Streetwise Reports: Oil has been declining over the last two months or so. Would you talk about some of the factors behind this decline?

Sam Pelaez: We can split the most interesting factors between, on one hand, the demand side, including the macroeconomy, the Purchasing Managers Indexes (PMIs) and the slowdown in emerging markets and in China. The other would be the supply side. I think it's a convergence of those two concepts that's caused some of this most recent weakness.

On the demand side, the PMIs are one of the factors we like to look at the most because they give some predictability as to what may come next for resources. The PMI in China particularly has come down all the way to 50 points. The 50 line is the line between expansion and contraction. We are not in a contraction in any of the major economies, but we've lost that big tailwind and momentum that we had last year and earlier this year with PMIs in the high-50s.

So, naturally, that has a very high correlation with demand for crude and we're seeing that slowdown on that side.

On the supply side, since August the U.S. became the largest crude producer in the world. It's larger than Russia, and it's larger than Saudi Arabia. That obviously has major implications for the global market and the supply/demand balance.

The U.S. is not a part of the Organization of the Petroleum Exporting Countries (OPEC); it's not part of any of these agreements to curtail production. U.S. producers have been able to use technology to their favor and use the excellent conditions, especially in Texas, to really grow that asset base and those production volumes, which indirectly are also helping the U.S. trade balance very positively.

So now we have the issue of emerging markets slowing down, a trade war in the headlines, and the U.S. continuing to pump more crude and now becoming a big exporter to the world. I think those are the big elements.

The smaller elements that have come into play are on the geopolitical side. Saudi Arabia, as well as other OPEC members, have been pumping more crude, partly to appease a critical Donald Trump, thus driving volumes to pre-cap levels.

SWR: Did it break the OPEC agreement to do this?

SP: The agreement hasn't been dissolved. But OPEC is pumping above the agreed quotas, so it is essentially in violation of the agreement. The news here is the outcome of the recent meeting in Vienna. OPEC and allies agreed to cut 1.2 million barrels per day, taking October volumes as a base. In reality, it's virtually not a cut because OPEC is only slashing the volume growth pumped over the summer months—which coincides with peak seasonal production.

It is a great outcome; members publish on news media about a cut, while simultaneously maintaining an elevated production volume. And I think this helps Saudi Arabia and others gaining favor with the U.S. by pumping more crude and driving prices lower. Lower crude prices are a major benefit to all the policies of Donald Trump. I think Trump has made it very clear that he doesn't want OPEC to conspire to get the prices of crude higher. The U.S. is a major crude oil producer, but it has ±350 million people who are consumers of gasoline and other refined products. In Trump’s mind, lower crude prices are beneficial for his economic prospects and the prospects of the country. And I think behind the scenes, Saudi Arabia understands that, and that's the reason why it has been pumping more crude.

At the same time, Russia also has an incentive to pump more crude because its currency has weakened this year even though crude prices have rallied. So that's created a very profitable window for it to boost production and capture that spread that's generally not open to it. Normally, when crude rises, so does the Russian ruble, so it doesn't get that alpha from the cost bases being in ruble and the international prices being set in U.S. dollars.

I think oil prices, where they sit today, are very comfortable for U.S., Russian and Saudi Arabian producers. And as a result, they'll be happy to just maintain, range bound, somewhere around these levels.

SWR: Does this put the screws on other countries that are higher-cost producers?

SP: Not really. I think the pressure points that we're seeing right now in certain countries don't have a lot to do with international prices. There's the political situation in Venezuela that's been unfolding for years, where there's a lack of capital expenditures and aging infrastructure that will continue to erode the volumes coming out of the country.

In Canada, we have a very different issue, which is the wide differentials because of the difficulty of getting the crude to the international markets. As a result, the realized price by Canadian producers is far lower, and obviously that would affect some of the production. But it has nothing to do with the international prices, I would say, or at least not directly.

SWR: What is your outlook for oil in the near to middle term?

SP: I think these prices, as I mentioned, are very comfortable for a lot of the major participants in the markets. It's enough for the U.S. shale producers to continue allocating capital to grow or at least to maintain the current production levels. And it's comfortable for Russia because Russia is a very natural low-cost producer with ruble cost-basis. As for Saudi Arabia, I think the majority of OPEC members will continue to make nice profits at these levels. So there's no real reason to try to push it higher by instituting new cuts or curtailing supply any further.

Going back to the demand side, we have to monitor the macro data, especially going into this winter season. Year-end is generally a big season for China demand, then it tends to slow very sharply in January and February, and it comes back after Chinese New Year. We have to monitor the PMIs because any slowdown or further decline from there should be very concerning, not just for the crude oil market but for the global economy as a whole.

SWR: A number of firms have been very bullish on commodities. How do you view this and which commodities do you see as more likely to rise than others?

SP: It's almost in unison now that the "bulge bracket" banks like Goldman Sachs, Morgan Stanley and Citi have all come out with either very positive comments for commodities as a complex, or very positive comments for specific subindustries or sectors within the commodities universe. Some of them prefer industrial metals. Some prefer base metals. Some prefer the energy sector. But the message is very clear. The ratio of the valuation of the overall market relative to these sectors is at an extreme low point.

I was reading a paid subscription report a month ago that said the materials sector in the S&P 500 has never been smaller than it is today, and not smaller in absolute terms but as a percentage of the S&P 500. It's not the same for energy, but energy still is in a very depressed position when it comes to its percentage weight to the overall market.

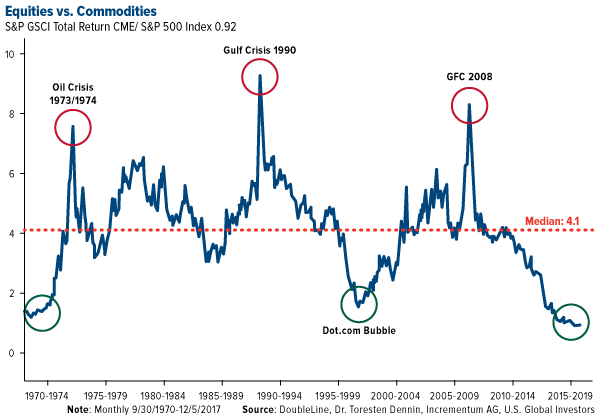

I've used this chart many times before, and I still continue to use it. It's a 50-year or so chart, starting in the early 1970s, and it shows the S&P commodities index, not commodity stocks index, just the commodities index, divided by the S&P 500. It's a ratio to show you how overpriced or underpriced the commodities universe is relative to the market as a whole, if you take the S&P 500 as a good proxy for the market as a whole.

And the reality is that it has never been lower. We've been at these troughs three times before. And it's obviously very cyclical. Every 10 years or so, we get these big, sharp rebounds and rallies. But we've never been lower for longer. So commodities are long overdue to outperform the market as a whole.

But the message is the same as that of the banks. There are big opportunities in the commodities universe right now. There are producers that are making substantial amounts of free cash flow at these prices, which are not bull market prices by any measure. So in general, I am very optimistic.

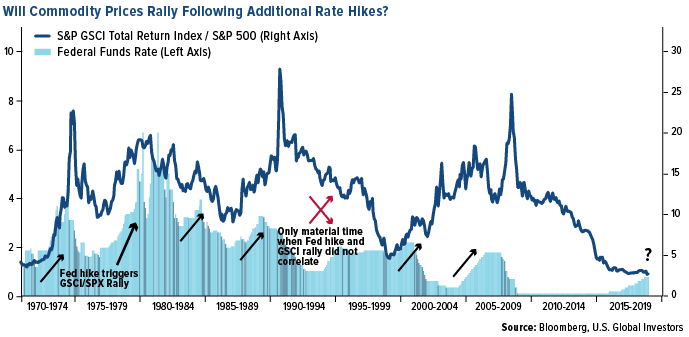

The next overlay that you can put on that chart of that ratio is the correlation with the Federal Reserve rates. And interestingly, I think there's been about seven Fed rate hiking cycles over those 50-odd years, and all but one of those cycles have coincided with the commodities outperforming the market. At first, it's difficult to reconcile that rates going up correspond with a cyclical market taking off. But generally, I think the Fed rates are catching up to inflation, and that inflation is the driver of the cycle.

So the Fed has been hiking rates, and we haven't seen any response on this chart. Part of that could be attributed to the trade war talks. But I think the message is very clear. We're very long overdue for a commodities rebound. The charts are telling you, and I think the fundamentals of some of the producers—some of which we can talk about in a minute here—are also telling you that this is a very good time to start allocating out of the sectors that have worked over the past few years, some of the technology sectors, some of the healthcare areas, and start looking at the most depressed and undervalued sectors right now, which are both energy and materials.

SWR: Would you talk about some companies that you see as undervalued at this point?

SP: Those two sectors, materials and energy, are very attractive right now. When you look at the multiples, for example, the explorers and producers in the U.S. are trading at about five times EBITDA. Historically they trade at six, maybe seven times. If you look at specific names, you can find them as low as two or three times EBITDA. Those are not market multiples consistent with profitable companies. Those are market multiples that you would see in bear markets or markets where there's a complete lack of confidence that the producers can deliver any profit. So I think there's a unique opportunity with some names to get involved.

Essentially these sector—and especially in Canada but also in the U.S.—are trading at emerging market multiples. So if you go back to 2011, some of these sectors were trading very close to the multiples in the overall market. Now, they're trading at half the multiple of the market, so they've lost about half of the value just from the multiple compression.

And if you go back to the ratio we were talking about before, there is reason to believe that the gap has to be compressed, that those multiples have to converge sometime in the next three years. I can't tell you that it's going to be next quarter or two. It could be as soon as then. But the opportunities have been laid, and we shall take profit from them.

On specific names that I like, there is a Canadian oil services company that has most of its operations in the U.S., CES Energy Solutions Corp. (CEU:TSX; CESDF:OTCMKT). It's one opportunity where you can benefit from a company that's been pummeled by the relationship to the Canadian oil market when in fact the majority of its assets and its operations are in Texas. Here you can get a company that's exposed to a very profitable market with lots of activity and is trading at a Canadian energy multiple. It's based in Calgary, but the majority of its operations and its focus is in the Permian Basin.

This is a U$1.0- billion valuation. It's a company that makes U$120 million a year in EBITDA, so pretty attractive valuation relative to its peers. If you look at its chart, you'll see the value destruction that's occurred. I think most of it is attributed to the fact that it moves in sync with the Canadian energy space, which has been under substantial pressure due to the inability to get enough infrastructure built for the export of the crude. But, in fact, CES is an energy services company, it's not a producer, and most of its assets and operations are in the U.S.

Switching over to the base metals sector, one of the companies that I've been paying attention to is HudBay Minerals Inc. (HBM:TSX; HBM:NYSE). This one trades both in Canada and the U.S. As a Canadian base metals producer, the stock is down about 40% year to date. There is now an activist fund that has got involved. The stock has rebounded some from there.

But this is another company where I think the valuation is completely disproportionate to the operations. This is a company that trades at 4x next year's EBITDA. Normally, these companies, with the profit generation that they can deliver, should be trading 8x. Just from the multiple alone, at these commodity prices, you should still see a very nice revaluation. And now that we have an activist fund involved, perhaps it may come sooner rather than later.

A precious metals story we also follow closely is Dundee Precious Metals Inc. (DPM:TSX; DPMLF:OTCMKT). This company has phenomenal owners, a top class operating team, and more importantly fully funded organic growth. The stock trades at 4x this year's EBITDA, but should see a significant bump in next year's EBITDA due to the commissioning of its fully funded new mine in Bulgaria. Essentially, you are picking up all of this growth for free at this valuation.

We've been looking elsewhere, and we've found some pretty attractive opportunities in other places, but perhaps they're not accessible for most readers. Some of the Russian companies trading in London are profitable companies and are offering spectacular dividends. I'll just mention one name.

EVRAZ Plc (EVR:LSE; EVRZF:OTC) is an industrial metals company and pays a dividend close to 15%, It's a very highly profitable company. And it's just been shunned by negative perceptions about Russia when, in fact, this is a very well-run company with very high margins, and it's a historical, consistent dividend payer. That gives you confidence that it can maintain the dividend.

SWR: Would you like to talk about one more company?

SP: On the same dividend note, there's a Canadian renewable energy producer that has substantial growth and is very profitable, Polaris Infrastructure Inc. (PIF:TSX). It has stable operations in emerging markets and pays a very nice dividend.

Its current operation is a geothermal facility in Nicaragua. This is contracted to the central utility. It's connected to the grid, has a multiyear contract in U.S. dollars. Polaris is a very good corporate citizen in the country and never has had any issues.

The stock is paying about an 8% dividend. It recently made an acquisition in Peru, partly to diversify the geopolitical risk. But it also was a single-asset company, and now it's a multiasset company. It's now in the hydropower business in Peru, based on the same idea: long-term contracts with the government in U.S. dollars and hugely profitable on an operating basis. Now that it did the acquisition—which actually carried very little principal or capital expenditure, so not to affect the dividend payouts—we may even see dividend hikes as the Peruvian assets come online.

SWR: Thank you, Sam. Do you have any parting comments?

SP: I'd like to end with a positive note. While there's been turmoil in the U.S. markets only very recently, most of the world has been in complete turmoil for nearly a year now since the trade war conversation was started. It's created opportunities in the market that I've never seen before in the time that I've been participating in the markets.

There are companies trading at valuations that would be inconceivable in a normal market situation. Investors can take advantage of these opportunities to lock-in quality assets at very attractive valuations, and ride with them as the commodities sector rebounds.

The markets never run out of exciting opportunities. It doesn't matter what the macro environment is or how turbulent it looks.

SWR: Thanks for your insights, Sam.

Samuel Pelaez is chief investment officer and portfolio manager with Galileo Global Equity Advisors. Prior to that he was an investment analyst at U.S. Global Investors, a boutique U.S.-based investment management firm. Pelaez graduated from the Schulich School of Business with Distinction in 2012. He also holds a Masters in Finance degree from The University of Cambridge. He is a CFA charter holder and member of the Toronto CFA Society.

| Want to be the first to know about interesting Gold, Base Metals, Alternative Energy and Oil & Gas - Services investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosure:

1) Patrice Fusillo conducted this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this interview are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Samuel Pelaez: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: N/A. I, or members of my immediate household or family, are paid by the following companies mentioned in this article: (N/A). My company has a financial relationship with the following companies mentioned in this interview: (N/A). Funds controlled by Galileo Funds own securities of the following companies mentioned in this article: CES Energy Solutions Corp., HudBay Minerals Inc., Dundee Precious Metals Inc., EVRAZ Plc, and Polaris Infrastructure Inc. I determined which companies would be included in this article based on my research and understanding of the sector. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.