Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ) has released its 2023 Sustainability Report highlighting its achievements and progress in meeting environmental, social, and governance (ESG) goals.

It was the company's 11th annual report on the subject and reported 142 months with no reportable spills and 97 months with no lost time incidents, and noted the company spent about US$8 million in Idaho in 2023 and more than US$100 million since 2014.

The report "demonstrates our commitment to doing business the right way," said President and Chief Executive Officer Jon Cherry. "Global demand for responsible mineral production is only growing, and our approach to sustainability helps position the Stibnite Gold Project to be the only mined source of antimony in the country. I'm excited to share our performance in health and safety, environmental responsibility, and corporate governance, all of which are foundational to our long-term success."

Antimony is important to national defense as a key material used in munitions, but no domestic supply is currently mined. According to the company's most recent investor presentation, Perpetua expects to reach a Final Record of Decision for Stibnite in Q4 of 2024.

Additionally, the company expects to receive ancillary permits and project financing in early 2025 and reach a construction decision later in 2025. Perpetua intends to achieve commercial operations in 2028 based on the current timeline.

"We're also expecting a valuation re-rate, as Perpetua continues to be significantly undervalued relative to our peer group," Cherry has said. "Permitted projects trade at a premium in our industry, and we expect our valuation to improve as we continue through this process. So, there is an opportunity today for new investors."

Millions Spent on Cleanup, Foundation Started

One of the successes the company pointed to in the report was early cleanup work being done to mitigate legacy water contamination. Perpetua said it has spent nearly US$17 million improving water quality in the historic Stibnite Mining Districts since 2021.

"Water quality on site has been degrading for decades due to the millions of tons of unconstrained tailings and mine waste left behind by previous operators," according to the Sustainability Report. "The cleanup is part of a multi-year, multi-million-dollar investment by Perpetua designed to improve environmental conditions at site before operations begin. Cleanup actions focused on locations that sit outside the footprint of Perpetua's proposed Stibnite Gold Project and would be left untouched if it wasn't for the Company’s voluntary cleanup efforts."

Perpetua also generated 4,129 kWh (kilowatt hours) of solar energy produced on site in 2023 and has produced 62,170 kWh of solar energy since 2015.

For governance, the company noted that 100% of its employees had participated in business integrity and compliance-related training and 33% of board members are gender or ethnically diverse, and 50% of executive management is female.

For the social part of the report, Perpetua noted that team members volunteered 1,595 hours of service in the local community and a total of 15,686 hours since 2015, and the founding of the Stibnite Foundation charitable nonprofit organization in 2018. The company funds it based on development milestones but will eventually shift to profit-sharing contributions once the project is in production.

"To date, Perpetua Resources has contributed (US)$300,000 to the Foundation along with a contribution of 150,000 shares in the company," according to the Sustainability Report. "Since 2019, the foundation board has allocated more than (US)$190,000 to support local projects. In 2023, the Stibnite Foundation awarded (US)$32,000 in grants to 15 organizations across the region, including regional fire departments and emergency medical services."

The Catalyst: Critical Mineral for the Military in Uncertain Times

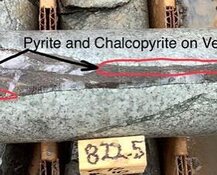

The gold and antimony at Stibnite represent distinctly different opportunities for investors. The project is one of the highest-grade, open-pit gold deposits in the U.S., according to the company, which is working to restore the abandoned mine site.

Antimony is a strategic critical mineral used in many military applications, including armor-piercing bullets, night vision goggles, and laser sighting.

Stibnite is expected to provide the U.S. with as much as 35% of its needs for antimony, a sector currently dominated by China, Russia, and Tajikistan, which control 90% of the supply chain, the company has said.

The gold drives the project's economics, but "it's really the antimony angle" that attracted him to Perpetua and Stibnite, the CEO Cherry has said. "This is a really important project for the U.S." as no domestic supply is currently mined.

Gold hit an all-time high of US$2,449.89 per ounce on May 20 but has cooled and hasn't returned to those heights. On Monday morning, it was up US$11.28 or 0.48% to US$2,336.14.

Analysts at investment bank UBS said they believe the gold market is entering a "seasonally quieter period," according to Investing.com, but noted it as an opportunity for gold investors. "We think any setbacks during this period should offer opportunities to build gold positions," the strategists said.

In addition to its traditional role as a safe asset, gold is also increasingly being bought by central banks, according to a report by Stockhead on June 18. The World Gold Council released its 2024 Central Banks Gold Reserves Survey, showing four in five respondents expected reserve managers to increase their gold holdings in the next year, the website reported.

Seventy central banks were polled by the Council. Nearly 30% said they are planning to add to their own gold reserves this year and 57% said gold will account for a higher proportion of global reserves within five years.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ)

"Extraordinary market pressure, unprecedented economic uncertainty, and political upheavals around the world have kept gold front of mind for central banks," the Council's global head of central banks and head of Asia-Pacific Shaokai Fan said, according to Stockhead. "Many of these institutions have become more aware of the asset's value as a way to manage risks and diversify their portfolios."

Ownership and Share Structure

According to Reuters, management and insiders own approximately 0.55% of Perpetua and institutions own about 33.09%.

Top institutional shareholders include Kopernik Global Investors LLC with 8.13%, Sun Valley Gold LLC with 7.23%, Krilogy Financial LLC with 2.68%, BlackRock Institutional Trust Co. with 2.63%, Herr Investment Group LLC with 2.12%, and State Street Global Advisors (US) with 0.73%, Reuters reported.

Of insiders, Chief Financial Officer Jessica Marie Largent owns 0.15%, former President and CEO Laurel Sayer owns 0.14%, and Director Chris Robinson owns 0.09%.

A strategic investor, Paulson & Co. Inc., owns 38.38% of the company.

Refinitiv reports that there are 64.54 million shares outstanding and 64.19 million free float traded shares. The company has a market cap of US$339.65 million and trades in a 52-week range between US$2.64 and US$7.13.

| Want to be the first to know about interesting Gold and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Perpetua Resources Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.