partners, providing equity research coverage of the natural resources sector. Prior to ROTH, he worked in equity research at Global Hunter Securities and at Very Independent Research, covering a wide array of resources companies including metals (steel and aluminum), mining (gold, silver and base metals) and forest products (containerboard, OCC, UFS, and pulp). Reagor earned a Bachelor of Arts in economics and mathematics from Monmouth University.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) Brian Sylvester conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report and The Life Sciences Report, and provides services to Streetwise Reports as an independent contractor. He owns, or his family owns, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: Pretium Resources Inc., MAG Silver Corp. and Integra Gold Corp. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

3) Joe Reagor: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: Integra Gold. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.