In the past several years, GSP Resource Corp. (GSPR:TSX.V; GSRCF:OTCBB), which only came into existence about 6 years ago, has gotten its hands on a most promising old copper mine (holds an option to acquire 100%), the Alwyn Copper mine, which just happens to be a mere kilometer from the rim of the giant expanding crater of the Highland Valley Copper Mine owned and operated by Teck Corporation and if this doesn't increase the chances of the company making worthwhile further discoveries at Alwin, then it's hard to say what will — not to mention the fact that, if legally permissible, it would seem to be a natural development for Teck's expanding crater to advance into and subsume the Alwin Copper Mine with positive implications for GSP Resource Corp and its shareholders which will become starkly obvious when we look at an overhead shot of the site.

Before going any further, it is timely to bring readers' attention to the news this morning that GSP Resource Corp. defined additional high-priority targets at the Alwin Mine Copper-Silver-Gold Project. The most important fact within the news release is that its recently completed exploration target block modeling has yielded over a dozen near-surface additional high-priority drill targets at Alwin, which clearly expedites making significant discoveries more quickly.

The stock charts for GSP Resource Corp look very positive indeed, but before we proceed to examine them, we will overview the fundamentals for the company with the help of some slides from the company's new investor deck, which came out this month.

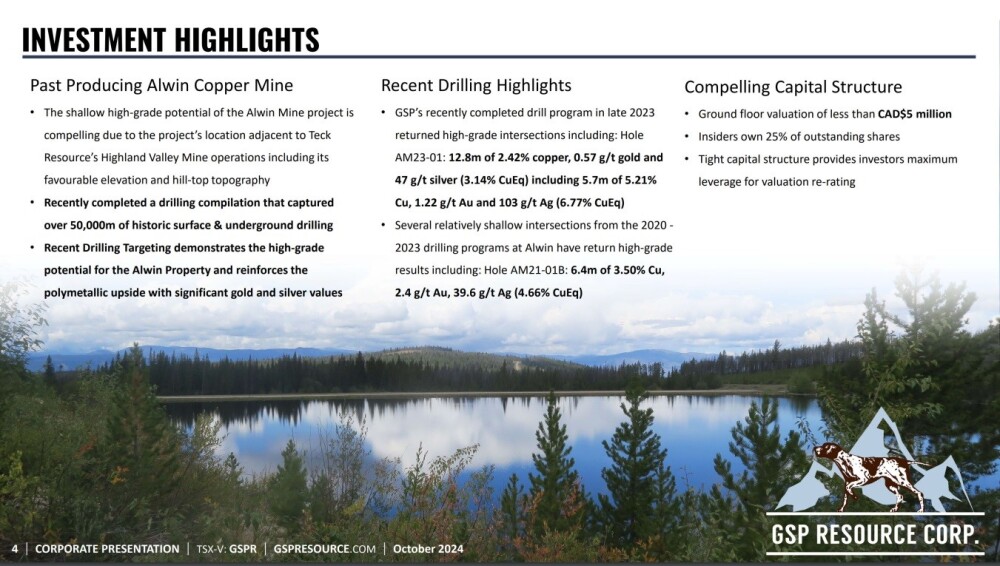

The company's investment highlights are as follows:

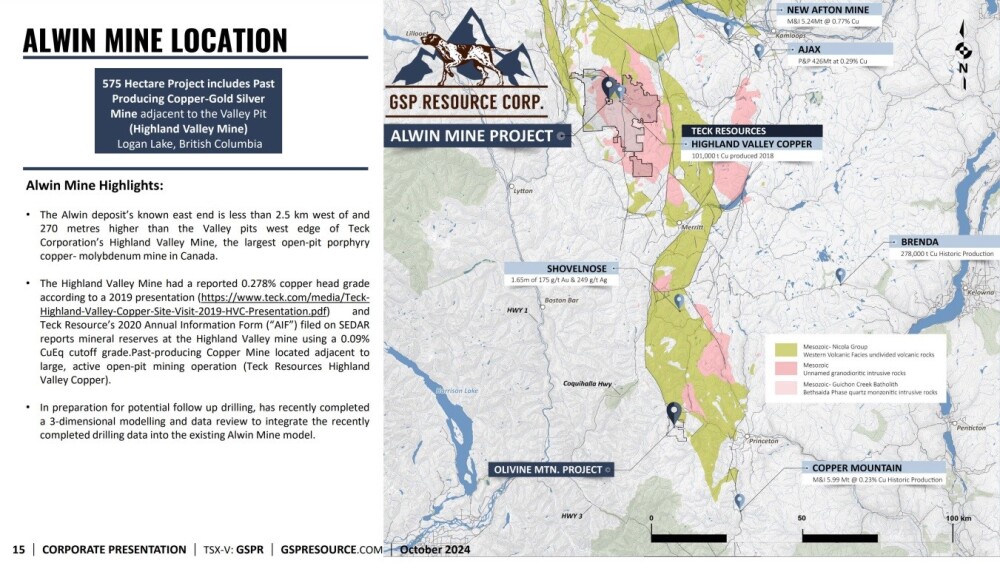

The Alwin Mine location and highlights of the property are shown on the following slide.

As we can see, it is almost on top of Teck's giant Highland Valley Copper open pit.

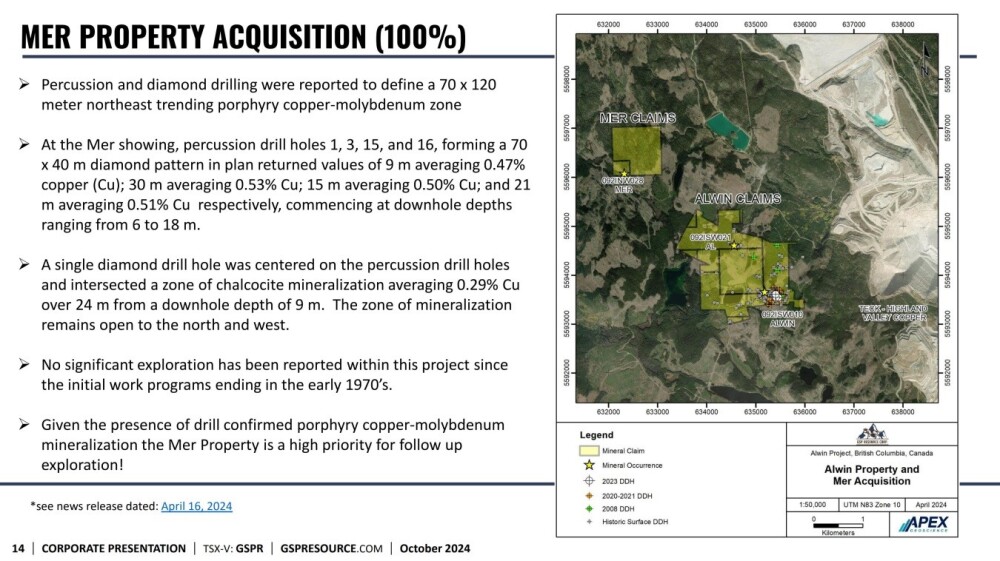

Back in April, the company also acquired the Mer Claims, which are just to the northwest of Alwin, and the extent of these properties and their positions relative to each other and also to Teck's nearby giant open pit can be seen on this slide, which also gives some details of work already undertaken at Mer.

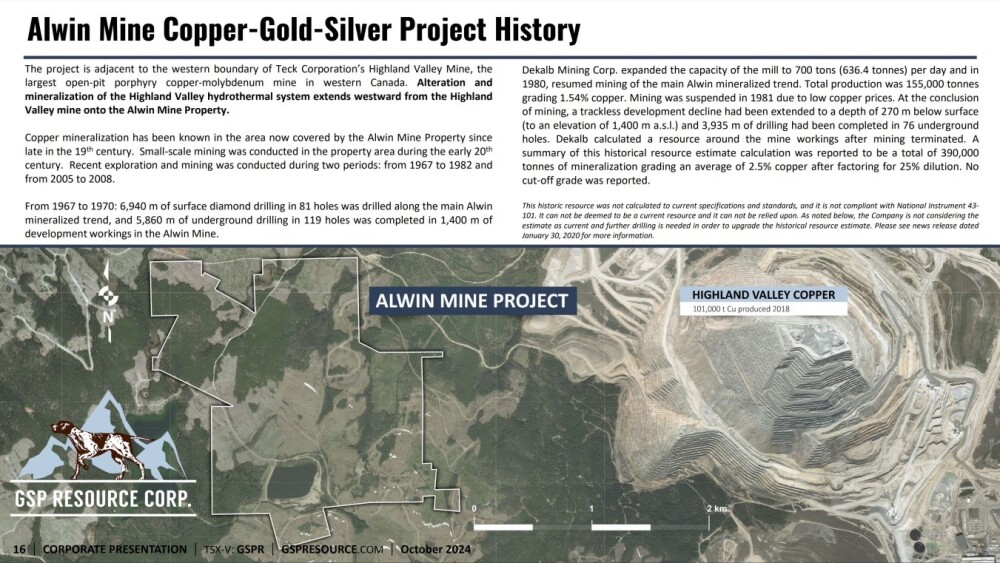

HEADING YOUR WAY — the next slide shows the extreme proximity of the Highland Valley Copper giant open pit to the Alwin Mine and, as it says, "Alteration and mineralization of the Highland Valley hydrothermal system extends westward from the Highland Valley mine onto the Alwin Property."

This means two things — Highland Valley will continue to expand westwards until it reaches its property boundary and will want to extend onto the Alwin property, which implies that Teck will want to buy Alwin, and it also means that, even before that happens, GSP Resource Corp could make further important discoveries at Alwin.

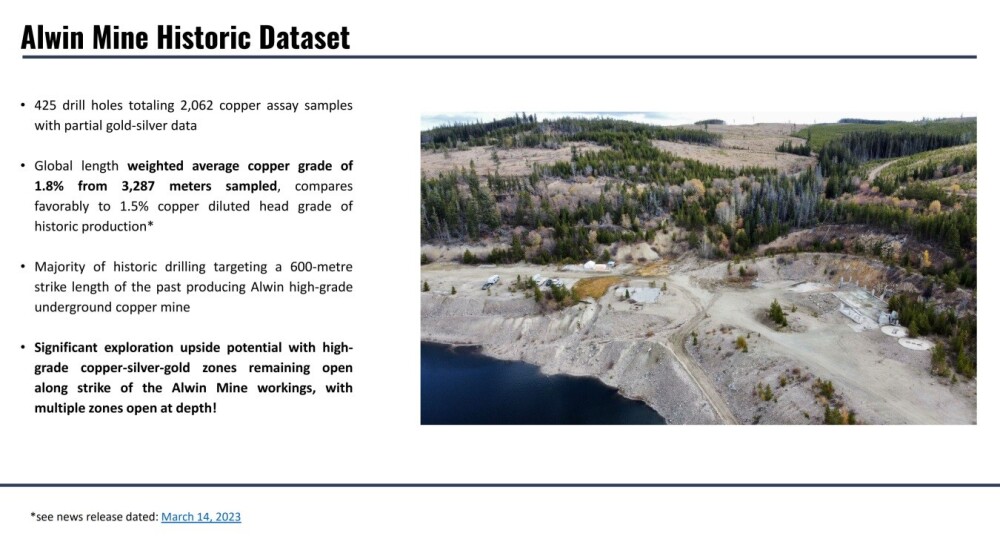

Because Alwin has been producing copper from way back in 1916 until it was forced to close due to low copper prices in 1981, the company is in possession of something that many junior mining companies can only dream about.

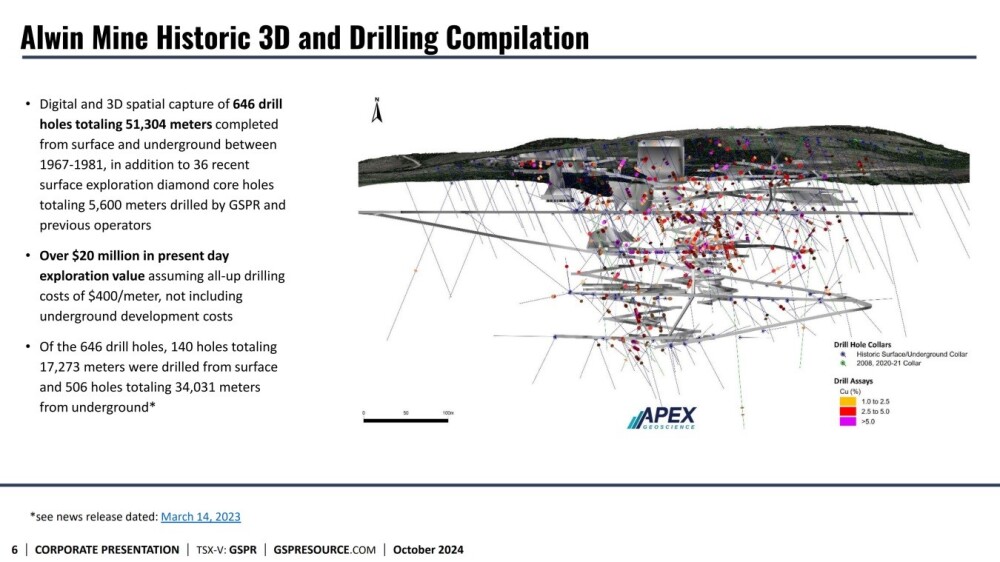

It has all of the data from hundreds of drill holes already done, which is a veritable library of information and a major cost-saving asset.

Thanks to this wealth of information from the hundreds of drill holes already made in the past, the company has been able to extrapolate the following 3D map of the Alwin Mine and its future potential.

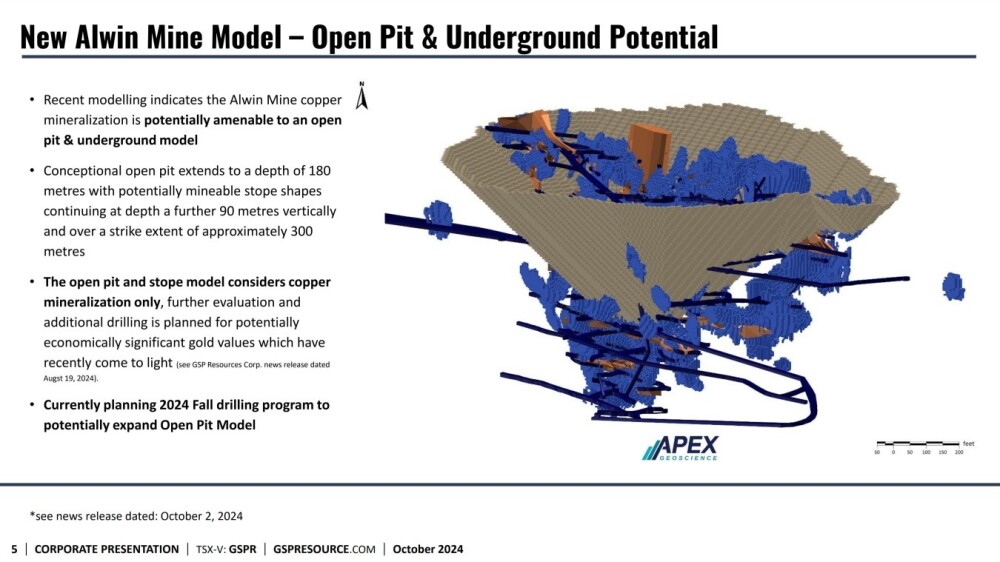

NO NEED TO REINVENT THE WHEEL — following the example of its mighty neighbor right next door, management has realized that they can fast-track Alwin to efficient and profitable production using the open pit method and go underground later when the time is right.

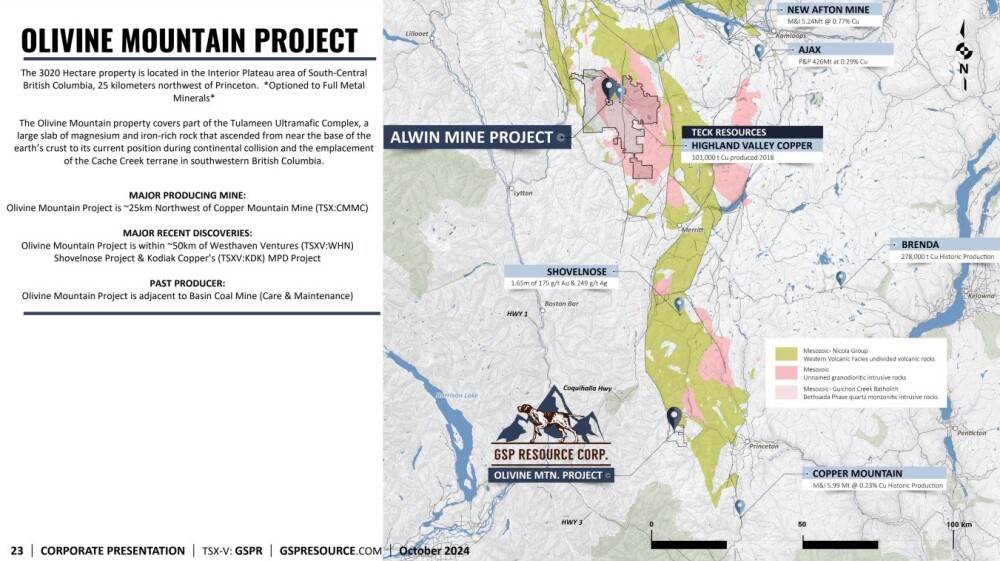

Further down the trend, the company is also the 100% owner of the Olivine Mountain Project, a 3020-hectare property whose location and some of its attributes are shown on the following map, although this property is optioned to Full Metal Minerals.

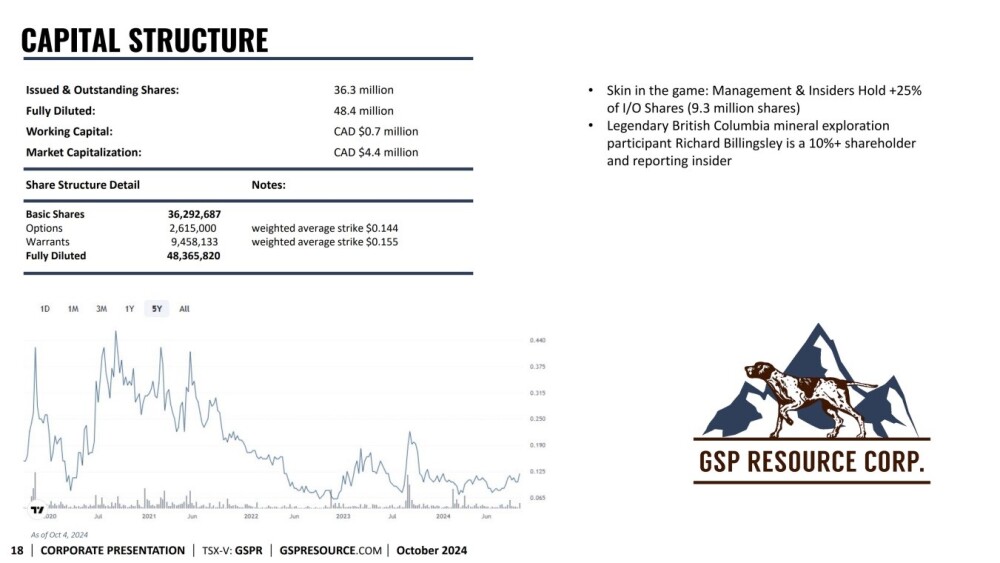

We will end with a look at the capital structure of the company.

The last slide shows that it has a relatively modest 36.3 million shares in issue, of which some 25% are owned by management and insiders. This means big upside in the event of an influx of demand for the stock.

Late placement in September, the company closed an oversubscribed private for 6.5 million units (the units being one common share plus a and one-half of one transferable common share purchase warrant), which has removed a constraint on the stock advancing.

On October 15, Bob Moriarty of 321Gold.com posted an insightful article on the company, in which he said, "The company's market capitalization is relatively small, estimated at around $4 million. This valuation includes recently issued shares. As GSP Resource continues to develop the Alwin project, it may become an increasingly attractive acquisition target for larger mining companies operating in the area."

Now we will examine the latest stock charts for GSP Resource Corp and right at the outset it can be stated that they make a clear and compelling case for buying /owning the stock for reasons that will quickly become apparent.

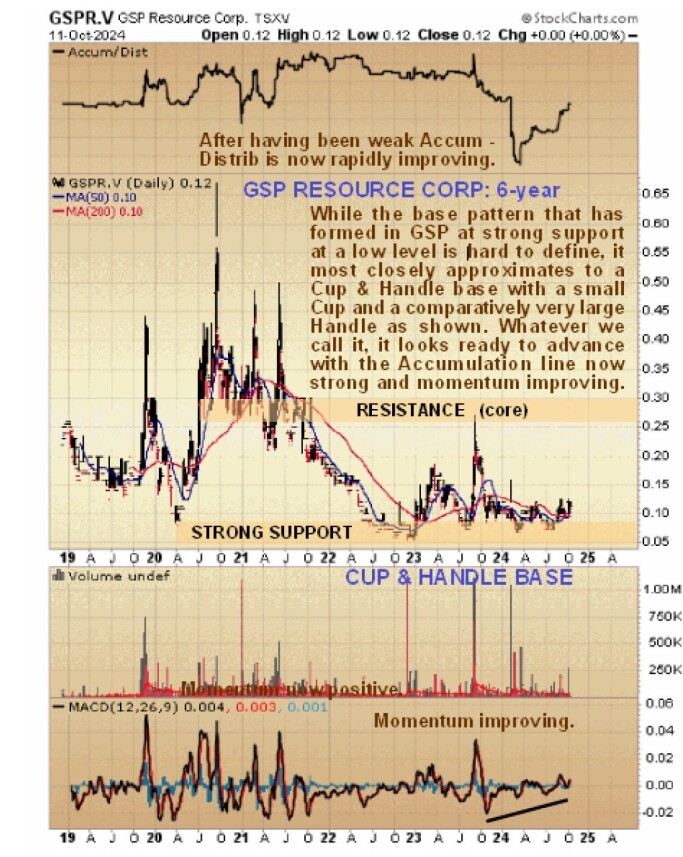

Starting with the 6-year chart, which shows the entire history of the stock, we see that after it peaked in the Summer of 2020 with a brief spike to about $0.67 that was followed by a topping pattern for over a year, it went into a severe bear market that by the time it was done late in 2022, has taken the price down to low at just 6 cents, which meant that it had lost over 90% of its value from its highs. After it hit bottom, a base pattern formed at strong support in the vicinity of its 2020 lows, and we will now look at this base pattern in more detail on a 3-year chart.

The 3-year chart shows the base pattern that has built out from the late 2022/early 2023 lows to advantage, and if we discount the freak spike move in the middle of last year, we can see that a large and distinct Cup & Handle base has formed which is comprised of a rather modest-sized Cup followed by a very large "Handle" that has taken as much as 18 months to complete.

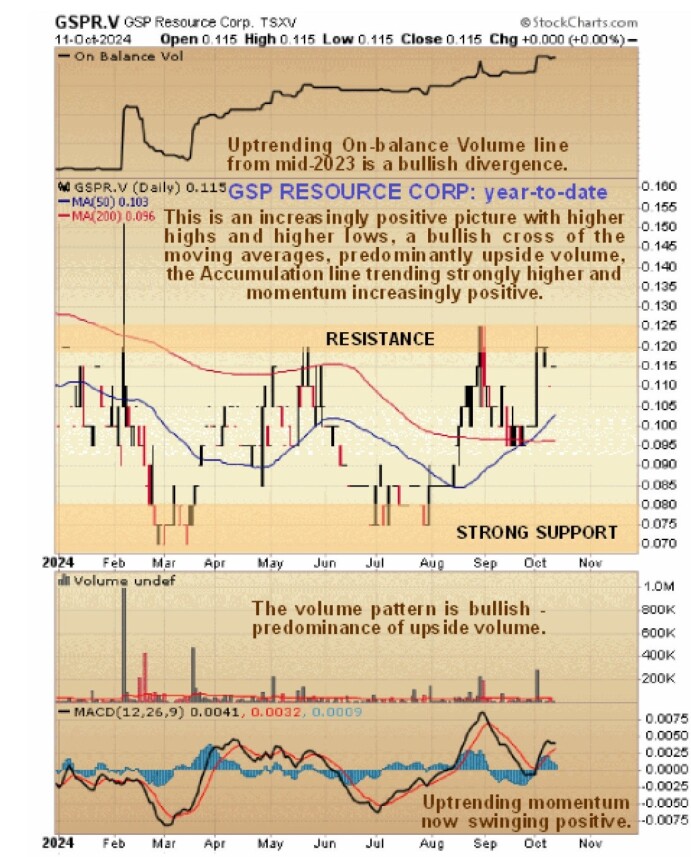

This pattern has major bullish implications, especially as, during its latter stages, it has been accompanied by a strongly bullish volume pattern and volume indicators with the On-balance Volume line, shown on this chart, trending steadily higher for over a year. This pattern certainly appears to be approaching completion, with the bullishly aligned moving averages that have just crossed, the positive volume pattern, and the uptrending On-balance Volume line and momentum (MACD) all pointing to an upside breakout soon.

On the year-to-date chart, we can see all of the factors just mentioned in more detail and, in addition, how the nascent new bull market is gradually gaining traction with the trend of higher highs and higher lows since March. So this is now a positive picture.

The conclusion must be that GSP Resource Corp is now a Strong Buy for all time horizons.

GSP Resource Corp.'s website.

GSP Resource Corp. (GSPR:TSX.V; GSRCF:OTCBB) closed for trading at CA$0.115, US$0.075 on October 14, 2024.

| Want to be the first to know about interesting Critical Metals, Gold, Silver and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.