Special Situations: You're a big fan of micro caps. Why is small better in a world that, according to your recent The Portfolio Guru Post newsletter, is experiencing weak global aggregate demand?

Jim Collins: I think small is better because small-cap company stocks move based on factors that aren't necessarily driven by global macroeconomics. That is particularly important in today's volatile market.

SS: Do you see the recent fall in the stock market as a temporary blip because of headline news out of China, or are we shifting to a new stage in the world market?

JC: I don't think it's a blip. I think it's a correction to more reasonable levels of valuation. A lot of people expected that China, India and the other emerging markets would generate marginal demand to soak up excess supply from the U.S. and Europe, but that was too optimistic. All markets are growing at much lower rates than the historical averages, and it is very risky to depend on a market devoid of any middle class to pull the world out of recession. We are seven years past the Lehman Brothers collapse but we haven't come very far.

"Chanticleer Holdings Inc. recently closed a rights offering that raised $6.6M."

SS: Last year, you called the LD Micro Conference "a micro-cap love-in," and shared the names of five companies that sounded interesting as a way to gain portfolio immunity to larger market volatility. You went back again this year. Was it just as alluring?

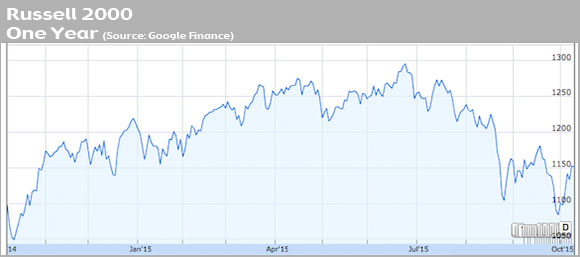

JC: The conference took place in the first week of June in the midst of very strong national market performance. The Russell 2000, which is generally looked at as the index for small- and micro-caps, was outperforming the major market averages. At LD Micro, people were very optimistic, which means there probably weren't as many bargains as the year before. The Russell has since moved into correction territory, as people are selling all stocks.

SS: Can you update us on some of the companies from last year?

JC: Torchlight Energy Resources Inc. (TRCH:NASDAQ) was just shifting to the operator role on its project in Texas when we talked. The company is very optimistic. It drilled its first well on the Orogrande, but instead of going to full production, it is collecting data. This is a large prospect, 180,000 acres. Last week Torchlight announced a definitive agreement with Founders Oil and Gas LLC. Founders will provide $5 million ($5M) in project reimbursement costs and an additional $45M in development capital in exchange for a 50% working interest in the project. Founders will also become the operator of record.

SS: It sounds as if you found some new prospects that look interesting this year. What are some of the names you're following up on?

JC: I have been looking at Chanticleer Holdings Inc. (HOTR:NASDAQ). It owns and operates 14 Hooters locations around the world. It also has been moving aggressively into the better-burger segment, the area where Shake Shack Inc. (SHAK:NYSE) has garnered buzz. Chanticleer is also growing its business in Australia and South Africa. Chanticleer recently closed a rights offering that raised $6.6M.

"Torchlight Energy Resources Inc. drilled its first well on the Orogrande."

We should keep seeing revenue growth through the existing Hooters franchises, a previous acquisition of a mid-Atlantic chain—The Burger Joint—and the smaller, regional better-burger concept restaurants that were funded in the most recent round. That could start adding to the bottom line right away.

SS: Chanticleer has been in acquisition mode over the last year. Revenue grew by 65% to just over $10M. Are you expecting it to continue acquiring?

JC: Absolutely. The reason Chanticleer did the rights offering was to complete an offering of Little Big Burger, a better-burger chain in the Pacific Northwest based in Portland, and also to take a larger stake in two of its Australian properties. Yes, it is absolutely out there, acquiring and raising capital for that very purpose.

SS: Does geographic diversification in Australia, South Africa and the U.S. help reduce the risk of the stock?

JC: The basic concept is somewhat recession resistant, but, yes, I think that globally there is more growth than in the U.S. alone.

"Small is better because small-cap company stocks move based on factors that aren't necessarily driven by global macroeconomics."

SS: What's another company that you saw at the conference you're going to look into further?

JC: I've been looking at Newtek Business Services Corp. (NEWT:NASDAQ). It is a strong and aggressive small business lender. I think the underlying business is very solid, making small business loans, having very low loan:value ratios and growing market share. Newtek converted from a C corp to a business development corporation (BDC), so it has to give all its retained earnings to shareholders. BDCs operate like real estate investment trusts (REITs); they have to distribute at least 90% of pretax profit.

On Oct. 1, Newtek declared a special dividend of $3.29 per share, payable on Dec. 31 to shareholders of record as of Nov. 18. Up to 27% of the dividend can be in cash, while the remainder will be in the form of shares of the company's common stock. The company's common dividend, based on quarterly earnings, is already yielding about 11%. Even without the special dividend, I think it's a great income play.

SS: The life sciences sector has been up all year. Did you see anything in that sector that you liked?

JC: My favorite there is still Second Sight Medical Products Inc. (EYES:NASDAQ). It is growing its install base, implantations of its Argus II bionic eye. The company should be able to increase the cadence of that, with 800 patients in its backlog. Those people need to be medically screened first, but there are a lot of people who want the product. It is seeing a great take-up in Italy, France and all over Western Europe, so there's global growth.

"We are seven years past the Lehman Brothers collapse but we haven't come very far."

The other catalyst for Second Sight is a trial in the United Kingdom for patients with age-related macular degeneration. Right now, it's only indicated in the U.S. for retinitis pigmentosa, which is less common.

SS: In Q2/15, Second Sight increased revenue by 335% compared to the period one year prior, to $2.7M, and it brought in a new president/CEO. Is that growth sustainable?

JC: Second Sight's growth comes from a small base. In Q1/15, it had 19 implantations, and in Q2/15, it had 20 implantations. Sequentially, it's growing, but year-on-year obviously it's growing a lot more.

The new CEO, Will McGuire, is going to more aggressively market the product. The former CEO, Bob Greenberg, has shifted to chairman of the board.

This is a transformational device. It quite literally allows a blind person to see again. We are going through the transition now from "Does it work?" to "How can we make it work better and how can we get it in more patients?" It's a really interesting time. That's why the company brought in new management to push this thing to the next level.

"Basic economics dictates that if a commodity is selling for less than it costs to produce, production will go down and that commodity price will eventually go up."

SS: Are you still following any telecom companies?

JC: Yes. One Horizon Group Inc. (HGI:NASDAQ) has a product called Aishuo that allows for a mobile VoIP solution in China and many other countries as well. Investors are giving up on China now, which is kind of silly. The company has had over 7 million downloads so far and has been approved for monetization through Alipay, which is part of Alibaba and Tencent. Users pay to "top up" minutes and One Horizon gets a piece of that. More than 90% of cellphones in the world are prepaid. People buy minutes and use them through a VoIP solution where carrier coverage isn't that good. One Horizon's software-based solution allows them to do that easily. It's really a software solution for the problem of poor cell coverage and for people who don't have a lot of minutes.

SS: One Horizon has had a lot of volatility as well.

JC: It has. Its former CEO sells shares periodically. I've found the best time to buy the stock is after it does a follow-on offering or an offering of secondary shares or both. That's what the company did on Aug. 4. So it's a trading opportunity. When it goes to the market, the stock goes down, you buy it and then it announces something on China, and then you might want to sell it.

SS: Jim, can you leave us with some words of wisdom for investors looking to get into new sectors with the same leverage that resource investors have historically enjoyed?

JC: There are a couple of basic concepts that people need to remember, especially when the market is going through a correction. From a resource standpoint, basic economics dictates that if the commodity is selling for less than it costs to produce, production will go down and that commodity price will eventually go up. So, oil in the $40s per barrel in the U.S., sooner or later, that has to reverse itself. I think it will be sooner rather than later. It's already happening. If you look at capital expenditure budgets for the oil companies—both the majors and the independents—they're getting slashed dramatically. Production in 2016 should be down significantly from 2015. My words of wisdom would be to respect the basic laws of supply and demand.

SS: Thank you for your time, Jim.

Jim Collins is the founding partner of Portfolio Guru. Collins preaches the gospel of income investing via his newsletter, The Portfolio Guru Post, and uses income investing principles to manage money for individuals on a fee-only, separately managed account basis. Previously, Collins spent 10 years as an equity analyst in New York and London covering the automotive sector for Lehman Brothers, Donaldson, Lufkin & Jenrette and UBS. He holds a Bachelor of Arts in economics and history from Duke University and has completed the academic requirements for the CFA designation.

DISCLOSURE:

1) JT Long conducted this interview for Streetwise Reports' Special Situations, and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are banner sponsors of Streetwise Reports: Chanticleer Holdings Inc. and Torchlight Energy Resources Inc. Streetwise Reports does not accept stock in exchange for its services.

3) Jim Collins: My firm owns shares of the following companies mentioned in this interview: Second Sight Medical Products Inc., Torchlight Energy Resources Inc. and Newtek Business Services Corp . I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.